- Out of 47 models in the 2024 small SUV category, the Mazda CX-5 ranks eighth and the Subaru Forester ranks 16th for cheapest overall car insurance rates.

- For the 2024 model year Mazda CX-5, car insurance prices cost from $1,834 to $2,068 per year, while the insurance price for the 2024 Subaru Forester ranges from $1,982 to $2,244, depending on the exact model being insured.

- If the cheapest auto insurance rates are your top priority, the 2.5 S Select and 2.5 S Preferred trims are the cheapest Mazda CX-5 models to insure, while the Base and Premium trims are the cheapest Subaru Forester models to insure.

Is insurance cheaper for a Mazda CX-5 or Subaru Forester?

Insurance rates on a 2024 Mazda CX-5 cost an average of $1,956 per year, while the 2024 Subaru Forester costs an average of $2,134 per year, making the Mazda CX-5 the cheapest to insure.

Out of eight Mazda CX-5 trim levels, the cheapest 2024 model to insure is the 2.5 S Select trim at an average cost of $1,834 per year. For the six trim levels available for the Subaru Forester, the cheapest 2024 trim to insure is the Base trim at a cost of $1,982 per year, or around $165 per month.

When comparing rates by trim level for both models, the lowest-cost model and trim level is the Mazda CX-5 2.5 S Select at an average cost of $1,834 per year. The highest-cost model and trim is the Subaru Forester Touring at a cost of $2,244 per year.

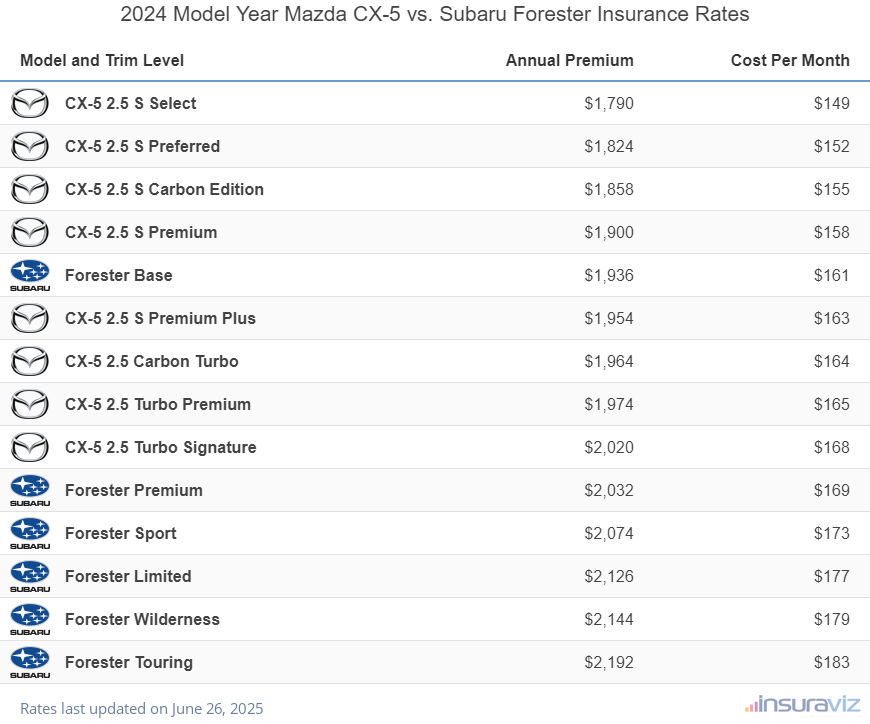

The table below compares the cost of car insurance for 2024 Mazda CX-5 and Subaru Forester models, broken down by trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| CX-5 2.5 S Select | $1,834 | $153 |

| CX-5 2.5 S Preferred | $1,868 | $156 |

| CX-5 2.5 S Carbon Edition | $1,902 | $159 |

| CX-5 2.5 S Premium | $1,946 | $162 |

| Forester Base | $1,982 | $165 |

| CX-5 2.5 S Premium Plus | $2,002 | $167 |

| CX-5 2.5 Carbon Turbo | $2,010 | $168 |

| CX-5 2.5 Turbo Premium | $2,022 | $169 |

| CX-5 2.5 Turbo Signature | $2,068 | $172 |

| Forester Premium | $2,082 | $174 |

| Forester Sport | $2,126 | $177 |

| Forester Limited | $2,178 | $182 |

| Forester Wilderness | $2,196 | $183 |

| Forester Touring | $2,244 | $187 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

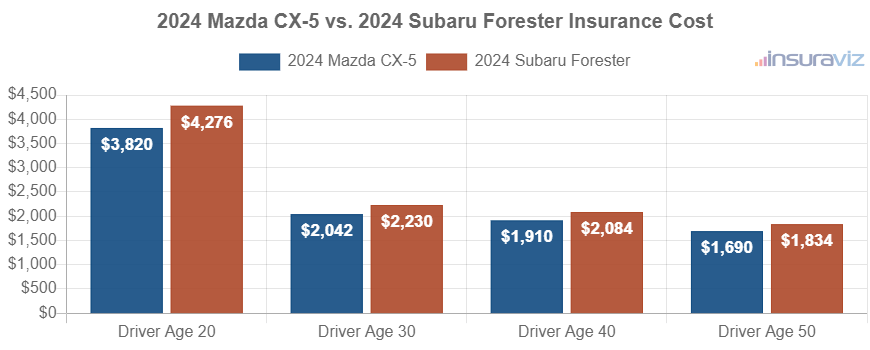

The next chart displays the average cost to insure both models for drivers aged 20 to 50. The average car insurance cost ranges from $1,730 to $3,916 per year for a 2024 Mazda CX-5, and $1,880 to $4,382 for a 2024 Subaru Forester for the included age groups.

The tables shown below display average car insurance rates for every trim level for both 2024 models, plus the average rate for each model.

2024 Mazda CX-5

$1,956

| 2024 Mazda CX-5 Trims | Rate |

|---|---|

| 2.5 S Select | $1,834 |

| 2.5 S Preferred | 1,868 |

| 2.5 S Carbon Edition | 1,902 |

| 2.5 S Premium | 1,946 |

| 2.5 S Premium Plus | 2,002 |

| 2.5 Carbon Turbo | 2,010 |

| 2.5 Turbo Premium | 2,022 |

| 2.5 Turbo Signature | 2,068 |

| 2024 Mazda CX-5 Average Rate | $1,956 |

2024 Subaru Forester

$2,134

| 2024 Subaru Forester Trims | Rate |

|---|---|

| Base | $1,982 |

| Premium | 2,082 |

| Sport | 2,126 |

| Limited | 2,178 |

| Wilderness | 2,196 |

| Touring | 2,244 |

| 2024 Subaru Forester Average Rate | $2,134 |

2023 Mazda CX-5 vs. Subaru Forester

Insurance rates for a 2023 Mazda CX-5 average $1,840 per year, while insurance for a Subaru Forester costs an average of $1,974 per year, making the Mazda CX-5 the model with lower average car insurance rates.

On a 2023 Mazda CX-5, average car insurance rates range from $1,698 per year for the CX-5 2.5 S model up to the most expensive rate of $1,968 for the CX-5 2.5 Turbo Signature model. The lowest-cost trims to insure are the 2.5 S, 2.5 S Select, and 2.5 S Preferred

For the 2023 Subaru Forester, rates range from $1,826 per year for the Base AWD model up to $2,086 for the Touring AWD model. The cheapest Forester models to insure are the Base AWD, Premium AWD, and Sport AWD

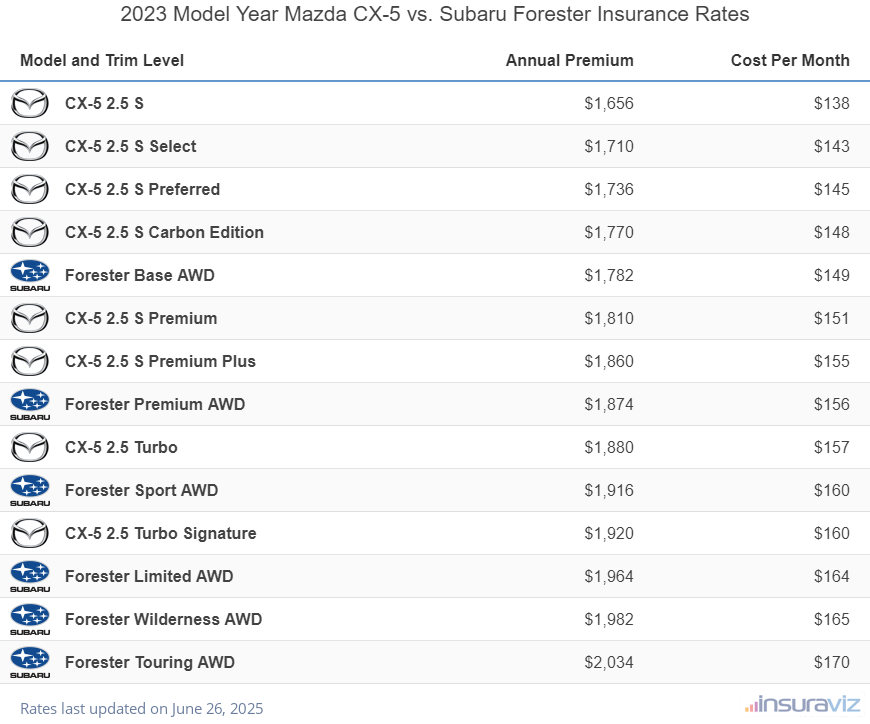

The next table compares and ranks the annual and monthly car insurance costs for 2023 Mazda CX-5 and Subaru Forester models, with the average cost to insure each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| CX-5 2.5 S | $1,698 | $142 |

| CX-5 2.5 S Select | $1,754 | $146 |

| CX-5 2.5 S Preferred | $1,782 | $149 |

| CX-5 2.5 S Carbon Edition | $1,816 | $151 |

| Forester Base AWD | $1,826 | $152 |

| CX-5 2.5 S Premium | $1,858 | $155 |

| CX-5 2.5 S Premium Plus | $1,906 | $159 |

| Forester Premium AWD | $1,922 | $160 |

| CX-5 2.5 Turbo | $1,928 | $161 |

| Forester Sport AWD | $1,966 | $164 |

| CX-5 2.5 Turbo Signature | $1,968 | $164 |

| Forester Limited AWD | $2,016 | $168 |

| Forester Wilderness AWD | $2,034 | $170 |

| Forester Touring AWD | $2,086 | $174 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

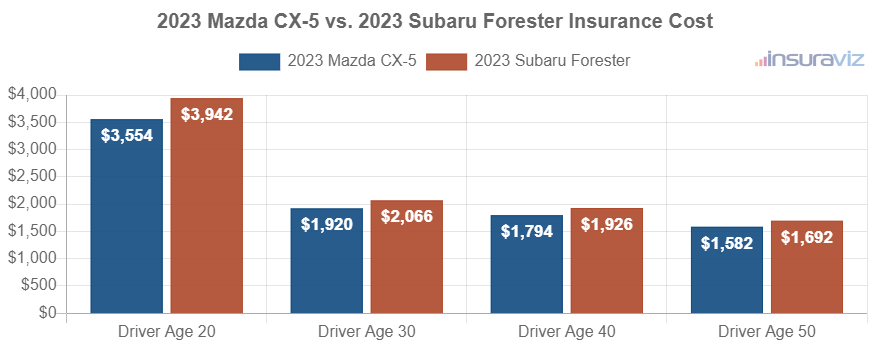

The chart below visualizes the average car insurance cost for the two models using different driver ages. A full-coverage car insurance policy ranges from $1,618 to $3,644 per year for a 2023 Mazda CX-5, and $1,732 to $4,040 on the 2023 Subaru Forester for the age groups used in this illustration.

Out of eight Mazda CX-5 trim levels, the most affordable 2023 trim to insure is the 2.5 S trim at an average cost of $1,698 per year, or $142 per month. Out of the six trims available for the Subaru Forester, the lowest-cost 2023 trim to insure is the Base AWD model at a cost of $1,826 per year, or $152 per month.

When comparing both models combined at a trim-level basis, the most affordable model and trim level to put coverage on is the Mazda CX-5 2.5 S at a cost of $1,698 per year. The most expensive vehicle to insure is the Subaru Forester Touring AWD at an average cost of $2,086 per year.

The tables below show the average car insurance cost by trim level for each 2023 model, including the average rate for each model. The model with the cheapest overall car insurance cost for 2023 is the Mazda CX-5.

2023 Mazda CX-5

$1,840

| 2023 Mazda CX-5 Trims | Rate |

|---|---|

| 2.5 S | $1,698 |

| 2.5 S Select | 1,754 |

| 2.5 S Preferred | 1,782 |

| 2.5 S Carbon Edition | 1,816 |

| 2.5 S Premium | 1,858 |

| 2.5 S Premium Plus | 1,906 |

| 2.5 Turbo | 1,928 |

| 2.5 Turbo Signature | 1,968 |

| 2023 Mazda CX-5 Average Rate | $1,840 |

2023 Subaru Forester

$1,974

| 2023 Subaru Forester Trims | Rate |

|---|---|

| Base AWD | $1,826 |

| Premium AWD | 1,922 |

| Sport AWD | 1,966 |

| Limited AWD | 2,016 |

| Wilderness AWD | 2,034 |

| Touring AWD | 2,086 |

| 2023 Subaru Forester Average Rate | $1,974 |

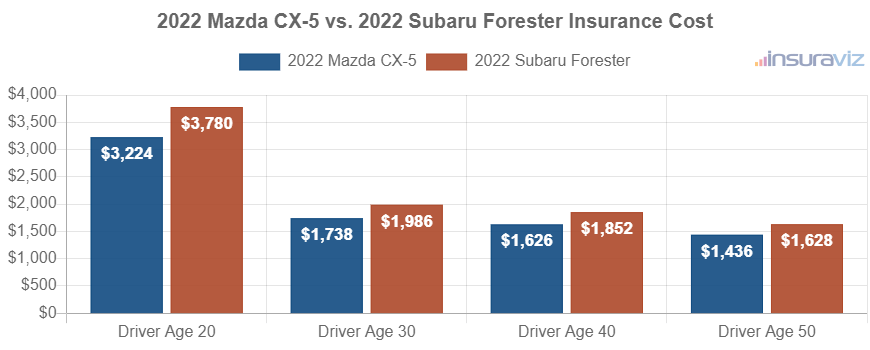

2022 Mazda CX-5 vs. Subaru Forester

For 2022 Mazda CX-5 and Subaru Forester models, the Mazda CX-5 has cheaper car insurance rates by an average of $232 per year.

The rate chart below shows the average car insurance cost for the two models for four different driver age groups. Average car insurance cost ranges from $1,470 to $3,302 per year for the 2022 Mazda CX-5, and $1,666 to $3,870 for a 2022 Subaru Forester.

The 2022 Mazda CX-5 has eight trims available, with the cheapest model to insure being the S model at an average cost of $1,520 per year. For the six option levels available for the Subaru Forester, the lowest-cost 2022 trim package to insure is the AWD trim at a cost of $1,782 per year, or around $149 per month.

When trim-level rates for both models are compared, the cheapest model and trim level to buy insurance for is the Mazda CX-5 S at an average of $1,520 per year. The highest-cost model and trim is the Subaru Forester Wilderness AWD at an average cost of $2,016 per year.

The two tables below break down average car insurance cost by trim level for each 2022 model, plus an average rate for each model. The 2022 Mazda CX-5 has cheaper overall car insurance rates than the 2022 Subaru Forester.

2022 Mazda CX-5

$1,668

| 2022 Mazda CX-5 Trims | Rate |

|---|---|

| S | $1,520 |

| S Select | 1,576 |

| S Carbon Edition | 1,636 |

| S Premium | 1,662 |

| S Premium Plus | 1,690 |

| Turbo | 1,730 |

| Turbo Signature | 1,756 |

| S Preferred | 1,770 |

| 2022 Mazda CX-5 Average Rate | $1,668 |

2022 Subaru Forester

$1,900

| 2022 Subaru Forester Trims | Rate |

|---|---|

| AWD | $1,782 |

| Premium AWD | 1,782 |

| Sport AWD | 1,850 |

| Touring AWD | 1,960 |

| Limited AWD | 2,006 |

| Wilderness AWD | 2,016 |

| 2022 Subaru Forester Average Rate | $1,900 |

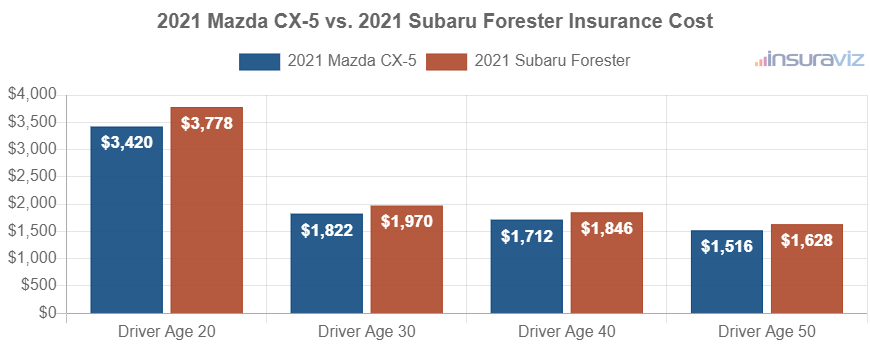

2021 Mazda CX-5 vs. Subaru Forester

When comparing car insurance rates for 2021 models, the Mazda CX-5 costs $1,752 per year for a full-coverage policy and the Subaru Forester costs $1,890, making the Mazda CX-5 the cheaper model to insure by $138 for this comparison year.

The chart below demonstrates the average car insurance cost for both 2021 models rated for multiple driver ages. For the 2021 Mazda CX-5, the average car insurance cost ranges from $1,554 to $3,504 per year for these driver ages. Full-coverage insurance for the 2021 Subaru Forester costs from $1,668 to $3,872 on average per year.

The 2021 Mazda CX-5 has eight trim levels available, with the lowest-cost model to insure being the Sport 2WD trim at an average cost of $1,596 per year, or around $133 per month.

Out of the six different option levels available for a Subaru Forester, the cheapest 2021 trim to insure is the AWD trim at a cost of $1,808.

When comparing rates by trim level for both models, the cheapest model and trim level to put coverage on is the Mazda CX-5 Sport 2WD at a cost of $1,596 per year, and the most expensive model and trim level is the Subaru Forester Touring AWD at an average of $2,026 per year.

The rate tables below show trim level insurance cost averages for both 2021 models, including the average rate for each model. The 2021 Mazda CX-5 comes out on top over the 2021 Subaru Forester for the cheapest overall car insurance cost.

2021 Mazda CX-5

$1,752

| 2021 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,596 |

| Sport AWD | 1,660 |

| Touring 2WD | 1,660 |

| Touring AWD | 1,726 |

| Grand Touring 2WD | 1,794 |

| Grand Touring AWD | 1,794 |

| Grand Touring Reserve AWD | 1,860 |

| Signature AWD | 1,926 |

| 2021 Mazda CX-5 Average Rate | $1,752 |

2021 Subaru Forester

$1,890

| 2021 Subaru Forester Trims | Rate |

|---|---|

| AWD | $1,808 |

| Alloy Wheel Package AWD | 1,808 |

| Premium AWD | 1,864 |

| Sport AWD | 1,896 |

| Limited AWD | 1,940 |

| Touring AWD | 2,026 |

| 2021 Subaru Forester Average Rate | $1,890 |

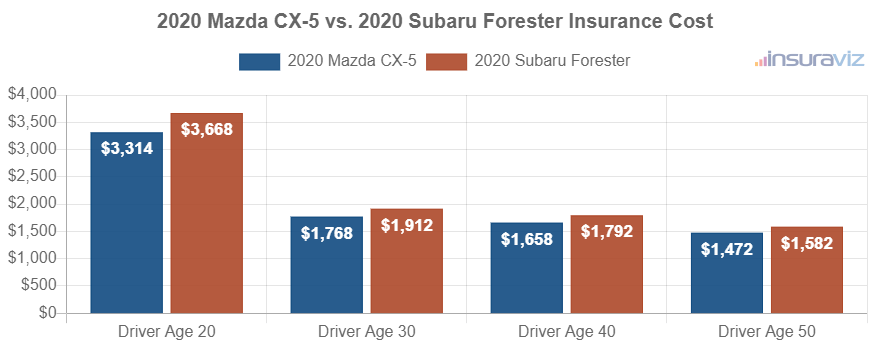

2020 Mazda CX-5 vs. Subaru Forester

When comparing average insurance cost for 2020 models, the Mazda CX-5 costs $1,700 per year to insure and the Subaru Forester costs $1,836, making the Mazda CX-5 the cheaper model by $136 for this comparison year.

The following chart displays the average car insurance cost for the two models for a range of driver ages. For the 2020 Mazda CX-5, the average car insurance cost ranges from $1,508 to $3,398 per year for the different drivers illustrated in the chart. A full-coverage policy for the 2020 Subaru Forester ranges from $1,622 to $3,760 on average per year.

Out of eight Mazda CX-5 trims, the lowest-cost 2020 model to insure is the Sport 2WD model at an average cost of $1,550 per year.

For the six different trims available for a Subaru Forester, the lowest-cost 2020 model to insure is the AWD trim at a cost of $1,752.

When rates are compared for the 14 trim options of both 2020 models, the cheapest trim to put coverage on is the Mazda CX-5 Sport 2WD at a cost of $1,550 per year. The most expensive model and trim level is the Subaru Forester Touring AWD at an average of $1,974 per year.

The next two tables illustrate the cost to insure the available trim levels for both 2020 models, along with an average cost for each model. The model with the cheapest overall car insurance rates for 2020 is the Mazda CX-5.

2020 Mazda CX-5

$1,700

| 2020 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,550 |

| Sport AWD | 1,612 |

| Touring 2WD | 1,612 |

| Touring AWD | 1,676 |

| Grand Touring 2WD | 1,740 |

| Grand Touring AWD | 1,740 |

| Grand Touring Reserve AWD | 1,802 |

| Signature AWD | 1,866 |

| 2020 Mazda CX-5 Average Rate | $1,700 |

2020 Subaru Forester

$1,836

| 2020 Subaru Forester Trims | Rate |

|---|---|

| AWD | $1,752 |

| Alloy Wheel Package AWD | 1,752 |

| Premium AWD | 1,806 |

| Sport AWD | 1,838 |

| Limited AWD | 1,892 |

| Touring AWD | 1,974 |

| 2020 Subaru Forester Average Rate | $1,836 |

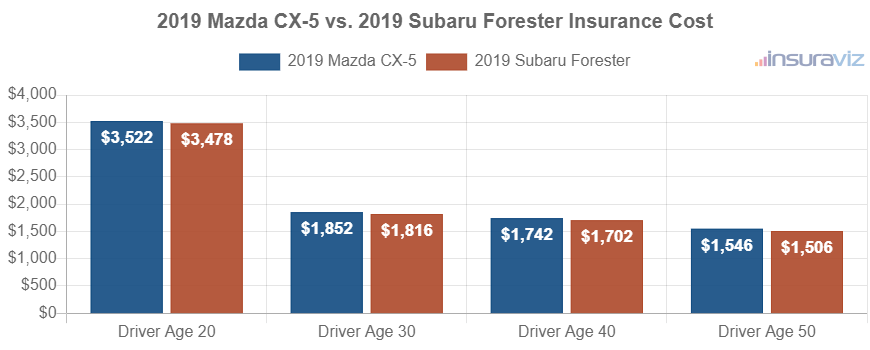

2019 Mazda CX-5 vs. Subaru Forester

For 2019 Mazda CX-5 and Subaru Forester models, the Subaru Forester has lower-cost car insurance by an average of $38 per year for this model year.

The chart below illustrates the average cost to insure both models with different drivers at the wheel. The average full-coverage insurance policy ranges from $1,586 to $3,606 per year for the 2019 Mazda CX-5, and $1,544 to $3,566 on the 2019 Subaru Forester for the age groups included in the chart.

A 2019 Mazda CX-5 has eight trim levels available, with the cheapest trim to insure being the Sport 2WD trim at an average cost of $1,646 per year. For the 10 trim options available for a Subaru Forester, the most affordable 2019 trim package to insure is the 2 AWD model at a cost of $1,654.

When comparing car insurance rates for both models by trim level, the cheapest trim to put coverage on is the Mazda CX-5 Sport 2WD at an average of $1,646 per year, and the most expensive trim is the Mazda CX-5 Signature AWD costing an average of $1,950 per year.

The tables below detail trim level insurance cost averages for both 2019 models, along with the average rate for each model. The cheapest of the two models to insure for the 2019 model year is the Subaru Forester.

2019 Mazda CX-5

$1,782

| 2019 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,646 |

| Sport AWD | 1,646 |

| Touring 2WD | 1,706 |

| Touring AWD | 1,768 |

| Grand Touring 2WD | 1,828 |

| Grand Touring AWD | 1,828 |

| Grand Touring Reserve AWD | 1,890 |

| Signature AWD | 1,950 |

| 2019 Mazda CX-5 Average Rate | $1,782 |

2019 Subaru Forester

$1,744

| 2019 Subaru Forester Trims | Rate |

|---|---|

| 2 AWD | $1,654 |

| 2.5I AWD | 1,654 |

| 2.0 Premium AWD | 1,698 |

| 2.5I Premium AWD | 1,698 |

| 2.0 Sport AWD | 1,736 |

| 2.5I Sport AWD | 1,736 |

| 2.0 Limited AWD | 1,776 |

| 2.5I Limited AWD | 1,776 |

| 2.0 Touring AWD | 1,856 |

| 2.5I Touring AWD | 1,856 |

| 2019 Subaru Forester Average Rate | $1,744 |

2018 Mazda CX-5 vs. Subaru Forester

When comparing insurance cost for the 2018 Mazda CX-5 and Subaru Forester models, the Mazda CX-5 is cheaper to insure by an average of $6 per year.

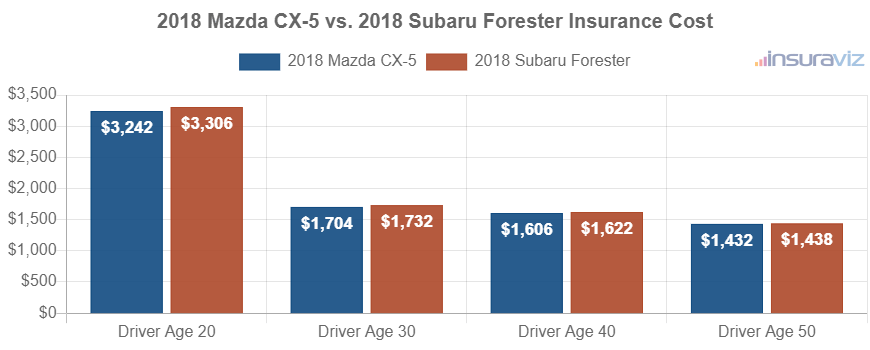

The chart below shows the average car insurance cost for both models with different ages of drivers. Insurance cost ranges from $1,466 to $3,320 per year on a 2018 Mazda CX-5, and $1,462 to $3,364 for a 2018 Subaru Forester for the age groups used in the chart.

A 2018 Mazda CX-5 has six trims available, with the lowest-cost model to insure being the Sport 2WD model at an average cost of $1,576 per year, or $131 per month. Out of the six different option levels available for a Subaru Forester, the lowest-cost 2018 model to insure is the 2.5I AWD trim at a cost of $1,514 per year, or $126 per month.

When comparing rates by trim level for both models, the most affordable model and trim level to buy insurance for is the Subaru Forester 2.5I AWD at an average of $1,514 per year, and the highest-cost model and trim level is the Subaru Forester 2.0XT Touring AWD at an average cost of $1,810 per year.

The tables shown below detail the expected annual car insurance cost by trim level for both 2018 models, including an overall average rate.

2018 Mazda CX-5

$1,644

| 2018 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,576 |

| Sport AWD | 1,576 |

| Touring 2WD | 1,634 |

| Touring AWD | 1,634 |

| Grand Touring 2WD | 1,692 |

| Grand Touring AWD | 1,748 |

| 2018 Mazda CX-5 Average Rate | $1,644 |

2018 Subaru Forester

$1,650

| 2018 Subaru Forester Trims | Rate |

|---|---|

| 2.5I AWD | $1,514 |

| 2.5I Premium AWD | 1,570 |

| 2.0XT Premium AWD | 1,622 |

| 2.5I Limited AWD | 1,628 |

| 2.5I Touring AWD | 1,756 |

| 2.0XT Touring AWD | 1,810 |

| 2018 Subaru Forester Average Rate | $1,650 |

2017 Mazda CX-5 vs. Subaru Forester

When comparing car insurance rates for 2017 models, a Mazda CX-5 costs an average of $1,576 per year to insure and a Subaru Forester costs $1,590, making the Mazda CX-5 cheaper to insure by $14 per year for this comparison year.

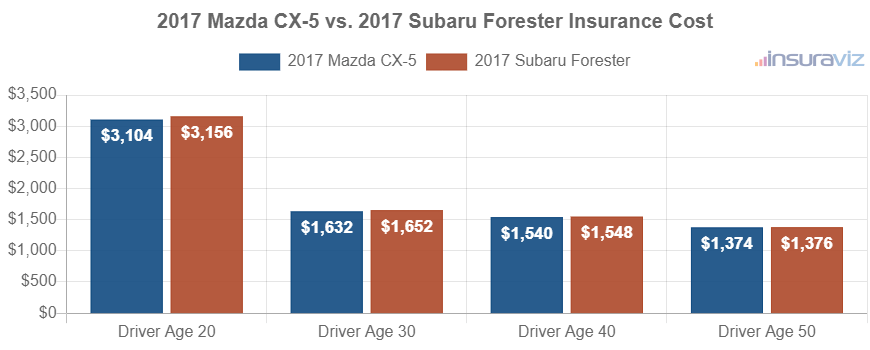

The chart shown below illustrates the average cost to insure both models rated for a variety of different driver ages. For a 2017 Mazda CX-5, the average car insurance cost ranges from $1,408 to $3,178 per year. Insurance for a 2017 Subaru Forester ranges from $1,408 to $3,236 on average per year.

The 2017 Mazda CX-5 has six trim levels available, with the most affordable model to insure being the Sport 2WD model at an average cost of $1,522 per year, or around $127 per month.

Out of the 13 trim levels available for the Subaru Forester, the cheapest 2017 model to insure is the 2.5I AWD trim at a cost of $1,450.

When comparing rates by trim level for both models, the most affordable model and trim level to buy insurance for is the Subaru Forester 2.5I AWD at a cost of $1,450 per year, and the most expensive model and trim level is the Subaru Forester 2.0XT Touring Navigation AWD at a cost of $1,682 per year.

The tables shown below show the average cost to insure each trim level for a 2017 Mazda CX-5 and Subaru Forester, plus the average rate for each model. The winner for the 2017 car insurance battle is the Mazda CX-5.

2017 Mazda CX-5

$1,576

| 2017 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,522 |

| Sport AWD | 1,522 |

| Touring 2WD | 1,522 |

| Touring AWD | 1,576 |

| Grand Touring 2WD | 1,630 |

| Grand Touring AWD | 1,682 |

| 2017 Mazda CX-5 Average Rate | $1,576 |

2017 Subaru Forester

$1,590

| 2017 Subaru Forester Trims | Rate |

|---|---|

| 2.5I AWD | $1,450 |

| 2.5I Premium AWD | 1,504 |

| 2.5I Premium AWP AWD | 1,540 |

| 2.5I Premium AWP and Eye Sight AWD | 1,540 |

| 2.0XT Premium AWD | 1,556 |

| 2.5I Limited AWD | 1,556 |

| 2.5I Limited Navigation AWD | 1,612 |

| 2.5I Touring AWD | 1,612 |

| 2.5I Touring Eyesight System AWD | 1,612 |

| 2.5I Touring Navigation AWD | 1,612 |

| 2.0XT Touring AWD | 1,682 |

| 2.0XT Touring Eyesight System AWD | 1,682 |

| 2.0XT Touring Navigation AWD | 1,682 |

| 2017 Subaru Forester Average Rate | $1,590 |

2016 Mazda CX-5 vs. Subaru Forester

A 2016 Mazda CX-5 costs $112 less per year to insure per year on average than a 2016 Subaru Forester, a difference of 7.3%.

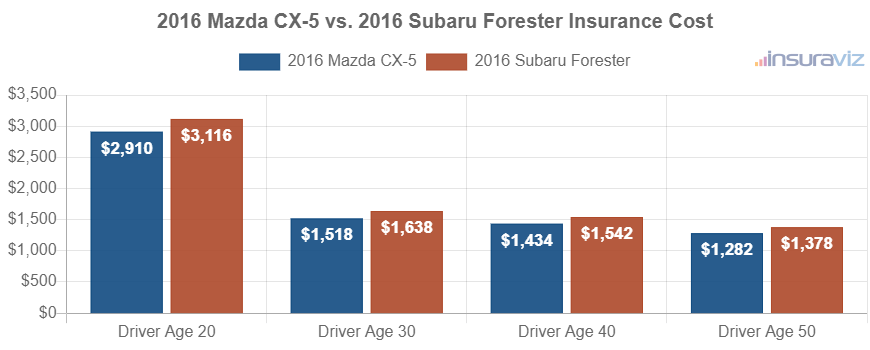

The chart below demonstrates the average cost to insure both models with different age drivers. Average car insurance cost ranges from $1,314 to $2,978 per year on a 2016 Mazda CX-5, and $1,410 to $3,190 on a 2016 Subaru Forester for the five age groups shown in the chart.

Out of six Mazda CX-5 trim levels, the cheapest 2016 trim level to insure is the Sport 2WD model at an average cost of $1,352 per year, or about $113 per month. Out of the 13 option levels available for a Subaru Forester, the most affordable 2016 model to insure is the 2.5I AWD model at a cost of $1,444.

When auto insurance rates for all 19 trim levels for both 2016 models are compared, the lowest-cost model and trim level to insure is the Mazda CX-5 Sport 2WD at an average rate of $1,352 per year. The highest-cost model and trim is the Subaru Forester 2.0XT Touring Navigation AWD at an average of $1,658 per year.

The next two tables detail average car insurance cost by trim level for each 2016 model, including an overall average cost for each model. The 2016 Mazda CX-5 takes the win over the 2016 Subaru Forester for the cheapest auto insurance rates.

2016 Mazda CX-5

$1,468

| 2016 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,352 |

| Sport AWD | 1,452 |

| Touring 2WD | 1,452 |

| Touring AWD | 1,486 |

| Grand Touring 2WD | 1,534 |

| Grand Touring AWD | 1,534 |

| 2016 Mazda CX-5 Average Rate | $1,468 |

2016 Subaru Forester

$1,580

| 2016 Subaru Forester Trims | Rate |

|---|---|

| 2.5I AWD | $1,444 |

| 2.5I Premium AWD | 1,492 |

| 2.5I Premium AWP AWD | 1,542 |

| 2.5I Premium AWP Navigation AWD | 1,542 |

| 2.0XT Premium AWD | 1,558 |

| 2.5I Limited AWD | 1,558 |

| 2.5I Limited Navigation AWD | 1,608 |

| 2.5I Touring AWD | 1,608 |

| 2.5I Touring Eyesight System AWD | 1,608 |

| 2.5I Touring Navigation AWD | 1,608 |

| 2.0XT Touring AWD | 1,658 |

| 2.0XT Touring Eyesight System AWD | 1,658 |

| 2.0XT Touring Navigation AWD | 1,658 |

| 2016 Subaru Forester Average Rate | $1,580 |

2015 Mazda CX-5 vs. Subaru Forester

When comparing average insurance rates for 2015 models, a Mazda CX-5 costs an average of $1,264 per year to insure and a Subaru Forester costs $1,506, making the Mazda CX-5 cheaper to insure by $242 per year for this model year.

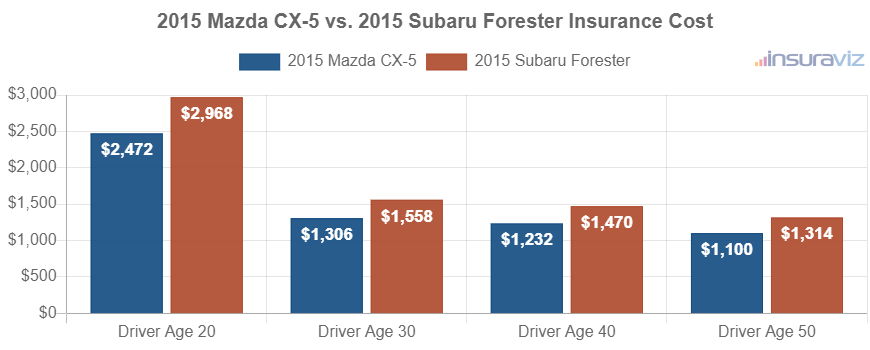

The chart shown below demonstrates the average cost to insure both 2015 models for different driver ages. For the 2015 Mazda CX-5, the average insurance cost ranges from $1,128 to $2,534 per year for the chosen age groups in the chart. Auto insurance on a 2015 Subaru Forester costs from $1,346 to $3,038 on average per year.

For the six trims available for the 2015 Mazda CX-5, the cheapest model to insure is the Sport 2WD trim at an average cost of $1,168 per year, or $97 per month. A 2015 Subaru Forester has 13 different option levels available, with the lowest-cost trim level to insure being the 2.5I AWD model at an average cost of $1,390 per year, or about $116 per month.

When looking at the combined rates by trim level for both models, the cheapest vehicle to insure is the Mazda CX-5 Sport 2WD at an average rate of $1,168 per year, and the most expensive model and trim level is the Subaru Forester 2.0XT Touring AWD at a cost of $1,588 per year.

The next tables show both 2015 models and all trim levels available for each one, including an overall average rate. The cheapest model to insure for the 2015 model year is the Mazda CX-5.

2015 Mazda CX-5

$1,264

| 2015 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,168 |

| Sport AWD | 1,260 |

| Touring 2WD | 1,260 |

| Grand Touring 2WD | 1,292 |

| Touring AWD | 1,292 |

| Grand Touring AWD | 1,306 |

| 2015 Mazda CX-5 Average Rate | $1,264 |

2015 Subaru Forester

$1,506

| 2015 Subaru Forester Trims | Rate |

|---|---|

| 2.5I AWD | $1,390 |

| 2.5I Premium AWD | 1,434 |

| 2.5I Premium AWP AWD | 1,434 |

| 2.5I Premium AWP Navigation AWD | 1,482 |

| 2.0XT Premium AWD | 1,496 |

| 2.5I Limited AWD | 1,496 |

| 2.5I Limited Navigation AWD | 1,496 |

| 2.5I Touring AWD | 1,530 |

| 2.5I Touring Eyesight System AWD | 1,534 |

| 2.5I Touring Navigation AWD | 1,538 |

| 2.0XT Touring Navigation AWD | 1,578 |

| 2.0XT Touring Eyesight System AWD | 1,580 |

| 2.0XT Touring AWD | 1,588 |

| 2015 Subaru Forester Average Rate | $1,506 |