- For the 2023 model year, a Jeep Grand Cherokee is cheaper to insure than a Jeep Cherokee by an average of $36 per year.

- Average full-coverage car insurance rates for a Jeep Grand Cherokee range from $1,760 to $2,118 per year, while car insurance for a 2023 Jeep Cherokee ranges from $1,922 to $2,040.

- Out of 31 models in the 2023 midsize SUV segment, the Jeep Grand Cherokee ranks 24th and the Jeep Cherokee ranks 25th for cheapest overall car insurance rates.

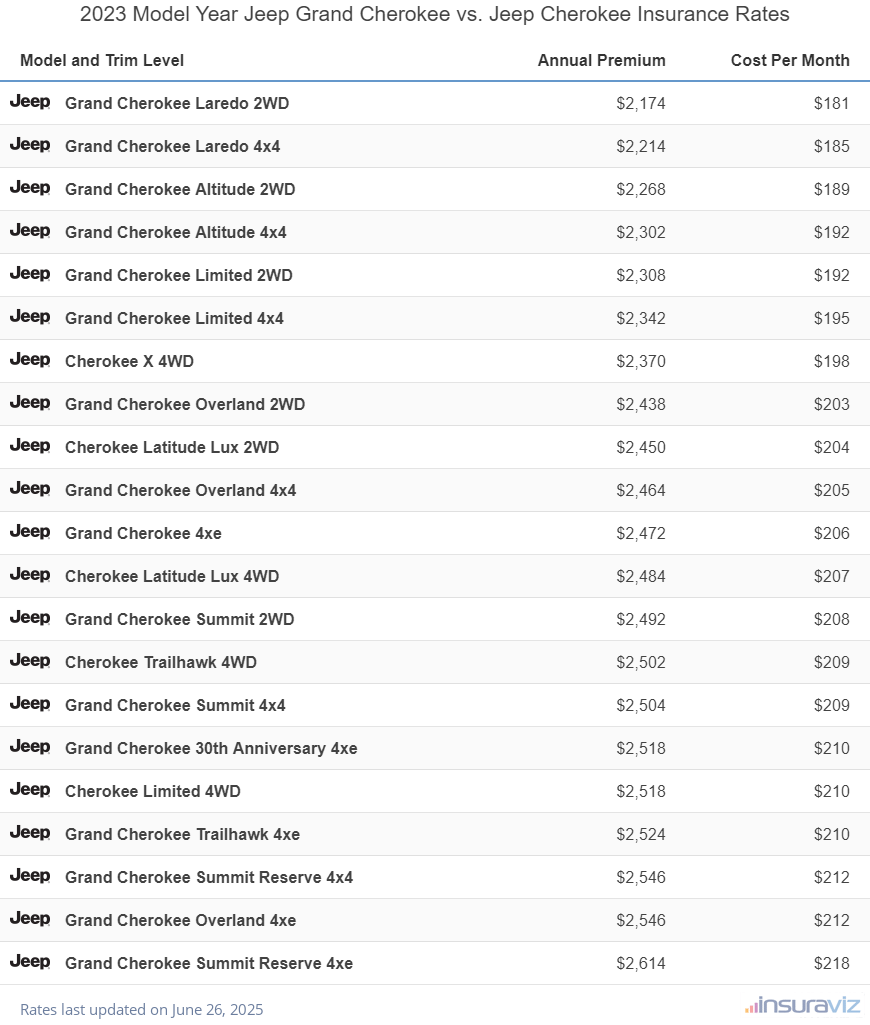

- If affordable monthly payments are the most important factor, the Laredo 2WD is the cheapest Jeep Grand Cherokee to insure, while the X 4WD is the cheapest Jeep Cherokee model to insure.

2023 Jeep Grand Cherokee vs Cherokee

Average insurance rates for a 2023 Jeep Grand Cherokee are $1,960 per year, and the 2023 Jeep Cherokee costs an average of $1,996 per year, making the Jeep Grand Cherokee the better deal by $36 per year.

For the 16 trim levels available for the 2023 Jeep Grand Cherokee, the cheapest trim to insure is the Laredo 2WD trim at an average cost of $1,760 per year. For the five trim levels available for the Jeep Cherokee, the cheapest 2023 model to insure is the X 4WD trim at a cost of $1,922.

When average insurance prices for all 21 trim levels for the 2023 model year of both models are compared, the overall cheapest vehicle to insure is the Jeep Grand Cherokee Laredo 2WD at an average rate of $1,760 per year. The highest-cost model and trim is the Jeep Grand Cherokee Summit Reserve 4xe costing $2,118 per year.

The next chart displays average Jeep Grand Cherokee and Jeep Cherokee car insurance rates for 2023 models, broken out by driver age.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Grand Cherokee Laredo 2WD | $1,760 | $147 |

| Grand Cherokee Laredo 4x4 | $1,794 | $150 |

| Grand Cherokee Altitude 2WD | $1,836 | $153 |

| Grand Cherokee Altitude 4x4 | $1,864 | $155 |

| Grand Cherokee Limited 2WD | $1,870 | $156 |

| Grand Cherokee Limited 4x4 | $1,896 | $158 |

| Cherokee X 4WD | $1,922 | $160 |

| Grand Cherokee Overland 2WD | $1,974 | $165 |

| Cherokee Latitude Lux 2WD | $1,986 | $166 |

| Grand Cherokee Overland 4x4 | $1,998 | $167 |

| Grand Cherokee 4xe | $2,000 | $167 |

| Cherokee Latitude Lux 4WD | $2,014 | $168 |

| Grand Cherokee Summit 2WD | $2,018 | $168 |

| Cherokee Trailhawk 4WD | $2,028 | $169 |

| Grand Cherokee Summit 4x4 | $2,030 | $169 |

| Grand Cherokee 30th Anniversary 4xe | $2,040 | $170 |

| Cherokee Limited 4WD | $2,040 | $170 |

| Grand Cherokee Trailhawk 4xe | $2,046 | $171 |

| Grand Cherokee Summit Reserve 4x4 | $2,064 | $172 |

| Grand Cherokee Overland 4xe | $2,064 | $172 |

| Grand Cherokee Summit Reserve 4xe | $2,118 | $177 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

The chart below displays the average cost to insure the two models using different driver ages. The average cost of car insurance ranges from $1,736 to $3,950 per year for a 2023 Jeep Grand Cherokee, and $1,788 to $4,034 for a 2023 Jeep Cherokee for the driver ages used.

The rate tables below illustrate average car insurance rates for each trim level, plus the average rate for each model.

2023 Jeep Grand Cherokee

$1,960

| 2023 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $1,760 |

| Laredo 4x4 | 1,794 |

| Altitude 2WD | 1,836 |

| Altitude 4x4 | 1,864 |

| Limited 2WD | 1,870 |

| Limited 4x4 | 1,896 |

| Overland 2WD | 1,974 |

| Overland 4x4 | 1,998 |

| 4xe | 2,000 |

| Summit 2WD | 2,018 |

| Summit 4x4 | 2,030 |

| 30th Anniversary 4xe | 2,040 |

| Trailhawk 4xe | 2,046 |

| Summit Reserve 4x4 | 2,064 |

| Overland 4xe | 2,064 |

| Summit Reserve 4xe | 2,118 |

| 2023 Jeep Grand Cherokee Average Rate | $1,960 |

2023 Jeep Cherokee

$1,996

| 2023 Jeep Cherokee Trims | Rate |

|---|---|

| X 4WD | $1,922 |

| Latitude Lux 2WD | 1,986 |

| Latitude Lux 4WD | 2,014 |

| Trailhawk 4WD | 2,028 |

| Limited 4WD | 2,040 |

| 2023 Jeep Cherokee Average Rate | $1,996 |

2022 Jeep Grand Cherokee vs. Cherokee

The next chart shows how average Jeep Grand Cherokee insurance compares to Jeep Cherokee insurance in order to determine which 2022 model has cheaper car insurance rates.

Out of 16 Jeep Grand Cherokee trims, the cheapest 2022 model to insure is the Laredo model at an average cost of $1,720 per year, or around $143 per month.

For the five trims available for the Jeep Cherokee, the cheapest 2022 trim level to insure is the X 4WD trim at a cost of $1,884.

When comparing rates by trim level for both models, the lowest-cost model and trim level to insure is the Jeep Grand Cherokee Laredo at an average rate of $1,720 per year. The overall most expensive vehicle to insure is the Jeep Grand Cherokee Summit Reserve 4xe costing $2,068 per year.

The rate tables below illustrate average car insurance rates for every trim level for both 2022 models, including an overall average cost for each model. The winner for the 2022 car insurance battle is the Jeep Grand Cherokee.

2022 Jeep Grand Cherokee

$1,912

| 2022 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo | $1,720 |

| L Laredo | 1,748 |

| Altitude | 1,788 |

| L Altitude | 1,812 |

| Limited | 1,822 |

| L Limited | 1,842 |

| Trailhawk | 1,892 |

| Overland | 1,934 |

| L Overland | 1,950 |

| 4xe | 1,954 |

| Summit | 1,972 |

| Trailhawk 4xe | 1,992 |

| Summit Reserve | 2,004 |

| Overland 4xe | 2,020 |

| Summit 4xe | 2,046 |

| Summit Reserve 4xe | 2,068 |

| 2022 Jeep Grand Cherokee Average Rate | $1,912 |

2022 Jeep Cherokee

$1,958

| 2022 Jeep Cherokee Trims | Rate |

|---|---|

| X 4WD | $1,884 |

| Latitude Lux 2WD | 1,946 |

| Latitude Lux 4WD | 1,972 |

| Trailhawk 4WD | 1,986 |

| Limited 4WD | 1,998 |

| 2022 Jeep Cherokee Average Rate | $1,958 |

2021 Jeep Grand Cherokee vs Cherokee

When comparing car insurance rates for 2021 models, the Jeep Grand Cherokee costs an average of $1,904 per year to insure and the Jeep Cherokee costs $1,940, making the Jeep Grand Cherokee the winner by $36 for the 2021 comparison year.

The next chart visualizes the average cost to insure both 2021 models rated for a variety of different driver ages. Insurance cost ranges from $1,686 to $3,854 per year for a 2021 Jeep Grand Cherokee, and $1,736 to $3,942 for a 2021 Jeep Cherokee for the illustrated age groups.

The 2021 Jeep Grand Cherokee has 26 trims available, with the cheapest model to insure being the Laredo 2WD trim at an average cost of $1,568 per year.

For the 21 trim levels available for the Jeep Cherokee, the cheapest 2021 trim level to insure is the Latitude 2WD model at a cost of $1,792 per year, or $149 per month.

When rates for all 47 trim levels for both vehicles are compared, the most affordable model and trim level to insure is the Jeep Grand Cherokee Laredo 2WD at an average of $1,568 per year. The most expensive vehicle to insure is the Jeep Grand Cherokee Trackhawk Signature Leather 4WD at an average cost of $2,248 per year.

The next two rate tables display the expected annual car insurance cost by trim level for both 2021 models, plus the average rate for each model.

2021 Jeep Grand Cherokee

$1,904

| 2021 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $1,568 |

| Laredo 4WD | 1,636 |

| Limited 2WD | 1,688 |

| Limited Luxury Group II 2WD | 1,742 |

| Trailhawk 4WD | 1,742 |

| Limited 4WD | 1,768 |

| Limited Luxury Group II 4WD | 1,768 |

| Limited Off-Road Adventure 4WD | 1,768 |

| Overland 2WD | 1,794 |

| Overland 4WD | 1,794 |

| Trailhawk Luxury Group 4WD | 1,794 |

| Summit 2WD | 1,844 |

| Summit Black Roof 2WD | 1,844 |

| Summit 4WD | 1,870 |

| Summit Signature Leather 2WD | 1,898 |

| Summit Black Roof 4WD | 1,916 |

| Summit Signature Leather 4WD | 1,916 |

| SRT 4WD | 1,986 |

| SRT Dual Pane Sunroof 4WD | 2,040 |

| SRT High Performance Audio 4WD | 2,040 |

| SRT Signature Leather 4WD | 2,040 |

| Trackhawk 4WD | 2,196 |

| Trackhawk Black Roof 4WD | 2,196 |

| Trackhawk Dual Pane Sunroof 4WD | 2,196 |

| Trackhawk High Performance Audio 4WD | 2,196 |

| Trackhawk Signature Leather 4WD | 2,248 |

| 2021 Jeep Grand Cherokee Average Rate | $1,904 |

2021 Jeep Cherokee

$1,940

| 2021 Jeep Cherokee Trims | Rate |

|---|---|

| Latitude 2WD | $1,792 |

| Latitude 2WD 6 Cyl Gas | 1,792 |

| Latitude 4WD | 1,844 |

| Latitude 4WD 6 Cyl Gas | 1,844 |

| Latitude Plus 2WD | 1,844 |

| Latitude Plus 2WD 6 Cyl Gas | 1,844 |

| Latitude Plus 2WD 4 Cyl Turbo | 1,896 |

| Latitude Plus 4WD | 1,896 |

| Latitude Plus 4WD 6 Cyl Gas | 1,896 |

| Latitude Plus 4WD 4 Cyl Turbo | 1,948 |

| Limited 2WD | 1,948 |

| Limited 2WD 6 Cyl Gas | 1,948 |

| Limited 2WD 4 Cyl Turbo | 2,002 |

| Limited 4WD 4 Cyl Turbo | 2,002 |

| Limited 4WD 6 Cyl Gas | 2,002 |

| Trailhawk 4WD 4 Cyl Turbo | 2,002 |

| Trailhawk 4WD 6 Cyl Gas | 2,002 |

| Overland 2WD 4 Cyl Turbo | 2,054 |

| Overland 2WD 6 Cyl Gas | 2,054 |

| Overland 4WD 4 Cyl Turbo | 2,054 |

| Overland 4WD 6 Cyl Gas | 2,054 |

| 2021 Jeep Cherokee Average Rate | $1,940 |

2020 Jeep Grand Cherokee vs Cherokee

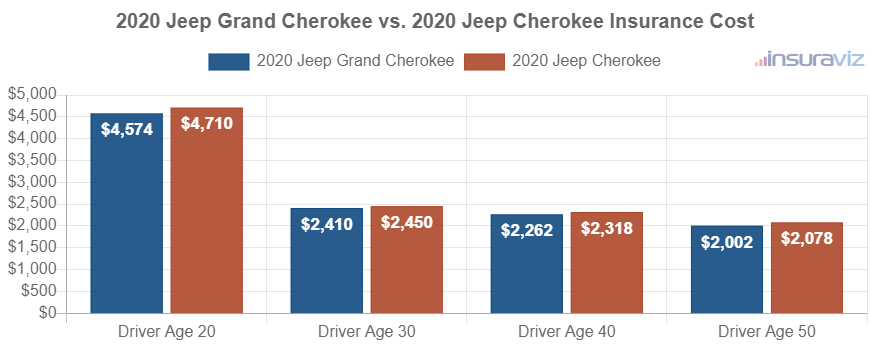

For the 2020 Jeep Grand Cherokee and Jeep Cherokee models, the Jeep Grand Cherokee is cheaper to insure by an average of $42 per year.

The chart shown below illustrates the average cost to insure both 2020 models for the 20 to 50-year-old driver age groups. For a 2020 Jeep Grand Cherokee, average insurance cost ranges from $1,636 to $3,738 per year for the example age groups. A 2020 Jeep Cherokee costs from $1,692 to $3,836 to insure per year.

Out of 26 trims for the 2020 Jeep Grand Cherokee, the cheapest car insurance rates are on the Laredo 2WD trim at a cost of $1,526 per year.

The 2020 Jeep Cherokee has 21 trim levels available, with the cheapest trim level to insure being the Latitude 2WD trim at an average cost of $1,746 per year, or about $146 per month.

When trim-level rates for both models are compared, the most affordable model and trim level to insure is the Jeep Grand Cherokee Laredo 2WD at an average cost of $1,526 per year. The most expensive model and trim level is the Jeep Grand Cherokee Trackhawk Signature Leather 4WD costing an average of $2,178 per year.

The tables below illustrate trim level insurance cost averages for both 2020 models, including the average rate for each model. The winner for the 2020 car insurance comparison is the Jeep Grand Cherokee.

2020 Jeep Grand Cherokee

$1,846

| 2020 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $1,526 |

| Laredo 4WD | 1,590 |

| Limited 2WD | 1,640 |

| Limited Luxury Group II 2WD | 1,692 |

| Trailhawk 4WD | 1,692 |

| Limited 4WD | 1,716 |

| Limited Luxury Group II 4WD | 1,716 |

| Limited Off-Road Adventure 4WD | 1,716 |

| Overland 2WD | 1,740 |

| Overland 4WD | 1,740 |

| Trailhawk Luxury Group 4WD | 1,740 |

| Summit 2WD | 1,792 |

| Summit Black Roof 2WD | 1,792 |

| Summit 4WD | 1,818 |

| Summit Signature Leather 2WD | 1,840 |

| Summit Black Roof 4WD | 1,858 |

| Summit Signature Leather 4WD | 1,858 |

| SRT 4WD | 1,928 |

| SRT Dual Pane Sunroof 4WD | 1,976 |

| SRT High Performance Audio 4WD | 1,976 |

| SRT Signature Leather 4WD | 1,976 |

| Trackhawk 4WD | 2,128 |

| Trackhawk Black Roof 4WD | 2,128 |

| Trackhawk Dual Pane Sunroof 4WD | 2,128 |

| Trackhawk High Performance Audio 4WD | 2,128 |

| Trackhawk Signature Leather 4WD | 2,178 |

| 2020 Jeep Grand Cherokee Average Rate | $1,846 |

2020 Jeep Cherokee

$1,888

| 2020 Jeep Cherokee Trims | Rate |

|---|---|

| Latitude 2WD | $1,746 |

| Latitude 2WD 6 Cyl Gas | 1,746 |

| Latitude 4WD | 1,796 |

| Latitude 4WD 6 Cyl Gas | 1,796 |

| Latitude Plus 2WD | 1,796 |

| Latitude Plus 2WD 6 Cyl Gas | 1,796 |

| Latitude Plus 2WD 4 Cyl Turbo | 1,846 |

| Latitude Plus 4WD | 1,846 |

| Latitude Plus 4WD 6 Cyl Gas | 1,846 |

| Latitude Plus 4WD 4 Cyl Turbo | 1,896 |

| Limited 2WD | 1,896 |

| Limited 2WD 6 Cyl Gas | 1,896 |

| Limited 2WD 4 Cyl Turbo | 1,948 |

| Limited 4WD 4 Cyl Turbo | 1,948 |

| Limited 4WD 6 Cyl Gas | 1,948 |

| Trailhawk 4WD 4 Cyl Turbo | 1,948 |

| Trailhawk 4WD 6 Cyl Gas | 1,948 |

| Overland 2WD 4 Cyl Turbo | 1,996 |

| Overland 2WD 6 Cyl Gas | 1,996 |

| Overland 4WD 4 Cyl Turbo | 1,996 |

| Overland 4WD 6 Cyl Gas | 1,996 |

| 2020 Jeep Cherokee Average Rate | $1,888 |

2019 Jeep Grand Cherokee vs Cherokee

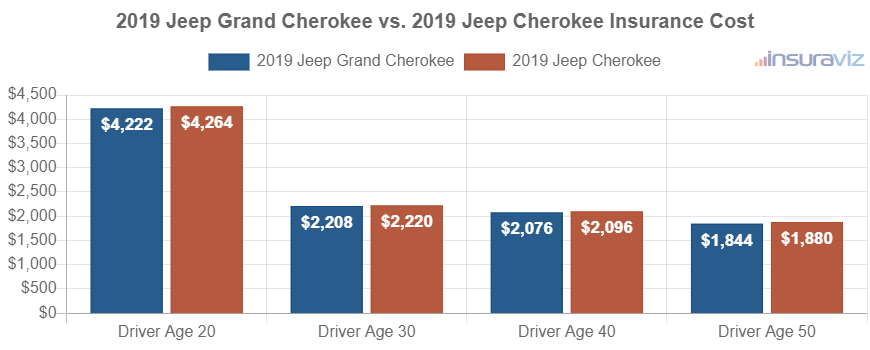

When comparing average insurance rates for 2019 models, a Jeep Grand Cherokee costs an average of $1,682 per year to insure and a Jeep Cherokee costs $1,700, making the Jeep Grand Cherokee cheaper to insure by $18 per year.

The chart shown below illustrates the average cost to insure both 2019 models for the 20, 30, 40, and 50-year-old driver age groups. Average insurance cost ranges from $1,494 to $3,422 per year for a 2019 Jeep Grand Cherokee, and $1,522 to $3,456 for a 2019 Jeep Cherokee for the example age groups.

Out of 11 trim levels for the 2019 Jeep Grand Cherokee, the cheapest auto insurance rates are on the Laredo 2WD model at a cost of $1,466 per year, or around $122 per month.

Out of the nine trim levels available for the Jeep Cherokee, the cheapest 2019 trim to insure is the Latitude 2WD trim at a cost of $1,570.

When average car insurance prices for all 20 trim levels for the 2019 model year of both models are compared, the lowest-cost model and trim level to insure is the Jeep Grand Cherokee Laredo 2WD at an average cost of $1,466 per year, and the most expensive trim is the Jeep Grand Cherokee Trackhawk 4WD costing an average of $2,044 per year.

The tables below illustrate average car insurance rates for every trim level for both 2019 models, plus an average rate for each model. The cheapest of the two models to insure for the 2019 model year is the Jeep Grand Cherokee.

2019 Jeep Grand Cherokee

$1,682

| 2019 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $1,466 |

| Laredo 4WD | 1,528 |

| Limited 2WD | 1,576 |

| Limited 4WD | 1,624 |

| Trailhawk 4WD | 1,624 |

| Overland 2WD | 1,672 |

| Overland 4WD | 1,672 |

| Summit 2WD | 1,720 |

| Summit 4WD | 1,720 |

| SRT 4WD | 1,850 |

| Trackhawk 4WD | 2,044 |

| 2019 Jeep Grand Cherokee Average Rate | $1,682 |

2019 Jeep Cherokee

$1,700

| 2019 Jeep Cherokee Trims | Rate |

|---|---|

| Latitude 2WD | $1,570 |

| Latitude 4WD | 1,618 |

| Latitude Plus 2WD | 1,618 |

| Latitude Plus 4WD | 1,666 |

| Limited 2WD | 1,714 |

| Limited 4WD | 1,762 |

| Trailhawk 4WD | 1,762 |

| Overland 2WD | 1,786 |

| Overland 4WD | 1,810 |

| 2019 Jeep Cherokee Average Rate | $1,700 |

2018 Jeep Grand Cherokee vs Cherokee

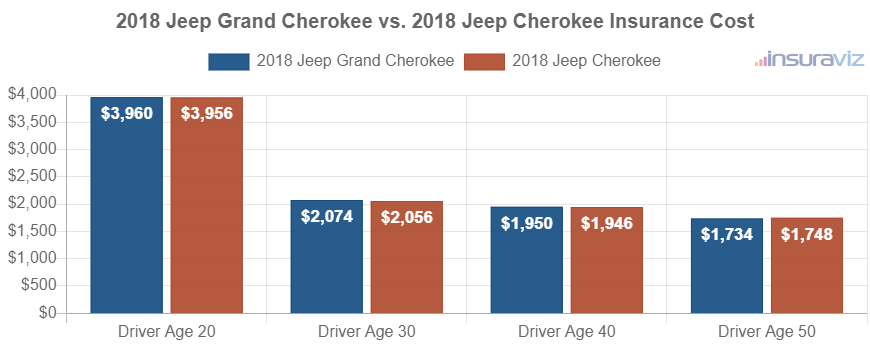

For the 2018 Jeep Grand Cherokee and Jeep Cherokee models, the Jeep Cherokee has cheaper car insurance rates by an average of $2 per year for this comparison year.

The rate chart below shows the average cost to insure both 2018 models using drivers aged 20 to 50. The average car insurance cost ranges from $1,406 to $3,208 per year for a 2018 Jeep Grand Cherokee, and $1,416 to $3,206 for a 2018 Jeep Cherokee.

For the 11 trims available for the 2018 Jeep Grand Cherokee, the cheapest model to insure is the Laredo 2WD model at an average cost of $1,406 per year, or around $117 per month.

For the 13 trims available for the Jeep Cherokee, the cheapest 2018 trim level to insure is the Latitude 2WD trim at a cost of $1,514.

When trim-level rates for both models are compared, the lowest-cost model and trim to insure is the Jeep Grand Cherokee Laredo 2WD at an average cost of $1,406 per year, and the most expensive vehicle to insure is the Jeep Grand Cherokee Trackhawk 4WD at an average cost of $1,948 per year.

The next two tables illustrate the average insurance cost by trim level for both 2018 models, including the average rate for each model. The 2018 Jeep Cherokee has lower-cost car average car insurance rates than the 2018 Jeep Grand Cherokee.

2018 Jeep Grand Cherokee

$1,582

| 2018 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $1,406 |

| Laredo 4WD | 1,406 |

| Limited 2WD | 1,512 |

| Limited 4WD | 1,554 |

| Overland 2WD | 1,554 |

| SRT 4WD | 1,554 |

| Trailhawk 4WD | 1,554 |

| Overland 4WD | 1,600 |

| Summit 2WD | 1,646 |

| Summit 4WD | 1,646 |

| Trackhawk 4WD | 1,948 |

| 2018 Jeep Grand Cherokee Average Rate | $1,582 |

2018 Jeep Cherokee

$1,580

| 2018 Jeep Cherokee Trims | Rate |

|---|---|

| Latitude 2WD | $1,514 |

| Latitude 4WD | 1,514 |

| Longitude 2WD | 1,514 |

| Longitude 4WD | 1,514 |

| Sport 2WD | 1,514 |

| Sport 4WD | 1,514 |

| Latitude Plus 2WD | 1,558 |

| Latitude Plus 4WD | 1,558 |

| Limited 2WD | 1,604 |

| Limited 4WD | 1,650 |

| Trailhawk 4WD | 1,650 |

| Overland 2WD | 1,694 |

| Overland 4WD | 1,738 |

| 2018 Jeep Cherokee Average Rate | $1,580 |

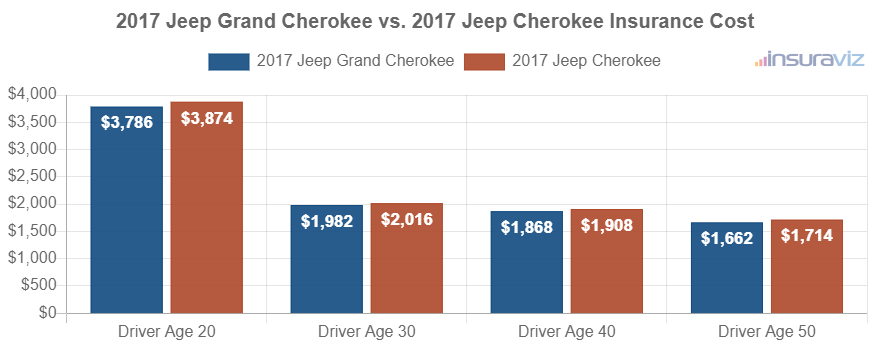

2017 Jeep Grand Cherokee vs Cherokee

For 2017 Jeep Grand Cherokee and Jeep Cherokee models, the Jeep Grand Cherokee has lower-cost car insurance by an average of $34 per year for this model year.

The rate chart below shows the average cost to insure both 2017 models using a range of rated driver ages. The average cost of car insurance ranges from $1,348 to $3,068 per year for a 2017 Jeep Grand Cherokee, and $1,390 to $3,140 for a 2017 Jeep Cherokee for the age groups used in the chart.

The 2017 Jeep Grand Cherokee has 16 trims available, with the cheapest trim to insure being the Laredo 2WD trim at an average cost of $1,356 per year, or about $113 per month. For the nine trim levels available for the Jeep Cherokee, the cheapest 2017 trim to insure is the Sport 2WD model at a cost of $1,422 per year, or about $119 per month.

When rates for all 25 trim levels for both vehicles are compared, the lowest-cost model and trim level to insure is the Jeep Grand Cherokee Laredo 2WD at an average rate of $1,356 per year. The most expensive model and trim level is the Jeep Cherokee Overland 4WD at an average cost of $1,678 per year.

The rate tables below illustrate trim level insurance cost averages for both 2017 models, plus the average rate for each model.

2017 Jeep Grand Cherokee

$1,512

| 2017 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $1,356 |

| Laredo 4WD | 1,356 |

| Limited 2WD | 1,456 |

| Limited 4WD | 1,456 |

| Limited 2WD Diesel | 1,498 |

| Limited 4WD Diesel | 1,498 |

| Overland 2WD | 1,498 |

| Trailhawk 4WD | 1,498 |

| Overland 2WD Diesel | 1,540 |

| Overland 4WD | 1,540 |

| Trailhawk 4WD Diesel | 1,540 |

| Overland 4WD Diesel | 1,584 |

| Summit 2WD | 1,584 |

| Summit 2WD Diesel | 1,584 |

| Summit 4WD | 1,584 |

| Summit 4WD Diesel | 1,626 |

| 2017 Jeep Grand Cherokee Average Rate | $1,512 |

2017 Jeep Cherokee

$1,546

| 2017 Jeep Cherokee Trims | Rate |

|---|---|

| Sport 2WD | $1,422 |

| Latitude 2WD | 1,464 |

| Sport 4WD | 1,464 |

| Latitude 4WD | 1,508 |

| Limited 2WD | 1,552 |

| Limited 4WD | 1,594 |

| Trailhawk 4WD | 1,594 |

| Overland 2WD | 1,638 |

| Overland 4WD | 1,678 |

| 2017 Jeep Cherokee Average Rate | $1,546 |

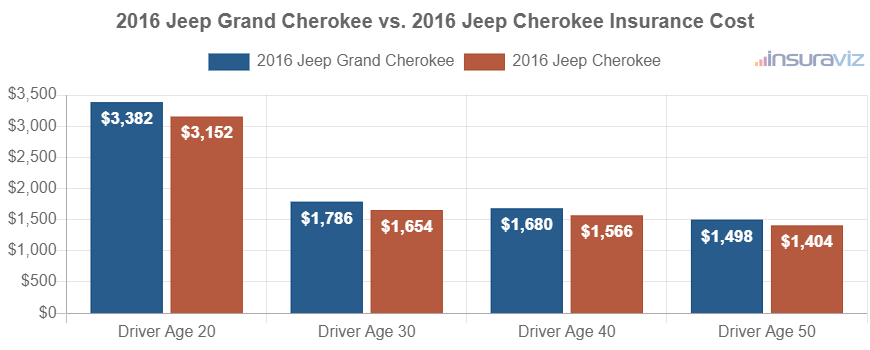

2016 Jeep Grand Cherokee vs Cherokee

For 2016 Jeep Grand Cherokee and Jeep Cherokee models, the Jeep Cherokee has lower-cost car insurance by an average of $88 per year for this comparison year.

The rate chart below displays the average cost to insure the two models for different driver ages. For a 2016 Jeep Grand Cherokee, the average cost of car insurance ranges from $1,208 to $2,728 per year for these driver ages. A 2016 Jeep Cherokee costs from $1,138 to $2,556 to insure per year.

Out of 15 trim levels for the 2016 Jeep Grand Cherokee, the cheapest insurance rates are on the Laredo 2WD model at a cost of $1,166 per year. The 2016 Jeep Cherokee has nine trims available, with the cheapest trim level to insure being the Sport 2WD model at an average cost of $1,154 per year, or $96 per month.

When comparing car insurance rates for both models by trim level, the cheapest trim to insure is the Jeep Cherokee Sport 2WD at an average of $1,154 per year, and the most expensive model and trim level is the Jeep Grand Cherokee SRT8 4WD costing an average of $1,532 per year.

The tables shown below show the average insurance cost by trim level for both 2016 models, plus the average rate for each model. The 2016 Jeep Cherokee has cheaper average car insurance rates than the 2016 Jeep Grand Cherokee.

2016 Jeep Grand Cherokee

$1,356

| 2016 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $1,166 |

| Laredo 4WD | 1,208 |

| Limited 2WD | 1,296 |

| Limited 4WD | 1,296 |

| Limited 2WD Diesel | 1,338 |

| Limited 4WD Diesel | 1,338 |

| Overland 2WD | 1,338 |

| Overland 2WD Diesel | 1,376 |

| Overland 4WD | 1,376 |

| Summit 2WD | 1,376 |

| Overland 4WD Diesel | 1,414 |

| Summit 4WD | 1,414 |

| Summit 2WD Diesel | 1,424 |

| Summit 4WD Diesel | 1,462 |

| SRT8 4WD | 1,532 |

| 2016 Jeep Grand Cherokee Average Rate | $1,356 |

2016 Jeep Cherokee

$1,268

| 2016 Jeep Cherokee Trims | Rate |

|---|---|

| Sport 2WD | $1,154 |

| Latitude 2WD | 1,194 |

| Sport 4WD | 1,194 |

| Latitude 4WD | 1,234 |

| Limited 2WD | 1,272 |

| Limited 4WD | 1,312 |

| Trailhawk 4WD | 1,312 |

| Overland 2WD | 1,350 |

| Overland 4WD | 1,390 |

| 2016 Jeep Cherokee Average Rate | $1,268 |

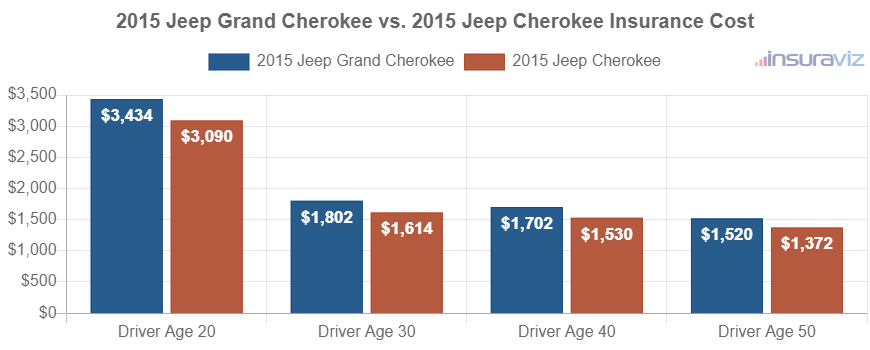

2015 Jeep Grand Cherokee vs Cherokee

When comparing car insurance rates for 2015 models, the Jeep Grand Cherokee costs an average of $1,380 per year to insure and the Jeep Cherokee costs $1,240, making the Jeep Cherokee the winner by $140 for this comparison year.

The rate chart below visualizes the average cost to insure the two models rated for a variety of different driver ages. The average car insurance cost ranges from $1,232 to $2,784 per year for a 2015 Jeep Grand Cherokee, and $1,112 to $2,502 for a 2015 Jeep Cherokee for these driver ages.

Out of nine trims for the 2015 Jeep Grand Cherokee, the cheapest average insurance prices are on the Laredo 2WD model at a cost of $1,240 per year.

For the seven trims available for the Jeep Cherokee, the cheapest 2015 trim level to insure is the Sport 2WD trim at a cost of $1,166 per year, or around $97 per month.

When looking at the aggregated rates by trim for both models, the cheapest vehicle to insure is the Jeep Cherokee Sport 2WD at a cost of $1,166 per year, and the most expensive vehicle to insure is the Jeep Grand Cherokee SRT8 4WD costing an average of $1,530 per year.

The tables shown below display average car insurance cost by trim level for each 2015 model, plus the average rate for each model.

2015 Jeep Grand Cherokee

$1,380

| 2015 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $1,240 |

| Laredo 4WD | 1,276 |

| Limited 2WD | 1,348 |

| Limited 4WD | 1,348 |

| Overland 2WD | 1,384 |

| Overland 4WD | 1,420 |

| Summit 2WD | 1,420 |

| Summit 4WD | 1,456 |

| SRT8 4WD | 1,530 |

| 2015 Jeep Grand Cherokee Average Rate | $1,380 |

2015 Jeep Cherokee

$1,240

| 2015 Jeep Cherokee Trims | Rate |

|---|---|

| Sport 2WD | $1,166 |

| Latitude 2WD | 1,202 |

| Sport 4WD | 1,202 |

| Latitude 4WD | 1,240 |

| Limited 2WD | 1,276 |

| Trailhawk 4WD | 1,276 |

| Limited 4WD | 1,312 |

| 2015 Jeep Cherokee Average Rate | $1,240 |