- Chevrolet Caprice insurance rates average $1,418 per year or $709 for a semi-annual policy, but can vary significantly based on the trim level.

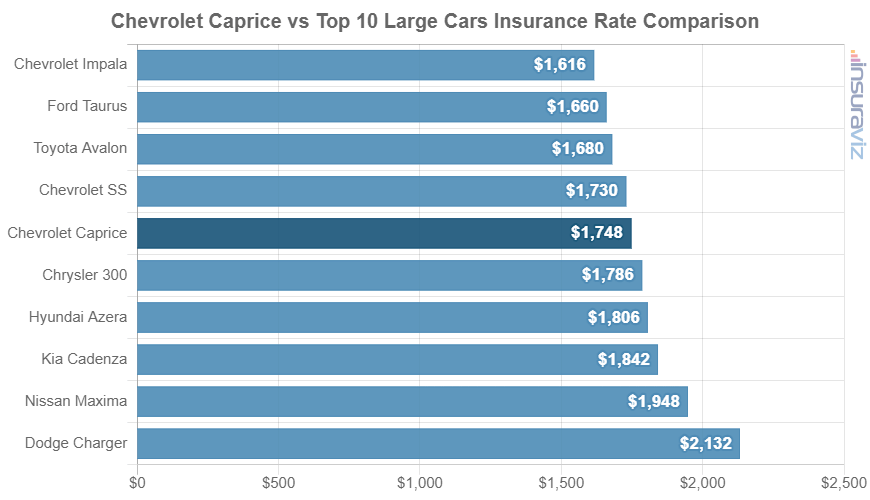

- Out of 11 other large cars in the 2016 model year, the Caprice ranks fifth for insurance affordability.

How much does Chevrolet Caprice insurance cost?

Chevrolet Caprice insurance rates cost an average of $1,418 annually for full coverage, or about $118 on a monthly basis. Overall, expect to pay about $38 less each year to insure a Chevrolet Caprice compared to similar vehicles, and $465 less per year than the all-vehicle national average of $1,883.

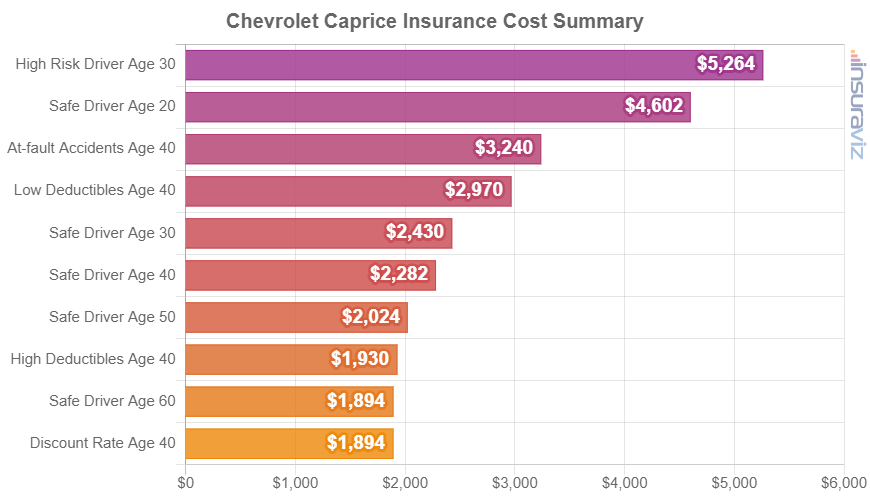

The following chart shows average insurance rates for a 2016 Caprice using different policy limits and driver ages.

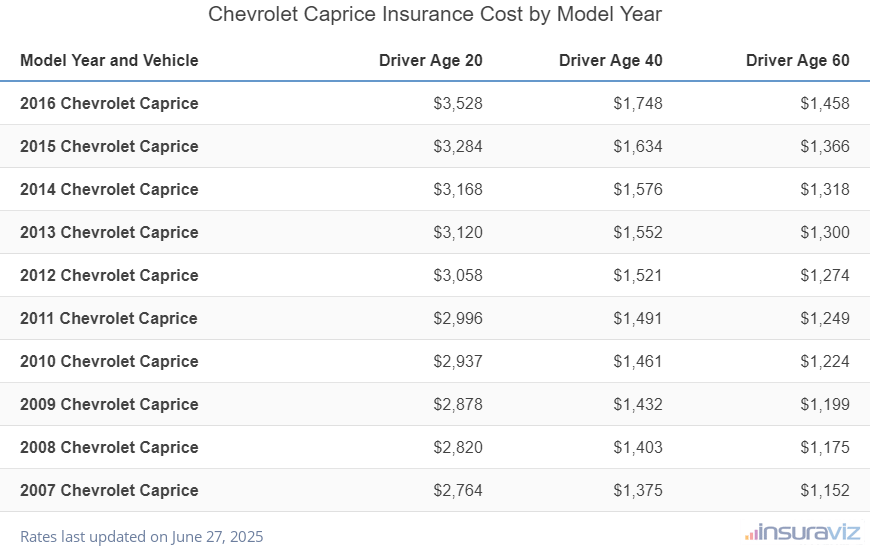

The following data table shows average full coverage auto insurance rates for a Chevrolet Caprice for the 2007 to 2016 model years broken out for drivers aged 20 to 60.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2016 Chevrolet Caprice | $2,860 | $1,418 | $1,184 |

| 2015 Chevrolet Caprice | $2,660 | $1,324 | $1,106 |

| 2014 Chevrolet Caprice | $2,568 | $1,276 | $1,070 |

| 2013 Chevrolet Caprice | $2,528 | $1,258 | $1,054 |

| 2012 Chevrolet Caprice | $2,477 | $1,233 | $1,033 |

| 2011 Chevrolet Caprice | $2,428 | $1,208 | $1,012 |

| 2010 Chevrolet Caprice | $2,379 | $1,184 | $992 |

| 2009 Chevrolet Caprice | $2,332 | $1,160 | $972 |

| 2008 Chevrolet Caprice | $2,285 | $1,137 | $953 |

| 2007 Chevrolet Caprice | $2,239 | $1,114 | $934 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Caprice trim levels for each model year. Updated February 23, 2024

The Chevy Caprice vs. other large sedans

The Chevrolet Caprice ranks fifth out of 11 total comparison vehicles in the large car segment for car insurance affordability. The Caprice costs an estimated $1,418 per year for insurance, while the class average auto insurance cost is $1,456 annually, a difference of $38 per year.

When compared side-by-side to the best-selling models in the large car category, auto insurance rates for a Chevrolet Caprice cost $310 less per year than the Dodge Charger, $108 more than the Chevrolet Impala, and $158 less than the Nissan Maxima.

The following chart shows how car insurance rates for a 2016 Caprice compare to the top 10 best-selling large cars in the United States like the Chrysler 300, Toyota Avalon, and the Ford Taurus.

Other rates and insights

Other notable observations about Chevrolet Caprice insurance cost include:

- The cost to insure teen drivers is expensive. Average rates for full coverage Caprice insurance costs $5,189 per year for a 16-year-old driver, $4,987 per year for a 17-year-old driver, $4,387 per year for an 18-year-old driver, and $4,020 per year for a 19-year-old driver.

- Prepare for sticker shock for high-risk insurance. For a 40-year-old driver, having a tendency to get into accidents or receive violations could increase the cost by $1,738 or more per year.

- The gender of the driver affects insurance costs. For a 2016 Chevrolet Caprice, a 20-year-old man pays an average rate of $2,860 per year, while a 20-year-old female pays an estimated $2,060, a difference of $800 per year in favor of the women by a long shot. But by age 50, the cost for male drivers is $1,268 and rates for female drivers are $1,230, a difference of only $38.

- Research policy discounts to save money. Discounts may be available if the policyholders take a defensive driving course, are claim-free, choose electronic billing, belong to certain professional organizations, or other policy discounts which could save the average driver as much as $240 per year.

- Your employment could lower your rates. The large majority of car insurance providers offer policy discounts for being employed in occupations like lawyers, dentists, architects, members of the military, high school and elementary teachers, and others. If your occupation qualifies you for this discount, you may save between $43 and $142 on your annual car insurance bill, depending on the age of the driver.