- Mazda 5 insurance costs an average of $1,560 per year, or around $130 per month for full coverage.

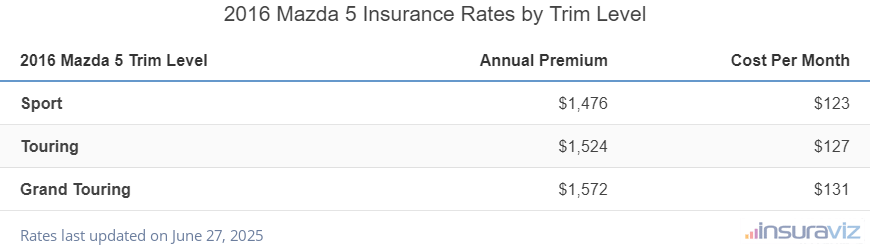

- With the cheapest insurance rates, the Sport trim costs an average of $1,510 per year to insure.

- At the high end, the Mazda 5 Grand Touring is the most expensive to insure at $1,606 for an annual policy.

How much does Mazda 5 car insurance cost?

Mazda 5 insurance costs on average $1,560 annually for full coverage, or $130 a month. Expect to pay around $716 less per year than the $2,276 average for all vehicles.

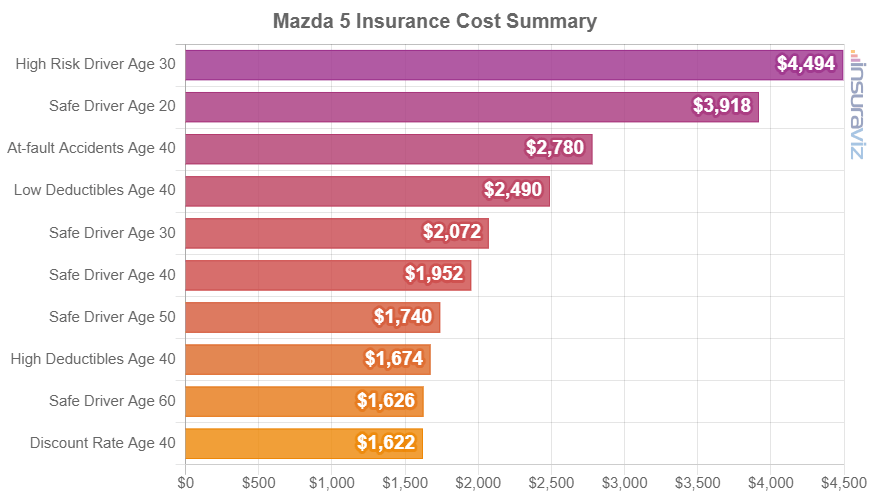

The chart below illustrates average car insurance cost for a 2016 Mazda 5 using different combinations of driver age and risk.

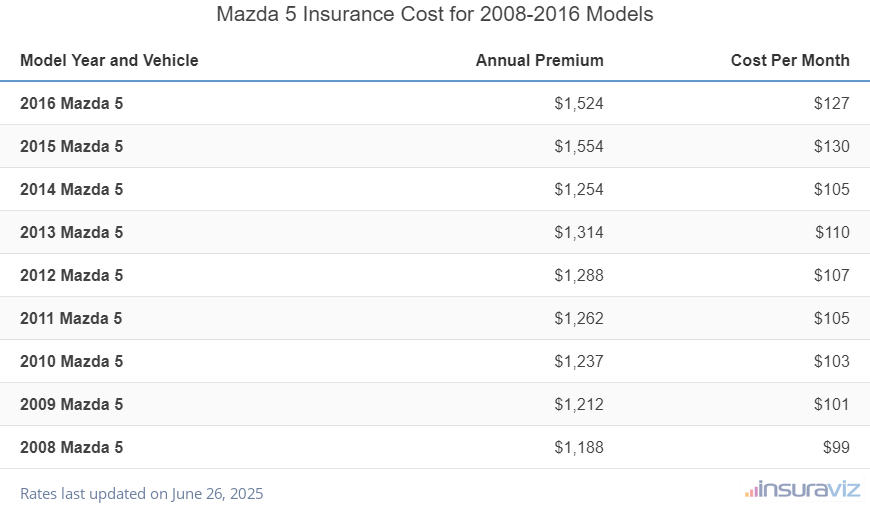

The following table illustrates average car insurance rates for a Mazda 5 for the 2008 to 2016 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2016 Mazda 5 | $1,560 | $130 |

| 2015 Mazda 5 | $1,592 | $133 |

| 2014 Mazda 5 | $1,284 | $107 |

| 2013 Mazda 5 | $1,342 | $112 |

| 2012 Mazda 5 | $1,315 | $110 |

| 2011 Mazda 5 | $1,289 | $107 |

| 2010 Mazda 5 | $1,263 | $105 |

| 2009 Mazda 5 | $1,238 | $103 |

| 2008 Mazda 5 | $1,213 | $101 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mazda 5 trim levels for each model year. Updated October 24, 2025

The rate table below displays average annual and 6-month policy costs, plus a monthly amount for budgeting, for each Mazda 5 package and trim level.

| 2016 Mazda 5 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sport | $1,510 | $126 |

| Touring | $1,560 | $130 |

| Grand Touring | $1,606 | $134 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

More insurance rates and insights

A few additional noteworthy observations about Mazda 5 insurance rates include:

- High-risk insurance can get expensive. For a 20-year-old driver, having too many driving record violations or accidents can increase the cost by $2,474 or more per year.

- Citations and violations increase policy cost. In order to get cheap insurance rates, it’s necessary to not be an aggressive driver. As a matter of fact, just a couple minor driving offenses have the ramification of increasing policy rates as much as $424 per year. Serious infractions such as DUI and hit-and-run could raise rates by an additional $1,460 or more.

- Being a safe driver saves money. Having at-fault accidents will cost you more, possibly by an extra $2,258 per year for a 20-year-old driver and even $422 per year for a 60-year-old driver.

- Increasing deductibles lowers insurance cost. Increasing your policy deductibles from $500 to $1,000 could save around $198 per year for a 40-year-old driver and $376 per year for a 20-year-old driver.

- Low physical damage deductibles increases cost. Dropping your physical damage deductibles from $500 to $250 could cost an additional $202 per year for a 40-year-old driver and $398 per year for a 20-year-old driver.

- Driver gender influences rates. For a 2016 Mazda 5, a 20-year-old male receives an average rate of $3,140 per year, while a 20-year-old woman will pay an average of $2,272, a difference of $868 per year. Women get significantly cheaper rates. But by age 50, the rate for males is $1,398 and the cost for women is $1,356, a difference of only $42.

- Mazda 5 insurance rates for teens are expensive. Average rates for full coverage Mazda 5 insurance costs $5,780 per year for a 16-year-old driver, $5,523 per year for a 17-year-old driver, $4,805 per year for an 18-year-old driver, and $4,428 per year for a 19-year-old driver.