- At an average cost of $2,608 per year, a 2024 Kia Forte has cheaper car insurance rates than a 2024 Hyundai Elantra by an average of $266 per year.

- Average car insurance cost per month for the Hyundai Elantra is 10.7% more expensive than the Kia Forte, at $217 versus $195, a difference of $22.

- Out of 15 models in the 2024 small car segment, the Hyundai Elantra ranks 13th and the Kia Forte ranks eighth for car insurance affordability.

Is insurance cheaper for a Hyundai Elantra or Kia Forte?

When comparing 2024 Hyundai Elantra and Kia Forte models, the model with the cheapest average car insurance rates is the Kia Forte. Insurance on a Hyundai Elantra costs an average of $2,608 per year, whereas insurance for a Kia Forte costs an average of $2,342 per year.

Out of seven Hyundai Elantra trims, the cheapest 2024 trim level to insure is the N model at an average cost of $2,224 per year, or $185 per month. Out of the five trim levels available for the Kia Forte, the cheapest 2024 trim level to insure is the LX model at a cost of $2,244.

When all 12 trims of both models are combined and compared, the cheapest trim is the Hyundai Elantra N at an average of $2,224 per year, and the most expensive vehicle to insure is the Hyundai Elantra Blue Hybrid costing an average of $2,874 per year.

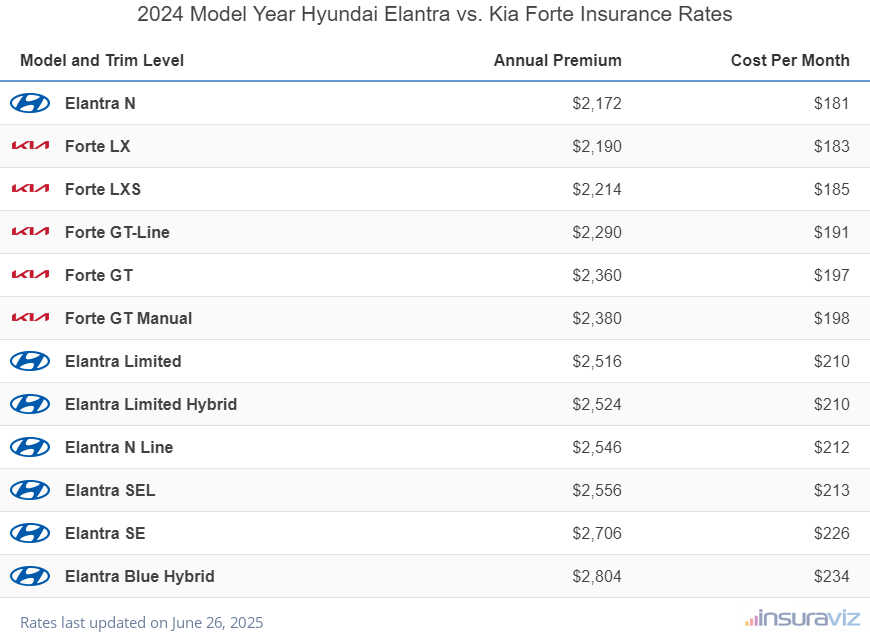

The table shown below compares the 12-month and monthly car insurance cost for 2024 Hyundai Elantra and Kia Forte models, broken down by individual trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Elantra N | $2,224 | $185 |

| Forte LX | $2,244 | $187 |

| Forte LXS | $2,266 | $189 |

| Forte GT-Line | $2,346 | $196 |

| Forte GT | $2,418 | $202 |

| Forte GT Manual | $2,438 | $203 |

| Elantra Limited | $2,578 | $215 |

| Elantra Limited Hybrid | $2,586 | $216 |

| Elantra N Line | $2,608 | $217 |

| Elantra SEL | $2,618 | $218 |

| Elantra SE | $2,774 | $231 |

| Elantra Blue Hybrid | $2,874 | $240 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

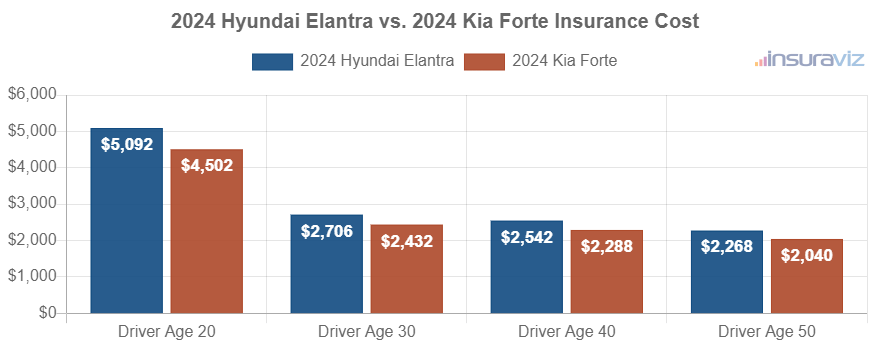

The chart shown below demonstrates the average cost to insure both 2024 models with different driver age groups. For a 2024 Hyundai Elantra, insurance cost ranges from $2,324 to $5,218 per year for the included age groups. A 2024 Kia Forte costs from $2,092 to $4,616 to insure per year.

The next two rate tables show trim level insurance rates for each 2024 model, plus an average rate for each model. The cheapest of the two models to insure for the 2024 model year is the Kia Forte.

2024 Hyundai Elantra

$2,608

| 2024 Hyundai Elantra Trims | Rate |

|---|---|

| N | $2,224 |

| Limited | 2,578 |

| Limited Hybrid | 2,586 |

| N Line | 2,608 |

| SEL | 2,618 |

| SE | 2,774 |

| Blue Hybrid | 2,874 |

| 2024 Hyundai Elantra Average Rate | $2,608 |

2024 Kia Forte

$2,342

| 2024 Kia Forte Trims | Rate |

|---|---|

| LX | $2,244 |

| LXS | 2,266 |

| GT-Line | 2,346 |

| GT | 2,418 |

| GT Manual | 2,438 |

| 2024 Kia Forte Average Rate | $2,342 |

2023 Hyundai Elantra vs. Kia Forte

For 2023 Elantra and Forte models, the cheaper model to insure on average is the Kia Forte. Insurance rates for the Hyundai Elantra average $2,542 per year, whereas insurance for a Kia Forte averages $2,286 per year.

Out of seven trims for the 2023 Hyundai Elantra, the cheapest car insurance rates are on the SEL model at a cost of $2,264 per year, or about $189 per month.

For the five trims available for the Kia Forte, the cheapest 2023 trim to insure is the LX trim at a cost of $2,192 per year, or about $183 per month.

When comparing aggregated rates for both models from a trim-level perspective, the cheapest trim to insure is the Kia Forte LX at an average cost of $2,192 per year, and the highest-cost model and trim level is the Hyundai Elantra N at an average of $2,768 per year.

From a monthly standpoint, car insurance rates for all 2023 Hyundai Elantra and Kia Forte models and trims range from $183 to $231 per month.

The table shown below compares and ranks the annual and monthly car insurance cost for 2023 Hyundai Elantra and Kia Forte models, showing average cost for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Forte LX | $2,192 | $183 |

| Forte LXS | $2,214 | $185 |

| Elantra SEL | $2,264 | $189 |

| Forte GT-Line | $2,280 | $190 |

| Elantra Hybrid Blue | $2,354 | $196 |

| Forte GT | $2,358 | $197 |

| Forte GT Manual | $2,382 | $199 |

| Elantra SE | $2,432 | $203 |

| Elantra Limited | $2,632 | $219 |

| Elantra N Line | $2,650 | $221 |

| Elantra Hybrid Limited | $2,692 | $224 |

| Elantra N | $2,768 | $231 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

The next chart shows the average cost to insure the two models for different driver ages. Average car insurance cost ranges from $2,272 to $5,078 per year for a 2023 Hyundai Elantra, and $2,036 to $4,560 for a 2023 Kia Forte for the illustrated age groups.

The rate tables below illustrate average car insurance cost by trim level for each 2023 model, plus an average rate for each model.

2023 Hyundai Elantra

$2,542

| 2023 Hyundai Elantra Trims | Rate |

|---|---|

| SEL | $2,264 |

| Hybrid Blue | 2,354 |

| SE | 2,432 |

| Limited | 2,632 |

| N Line | 2,650 |

| Hybrid Limited | 2,692 |

| N | 2,768 |

| 2023 Hyundai Elantra Average Rate | $2,542 |

2023 Kia Forte

$2,286

| 2023 Kia Forte Trims | Rate |

|---|---|

| LX | $2,192 |

| LXS | 2,214 |

| GT-Line | 2,280 |

| GT | 2,358 |

| GT Manual | 2,382 |

| 2023 Kia Forte Average Rate | $2,286 |

2022 Hyundai Elantra vs. Kia Forte

Insurance rates for a 2022 Hyundai Elantra average $2,466 per year, while insurance for a Kia Forte costs an average of $2,238 per year, making the Kia Forte the model with cheaper overall insurance rates.

Within each model, however, insurance cost varies greatly depending on the exact trim level of the vehicle being insured. For a 2022 Hyundai Elantra, insurance rates range from the cheapest rate of $2,170 per year for the SEL model up to the most expensive rate of $2,680 for the N model. For a 2022 Kia Forte, rates range from $2,142 per year for the FE model up to $2,324 for the GT model.

When comparing rates by trim level for both models, the lowest-cost model and trim is the Kia Forte FE at an average cost of $2,142 per year. The most expensive model and trim level is the Hyundai Elantra N at an average cost of $2,680 per year.

For a 2022 Hyundai Elantra, the cheapest models are the SEL, Hybrid Blue, and SE. The cheapest Kia Forte models include the FE, LXS, and GT-Line. From a cost-per-month basis, car insurance rates for all 2022 Hyundai Elantra and Kia Forte models range from $179 to $223 per month.

The rate table below compares and ranks the cost of car insurance for 2022 Hyundai Elantra and Kia Forte models, showing average cost for every trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Forte FE | $2,142 | $179 |

| Elantra SEL | $2,170 | $181 |

| Forte LXS | $2,190 | $183 |

| Elantra Hybrid Blue | $2,236 | $186 |

| Forte GT-Line | $2,256 | $188 |

| Forte GT Manual | $2,276 | $190 |

| Forte GT | $2,324 | $194 |

| Elantra SE | $2,382 | $199 |

| Elantra N Line | $2,566 | $214 |

| Elantra Limited | $2,578 | $215 |

| Elantra Hybrid Limited | $2,652 | $221 |

| Elantra N | $2,680 | $223 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

The next chart shows the average cost to insure both models with different drivers at the wheel. For a 2022 Hyundai Elantra, the average car insurance cost ranges from $2,206 to $4,964 per year for the included driver ages. A 2022 Kia Forte costs from $1,996 to $4,490 to insure per year.

How does car insurance cost for a 2022 Hyundai Elantra compare to a Kia Forte?

- The cheapest 2022 Hyundai Elantra insurance is on the SEL costing $2,170 per year. The cheapest 2022 Kia Forte to insure is the FE costing $2,142 per year.

- Average car insurance cost per month for the Hyundai Elantra is 9.7% more expensive than the Kia Forte, at $206 versus $187, a difference of $19.

- When compared to the national average car insurance rate of $2,276 per year, the Hyundai Elantra costs $190 more per year, while the Kia Forte costs $38 less per year.

- For a 19-year-old driver, insurance on a Hyundai Elantra costs an average of $6,986 per year and Kia Forte insurance costs an average of $6,308 per year, a difference of $678 per year.

- A high deductible policy could save as much as $332 per year for the Hyundai Elantra and $318 for the Kia Forte.

- When comparing the most expensive models of each vehicle to insure, the most expensive 2022 Hyundai Elantra to insure is the N at $2,680 per year. The most expensive 2022 Kia Forte to insure is the GT at $2,324 per year.

- For a 17-year-old driver, insurance on a Hyundai Elantra costs an average of $8,668 per year and Kia Forte insurance costs an average of $7,798 per year, a difference of $870 per year.

- A low deductible policy could cost up to $644 more per year for the Hyundai Elantra and $612 for the Kia Forte.

For the seven trim levels available for the 2022 Hyundai Elantra, the cheapest trim level to insure is the SEL trim at an average cost of $2,170 per year, or around $181 per month.

The 2022 Kia Forte has five trim levels available, with the cheapest trim to insure being the FE trim at an average cost of $2,142 per year, or $179 per month.

When insurance rates for all 12 trims of both models are combined and sorted by cost, the cheapest vehicle to insure is the Kia Forte FE at a cost of $2,142 per year, and the most expensive vehicle to insure is the Hyundai Elantra N costing an average of $2,680 per year.

The rate tables below show the cost to insure the available trim levels for both 2022 models, along with an average cost for each model. The 2022 Kia Forte has cheaper overall car insurance rates than the 2022 Hyundai Elantra.

2022 Hyundai Elantra

$2,466

| 2022 Hyundai Elantra Trims | Rate |

|---|---|

| SEL | $2,170 |

| Hybrid Blue | 2,236 |

| SE | 2,382 |

| N Line | 2,566 |

| Limited | 2,578 |

| Hybrid Limited | 2,652 |

| N | 2,680 |

| 2022 Hyundai Elantra Average Rate | $2,466 |

2022 Kia Forte

$2,238

| 2022 Kia Forte Trims | Rate |

|---|---|

| FE | $2,142 |

| LXS | 2,190 |

| GT-Line | 2,256 |

| GT Manual | 2,276 |

| GT | 2,324 |

| 2022 Kia Forte Average Rate | $2,238 |

2021 Hyundai Elantra vs. Kia Forte

When comparing insurance rates for 2021 models, a Hyundai Elantra costs an average of $2,356 per year to insure and a Kia Forte costs $2,020, making the Kia Forte cheaper to insure by $336 per year for 2021.

The chart below demonstrates the average cost to insure both models for the 20, 30, 40, and 50-year-old driver age groups. For a 2021 Hyundai Elantra, the average car insurance cost ranges from $2,110 to $4,758 per year for these driver ages. A 2021 Kia Forte costs from $1,798 to $4,050 to insure per year.

For the six trims available for the 2021 Hyundai Elantra, the cheapest model to insure is the SEL Sedan trim at an average cost of $1,890 per year, or around $158 per month.

For the five trim levels available for the Kia Forte, the cheapest 2021 trim to insure is the FE Sedan model at a cost of $1,930 per year, or $161 per month.

When trim-level rates for both models are compared, the most affordable model and trim level to insure is the Hyundai Elantra SEL Sedan at an average of $1,890 per year, and the most expensive vehicle to insure is the Hyundai Elantra Sport Sedan costing $2,610 per year.

The next tables show average car insurance cost by trim level for each 2021 model, along with an average cost for each model. The 2021 Kia Forte has more affordable average car insurance rates than the 2021 Hyundai Elantra.

2021 Hyundai Elantra

$2,356

| 2021 Hyundai Elantra Trims | Rate |

|---|---|

| SEL Sedan | $1,890 |

| EcoSedan | 1,956 |

| SE Sedan | 2,498 |

| Value Edition Sedan | 2,564 |

| Limited Sedan | 2,610 |

| Sport Sedan | 2,610 |

| 2021 Hyundai Elantra Average Rate | $2,356 |

2021 Kia Forte

$2,020

| 2021 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,930 |

| LXS Sedan | 1,976 |

| EX Sedan | 2,044 |

| GT-Line Sedan | 2,044 |

| GT Sedan | 2,108 |

| 2021 Kia Forte Average Rate | $2,020 |

2020 Hyundai Elantra vs. Kia Forte

When comparing insurance rates for the 2020 Hyundai Elantra and Kia Forte models, the Kia Forte has cheaper rates by an average of $320 per year for 2020.

The rate chart below visualizes the average cost to insure both models using a range of rated driver ages. Average car insurance cost ranges from $2,048 to $4,618 per year for a 2020 Hyundai Elantra, and $1,748 to $3,938 for a 2020 Kia Forte for the illustrated age groups.

The 2020 Hyundai Elantra has eight trim levels available, with the cheapest model to insure being the SEL Sedan trim at an average cost of $1,840 per year.

For the five trim levels available for the Kia Forte, the cheapest 2020 trim level to insure is the FE Sedan trim at a cost of $1,876.

When comparing aggregated rates for both models from a trim-level perspective, the lowest-cost model and trim to insure is the Hyundai Elantra SEL Sedan at an average cost of $1,840 per year, and the most expensive model and trim level is the Hyundai Elantra GT N Line Sedan at an average of $2,606 per year.

The tables shown below display the cost to insure the available trim levels for both 2020 models, as well as the overall average rate for each model. The winner for the 2020 car insurance cost comparison is the Kia Forte.

2020 Hyundai Elantra

$2,284

| 2020 Hyundai Elantra Trims | Rate |

|---|---|

| SEL Sedan | $1,840 |

| EcoSedan | 1,902 |

| GT Hatchback | 1,902 |

| SE Sedan | 2,436 |

| Value Edition Sedan | 2,500 |

| Limited Sedan | 2,544 |

| Sport Sedan | 2,544 |

| GT N Line Sedan | 2,606 |

| 2020 Hyundai Elantra Average Rate | $2,284 |

2020 Kia Forte

$1,964

| 2020 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,876 |

| LXS Sedan | 1,920 |

| EX Sedan | 1,986 |

| GT-Line Sedan | 1,986 |

| GT Sedan | 2,048 |

| 2020 Kia Forte Average Rate | $1,964 |

2019 Hyundai Elantra vs. Kia Forte

When comparing insurance cost for 2019 models, a Hyundai Elantra costs an average of $2,148 per year to insure and a Kia Forte costs $1,908, making the Kia Forte cheaper to insure by $240 per year.

The rate chart below illustrates the average cost to insure both models for four different driver age groups. The average cost of car insurance ranges from $1,928 to $4,346 per year for a 2019 Hyundai Elantra, and $1,710 to $3,838 for a 2019 Kia Forte.

Out of eight trim levels for the 2019 Hyundai Elantra, the cheapest auto insurance rates are on the SEL Sedan trim at a cost of $1,894 per year. For the four trims available for the Kia Forte, the cheapest 2019 trim level to insure is the FE Sedan trim at a cost of $1,830.

When comparing car insurance rates for both models by trim level, the lowest-cost model and trim level to insure is the Kia Forte FE Sedan at an average rate of $1,830 per year, and the highest-cost model and trim is the Hyundai Elantra GT N Line Sedan at an average cost of $2,368 per year.

The tables below show both 2019 models and all trim levels available for each one, including an overall average cost for each model.

2019 Hyundai Elantra

$2,148

| 2019 Hyundai Elantra Trims | Rate |

|---|---|

| SEL Sedan | $1,894 |

| EcoSedan | 1,954 |

| GT Hatchback | 1,954 |

| SE Sedan | 2,142 |

| Value Edition Sedan | 2,246 |

| Limited Sedan | 2,306 |

| Sport Sedan | 2,306 |

| GT N Line Sedan | 2,368 |

| 2019 Hyundai Elantra Average Rate | $2,148 |

2019 Kia Forte

$1,908

| 2019 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,830 |

| LX Sedan | 1,912 |

| S Sedan | 1,930 |

| EX Sedan | 1,964 |

| 2019 Kia Forte Average Rate | $1,908 |

2018 Hyundai Elantra vs. Kia Forte

When comparing average insurance rates for the 2018 Hyundai Elantra and Kia Forte models, the Hyundai Elantra is cheaper to insure by an average of $10 per year.

The chart shown below demonstrates the average cost to insure both models for the 20 to 50-year-old driver age groups. Average car insurance cost ranges from $1,900 to $4,274 per year for a 2018 Hyundai Elantra, and $1,910 to $4,278 for a 2018 Kia Forte.

Out of eight Hyundai Elantra trims, the cheapest 2018 model to insure is the GT Sport Hatchback model at an average cost of $1,628 per year. The 2018 Kia Forte has seven trims available, with the cheapest trim level to insure being the S Sedan model at an average cost of $1,760 per year, or around $147 per month.

When comparing both models at a trim-level basis, the lowest-cost model and trim level to insure is the Hyundai Elantra GT Sport Hatchback at an average rate of $1,628 per year. The most expensive model and trim level is the Kia Forte Forte5 SX Hatchback costing an average of $2,336 per year.

The next two rate tables show average car insurance cost by trim level for a 2018 Hyundai Elantra and Kia Forte, including an overall average cost for each model. The model with the cheapest overall car insurance cost for 2018 is the Hyundai Elantra.

2018 Hyundai Elantra

$2,114

| 2018 Hyundai Elantra Trims | Rate |

|---|---|

| GT Sport Hatchback | $1,628 |

| SE Sedan | 2,068 |

| GT Hatchback | 2,164 |

| SEL Sedan | 2,164 |

| Value Edition Sedan | 2,164 |

| EcoSedan Turbo | 2,222 |

| Sport Sedan | 2,222 |

| Limited Sedan | 2,280 |

| 2018 Hyundai Elantra Average Rate | $2,114 |

2018 Kia Forte

$2,124

| 2018 Kia Forte Trims | Rate |

|---|---|

| S Sedan | $1,760 |

| LX Sedan | 2,028 |

| Forte5 LX Hatchback | 2,124 |

| EX Sedan | 2,182 |

| SX Sedan | 2,182 |

| Forte5 EX Hatchback | 2,240 |

| Forte5 SX Hatchback | 2,336 |

| 2018 Kia Forte Average Rate | $2,124 |

2017 Hyundai Elantra vs. Kia Forte

When comparing car insurance rates for 2017 models, a Hyundai Elantra costs an average of $2,124 per year to insure and a Kia Forte costs $2,060, making the Kia Forte cheaper to insure by $64 per year for this comparison year.

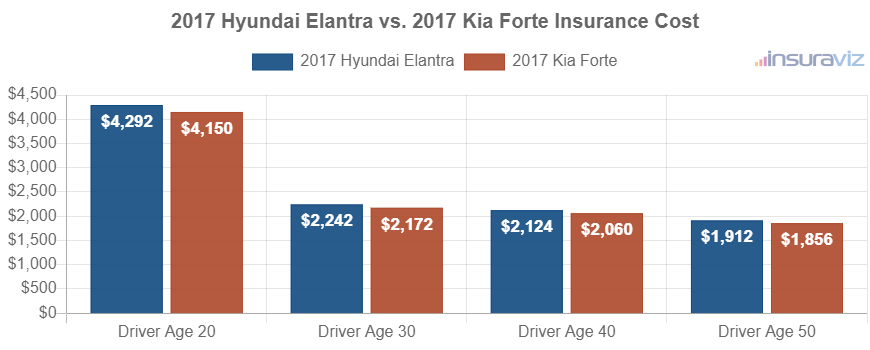

The next chart illustrates the average cost to insure both models using a range of rated driver ages. The average car insurance cost ranges from $1,912 to $4,292 per year for a 2017 Hyundai Elantra, and $1,856 to $4,150 for a 2017 Kia Forte.

Out of five trims for the 2017 Hyundai Elantra, the cheapest car insurance rates are on the SE Sedan trim at a cost of $2,008 per year. Out of the six trim levels available for the Kia Forte, the cheapest 2017 trim to insure is the S Sedan model at a cost of $1,896 per year, or about $158 per month.

When rates are compared for the 11 trim levels of both 2017 models, the most affordable model and trim level to insure is the Kia Forte S Sedan at an average rate of $1,896 per year, and the highest-cost model and trim level is the Hyundai Elantra Limited Sedan at an average of $2,206 per year.

The next two tables illustrate average cost to insure each trim level for a 2017 Hyundai Elantra and Kia Forte, along with an average cost for each model.

2017 Hyundai Elantra

$2,124

| 2017 Hyundai Elantra Trims | Rate |

|---|---|

| SE Sedan | $2,008 |

| GT Hatchback | 2,100 |

| EcoSedan | 2,152 |

| Sport Sedan | 2,152 |

| Limited Sedan | 2,206 |

| 2017 Hyundai Elantra Average Rate | $2,124 |

2017 Kia Forte

$2,060

| 2017 Kia Forte Trims | Rate |

|---|---|

| S Sedan | $1,896 |

| LX Sedan | 2,000 |

| LX Hatchback | 2,062 |

| EX Hatchback | 2,116 |

| EX Sedan | 2,116 |

| SX Hatchback | 2,168 |

| 2017 Kia Forte Average Rate | $2,060 |

2016 Hyundai Elantra vs. Kia Forte

When comparing average insurance cost for 2016 models, the Hyundai Elantra costs an average of $1,804 per year to insure and the Kia Forte costs $1,766, making the Kia Forte the winner by $38 for this model year.

The rate chart below illustrates the average cost to insure both models rated for a variety of different driver ages. Average insurance cost ranges from $1,628 to $3,626 per year for a 2016 Hyundai Elantra, and $1,592 to $3,550 for a 2016 Kia Forte for these driver ages.

Out of five trims for the 2016 Hyundai Elantra, the cheapest average car insurance prices are on the SE Sedan model at a cost of $1,716 per year, or about $143 per month.

The 2016 Kia Forte has seven trims available, with the cheapest model to insure being the LX Sedan trim at an average cost of $1,652 per year.

When looking at the aggregated rates by trim for both models, the lowest-cost model and trim to insure is the Kia Forte LX Sedan at an average rate of $1,652 per year. The most expensive vehicle to insure is the Kia Forte SX Hatchback costing $1,848 per year.

The tables shown below show the average cost to insure all 2016 trim levels, plus the average rate for each model. The winner for the 2016 car insurance cost comparison is the Kia Forte.

2016 Hyundai Elantra

$1,804

| 2016 Hyundai Elantra Trims | Rate |

|---|---|

| SE Sedan | $1,716 |

| GT Hatchback | 1,800 |

| Value Edition Sedan | 1,800 |

| Limited Sedan | 1,848 |

| Sport Sedan | 1,848 |

| 2016 Hyundai Elantra Average Rate | $1,804 |

2016 Kia Forte

$1,766

| 2016 Kia Forte Trims | Rate |

|---|---|

| LX Sedan | $1,652 |

| EX Coupe | 1,682 |

| SX Coupe | 1,732 |

| EX Sedan | 1,800 |

| LX Hatchback | 1,800 |

| EX Hatchback | 1,848 |

| SX Hatchback | 1,848 |

| 2016 Kia Forte Average Rate | $1,766 |

2015 Hyundai Elantra vs. Kia Forte

When comparing car insurance rates for the 2015 Hyundai Elantra and Kia Forte models, the Hyundai Elantra has cheaper rates by an average of $124 per year.

The rate chart below displays the average cost to insure the two models for different driver ages. For a 2015 Hyundai Elantra, insurance cost ranges from $1,416 to $3,122 per year for these driver ages. A 2015 Kia Forte costs from $1,528 to $3,400 to insure per year.

For the four trims available for the 2015 Hyundai Elantra, the cheapest trim level to insure is the SE Sedan model at an average cost of $1,508 per year, or $126 per month. Out of the five trim levels available for the Kia Forte, the cheapest 2015 trim to insure is the EX Coupe model at a cost of $1,636.

When trim-level rates for both models are compared, the overall cheapest vehicle to insure is the Hyundai Elantra SE Sedan at an average of $1,508 per year, and the most expensive model and trim level is the Kia Forte EX Hatchback costing an average of $1,774 per year.

The tables shown below show trim level insurance cost averages for both 2015 models, along with the average rate for each model. The 2015 Hyundai Elantra wins the head-to-head comparison over the 2015 Kia Forte for the cheapest average car insurance rates.

2015 Hyundai Elantra

$1,568

| 2015 Hyundai Elantra Trims | Rate |

|---|---|

| SE Sedan | $1,508 |

| GT Hatchback | 1,556 |

| Limited Sedan | 1,600 |

| Sport Sedan | 1,600 |

| 2015 Hyundai Elantra Average Rate | $1,568 |

2015 Kia Forte

$1,692

| 2015 Kia Forte Trims | Rate |

|---|---|

| EX Coupe | $1,636 |

| LX Sedan | 1,650 |

| SX Coupe | 1,682 |

| EX Sedan | 1,726 |

| EX Hatchback | 1,774 |

| 2015 Kia Forte Average Rate | $1,692 |