- At an average cost of $2,062 per year, a 2024 Kia Forte has cheaper car insurance rates than a 2024 Hyundai Elantra by an average of $210 per year.

- Average car insurance cost per month for the Hyundai Elantra is 11% more expensive than the Kia Forte, at $172 versus $154, a difference of $18.

- Out of 15 models in the 2024 small car segment, the Hyundai Elantra ranks 13th and the Kia Forte ranks eighth for car insurance affordability.

Is insurance cheaper for a Hyundai Elantra or Kia Forte?

When comparing 2024 Hyundai Elantra and Kia Forte models, the model with the cheapest average car insurance rates is the Kia Forte. Insurance on a Hyundai Elantra costs an average of $2,062 per year, whereas insurance for a Kia Forte costs an average of $1,852 per year.

Out of seven Hyundai Elantra trims, the cheapest 2024 trim level to insure is the N model at an average cost of $1,762 per year, or $147 per month. Out of the five trim levels available for the Kia Forte, the cheapest 2024 trim level to insure is the LX model at a cost of $1,772.

When all 12 trims of both models are combined and compared, the cheapest trim is the Hyundai Elantra N at an average of $1,762 per year, and the most expensive vehicle to insure is the Hyundai Elantra Blue Hybrid costing an average of $2,274 per year.

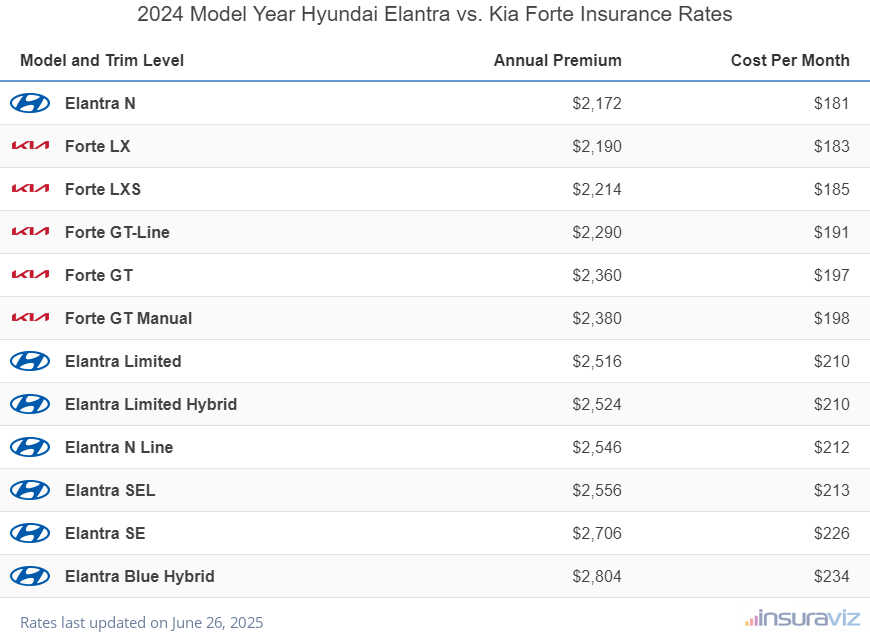

The table shown below compares the 12-month and monthly car insurance cost for 2024 Hyundai Elantra and Kia Forte models, broken down by individual trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Elantra N | $1,762 | $147 |

| Forte LX | $1,772 | $148 |

| Forte LXS | $1,792 | $149 |

| Forte GT-Line | $1,854 | $155 |

| Forte GT | $1,912 | $159 |

| Forte GT Manual | $1,926 | $161 |

| Elantra Limited | $2,040 | $170 |

| Elantra Limited Hybrid | $2,046 | $171 |

| Elantra N Line | $2,062 | $172 |

| Elantra SEL | $2,072 | $173 |

| Elantra SE | $2,196 | $183 |

| Elantra Blue Hybrid | $2,274 | $190 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

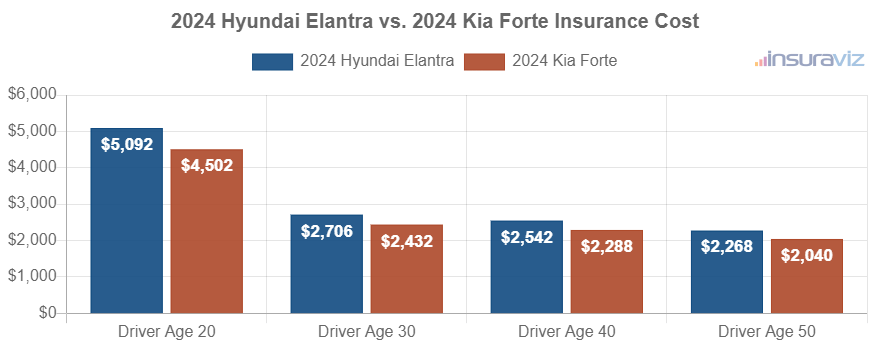

The chart shown below demonstrates the average cost to insure both 2024 models with different driver age groups. For a 2024 Hyundai Elantra, insurance cost ranges from $1,840 to $4,128 per year for the included age groups. A 2024 Kia Forte costs from $1,656 to $3,650 to insure per year.

The next two rate tables show trim level insurance rates for each 2024 model, plus an average rate for each model. The cheapest of the two models to insure for the 2024 model year is the Kia Forte.

2024 Hyundai Elantra

$2,062

| 2024 Hyundai Elantra Trims | Rate |

|---|---|

| N | $1,762 |

| Limited | 2,040 |

| Limited Hybrid | 2,046 |

| N Line | 2,062 |

| SEL | 2,072 |

| SE | 2,196 |

| Blue Hybrid | 2,274 |

| 2024 Hyundai Elantra Average Rate | $2,062 |

2024 Kia Forte

$1,852

| 2024 Kia Forte Trims | Rate |

|---|---|

| LX | $1,772 |

| LXS | 1,792 |

| GT-Line | 1,854 |

| GT | 1,912 |

| GT Manual | 1,926 |

| 2024 Kia Forte Average Rate | $1,852 |

2023 Hyundai Elantra vs. Kia Forte

For 2023 Elantra and Forte models, the cheaper model to insure on average is the Kia Forte. Insurance rates for the Hyundai Elantra average $2,012 per year, whereas insurance for a Kia Forte averages $1,806 per year.

Out of seven trims for the 2023 Hyundai Elantra, the cheapest car insurance rates are on the SEL model at a cost of $1,790 per year, or about $149 per month.

For the five trims available for the Kia Forte, the cheapest 2023 trim to insure is the LX trim at a cost of $1,734 per year, or about $145 per month.

When comparing aggregated rates for both models from a trim-level perspective, the cheapest trim to insure is the Kia Forte LX at an average cost of $1,734 per year, and the highest-cost model and trim level is the Hyundai Elantra N at an average of $2,190 per year.

From a monthly standpoint, car insurance rates for all 2023 Hyundai Elantra and Kia Forte models and trims range from $145 to $183 per month.

The table shown below compares and ranks the annual and monthly car insurance cost for 2023 Hyundai Elantra and Kia Forte models, showing average cost for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Forte LX | $1,734 | $145 |

| Forte LXS | $1,752 | $146 |

| Elantra SEL | $1,790 | $149 |

| Forte GT-Line | $1,802 | $150 |

| Elantra Hybrid Blue | $1,860 | $155 |

| Forte GT | $1,866 | $156 |

| Forte GT Manual | $1,884 | $157 |

| Elantra SE | $1,926 | $161 |

| Elantra Limited | $2,086 | $174 |

| Elantra N Line | $2,096 | $175 |

| Elantra Hybrid Limited | $2,132 | $178 |

| Elantra N | $2,190 | $183 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 22, 2024

The next chart shows the average cost to insure the two models for different driver ages. Average car insurance cost ranges from $1,798 to $4,016 per year for a 2023 Hyundai Elantra, and $1,612 to $3,606 for a 2023 Kia Forte for the illustrated age groups.

The rate tables below illustrate average car insurance cost by trim level for each 2023 model, plus an average rate for each model.

2023 Hyundai Elantra

$2,012

| 2023 Hyundai Elantra Trims | Rate |

|---|---|

| SEL | $1,790 |

| Hybrid Blue | 1,860 |

| SE | 1,926 |

| Limited | 2,086 |

| N Line | 2,096 |

| Hybrid Limited | 2,132 |

| N | 2,190 |

| 2023 Hyundai Elantra Average Rate | $2,012 |

2023 Kia Forte

$1,806

| 2023 Kia Forte Trims | Rate |

|---|---|

| LX | $1,734 |

| LXS | 1,752 |

| GT-Line | 1,802 |

| GT | 1,866 |

| GT Manual | 1,884 |

| 2023 Kia Forte Average Rate | $1,806 |

2022 Hyundai Elantra vs. Kia Forte

Insurance rates for a 2022 Hyundai Elantra average $1,950 per year, while insurance for a Kia Forte costs an average of $1,770 per year, making the Kia Forte the model with cheaper overall insurance rates.

Within each model, however, insurance cost varies greatly depending on the exact trim level of the vehicle being insured. For a 2022 Hyundai Elantra, insurance rates range from the cheapest rate of $1,716 per year for the SEL model up to the most expensive rate of $2,122 for the N model. For a 2022 Kia Forte, rates range from $1,694 per year for the FE model up to $1,838 for the GT model.

When comparing rates by trim level for both models, the lowest-cost model and trim is the Kia Forte FE at an average cost of $1,694 per year. The most expensive model and trim level is the Hyundai Elantra N at an average cost of $2,122 per year.

For a 2022 Hyundai Elantra, the cheapest models are the SEL, Hybrid Blue, and SE. The cheapest Kia Forte models include the FE, LXS, and GT-Line. From a cost-per-month basis, car insurance rates for all 2022 Hyundai Elantra and Kia Forte models range from $141 to $177 per month.

The rate table below compares and ranks the cost of car insurance for 2022 Hyundai Elantra and Kia Forte models, showing average cost for every trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Forte FE | $1,694 | $141 |

| Elantra SEL | $1,716 | $143 |

| Forte LXS | $1,732 | $144 |

| Elantra Hybrid Blue | $1,770 | $148 |

| Forte GT-Line | $1,786 | $149 |

| Forte GT Manual | $1,800 | $150 |

| Forte GT | $1,838 | $153 |

| Elantra SE | $1,886 | $157 |

| Elantra N Line | $2,030 | $169 |

| Elantra Limited | $2,042 | $170 |

| Elantra Hybrid Limited | $2,100 | $175 |

| Elantra N | $2,122 | $177 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 22, 2024

The next chart shows the average cost to insure both models with different drivers at the wheel. For a 2022 Hyundai Elantra, the average car insurance cost ranges from $1,746 to $3,926 per year for the included driver ages. A 2022 Kia Forte costs from $1,580 to $3,550 to insure per year.

How does car insurance cost for a 2022 Hyundai Elantra compare to a Kia Forte?

- The cheapest 2022 Hyundai Elantra insurance is on the SEL costing $1,716 per year. The cheapest 2022 Kia Forte to insure is the FE costing $1,694 per year.

- Average car insurance cost per month for the Hyundai Elantra is 9.6% more expensive than the Kia Forte, at $163 versus $148, a difference of $15.

- When compared to the national average car insurance rate of $1,883 per year, the Hyundai Elantra costs $67 more per year, while the Kia Forte costs $113 less per year.

- For a 19-year-old driver, insurance on a Hyundai Elantra costs an average of $5,527 per year and Kia Forte insurance costs an average of $4,988 per year, a difference of $539 per year.

- A high deductible policy could save as much as $264 per year for the Hyundai Elantra and $250 for the Kia Forte.

- When comparing the most expensive models of each vehicle to insure, the most expensive 2022 Hyundai Elantra to insure is the N at $2,122 per year. The most expensive 2022 Kia Forte to insure is the GT at $1,838 per year.

- For a 17-year-old driver, insurance on a Hyundai Elantra costs an average of $6,857 per year and Kia Forte insurance costs an average of $6,166 per year, a difference of $691 per year.

- A low deductible policy could cost up to $508 more per year for the Hyundai Elantra and $484 for the Kia Forte.

For the seven trim levels available for the 2022 Hyundai Elantra, the cheapest trim level to insure is the SEL trim at an average cost of $1,716 per year, or around $143 per month.

The 2022 Kia Forte has five trim levels available, with the cheapest trim to insure being the FE trim at an average cost of $1,694 per year, or $141 per month.

When insurance rates for all 12 trims of both models are combined and sorted by cost, the cheapest vehicle to insure is the Kia Forte FE at a cost of $1,694 per year, and the most expensive vehicle to insure is the Hyundai Elantra N costing an average of $2,122 per year.

The rate tables below show the cost to insure the available trim levels for both 2022 models, along with an average cost for each model. The 2022 Kia Forte has cheaper overall car insurance rates than the 2022 Hyundai Elantra.

2022 Hyundai Elantra

$1,950

| 2022 Hyundai Elantra Trims | Rate |

|---|---|

| SEL | $1,716 |

| Hybrid Blue | 1,770 |

| SE | 1,886 |

| N Line | 2,030 |

| Limited | 2,042 |

| Hybrid Limited | 2,100 |

| N | 2,122 |

| 2022 Hyundai Elantra Average Rate | $1,950 |

2022 Kia Forte

$1,770

| 2022 Kia Forte Trims | Rate |

|---|---|

| FE | $1,694 |

| LXS | 1,732 |

| GT-Line | 1,786 |

| GT Manual | 1,800 |

| GT | 1,838 |

| 2022 Kia Forte Average Rate | $1,770 |

2021 Hyundai Elantra vs. Kia Forte

When comparing insurance rates for 2021 models, a Hyundai Elantra costs an average of $1,864 per year to insure and a Kia Forte costs $1,598, making the Kia Forte cheaper to insure by $266 per year for 2021.

The chart below demonstrates the average cost to insure both models for the 20, 30, 40, and 50-year-old driver age groups. For a 2021 Hyundai Elantra, the average car insurance cost ranges from $1,670 to $3,766 per year for these driver ages. A 2021 Kia Forte costs from $1,426 to $3,202 to insure per year.

For the six trims available for the 2021 Hyundai Elantra, the cheapest model to insure is the SEL Sedan trim at an average cost of $1,496 per year, or around $125 per month.

For the five trim levels available for the Kia Forte, the cheapest 2021 trim to insure is the FE Sedan model at a cost of $1,526 per year, or $127 per month.

When trim-level rates for both models are compared, the most affordable model and trim level to insure is the Hyundai Elantra SEL Sedan at an average of $1,496 per year, and the most expensive vehicle to insure is the Hyundai Elantra Sport Sedan costing $2,066 per year.

The next tables show average car insurance cost by trim level for each 2021 model, along with an average cost for each model. The 2021 Kia Forte has more affordable average car insurance rates than the 2021 Hyundai Elantra.

2021 Hyundai Elantra

$1,864

| 2021 Hyundai Elantra Trims | Rate |

|---|---|

| SEL Sedan | $1,496 |

| EcoSedan | 1,548 |

| SE Sedan | 1,976 |

| Value Edition Sedan | 2,030 |

| Limited Sedan | 2,066 |

| Sport Sedan | 2,066 |

| 2021 Hyundai Elantra Average Rate | $1,864 |

2021 Kia Forte

$1,598

| 2021 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,526 |

| LXS Sedan | 1,562 |

| EX Sedan | 1,614 |

| GT-Line Sedan | 1,614 |

| GT Sedan | 1,668 |

| 2021 Kia Forte Average Rate | $1,598 |

2020 Hyundai Elantra vs. Kia Forte

When comparing insurance rates for the 2020 Hyundai Elantra and Kia Forte models, the Kia Forte has cheaper rates by an average of $254 per year for 2020.

The rate chart below visualizes the average cost to insure both models using a range of rated driver ages. Average car insurance cost ranges from $1,622 to $3,650 per year for a 2020 Hyundai Elantra, and $1,386 to $3,114 for a 2020 Kia Forte for the illustrated age groups.

The 2020 Hyundai Elantra has eight trim levels available, with the cheapest model to insure being the SEL Sedan trim at an average cost of $1,456 per year.

For the five trim levels available for the Kia Forte, the cheapest 2020 trim level to insure is the FE Sedan trim at a cost of $1,486.

When comparing aggregated rates for both models from a trim-level perspective, the lowest-cost model and trim to insure is the Hyundai Elantra SEL Sedan at an average cost of $1,456 per year, and the most expensive model and trim level is the Hyundai Elantra GT N Line Sedan at an average of $2,064 per year.

The tables shown below display the cost to insure the available trim levels for both 2020 models, as well as the overall average rate for each model. The winner for the 2020 car insurance cost comparison is the Kia Forte.

2020 Hyundai Elantra

$1,808

| 2020 Hyundai Elantra Trims | Rate |

|---|---|

| SEL Sedan | $1,456 |

| EcoSedan | 1,504 |

| GT Hatchback | 1,504 |

| SE Sedan | 1,928 |

| Value Edition Sedan | 1,976 |

| Limited Sedan | 2,012 |

| Sport Sedan | 2,012 |

| GT N Line Sedan | 2,064 |

| 2020 Hyundai Elantra Average Rate | $1,808 |

2020 Kia Forte

$1,554

| 2020 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,486 |

| LXS Sedan | 1,520 |

| EX Sedan | 1,570 |

| GT-Line Sedan | 1,570 |

| GT Sedan | 1,620 |

| 2020 Kia Forte Average Rate | $1,554 |

2019 Hyundai Elantra vs. Kia Forte

When comparing insurance cost for 2019 models, a Hyundai Elantra costs an average of $1,698 per year to insure and a Kia Forte costs $1,508, making the Kia Forte cheaper to insure by $190 per year.

The rate chart below illustrates the average cost to insure both models for four different driver age groups. The average cost of car insurance ranges from $1,522 to $3,438 per year for a 2019 Hyundai Elantra, and $1,354 to $3,036 for a 2019 Kia Forte.

Out of eight trim levels for the 2019 Hyundai Elantra, the cheapest auto insurance rates are on the SEL Sedan trim at a cost of $1,496 per year. For the four trims available for the Kia Forte, the cheapest 2019 trim level to insure is the FE Sedan trim at a cost of $1,446.

When comparing car insurance rates for both models by trim level, the lowest-cost model and trim level to insure is the Kia Forte FE Sedan at an average rate of $1,446 per year, and the highest-cost model and trim is the Hyundai Elantra GT N Line Sedan at an average cost of $1,874 per year.

The tables below show both 2019 models and all trim levels available for each one, including an overall average cost for each model.

2019 Hyundai Elantra

$1,698

| 2019 Hyundai Elantra Trims | Rate |

|---|---|

| SEL Sedan | $1,496 |

| EcoSedan | 1,544 |

| GT Hatchback | 1,544 |

| SE Sedan | 1,696 |

| Value Edition Sedan | 1,778 |

| Limited Sedan | 1,826 |

| Sport Sedan | 1,826 |

| GT N Line Sedan | 1,874 |

| 2019 Hyundai Elantra Average Rate | $1,698 |

2019 Kia Forte

$1,508

| 2019 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,446 |

| LX Sedan | 1,510 |

| S Sedan | 1,524 |

| EX Sedan | 1,552 |

| 2019 Kia Forte Average Rate | $1,508 |

2018 Hyundai Elantra vs. Kia Forte

When comparing average insurance rates for the 2018 Hyundai Elantra and Kia Forte models, the Hyundai Elantra is cheaper to insure by an average of $6 per year.

The chart shown below demonstrates the average cost to insure both models for the 20 to 50-year-old driver age groups. Average car insurance cost ranges from $1,506 to $3,380 per year for a 2018 Hyundai Elantra, and $1,510 to $3,384 for a 2018 Kia Forte.

Out of eight Hyundai Elantra trims, the cheapest 2018 model to insure is the GT Sport Hatchback model at an average cost of $1,290 per year. The 2018 Kia Forte has seven trims available, with the cheapest trim level to insure being the S Sedan model at an average cost of $1,392 per year, or around $116 per month.

When comparing both models at a trim-level basis, the lowest-cost model and trim level to insure is the Hyundai Elantra GT Sport Hatchback at an average rate of $1,290 per year. The most expensive model and trim level is the Kia Forte Forte5 SX Hatchback costing an average of $1,848 per year.

The next two rate tables show average car insurance cost by trim level for a 2018 Hyundai Elantra and Kia Forte, including an overall average cost for each model. The model with the cheapest overall car insurance cost for 2018 is the Hyundai Elantra.

2018 Hyundai Elantra

$1,672

| 2018 Hyundai Elantra Trims | Rate |

|---|---|

| GT Sport Hatchback | $1,290 |

| SE Sedan | 1,638 |

| GT Hatchback | 1,712 |

| SEL Sedan | 1,712 |

| Value Edition Sedan | 1,712 |

| EcoSedan Turbo | 1,758 |

| Sport Sedan | 1,758 |

| Limited Sedan | 1,804 |

| 2018 Hyundai Elantra Average Rate | $1,672 |

2018 Kia Forte

$1,678

| 2018 Kia Forte Trims | Rate |

|---|---|

| S Sedan | $1,392 |

| LX Sedan | 1,606 |

| Forte5 LX Hatchback | 1,680 |

| EX Sedan | 1,726 |

| SX Sedan | 1,726 |

| Forte5 EX Hatchback | 1,772 |

| Forte5 SX Hatchback | 1,848 |

| 2018 Kia Forte Average Rate | $1,678 |

2017 Hyundai Elantra vs. Kia Forte

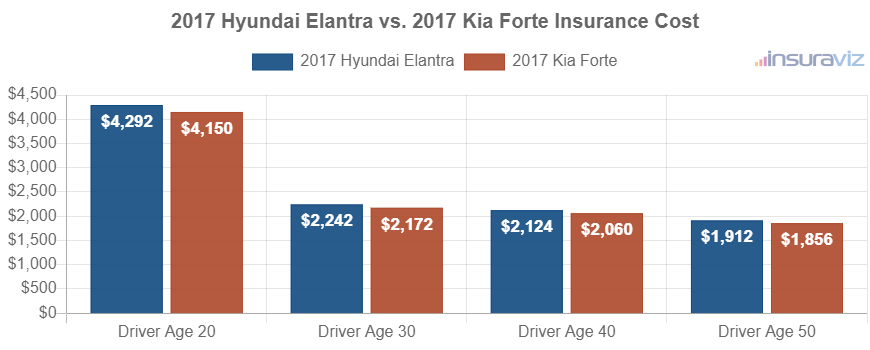

When comparing car insurance rates for 2017 models, a Hyundai Elantra costs an average of $1,680 per year to insure and a Kia Forte costs $1,630, making the Kia Forte cheaper to insure by $50 per year for this comparison year.

The next chart illustrates the average cost to insure both models using a range of rated driver ages. The average car insurance cost ranges from $1,512 to $3,394 per year for a 2017 Hyundai Elantra, and $1,468 to $3,284 for a 2017 Kia Forte.

Out of five trims for the 2017 Hyundai Elantra, the cheapest car insurance rates are on the SE Sedan trim at a cost of $1,588 per year. Out of the six trim levels available for the Kia Forte, the cheapest 2017 trim to insure is the S Sedan model at a cost of $1,500 per year, or about $125 per month.

When rates are compared for the 11 trim levels of both 2017 models, the most affordable model and trim level to insure is the Kia Forte S Sedan at an average rate of $1,500 per year, and the highest-cost model and trim level is the Hyundai Elantra Limited Sedan at an average of $1,748 per year.

The next two tables illustrate average cost to insure each trim level for a 2017 Hyundai Elantra and Kia Forte, along with an average cost for each model.

2017 Hyundai Elantra

$1,680

| 2017 Hyundai Elantra Trims | Rate |

|---|---|

| SE Sedan | $1,588 |

| GT Hatchback | 1,662 |

| EcoSedan | 1,704 |

| Sport Sedan | 1,704 |

| Limited Sedan | 1,748 |

| 2017 Hyundai Elantra Average Rate | $1,680 |

2017 Kia Forte

$1,630

| 2017 Kia Forte Trims | Rate |

|---|---|

| S Sedan | $1,500 |

| LX Sedan | 1,582 |

| LX Hatchback | 1,632 |

| EX Hatchback | 1,674 |

| EX Sedan | 1,674 |

| SX Hatchback | 1,718 |

| 2017 Kia Forte Average Rate | $1,630 |

2016 Hyundai Elantra vs. Kia Forte

When comparing average insurance cost for 2016 models, the Hyundai Elantra costs an average of $1,426 per year to insure and the Kia Forte costs $1,398, making the Kia Forte the winner by $28 for this model year.

The rate chart below illustrates the average cost to insure both models rated for a variety of different driver ages. Average insurance cost ranges from $1,288 to $2,868 per year for a 2016 Hyundai Elantra, and $1,260 to $2,804 for a 2016 Kia Forte for these driver ages.

Out of five trims for the 2016 Hyundai Elantra, the cheapest average car insurance prices are on the SE Sedan model at a cost of $1,358 per year, or about $113 per month.

The 2016 Kia Forte has seven trims available, with the cheapest model to insure being the LX Sedan trim at an average cost of $1,306 per year.

When looking at the aggregated rates by trim for both models, the lowest-cost model and trim to insure is the Kia Forte LX Sedan at an average rate of $1,306 per year. The most expensive vehicle to insure is the Kia Forte SX Hatchback costing $1,462 per year.

The tables shown below show the average cost to insure all 2016 trim levels, plus the average rate for each model. The winner for the 2016 car insurance cost comparison is the Kia Forte.

2016 Hyundai Elantra

$1,426

| 2016 Hyundai Elantra Trims | Rate |

|---|---|

| SE Sedan | $1,358 |

| GT Hatchback | 1,424 |

| Value Edition Sedan | 1,424 |

| Limited Sedan | 1,462 |

| Sport Sedan | 1,462 |

| 2016 Hyundai Elantra Average Rate | $1,426 |

2016 Kia Forte

$1,398

| 2016 Kia Forte Trims | Rate |

|---|---|

| LX Sedan | $1,306 |

| EX Coupe | 1,332 |

| SX Coupe | 1,370 |

| EX Sedan | 1,424 |

| LX Hatchback | 1,424 |

| EX Hatchback | 1,462 |

| SX Hatchback | 1,462 |

| 2016 Kia Forte Average Rate | $1,398 |

2015 Hyundai Elantra vs. Kia Forte

When comparing car insurance rates for the 2015 Hyundai Elantra and Kia Forte models, the Hyundai Elantra has cheaper rates by an average of $96 per year.

The rate chart below displays the average cost to insure the two models for different driver ages. For a 2015 Hyundai Elantra, insurance cost ranges from $1,122 to $2,476 per year for these driver ages. A 2015 Kia Forte costs from $1,208 to $2,688 to insure per year.

For the four trims available for the 2015 Hyundai Elantra, the cheapest trim level to insure is the SE Sedan model at an average cost of $1,196 per year, or $100 per month. Out of the five trim levels available for the Kia Forte, the cheapest 2015 trim to insure is the EX Coupe model at a cost of $1,294.

When trim-level rates for both models are compared, the overall cheapest vehicle to insure is the Hyundai Elantra SE Sedan at an average of $1,196 per year, and the most expensive model and trim level is the Kia Forte EX Hatchback costing an average of $1,402 per year.

The tables shown below show trim level insurance cost averages for both 2015 models, along with the average rate for each model. The 2015 Hyundai Elantra wins the head-to-head comparison over the 2015 Kia Forte for the cheapest average car insurance rates.

2015 Hyundai Elantra

$1,242

| 2015 Hyundai Elantra Trims | Rate |

|---|---|

| SE Sedan | $1,196 |

| GT Hatchback | 1,234 |

| Limited Sedan | 1,270 |

| Sport Sedan | 1,270 |

| 2015 Hyundai Elantra Average Rate | $1,242 |

2015 Kia Forte

$1,338

| 2015 Kia Forte Trims | Rate |

|---|---|

| EX Coupe | $1,294 |

| LX Sedan | 1,306 |

| SX Coupe | 1,330 |

| EX Sedan | 1,366 |

| EX Hatchback | 1,402 |

| 2015 Kia Forte Average Rate | $1,338 |