- The Nissan Sentra routs the Nissan Versa in our cost comparison, costing $134 less per year to insure on average.

- For a 2024 Nissan Sentra, auto insurance rates range from $1,700 to $1,786 per year, while the insurance price for the 2024 Nissan Versa costs from $1,800 to $1,924, depending on the trim level being insured.

- The Nissan Sentra S and the Nissan Versa S Manual are the trim levels with the cheapest insurance rates for both models based on our comparison.

Is insurance cheaper for a Nissan Sentra or Versa?

Insurance on a 2024 Nissan Sentra costs an average of $1,738 per year, while a 2024 Nissan Versa averages $1,872 per year, making the Nissan Sentra the better deal by $134 per year.

Out of three Nissan Sentra trims, the cheapest 2024 model to insure is the S model at an average cost of $1,700 per year. Out of the four trims available for the Nissan Versa, the cheapest 2024 trim level to insure is the S Manual trim at a cost of $1,800.

When comparing both models at a trim-level basis, the cheapest vehicle to insure is the Nissan Sentra S at an average cost of $1,700 per year. The highest-cost model and trim level is the Nissan Versa SR at a cost of $1,924 per year.

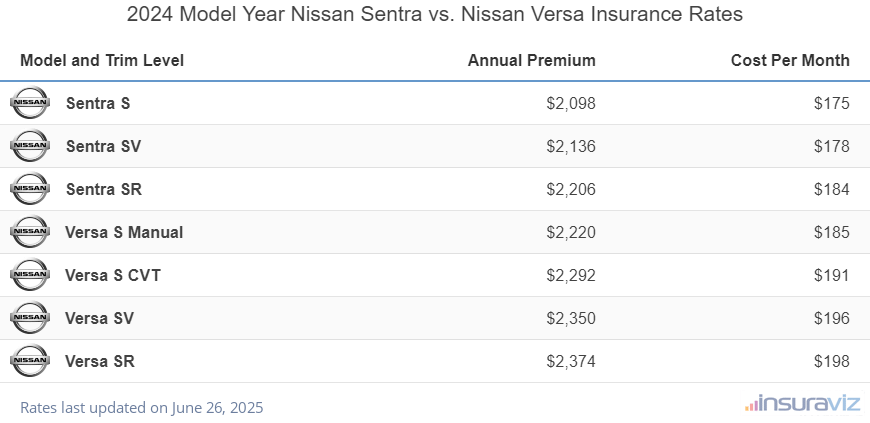

The next table compares and ranks the yearly and monthly cost of car insurance for 2024 Nissan Sentra and Nissan Versa models, showing average cost for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sentra S | $1,700 | $142 |

| Sentra SV | $1,730 | $144 |

| Sentra SR | $1,786 | $149 |

| Versa S Manual | $1,800 | $150 |

| Versa S CVT | $1,858 | $155 |

| Versa SV | $1,906 | $159 |

| Versa SR | $1,924 | $160 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 22, 2024

The chart below visualizes the average cost to insure both 2024 models for the 20 to 50-year-old driver age groups. For a 2024 Nissan Sentra, the average cost of car insurance ranges from $1,556 to $3,436 per year for the driver ages used. A 2024 Nissan Versa costs from $1,684 to $3,686 to insure per year.

The two tables below illustrate the expected annual car insurance cost by trim level for both 2024 models, including an overall average cost for each model. The cheapest of the two models to insure for the 2024 model year is the Nissan Sentra.

2024 Nissan Sentra

$1,738

| 2024 Nissan Sentra Trims | Rate |

|---|---|

| S | $1,700 |

| SV | 1,730 |

| SR | 1,786 |

| 2024 Nissan Sentra Average Rate | $1,738 |

2024 Nissan Versa

$1,872

| 2024 Nissan Versa Trims | Rate |

|---|---|

| S Manual | $1,800 |

| S CVT | 1,858 |

| SV | 1,906 |

| SR | 1,924 |

| 2024 Nissan Versa Average Rate | $1,872 |

2023 Nissan Sentra vs. Nissan Versa

Car insurance on a 2023 Nissan Sentra costs an average of $1,708 per year, whereas a 2023 Nissan Versa averages $1,960 per year, making the Nissan Sentra the model with better average insurance cost.

For the four trims available for the 2023 Nissan Sentra, the cheapest model to insure is the S model at an average cost of $1,658 per year, or $138 per month. For the four trim levels available for the Nissan Versa, the cheapest 2023 trim level to insure is the S Manual model at a cost of $1,888 per year, or $157 per month.

When comparing aggregated rates for both models from a trim-level perspective, the cheapest model and trim level to insure is the Nissan Sentra S at an average cost of $1,658 per year. The most expensive vehicle to insure is the Nissan Versa SR at an average cost of $2,016 per year.

The next table compares and ranks the cost of car insurance for 2023 Nissan Sentra and Nissan Versa models, with average rates for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sentra S | $1,658 | $138 |

| Sentra SV | $1,686 | $141 |

| Sentra SR | $1,736 | $145 |

| Sentra SR Midnight Edition | $1,752 | $146 |

| Versa S Manual | $1,888 | $157 |

| Versa S CVT | $1,946 | $162 |

| Versa SV | $1,992 | $166 |

| Versa SR | $2,016 | $168 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

The rate chart below illustrates the average cost to insure both 2023 models using drivers aged 20 to 50. For a 2023 Nissan Sentra, insurance cost ranges from $1,526 to $3,380 per year for the driver ages used. A 2023 Nissan Versa costs from $1,766 to $3,942 to insure per year.

The two tables below display trim level insurance rates for each 2023 model, plus the average rate for each model. The 2023 Nissan Sentra wins the head-to-head comparison over the 2023 Nissan Versa for cheapest auto insurance rates.

2023 Nissan Sentra

$1,708

| 2023 Nissan Sentra Trims | Rate |

|---|---|

| S | $1,658 |

| SV | 1,686 |

| SR | 1,736 |

| SR Midnight Edition | 1,752 |

| 2023 Nissan Sentra Average Rate | $1,708 |

2023 Nissan Versa

$1,960

| 2023 Nissan Versa Trims | Rate |

|---|---|

| S Manual | $1,888 |

| S CVT | 1,946 |

| SV | 1,992 |

| SR | 2,016 |

| 2023 Nissan Versa Average Rate | $1,960 |

2022 Nissan Sentra vs. Nissan Versa

For the 2022 model year, the model having the cheapest car insurance rates is the Nissan Sentra. Average car insurance rates for the Nissan Sentra are $1,686 per year, whereas insurance for a Nissan Versa costs an average of $1,956 per year.

Within each model, however, the cost of insurance varies greatly depending on the trim level. For a 2022 Nissan Sentra, rates range from the cheapest rate of $1,620 per year for the S model up to $1,764 for the SR Premium model. For a 2022 Nissan Versa, rates range from $1,920 per year for the S model up to $2,020 on the most expensive to insure SR model.

The table shown below ranks the annual and monthly cost of car insurance for 2022 Nissan Sentra and Nissan Versa models, with average rates for each vehicle.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sentra S | $1,620 | $135 |

| Sentra SV | $1,674 | $140 |

| Sentra SR | $1,684 | $140 |

| Sentra SR Midnight Edition | $1,688 | $141 |

| Sentra SR Premium | $1,764 | $147 |

| Versa S | $1,920 | $160 |

| Versa SV | $1,930 | $161 |

| Versa SR | $2,020 | $168 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

The chart shown below demonstrates the average insurance cost for both models rated for different driver ages. For the 2022 Nissan Sentra, the average cost of car insurance ranges from $1,508 to $3,350 per year for the age groups used in this illustration. Insurance on a 2022 Nissan Versa ranges from $1,762 to $3,936 on average per year.

Out of five trim levels for a 2022 Nissan Sentra, the most affordable car insurance rates are on the S model at a cost of $1,620 per year. For the three different trim levels available for a Nissan Versa, the most affordable 2022 trim to insure is the S trim at a cost of $1,920 per year, or around $160 per month.

When insurance prices for all eight trim levels for both vehicles are compared, the most affordable model and trim level to put coverage on is the Nissan Sentra S at an average of $1,620 per year. The most expensive model and trim level is the Nissan Versa SR costing an average of $2,020 per year.

The tables shown below show the expected annual car insurance cost by trim level for both 2022 models, as well as the overall average rate for each model. The winner for the 2022 car insurance comparison is the Nissan Sentra.

2022 Nissan Sentra

$1,686

| 2022 Nissan Sentra Trims | Rate |

|---|---|

| S | $1,620 |

| SV | 1,674 |

| SR | 1,684 |

| SR Midnight Edition | 1,688 |

| SR Premium | 1,764 |

| 2022 Nissan Sentra Average Rate | $1,686 |

2022 Nissan Versa

$1,956

| 2022 Nissan Versa Trims | Rate |

|---|---|

| S | $1,920 |

| SV | 1,930 |

| SR | 2,020 |

| 2022 Nissan Versa Average Rate | $1,956 |

2021 Nissan Sentra vs. Nissan Versa

When comparing car insurance rates for the 2021 Nissan Sentra and Nissan Versa models, the Nissan Sentra is cheaper to insure by an average of $238 per year.

The chart below shows the average insurance cost for both models rated for drivers aged 20 to 50. For the 2021 Nissan Sentra, average insurance cost ranges from $1,354 to $3,004 per year for the five age groups shown in the chart. Insurance on the 2021 Nissan Versa ranges from $1,578 to $3,524 on average per year.

Out of five trim levels for the 2021 Nissan Sentra, the lowest-cost rates are on the S Sedan trim at a cost of $1,452 per year, or $121 per month. The 2021 Nissan Versa has five different option levels available, with the most affordable trim level to insure being the 1.6 S MT Sedan model at an average cost of $1,682 per year, or $140 per month.

When insurance prices for all 10 trim levels for the 2021 model year of both models are compared, the lowest-cost model and trim to insure is the Nissan Sentra S Sedan at an average of $1,452 per year. The highest-cost model and trim level is the Nissan Versa 1.6 SR Sedan at an average of $1,838 per year.

The next two tables display trim level insurance rates for each 2021 model, plus the average rate for each model.

2021 Nissan Sentra

$1,516

| 2021 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,452 |

| SR Sedan | 1,504 |

| SV Sedan | 1,504 |

| SR Premium Sedan | 1,558 |

| SV Premium Sedan | 1,558 |

| 2021 Nissan Sentra Average Rate | $1,516 |

2021 Nissan Versa

$1,754

| 2021 Nissan Versa Trims | Rate |

|---|---|

| 1.6 S MT Sedan | $1,682 |

| 1.6 ConvertibleT Sedan | 1,748 |

| 1.6 S ConvertibleT Sedan | 1,748 |

| 1.6 SV Sedan | 1,748 |

| 1.6 SR Sedan | 1,838 |

| 2021 Nissan Versa Average Rate | $1,754 |

2020 Nissan Sentra vs. Nissan Versa

A 2020 Nissan Sentra is $234 cheaper to insure per year on average than a 2020 Nissan Versa, a difference of 14.7%.

The chart shown below illustrates the average insurance cost for both models for the 20, 30, 40, and 50-year-old driver age groups. For a 2020 Nissan Sentra, average car insurance cost ranges from $1,318 to $2,924 per year. Auto insurance for a 2020 Nissan Versa ranges from $1,540 to $3,436 on average per year.

For the five trims available for a 2020 Nissan Sentra, the lowest-cost model to insure is the S Sedan trim at an average cost of $1,414 per year. Out of the five different trims available for a Nissan Versa, the cheapest 2020 trim level to insure is the 1.6 S MT Sedan model at a cost of $1,640 per year, or $137 per month.

When looking at the aggregated rates by trim for both models, the overall cheapest vehicle to insure is the Nissan Sentra S Sedan at an average cost of $1,414 per year, and the most expensive model and trim level is the Nissan Versa 1.6 SR Sedan costing $1,790 per year.

The tables below illustrate average car insurance rates for each trim level, along with the average rate for each model.

2020 Nissan Sentra

$1,476

| 2020 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,414 |

| SR Sedan | 1,464 |

| SV Sedan | 1,464 |

| SR Premium Sedan | 1,516 |

| SV Premium Sedan | 1,516 |

| 2020 Nissan Sentra Average Rate | $1,476 |

2020 Nissan Versa

$1,710

| 2020 Nissan Versa Trims | Rate |

|---|---|

| 1.6 S MT Sedan | $1,640 |

| 1.6 ConvertibleT Sedan | 1,706 |

| 1.6 S ConvertibleT Sedan | 1,706 |

| 1.6 SV Sedan | 1,706 |

| 1.6 SR Sedan | 1,790 |

| 2020 Nissan Versa Average Rate | $1,710 |

2019 Nissan Sentra vs. Nissan Versa

When comparing insurance rates for 2019 models, the Nissan Sentra costs an average of $1,490 per year for full coverage and the Nissan Versa costs $1,504, making the Nissan Sentra the model with cheaper insurance by $14 for the 2019 comparison year.

The chart below visualizes the average car insurance cost for both 2019 models rated for multiple driver ages. The average cost of car insurance ranges from $1,340 to $2,956 per year on a 2019 Nissan Sentra, and $1,354 to $3,008 for a 2019 Nissan Versa for the age groups used in this illustration.

Out of five Nissan Sentra trims, the lowest-cost 2019 trim level to insure is the S Sedan model at an average cost of $1,388 per year, or $116 per month. For the six different trims available for a Nissan Versa, the most affordable 2019 trim to insure is the Note 1.6 S Hatchback model at a cost of $1,346.

When rates for all 11 trim levels for both vehicles are compared, the lowest-cost model and trim to put coverage on is the Nissan Versa Note 1.6 S Hatchback at an average rate of $1,346 per year, and the most expensive model and trim level is the Nissan Versa 1.6 SV Sedan at an average cost of $1,614 per year.

The next two rate tables display the average cost to insure all 2019 trim levels, including the average rate for each model. The cheapest of the two models to insure for the 2019 model year is the Nissan Sentra.

2019 Nissan Sentra

$1,490

| 2019 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,388 |

| SV Sedan | 1,436 |

| SL Sedan | 1,532 |

| SR Sedan | 1,532 |

| Nismo Sedan | 1,566 |

| 2019 Nissan Sentra Average Rate | $1,490 |

2019 Nissan Versa

$1,504

| 2019 Nissan Versa Trims | Rate |

|---|---|

| Note 1.6 S Hatchback | $1,346 |

| Note 1.6 SV Hatchback | 1,408 |

| Note 1.6 SR Hatchback | 1,456 |

| 1.6 S Sedan | 1,566 |

| 1.6 S Plus Sedan | 1,614 |

| 1.6 SV Sedan | 1,614 |

| 2019 Nissan Versa Average Rate | $1,504 |

2018 Nissan Sentra vs. Nissan Versa

For the 2018 Nissan Sentra and Nissan Versa models, the Nissan Sentra has cheaper car insurance cost by $2 per year for this model year.

The rate chart below visualizes the average cost to insure the two models for four different driver age groups. For the 2018 Nissan Sentra, the average car insurance cost ranges from $1,286 to $2,834 per year for the illustrated age groups. A full-coverage policy on the 2018 Nissan Versa ranges from $1,296 to $2,870 on average per year.

A 2018 Nissan Sentra has five trim levels available, with the cheapest trim to insure being the S Sedan trim at an average cost of $1,330 per year, or around $111 per month.

For the six trims available for a Nissan Versa, the cheapest 2018 trim to insure is the Note 1.6 S Hatchback model at a cost of $1,302 per year, or around $109 per month.

When rates are compared for the 11 trim and option levels of both 2018 models, the cheapest trim to insure is the Nissan Versa Note 1.6 S Hatchback at an average rate of $1,302 per year, and the highest-cost model and trim level is the Nissan Versa 1.6 SV Sedan at an average cost of $1,560 per year.

The rate tables below show average car insurance rates for each trim level, including an overall average cost for each model. The 2018 Nissan Sentra comes out with a win over the 2018 Nissan Versa for cheapest auto insurance rates.

2018 Nissan Sentra

$1,432

| 2018 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,330 |

| SV Sedan | 1,386 |

| SR Sedan | 1,456 |

| SL Sedan | 1,478 |

| Nismo Sedan | 1,510 |

| 2018 Nissan Sentra Average Rate | $1,432 |

2018 Nissan Versa

$1,434

| 2018 Nissan Versa Trims | Rate |

|---|---|

| Note 1.6 S Hatchback | $1,302 |

| Note 1.6 SR Hatchback | 1,360 |

| Note 1.6 SV Hatchback | 1,360 |

| 1.6 S Sedan | 1,456 |

| 1.6 S Plus Sedan | 1,560 |

| 1.6 SV Sedan | 1,560 |

| 2018 Nissan Versa Average Rate | $1,434 |

2017 Nissan Sentra vs. Nissan Versa

When comparing car insurance rates for the 2017 Nissan Sentra and Nissan Versa models, the Nissan Sentra is cheaper to insure by an average of $74 per year.

The following chart illustrates the average cost to insure the two models for a range of driver ages. The average cost of car insurance ranges from $1,202 to $2,626 per year on the 2017 Nissan Sentra, and $1,270 to $2,810 for the 2017 Nissan Versa for the age groups used in this illustration.

Out of three trim levels for a 2017 Nissan Sentra, the lowest-cost insurance prices are on the S Sedan trim at a cost of $1,302 per year. For the eight different option levels available for the Nissan Versa, the cheapest 2017 model to insure is the Note 1.6 S Plus Hatchback model at a cost of $1,262.

When looking at the aggregated rates by trim level for both models, the lowest-cost model and trim level to insure is the Nissan Versa Note 1.6 S Plus Hatchback at an average rate of $1,262 per year, and the most expensive trim is the Nissan Versa 1.6 SL Sedan at an average cost of $1,572 per year.

The tables below display the average insurance cost by trim level for both 2017 models, plus an average rate for each model. The cheapest to insure for the 2017 model year is the Nissan Sentra.

2017 Nissan Sentra

$1,330

| 2017 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,302 |

| SR Sedan | 1,346 |

| SV Sedan | 1,346 |

| 2017 Nissan Sentra Average Rate | $1,330 |

2017 Nissan Versa

$1,404

| 2017 Nissan Versa Trims | Rate |

|---|---|

| Note 1.6 S Plus Hatchback | $1,262 |

| Note 1.6 SR Hatchback | 1,320 |

| Note 1.6 SV Hatchback | 1,320 |

| Note 1.6 SL Hatchback | 1,362 |

| 1.6 S Sedan | 1,418 |

| 1.6 S Plus Sedan | 1,474 |

| 1.6 SV Sedan | 1,518 |

| 1.6 SL Sedan | 1,572 |

| 2017 Nissan Versa Average Rate | $1,404 |

2016 Nissan Sentra vs. Nissan Versa

For the 2016 Nissan Sentra and Nissan Versa models, the Nissan Versa has cheaper car insurance rates by $162 per year for this model year.

The chart below visualizes the average car insurance cost for the two models using different driver ages. For a 2016 Nissan Sentra, insurance cost ranges from $1,164 to $2,550 per year for the illustrated age groups. Full-coverage car insurance on the 2016 Nissan Versa costs from $1,016 to $2,230 on average per year.

Out of five trims for a 2016 Nissan Sentra, the most affordable car insurance rates are on the S Sedan trim at a cost of $1,234 per year, or around $103 per month. Out of the nine trim options available for a Nissan Versa, the most affordable 2016 model to insure is the Note 1.6 S Hatchback model at a cost of $996.

When comparing rates by trim level for both models, the cheapest vehicle to insure is the Nissan Versa Note 1.6 S Hatchback at an average cost of $996 per year, and the most expensive model and trim level is the Nissan Sentra SL Sedan at an average of $1,352 per year.

The tables below display trim level insurance cost averages for both 2016 models, as well as an average rate for each model.

2016 Nissan Sentra

$1,288

| 2016 Nissan Sentra Trims | Rate |

|---|---|

| S Sedan | $1,234 |

| S Plus Sedan | 1,272 |

| SV Sedan | 1,272 |

| SR Sedan | 1,312 |

| SL Sedan | 1,352 |

| 2016 Nissan Sentra Average Rate | $1,288 |

2016 Nissan Versa

$1,126

| 2016 Nissan Versa Trims | Rate |

|---|---|

| Note 1.6 S Hatchback | $996 |

| Note 1.6 S Plus Hatchback | 996 |

| Note 1.6 SR Hatchback | 1,048 |

| Note 1.6 SV Hatchback | 1,048 |

| Note 1.6 SL Hatchback | 1,086 |

| 1.6 S Sedan | 1,170 |

| 1.6 S Plus Sedan | 1,210 |

| 1.6 SV Sedan | 1,260 |

| 1.6 SL Sedan | 1,326 |

| 2016 Nissan Versa Average Rate | $1,126 |

2015 Nissan Sentra vs. Nissan Versa

When comparing insurance cost for 2015 models, the Nissan Sentra costs $1,134 per year for a full-coverage policy and the Nissan Versa costs $1,082, making the Nissan Versa the cheaper model to insure by $52 for this model year.

The rate chart below shows the average insurance cost for both 2015 models rated for a variety of different driver ages. Average full-coverage insurance ranges from $1,022 to $2,230 per year for a 2015 Nissan Sentra, and $978 to $2,154 on a 2015 Nissan Versa.

Out of five Nissan Sentra trims, the lowest-cost 2015 model to insure is the S Plus Sedan trim at an average cost of $1,104 per year, or about $92 per month. For the nine different option levels available for the Nissan Versa, the most affordable 2015 trim to insure is the Note 1.6 S Hatchback trim at a cost of $976 per year, or about $81 per month.

When looking at the combined rates by trim level for both models, the cheapest vehicle to insure is the Nissan Versa Note 1.6 S Hatchback at an average cost of $976 per year. The most expensive model and trim level is the Nissan Versa 1.6 SL Sedan at an average of $1,270 per year.

The two tables below show both 2015 models and all trim levels available for each one, along with an average cost for each model. The model with the cheapest overall car insurance cost for 2015 is the Nissan Versa.

2015 Nissan Sentra

$1,134

| 2015 Nissan Sentra Trims | Rate |

|---|---|

| S Plus Sedan | $1,104 |

| S Sedan | 1,104 |

| SR Sedan | 1,140 |

| SV Sedan | 1,140 |

| SL Sedan | 1,178 |

| 2015 Nissan Sentra Average Rate | $1,134 |

2015 Nissan Versa

$1,082

| 2015 Nissan Versa Trims | Rate |

|---|---|

| Note 1.6 S Hatchback | $976 |

| Note 1.6 S Plus Hatchback | 976 |

| Note 1.6 SL Hatchback | 1,024 |

| Note 1.6 SR Hatchback | 1,024 |

| Note 1.6 SV Hatchback | 1,024 |

| 1.6 S Sedan | 1,088 |

| 1.6 S Plus Sedan | 1,160 |

| 1.6 SV Sedan | 1,196 |

| 1.6 SL Sedan | 1,270 |

| 2015 Nissan Versa Average Rate | $1,082 |