- A 2024 Chevrolet Tahoe costs less to insure than a 2024 Chevrolet Blazer by an average of $224 per year, $2,252 compared to $2,476.

- For the 2024 Chevrolet Tahoe, average full-coverage car insurance rates cost from $2,108 to $2,380 per year, while car insurance for the 2024 Chevrolet Blazer costs from $2,288 to $2,734.

Is a Chevrolet Tahoe or Blazer cheaper to insure?

Insurance rates for a 2024 Chevrolet Tahoe average $2,252 per year, whereas insurance for a Chevrolet Blazer costs an average of $2,476 per year, making the Chevrolet Tahoe the cheaper of the two models to insure.

For the 11 trims available for the 2024 Chevrolet Tahoe, the cheapest trim to insure is the LS 2WD trim at an average cost of $2,108 per year.

For the 12 trims available for the Chevrolet Blazer, the cheapest 2024 trim level to insure is the 2LT 2WD model at a cost of $2,288 per year, or around $191 per month.

When comparing rates by trim level for both models, the lowest-cost model and trim level is the Chevrolet Tahoe LS 2WD at a cost of $2,108 per year, and the most expensive vehicle to insure is the Chevrolet Blazer EV SS at a cost of $2,734 per year.

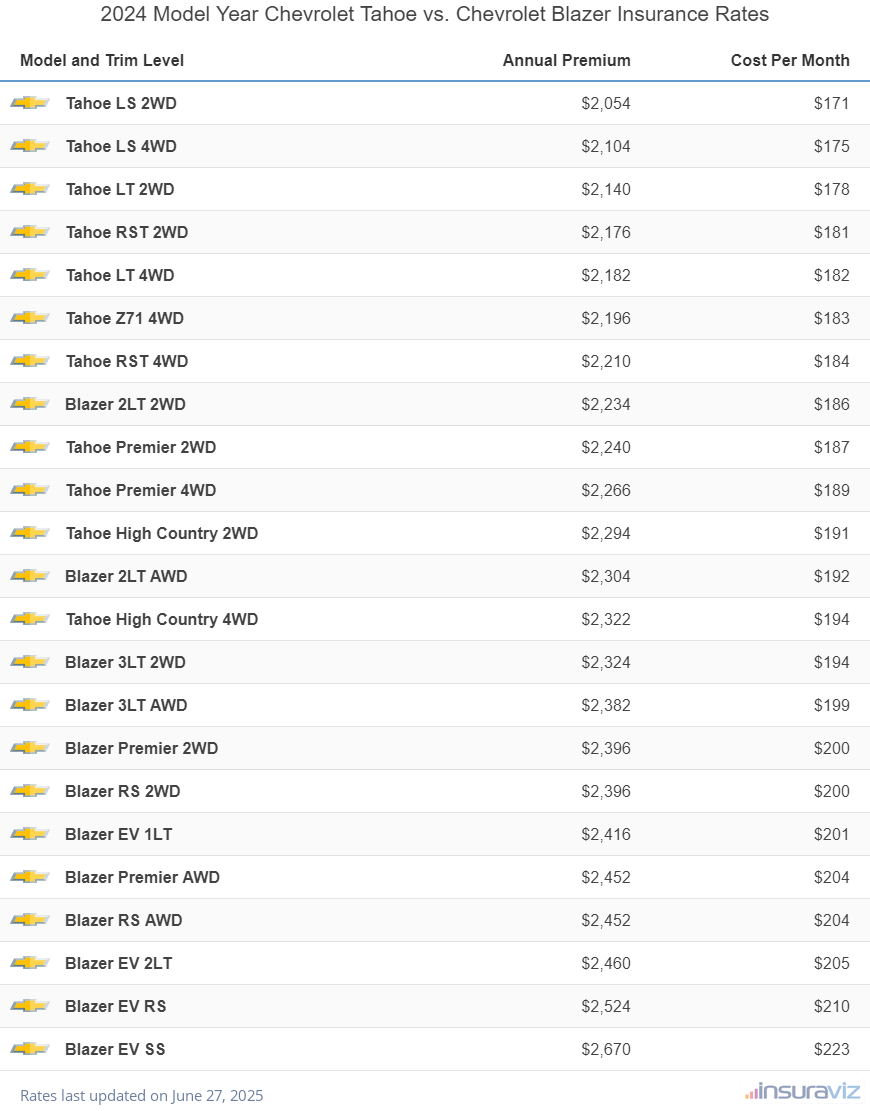

The table shown below ranks the annual and monthly cost of car insurance for 2024 Chevrolet Tahoe and Chevrolet Blazer models, broken down by individual trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Tahoe LS 2WD | $2,108 | $176 |

| Tahoe LS 4WD | $2,158 | $180 |

| Tahoe LT 2WD | $2,194 | $183 |

| Tahoe RST 2WD | $2,230 | $186 |

| Tahoe LT 4WD | $2,238 | $187 |

| Tahoe Z71 4WD | $2,252 | $188 |

| Tahoe RST 4WD | $2,264 | $189 |

| Blazer 2LT 2WD | $2,288 | $191 |

| Tahoe Premier 2WD | $2,294 | $191 |

| Tahoe Premier 4WD | $2,322 | $194 |

| Tahoe High Country 2WD | $2,350 | $196 |

| Blazer 2LT AWD | $2,360 | $197 |

| Tahoe High Country 4WD | $2,380 | $198 |

| Blazer 3LT 2WD | $2,380 | $198 |

| Blazer 3LT AWD | $2,438 | $203 |

| Blazer Premier 2WD | $2,452 | $204 |

| Blazer RS 2WD | $2,452 | $204 |

| Blazer EV 1LT | $2,474 | $206 |

| Blazer Premier AWD | $2,510 | $209 |

| Blazer RS AWD | $2,510 | $209 |

| Blazer EV 2LT | $2,516 | $210 |

| Blazer EV RS | $2,582 | $215 |

| Blazer EV SS | $2,734 | $228 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

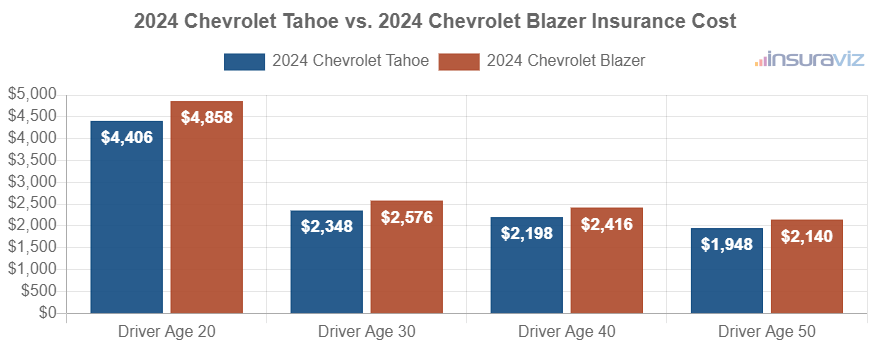

The next chart illustrates the average cost to insure both 2024 models for four different driver age groups. For a 2024 Chevrolet Tahoe, the average cost of car insurance ranges from $1,994 to $4,514 per year for the driver ages used. A 2024 Chevrolet Blazer costs from $2,192 to $4,980 to insure per year.

The tables below show the average cost to insure all 2024 trim levels, plus an average rate for each model. The 2024 Chevrolet Tahoe defeats the 2024 Chevrolet Blazer for cheapest car insurance rates.

2024 Chevrolet Tahoe

$2,252

| 2024 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,108 |

| LS 4WD | 2,158 |

| LT 2WD | 2,194 |

| RST 2WD | 2,230 |

| LT 4WD | 2,238 |

| Z71 4WD | 2,252 |

| RST 4WD | 2,264 |

| Premier 2WD | 2,294 |

| Premier 4WD | 2,322 |

| High Country 2WD | 2,350 |

| High Country 4WD | 2,380 |

| 2024 Chevrolet Tahoe Average Rate | $2,252 |

2024 Chevrolet Blazer

$2,476

| 2024 Chevrolet Blazer Trims | Rate |

|---|---|

| 2LT 2WD | $2,288 |

| 2LT AWD | 2,360 |

| 3LT 2WD | 2,380 |

| 3LT AWD | 2,438 |

| Premier 2WD | 2,452 |

| RS 2WD | 2,452 |

| EV 1LT | 2,474 |

| Premier AWD | 2,510 |

| RS AWD | 2,510 |

| EV 2LT | 2,516 |

| EV RS | 2,582 |

| EV SS | 2,734 |

| 2024 Chevrolet Blazer Average Rate | $2,476 |

2023 Chevrolet Tahoe vs. Chevrolet Blazer

When comparing 2023 Chevrolet Tahoe and Chevrolet Blazer models, the cheaper model to insure on average is the Chevrolet Tahoe. Insurance rates on a Chevrolet Tahoe cost an average of $2,188 per year, while the Chevrolet Blazer costs an average of $2,362 per year.

For a 2023 Chevrolet Tahoe, car insurance rates range from the cheapest rate of $2,046 per year for the LS 2WD model up to $2,304 for the High Country 4WD model.

For a 2023 Chevrolet Blazer, rates can range from $2,224 per year for the 2LT 2WD model up to $2,448 on the most expensive RS AWD model.

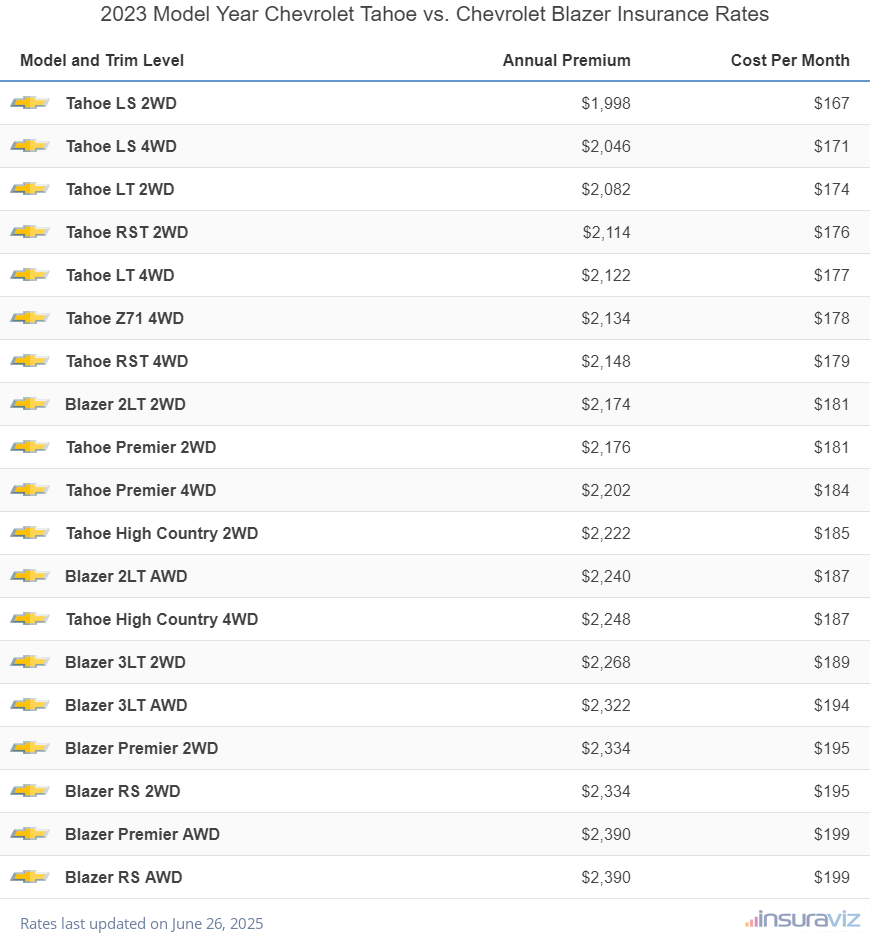

The table shown below ranks the yearly and monthly cost of car insurance for 2023 Chevrolet Tahoe and Chevrolet Blazer models, with the cost to insure each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Tahoe LS 2WD | $2,046 | $171 |

| Tahoe LS 4WD | $2,096 | $175 |

| Tahoe LT 2WD | $2,130 | $178 |

| Tahoe RST 2WD | $2,164 | $180 |

| Tahoe LT 4WD | $2,172 | $181 |

| Tahoe Z71 4WD | $2,184 | $182 |

| Tahoe RST 4WD | $2,200 | $183 |

| Blazer 2LT 2WD | $2,224 | $185 |

| Tahoe Premier 2WD | $2,228 | $186 |

| Tahoe Premier 4WD | $2,256 | $188 |

| Tahoe High Country 2WD | $2,276 | $190 |

| Blazer 2LT AWD | $2,292 | $191 |

| Tahoe High Country 4WD | $2,304 | $192 |

| Blazer 3LT 2WD | $2,322 | $194 |

| Blazer 3LT AWD | $2,376 | $198 |

| Blazer Premier 2WD | $2,390 | $199 |

| Blazer RS 2WD | $2,390 | $199 |

| Blazer Premier AWD | $2,448 | $204 |

| Blazer RS AWD | $2,448 | $204 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

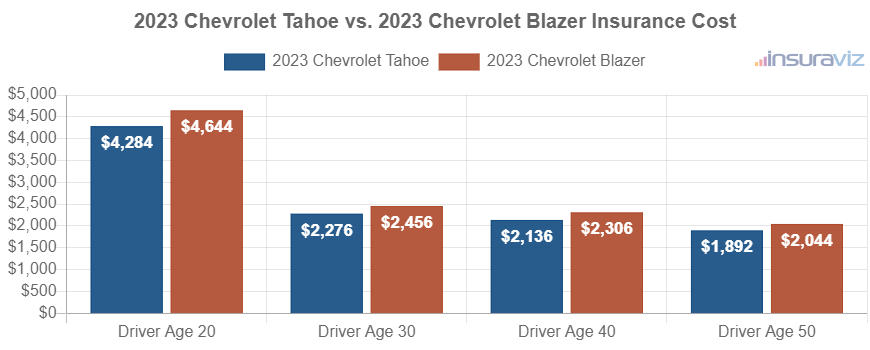

The next chart shows the average insurance cost for the two models for drivers from ages 20 to 50. Average insurance cost ranges from $1,938 to $4,390 per year on the 2023 Chevrolet Tahoe, and $2,094 to $4,760 on the 2023 Chevrolet Blazer for the age groups used in the chart.

Out of 11 Chevrolet Tahoe trim levels, the most affordable 2023 model to insure is the LS 2WD model at an average cost of $2,046 per year, or about $171 per month. For the eight different trims available for a Chevrolet Blazer, the most affordable 2023 trim package to insure is the 2LT 2WD trim at a cost of $2,224 per year, or around $185 per month.

When rates for all 19 trim levels for both vehicles are combined and compared, the most affordable model and trim level to buy insurance for is the Chevrolet Tahoe LS 2WD at an average rate of $2,046 per year, and the most expensive vehicle to insure is the Chevrolet Blazer RS AWD at an average cost of $2,448 per year.

The tables below detail average car insurance cost by trim level for each 2023 model, plus the average rate for each model.

2023 Chevrolet Tahoe

$2,188

| 2023 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,046 |

| LS 4WD | 2,096 |

| LT 2WD | 2,130 |

| RST 2WD | 2,164 |

| LT 4WD | 2,172 |

| Z71 4WD | 2,184 |

| RST 4WD | 2,200 |

| Premier 2WD | 2,228 |

| Premier 4WD | 2,256 |

| High Country 2WD | 2,276 |

| High Country 4WD | 2,304 |

| 2023 Chevrolet Tahoe Average Rate | $2,188 |

2023 Chevrolet Blazer

$2,362

| 2023 Chevrolet Blazer Trims | Rate |

|---|---|

| 2LT 2WD | $2,224 |

| 2LT AWD | 2,292 |

| 3LT 2WD | 2,322 |

| 3LT AWD | 2,376 |

| Premier 2WD | 2,390 |

| RS 2WD | 2,390 |

| Premier AWD | 2,448 |

| RS AWD | 2,448 |

| 2023 Chevrolet Blazer Average Rate | $2,362 |

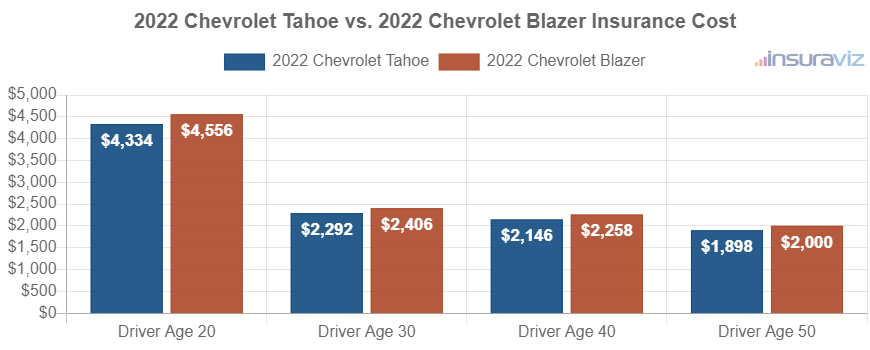

2022 Chevrolet Tahoe vs. Chevrolet Blazer

When comparing car insurance rates for 2022 models, the Chevrolet Tahoe costs an average of $2,198 per year to insure and the Chevrolet Blazer costs $2,312, making the Chevrolet Tahoe the cheaper model by $114 for this comparison year.

The following chart visualizes the average cost to insure the two models with different driver age groups. Average full-coverage insurance ranges from $1,946 to $4,438 per year on a 2022 Chevrolet Tahoe, and $2,050 to $4,670 for a 2022 Chevrolet Blazer for the different drivers illustrated in the chart.

Out of 11 trim levels for the 2022 Chevrolet Tahoe, the cheapest car insurance rates are on the LS 2WD trim at a cost of $2,046 per year.

For the eight different trims available for a Chevrolet Blazer, the most affordable 2022 trim level to insure is the 2LT 2WD model at a cost of $2,174 per year, or about $181 per month.

When comparing car insurance rates for both models by trim level, the lowest-cost model and trim to buy insurance for is the Chevrolet Tahoe LS 2WD at an average of $2,046 per year. The most expensive model and trim level is the Chevrolet Blazer RS AWD at an average cost of $2,398 per year.

The tables shown below show the average cost to insure each trim level for a 2022 Chevrolet Tahoe and Chevrolet Blazer, plus the average rate for each model. The winner for the 2022 car insurance rate comparison is the Chevrolet Tahoe.

2022 Chevrolet Tahoe

$2,198

| 2022 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,046 |

| LS 4WD | 2,098 |

| LT 2WD | 2,132 |

| LT 4WD | 2,178 |

| RST 2WD | 2,178 |

| Z71 4WD | 2,204 |

| RST 4WD | 2,216 |

| Premier 2WD | 2,236 |

| Premier 4WD | 2,270 |

| High Country 2WD | 2,292 |

| High Country 4WD | 2,320 |

| 2022 Chevrolet Tahoe Average Rate | $2,198 |

2022 Chevrolet Blazer

$2,312

| 2022 Chevrolet Blazer Trims | Rate |

|---|---|

| 2LT 2WD | $2,174 |

| 2LT AWD | 2,240 |

| 3LT 2WD | 2,274 |

| 3LT AWD | 2,328 |

| Premier 2WD | 2,344 |

| RS 2WD | 2,344 |

| Premier AWD | 2,398 |

| RS AWD | 2,398 |

| 2022 Chevrolet Blazer Average Rate | $2,312 |

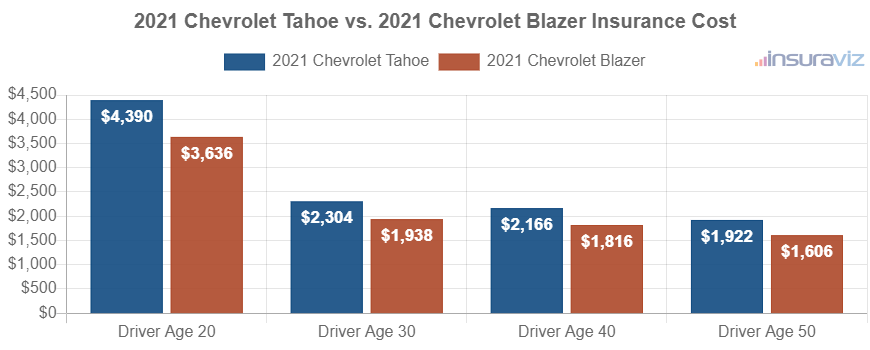

2021 Chevrolet Tahoe vs. Chevrolet Blazer

When comparing car insurance rates for the 2021 Chevrolet Tahoe and Chevrolet Blazer models, the Chevrolet Blazer is cheaper to insure by $358 per year for 2021.

The rate chart below shows the average insurance cost for both 2021 models for drivers aged 20 to 50. For the 2021 Chevrolet Tahoe, average insurance prices vary from $1,968 to $4,496 per year for the age groups used in this illustration. Full-coverage insurance on a 2021 Chevrolet Blazer costs from $1,646 to $3,726 on average per year.

A 2021 Chevrolet Tahoe has six trims available, with the most affordable trim level to insure being the LS 2WD model at an average cost of $2,116 per year, or $176 per month. For the seven trims available for a Chevrolet Blazer, the lowest-cost 2021 model to insure is the L 2WD model at a cost of $1,660.

When comparing both models combined at a trim-level basis, the overall cheapest vehicle to put coverage on is the Chevrolet Blazer L 2WD at a cost of $1,660 per year, and the most expensive trim is the Chevrolet Tahoe Premier 4WD at a cost of $2,314 per year.

The next two rate tables break down average car insurance rates for every trim level for both 2021 models, including an overall average cost for each model. The 2021 Chevrolet Blazer has lower-cost car average car insurance rates than the 2021 Chevrolet Tahoe.

2021 Chevrolet Tahoe

$2,218

| 2021 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,116 |

| LS 4WD | 2,182 |

| LT 2WD | 2,182 |

| LT 4WD | 2,248 |

| Premier 2WD | 2,268 |

| Premier 4WD | 2,314 |

| 2021 Chevrolet Tahoe Average Rate | $2,218 |

2021 Chevrolet Blazer

$1,860

| 2021 Chevrolet Blazer Trims | Rate |

|---|---|

| L 2WD | $1,660 |

| LT 2WD | 1,772 |

| LT 4WD | 1,826 |

| Premier 2WD | 1,926 |

| RS 2WD | 1,926 |

| RS 4WD | 1,926 |

| Premier 4WD | 1,990 |

| 2021 Chevrolet Blazer Average Rate | $1,860 |

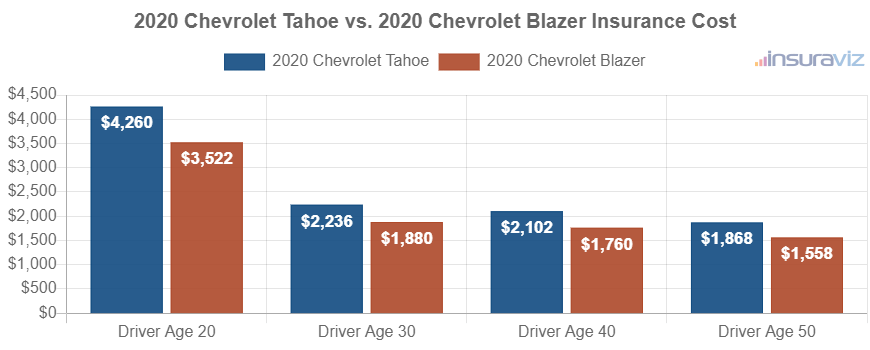

2020 Chevrolet Tahoe vs. Chevrolet Blazer

When comparing average insurance rates for 2020 models, a Chevrolet Tahoe costs an average of $2,152 per year to insure while a Chevrolet Blazer costs $1,804, making the Chevrolet Blazer cheaper to insure by $348 per year.

The rate chart below demonstrates the average cost to insure the two models for drivers from ages 20 to 50. For a 2020 Chevrolet Tahoe, the average car insurance cost ranges from $1,910 to $4,364 per year for the age groups included in the chart. Full-coverage insurance on a 2020 Chevrolet Blazer ranges from $1,598 to $3,610 on average per year.

Out of six trims for a 2020 Chevrolet Tahoe, the cheapest car insurance rates are on the LS 2WD trim at a cost of $2,054 per year, or around $171 per month. For the seven trim options available for the Chevrolet Blazer, the most affordable 2020 model to insure is the L 2WD model at a cost of $1,612 per year, or around $134 per month.

When comparing combined rates for both models from a trim-level perspective, the cheapest vehicle to put coverage on is the Chevrolet Blazer L 2WD at an average cost of $1,612 per year, and the most expensive model and trim level is the Chevrolet Tahoe Premier 4WD costing an average of $2,246 per year.

The tables below display average car insurance rates for every trim level for both 2020 models, including an overall average rate. The 2020 Chevrolet Blazer wins out over the 2020 Chevrolet Tahoe for the cheapest overall car insurance rates.

2020 Chevrolet Tahoe

$2,152

| 2020 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,054 |

| LS 4WD | 2,118 |

| LT 2WD | 2,118 |

| LT 4WD | 2,180 |

| Premier 2WD | 2,200 |

| Premier 4WD | 2,246 |

| 2020 Chevrolet Tahoe Average Rate | $2,152 |

2020 Chevrolet Blazer

$1,804

| 2020 Chevrolet Blazer Trims | Rate |

|---|---|

| L 2WD | $1,612 |

| LT 2WD | 1,718 |

| LT 4WD | 1,772 |

| Premier 2WD | 1,866 |

| RS 2WD | 1,866 |

| RS 4WD | 1,866 |

| Premier 4WD | 1,928 |

| 2020 Chevrolet Blazer Average Rate | $1,804 |

2019 Chevrolet Tahoe vs. Chevrolet Blazer

A 2019 Chevrolet Blazer is $46 cheaper to insure per year on average than a 2019 Chevrolet Tahoe, a difference of 2.3%.

The next chart illustrates the average insurance cost for the two models for the 20, 30, 40, and 50-year-old driver age groups. A full-coverage car insurance policy ranges from $1,792 to $4,104 per year for the 2019 Chevrolet Tahoe, and $1,754 to $3,988 for a 2019 Chevrolet Blazer for the age groups used in this illustration.

Out of nine Chevrolet Tahoe trim levels, the most affordable 2019 trim level to insure is the LS 2WD trim at an average cost of $1,932 per year, or about $161 per month. For the seven trim levels available for the Chevrolet Blazer, the lowest-cost 2019 trim to insure is the L 2WD trim at a cost of $1,786 per year, or around $149 per month.

When looking at the aggregated rates by trim for both models, the cheapest model and trim level to buy insurance for is the Chevrolet Blazer L 2WD at an average cost of $1,786 per year. The overall most expensive vehicle to insure is the Chevrolet Tahoe Premier 4WD at an average cost of $2,116 per year.

The next tables detail the average insurance cost by trim level for both 2019 models, including an overall average cost for each model.

2019 Chevrolet Tahoe

$2,022

| 2019 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,932 |

| LS 4WD | 1,994 |

| LT 2WD | 1,994 |

| Police Edition 2WD | 1,994 |

| Police Edition 4WD | 1,994 |

| LT 4WD | 2,054 |

| SSV 4WD | 2,054 |

| Premier 2WD | 2,072 |

| Premier 4WD | 2,116 |

| 2019 Chevrolet Tahoe Average Rate | $2,022 |

2019 Chevrolet Blazer

$1,976

| 2019 Chevrolet Blazer Trims | Rate |

|---|---|

| L 2WD | $1,786 |

| LT 2WD | 1,908 |

| LT 4WD | 1,968 |

| Premier 2WD | 2,030 |

| RS 2WD | 2,030 |

| RS 4WD | 2,030 |

| Premier 4WD | 2,090 |

| 2019 Chevrolet Blazer Average Rate | $1,976 |