- When comparing 2024 models, the Nissan Sentra beats the Kia Forte in our head-to-head insurance cost comparison, costing an average of $114 less per year to insure.

- With 15 models in the 2024 small car category, the Nissan Sentra ranks fourth and the Kia Forte ranks eighth for most affordable car insurance.

- For a 2024 Nissan Sentra, rates cost from $1,700 to $1,786 per year, while auto insurance for a 2024 Kia Forte costs from $1,772 to $1,926, depending on the exact model being insured.

- When compared to the average cost of car insurance in the U.S. of $1,883 per year, the Nissan Sentra costs $145 less per year, while the Kia Forte costs $31 less per year.

Is insurance cheaper for a Nissan Sentra or Kia Forte?

When comparing the Nissan Sentra and Kia Forte for the 2024 model year, the model having more affordable car insurance is the Nissan Sentra. Average car insurance rates for the Nissan Sentra are $1,738 per year, while insurance for the Kia Forte averages $1,852 per year.

Out of three Nissan Sentra trims, the cheapest 2024 trim level to insure is the S trim at an average cost of $1,700 per year, or around $142 per month. The 2024 Kia Forte has five trims available, with the cheapest model to insure being the LX trim at an average cost of $1,772 per year.

When rates for all eight trim levels for both vehicles are compared, the lowest-cost model and trim is the Nissan Sentra S at a cost of $1,700 per year. The overall most expensive vehicle to insure is the Kia Forte GT Manual at an average of $1,926 per year.

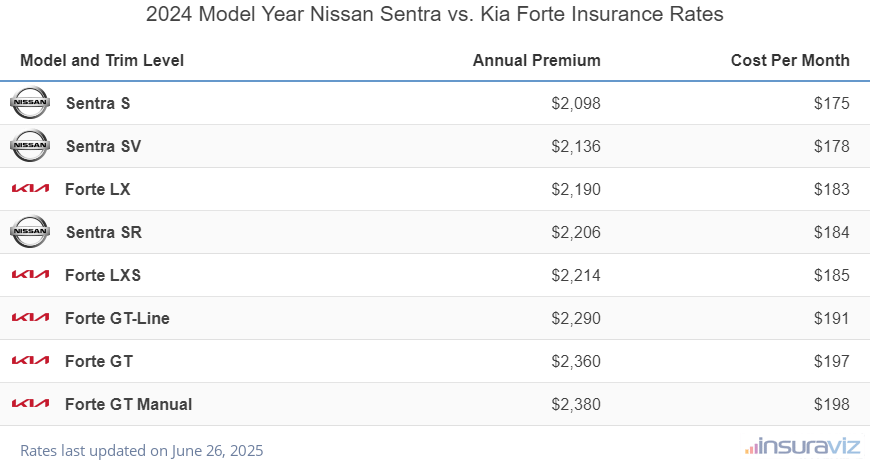

The next table compares and ranks the annual and monthly car insurance cost for 2024 Nissan Sentra and Kia Forte models, showing average cost for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sentra S | $1,700 | $142 |

| Sentra SV | $1,730 | $144 |

| Forte LX | $1,772 | $148 |

| Sentra SR | $1,786 | $149 |

| Forte LXS | $1,792 | $149 |

| Forte GT-Line | $1,854 | $155 |

| Forte GT | $1,912 | $159 |

| Forte GT Manual | $1,926 | $161 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

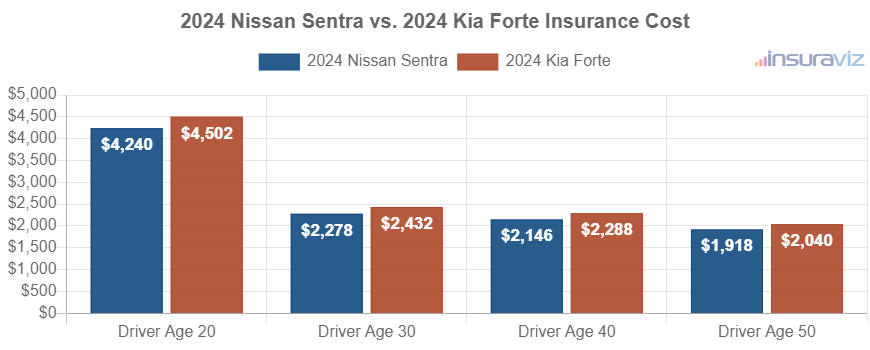

The rate chart below displays the average cost to insure both 2024 models with different driver age groups. Average car insurance cost ranges from $1,556 to $3,436 per year for a 2024 Nissan Sentra, and $1,656 to $3,650 for a 2024 Kia Forte for the age groups used in this illustration.

The tables shown below illustrate average car insurance cost by trim level for each 2024 model, plus an average rate for each model. The 2024 Nissan Sentra can declare victory over the 2024 Kia Forte for cheapest car insurance rates.

2024 Nissan Sentra

$1,738

| 2024 Nissan Sentra Trims | Rate |

|---|---|

| S | $1,700 |

| SV | 1,730 |

| SR | 1,786 |

| 2024 Nissan Sentra Average Rate | $1,738 |

2024 Kia Forte

$1,852

| 2024 Kia Forte Trims | Rate |

|---|---|

| LX | $1,772 |

| LXS | 1,792 |

| GT-Line | 1,854 |

| GT | 1,912 |

| GT Manual | 1,926 |

| 2024 Kia Forte Average Rate | $1,852 |

2023 Nissan Sentra vs. Kia Forte

Average car insurance rates for a 2024 Nissan Sentra are $1,738 per year, whereas the 2024 Kia Forte costs an average of $1,852 per year, making the Nissan Sentra the model with more affordable average car insurance rates.

Out of three Nissan Sentra trims, the cheapest 2024 trim to insure is the S trim at an average cost of $1,700 per year.

For the five trim levels available for the Kia Forte, the cheapest 2024 model to insure is the LX trim at a cost of $1,772.

When comparing aggregated rates for both models from a trim-level perspective, the cheapest trim to insure is the Nissan Sentra S at an average of $1,700 per year. The overall most expensive vehicle to insure is the Kia Forte GT Manual costing $1,926 per year.

The next table compares and ranks the annual and monthly cost of car insurance for 2024 Nissan Sentra and Kia Forte models, broken down by individual trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sentra S | $1,700 | $142 |

| Sentra SV | $1,732 | $144 |

| Forte LX | $1,778 | $148 |

| Sentra SR | $1,780 | $148 |

| Forte LXS | $1,796 | $150 |

| Sentra SR Midnight Edition | $1,798 | $150 |

| Forte GT-Line | $1,850 | $154 |

| Forte GT | $1,916 | $160 |

| Forte GT Manual | $1,934 | $161 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

The rate chart below displays the average cost to insure the two models for four different driver age groups. For a 2024 Nissan Sentra, insurance cost ranges from $1,556 to $3,436 per year for the age groups used in the chart. A 2024 Kia Forte costs from $1,656 to $3,650 to insure per year.

The next tables illustrate average car insurance rates for each trim level, plus the average rate for each model.

2023 Nissan Sentra

$1,708

| 2023 Nissan Sentra Trims | Rate |

|---|---|

| S | $1,658 |

| SV | 1,686 |

| SR | 1,736 |

| SR Midnight Edition | 1,752 |

| 2023 Nissan Sentra Average Rate | $1,708 |

2023 Kia Forte

$1,806

| 2023 Kia Forte Trims | Rate |

|---|---|

| LX | $1,734 |

| LXS | 1,752 |

| GT-Line | 1,802 |

| GT | 1,866 |

| GT Manual | 1,884 |

| 2023 Kia Forte Average Rate | $1,806 |

2022 Nissan Sentra vs. Kia Forte

Insurance cost for a 2022 Nissan Sentra averages $1,686 per year, whereas the 2022 Kia Forte costs an average of $1,770 per year, making the Nissan Sentra the model with lower average car insurance rates.

However, the vehicle trim level has a considerable impact on the final cost of insurance. So to get an accurate comparison, you need to factor the vehicle options into the mix.

To illustrate this, on a 2022 Nissan Sentra, rates range from the lowest full-coverage rate of $1,620 per year for the S model up to the most expensive rate of $1,764 for the SR Premium model. For a 2022 Kia Forte, rates range from $1,694 per year for the FE model up to $1,838 on the GT model.

Based on these numbers, if you’re comparing a base model Forte with an higher-end Sentra, then the Forte is probably going to have the cheaper overall insurance rates.

The table below shows the average annual and monthly cost of car insurance for both the 2022 Sentra and Forte, for each trim level available for each model.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sentra S | $1,620 | $135 |

| Sentra SV | $1,674 | $140 |

| Sentra SR | $1,684 | $140 |

| Sentra SR Midnight Edition | $1,688 | $141 |

| Forte FE | $1,694 | $141 |

| Forte LXS | $1,732 | $144 |

| Sentra SR Premium | $1,764 | $147 |

| Forte GT-Line | $1,786 | $149 |

| Forte GT Manual | $1,800 | $150 |

| Forte GT | $1,838 | $153 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

The chart shown below shows the average car insurance cost for the two models for different driver ages. For a 2022 Nissan Sentra, average car insurance cost ranges from $1,508 to $3,350 per year for the age groups used in this illustration. Auto insurance for a 2022 Kia Forte costs from $1,580 to $3,550 on average per year.

For the five trims available for the 2022 Nissan Sentra, the cheapest trim level to insure is the S model at an average cost of $1,620 per year, or $135 per month.

For the five trim and option levels available for the Kia Forte, the cheapest 2022 model to insure is the FE model at a cost of $1,694 per year, or around $141 per month.

When average car insurance prices for all 10 trims of both models are combined and sorted by cost, the cheapest trim to insure is the Nissan Sentra S at an average of $1,620 per year, and the most expensive model and trim level is the Kia Forte GT costing an average of $1,838 per year.

The next tables display average car insurance cost by trim level for a 2022 Nissan Sentra and Kia Forte, along with an average cost for each model.

2022 Nissan Sentra

$1,686

| 2022 Nissan Sentra Trims | Rate |

|---|---|

| S | $1,620 |

| SV | 1,674 |

| SR | 1,684 |

| SR Midnight Edition | 1,688 |

| SR Premium | 1,764 |

| 2022 Nissan Sentra Average Rate | $1,686 |

2022 Kia Forte

$1,770

| 2022 Kia Forte Trims | Rate |

|---|---|

| FE | $1,694 |

| LXS | 1,732 |

| GT-Line | 1,786 |

| GT Manual | 1,800 |

| GT | 1,838 |

| 2022 Kia Forte Average Rate | $1,770 |

2021 Nissan Sentra vs. Kia Forte

A 2021 Nissan Sentra is $82 cheaper to insure per year on average than a 2021 Kia Forte, a difference of 5.3%.

The chart shown below demonstrates the average car insurance cost for the two models with different driver age groups. For a 2021 Nissan Sentra, the average car insurance cost ranges from $1,354 to $3,004 per year. Car insurance for a 2021 Kia Forte ranges from $1,426 to $3,202 on average per year.

For the five trims available for the 2021 Nissan Sentra, the cheapest model to insure is the S Sedan trim at an average cost of $1,452 per year.

For the five different trim levels available for the Kia Forte, the cheapest 2021 model to insure is the FE Sedan trim at a cost of $1,526 per year, or $127 per month.

When comparing combined rates for both models from a trim-level perspective, the overall cheapest vehicle to buy insurance for is the Nissan Sentra S Sedan at an average cost of $1,452 per year, and the most expensive model and trim level is the Kia Forte GT Sedan costing an average of $1,668 per year.

The next two tables break down the expected annual car insurance cost by trim level for both 2021 models, plus the average rate for each model. The cheapest to insure for the 2021 model year is the Nissan Sentra.

2021 Nissan Sentra

$1,516

| 2021 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,452 |

| SR Sedan | 1,504 |

| SV Sedan | 1,504 |

| SR Premium Sedan | 1,558 |

| SV Premium Sedan | 1,558 |

| 2021 Nissan Sentra Average Rate | $1,516 |

2021 Kia Forte

$1,598

| 2021 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,526 |

| LXS Sedan | 1,562 |

| EX Sedan | 1,614 |

| GT-Line Sedan | 1,614 |

| GT Sedan | 1,668 |

| 2021 Kia Forte Average Rate | $1,598 |

2020 Nissan Sentra vs. Kia Forte

When comparing car insurance rates for 2020 models, a Nissan Sentra costs an average of $1,476 per year to insure while a Kia Forte costs $1,554, making the Nissan Sentra cheaper to insure by $78 per year for 2020.

The next chart demonstrates the average cost to insure both 2020 models for drivers from age 20 to 50. The average full-coverage insurance policy ranges from $1,318 to $2,924 per year for a 2020 Nissan Sentra, and $1,386 to $3,114 for a 2020 Kia Forte for the sample drivers in the chart

Out of five trim levels for the 2020 Nissan Sentra, the cheapest average car insurance prices are on the S Sedan trim at a cost of $1,414 per year, or about $118 per month.

For the five different trim levels available for the Kia Forte, the cheapest 2020 trim to insure is the FE Sedan model at a cost of $1,486.

When comparing rates by trim level for both models, the lowest-cost model and trim level to insure is the Nissan Sentra S Sedan at an average of $1,414 per year, and the most expensive model and trim level is the Kia Forte GT Sedan costing an average of $1,620 per year.

The tables below display the average cost to insure each trim level for a 2020 Nissan Sentra and Kia Forte, including an overall average rate. The winner for the 2020 car insurance rate comparison is the Nissan Sentra.

2020 Nissan Sentra

$1,476

| 2020 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,414 |

| SR Sedan | 1,464 |

| SV Sedan | 1,464 |

| SR Premium Sedan | 1,516 |

| SV Premium Sedan | 1,516 |

| 2020 Nissan Sentra Average Rate | $1,476 |

2020 Kia Forte

$1,554

| 2020 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,486 |

| LXS Sedan | 1,520 |

| EX Sedan | 1,570 |

| GT-Line Sedan | 1,570 |

| GT Sedan | 1,620 |

| 2020 Kia Forte Average Rate | $1,554 |

2019 Nissan Sentra vs. Kia Forte

When comparing insurance cost for the 2019 Nissan Sentra and Kia Forte models, the Nissan Sentra is cheaper by $18 per year.

The next chart shows the average cost to insure the two models with different drivers at the wheel. For a 2019 Nissan Sentra, average car insurance cost ranges from $1,340 to $2,956 per year for the sample drivers in the chart. Auto insurance on a 2019 Kia Forte ranges from $1,354 to $3,036 on average per year.

Out of five trims for the 2019 Nissan Sentra, the cheapest insurance rates are on the S Sedan model at a cost of $1,388 per year, or about $116 per month. The 2019 Kia Forte has four option levels available, with the cheapest trim level to insure being the FE Sedan trim at an average cost of $1,446 per year.

When insurance rates for all nine trims of both models are combined and sorted by cost, the overall cheapest vehicle to put coverage on is the Nissan Sentra S Sedan at an average of $1,388 per year. The highest-cost model and trim level is the Nissan Sentra Nismo Sedan at an average of $1,566 per year.

The next two tables illustrate the average cost to insure all 2019 trim levels, including an overall average cost for each model. The model with the cheapest auto insurance rates for 2019 is the Nissan Sentra.

2019 Nissan Sentra

$1,490

| 2019 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,388 |

| SV Sedan | 1,436 |

| SL Sedan | 1,532 |

| SR Sedan | 1,532 |

| Nismo Sedan | 1,566 |

| 2019 Nissan Sentra Average Rate | $1,490 |

2019 Kia Forte

$1,508

| 2019 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,446 |

| LX Sedan | 1,510 |

| S Sedan | 1,524 |

| EX Sedan | 1,552 |

| 2019 Kia Forte Average Rate | $1,508 |

2018 Nissan Sentra vs. Kia Forte

When comparing insurance cost for the 2018 Nissan Sentra and Kia Forte models, the Nissan Sentra is cheaper by an average of $246 per year for 2018.

The chart below shows the average cost to insure both models rated for different driver ages. For a 2018 Nissan Sentra, the average car insurance cost ranges from $1,286 to $2,834 per year for the driver ages used. A full-coverage policy on a 2018 Kia Forte costs from $1,510 to $3,384 on average per year.

Out of five trim levels for the 2018 Nissan Sentra, the cheapest insurance rates are on the S Sedan model at a cost of $1,330 per year, or around $111 per month. For the seven option levels available for the Kia Forte, the cheapest 2018 trim package to insure is the S Sedan trim at a cost of $1,392 per year, or $116 per month.

When comparing both models combined at a trim-level basis, the lowest-cost model and trim to insure is the Nissan Sentra S Sedan at an average of $1,330 per year, and the most expensive trim is the Kia Forte Forte5 SX Hatchback at an average cost of $1,848 per year.

The next two tables show both 2018 models and all trim levels available for each one, along with the average rate for each model. The 2018 Nissan Sentra reigns victorious over the 2018 Kia Forte for the cheapest overall car insurance rates.

2018 Nissan Sentra

$1,432

| 2018 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,330 |

| SV Sedan | 1,386 |

| SR Sedan | 1,456 |

| SL Sedan | 1,478 |

| Nismo Sedan | 1,510 |

| 2018 Nissan Sentra Average Rate | $1,432 |

2018 Kia Forte

$1,678

| 2018 Kia Forte Trims | Rate |

|---|---|

| S Sedan | $1,392 |

| LX Sedan | 1,606 |

| Forte5 LX Hatchback | 1,680 |

| EX Sedan | 1,726 |

| SX Sedan | 1,726 |

| Forte5 EX Hatchback | 1,772 |

| Forte5 SX Hatchback | 1,848 |

| 2018 Kia Forte Average Rate | $1,678 |

2017 Nissan Sentra vs. Kia Forte

A 2017 Nissan Sentra costs $300 less per year to insure per year on average than a 2017 Kia Forte, a difference of 20.3%.

The chart below demonstrates the average cost to insure both models for the 20, 30, 40, and 50-year-old driver age groups. For a 2017 Nissan Sentra, average car insurance cost ranges from $1,202 to $2,626 per year. Car insurance for a 2017 Kia Forte costs from $1,468 to $3,284 on average per year.

For the three trims available for the 2017 Nissan Sentra, the cheapest model to insure is the S Sedan model at an average cost of $1,302 per year. Out of the six option levels available for the Kia Forte, the cheapest 2017 trim level to insure is the S Sedan trim at a cost of $1,500.

When all nine trims of both models are combined and compared, the lowest-cost model and trim level to buy insurance for is the Nissan Sentra S Sedan at a cost of $1,302 per year, and the most expensive trim is the Kia Forte SX Hatchback costing $1,718 per year.

The tables shown below break down trim level insurance rates for each 2017 model, including the average rate for each model. The model with the cheapest auto insurance rates for 2017 is the Nissan Sentra.

2017 Nissan Sentra

$1,330

| 2017 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,302 |

| SR Sedan | 1,346 |

| SV Sedan | 1,346 |

| 2017 Nissan Sentra Average Rate | $1,330 |

2017 Kia Forte

$1,630

| 2017 Kia Forte Trims | Rate |

|---|---|

| S Sedan | $1,500 |

| LX Sedan | 1,582 |

| LX Hatchback | 1,632 |

| EX Hatchback | 1,674 |

| EX Sedan | 1,674 |

| SX Hatchback | 1,718 |

| 2017 Kia Forte Average Rate | $1,630 |

2016 Nissan Sentra vs. Kia Forte

For the 2016 Nissan Sentra and Kia Forte models, the Nissan Sentra has cheaper car insurance cost by $110 per year for this model year.

The following chart shows the average cost to insure the two models for the 20, 30, 40, and 50-year-old driver age groups. The average full-coverage insurance policy ranges from $1,164 to $2,550 per year on a 2016 Nissan Sentra, and $1,260 to $2,804 on a 2016 Kia Forte for the chosen age groups in the chart

Out of five Nissan Sentra trims, the cheapest 2016 model to insure is the S Sedan trim at an average cost of $1,234 per year, or around $103 per month. For the seven trim options available for the Kia Forte, the cheapest 2016 trim package to insure is the LX Sedan trim at a cost of $1,306.

When all 12 trims of both models are combined and compared, the lowest-cost model and trim to buy insurance for is the Nissan Sentra S Sedan at an average rate of $1,234 per year, and the highest-cost model and trim is the Kia Forte SX Hatchback costing $1,462 per year.

The next tables display trim level insurance cost averages for both 2016 models, including an overall average rate. The cheapest model to insure for the 2016 model year is the Nissan Sentra.

2016 Nissan Sentra

$1,288

| 2016 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,234 |

| S Plus Sedan | 1,272 |

| SV Sedan | 1,272 |

| SR Sedan | 1,312 |

| SL Sedan | 1,352 |

| 2016 Nissan Sentra Average Rate | $1,288 |

2016 Kia Forte

$1,398

| 2016 Kia Forte Trims | Rate |

|---|---|

| LX Sedan | $1,306 |

| EX Coupe | 1,332 |

| SX Coupe | 1,370 |

| EX Sedan | 1,424 |

| LX Hatchback | 1,424 |

| EX Hatchback | 1,462 |

| SX Hatchback | 1,462 |

| 2016 Kia Forte Average Rate | $1,398 |

2015 Nissan Sentra vs. Kia Forte

When comparing insurance cost for 2015 models, the Nissan Sentra costs an average of $1,134 per year to insure and the Kia Forte costs $1,338, making the Nissan Sentra the cheaper model to insure by $204.

The following chart illustrates the average insurance cost for both 2015 models with different drivers at the wheel. For a 2015 Nissan Sentra, average insurance cost ranges from $1,022 to $2,230 per year for the age groups used in the chart. A full-coverage policy for a 2015 Kia Forte costs from $1,208 to $2,688 on average per year.

The 2015 Nissan Sentra has five trim levels available, with the cheapest model to insure being the S Plus Sedan trim at an average cost of $1,104 per year.

The 2015 Kia Forte has five trim and option levels available, with the cheapest trim level to insure being the EX Coupe model at an average cost of $1,294 per year.

When rates are compared for the 10 trims of both 2015 models, the lowest-cost model and trim to buy insurance for is the Nissan Sentra S Plus Sedan at an average cost of $1,104 per year. The most expensive model and trim level is the Kia Forte EX Hatchback costing an average of $1,402 per year.

The rate tables below detail average car insurance cost by trim level for a 2015 Nissan Sentra and Kia Forte, as well as the overall average rate for each model.

2015 Nissan Sentra

$1,134

| 2015 Nissan Sentra Trims | Rate |

|---|---|

| S Plus Sedan | $1,104 |

| S Sedan | 1,104 |

| SR Sedan | 1,140 |

| SV Sedan | 1,140 |

| SL Sedan | 1,178 |

| 2015 Nissan Sentra Average Rate | $1,134 |

2015 Kia Forte

$1,338

| 2015 Kia Forte Trims | Rate |

|---|---|

| EX Coupe | $1,294 |

| LX Sedan | 1,306 |

| SX Coupe | 1,330 |

| EX Sedan | 1,366 |

| EX Hatchback | 1,402 |

| 2015 Kia Forte Average Rate | $1,338 |