- A 2024 Chevrolet Tahoe costs less to insure than a 2024 Chevrolet Blazer by an average of $176 per year, $1,782 compared to $1,958.

- For the 2024 Chevrolet Tahoe, average full-coverage car insurance rates cost from $1,666 to $1,882 per year, while car insurance for the 2024 Chevrolet Blazer costs from $1,808 to $2,162.

Is a Chevrolet Tahoe or Blazer cheaper to insure?

Insurance rates for a 2024 Chevrolet Tahoe average $1,782 per year, whereas insurance for a Chevrolet Blazer costs an average of $1,958 per year, making the Chevrolet Tahoe the cheaper of the two models to insure.

For the 11 trims available for the 2024 Chevrolet Tahoe, the cheapest trim to insure is the LS 2WD trim at an average cost of $1,666 per year.

For the 12 trims available for the Chevrolet Blazer, the cheapest 2024 trim level to insure is the 2LT 2WD model at a cost of $1,808 per year, or around $151 per month.

When comparing rates by trim level for both models, the lowest-cost model and trim level is the Chevrolet Tahoe LS 2WD at a cost of $1,666 per year, and the most expensive vehicle to insure is the Chevrolet Blazer EV SS at a cost of $2,162 per year.

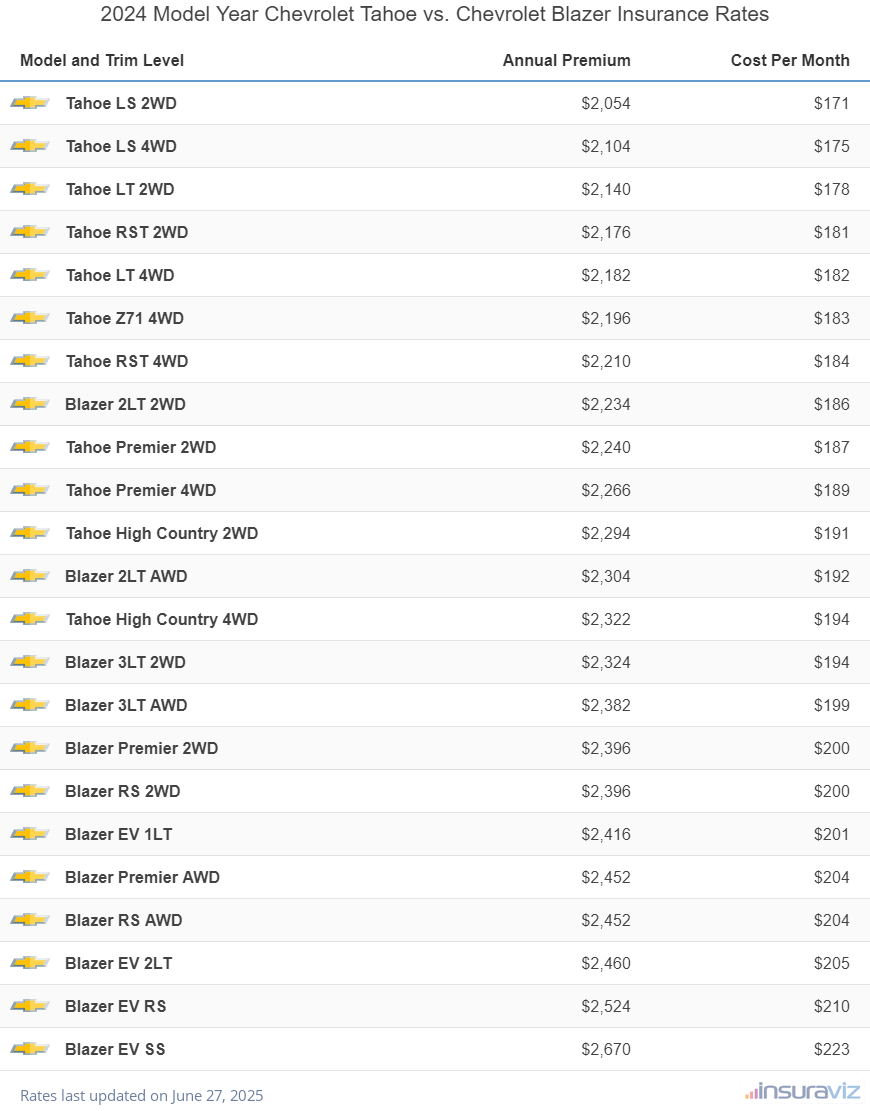

The table shown below ranks the annual and monthly cost of car insurance for 2024 Chevrolet Tahoe and Chevrolet Blazer models, broken down by individual trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Tahoe LS 2WD | $1,666 | $139 |

| Tahoe LS 4WD | $1,704 | $142 |

| Tahoe LT 2WD | $1,734 | $145 |

| Tahoe RST 2WD | $1,762 | $147 |

| Tahoe LT 4WD | $1,768 | $147 |

| Tahoe Z71 4WD | $1,780 | $148 |

| Tahoe RST 4WD | $1,790 | $149 |

| Blazer 2LT 2WD | $1,808 | $151 |

| Tahoe Premier 2WD | $1,814 | $151 |

| Tahoe Premier 4WD | $1,836 | $153 |

| Tahoe High Country 2WD | $1,860 | $155 |

| Blazer 2LT AWD | $1,866 | $156 |

| Tahoe High Country 4WD | $1,882 | $157 |

| Blazer 3LT 2WD | $1,882 | $157 |

| Blazer 3LT AWD | $1,928 | $161 |

| Blazer Premier 2WD | $1,940 | $162 |

| Blazer RS 2WD | $1,940 | $162 |

| Blazer EV 1LT | $1,958 | $163 |

| Blazer Premier AWD | $1,986 | $166 |

| Blazer RS AWD | $1,986 | $166 |

| Blazer EV 2LT | $1,992 | $166 |

| Blazer EV RS | $2,042 | $170 |

| Blazer EV SS | $2,162 | $180 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

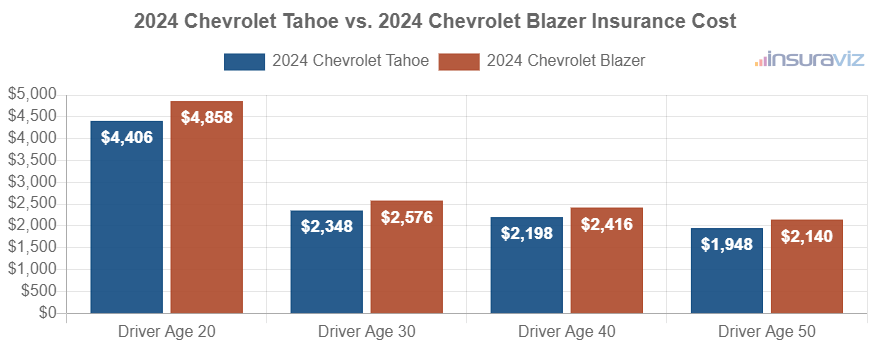

The next chart illustrates the average cost to insure both 2024 models for four different driver age groups. For a 2024 Chevrolet Tahoe, the average cost of car insurance ranges from $1,578 to $3,572 per year for the driver ages used. A 2024 Chevrolet Blazer costs from $1,736 to $3,940 to insure per year.

The tables below show the average cost to insure all 2024 trim levels, plus an average rate for each model. The 2024 Chevrolet Tahoe defeats the 2024 Chevrolet Blazer for cheapest car insurance rates.

2024 Chevrolet Tahoe

$1,782

| 2024 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,666 |

| LS 4WD | 1,704 |

| LT 2WD | 1,734 |

| RST 2WD | 1,762 |

| LT 4WD | 1,768 |

| Z71 4WD | 1,780 |

| RST 4WD | 1,790 |

| Premier 2WD | 1,814 |

| Premier 4WD | 1,836 |

| High Country 2WD | 1,860 |

| High Country 4WD | 1,882 |

| 2024 Chevrolet Tahoe Average Rate | $1,782 |

2024 Chevrolet Blazer

$1,958

| 2024 Chevrolet Blazer Trims | Rate |

|---|---|

| 2LT 2WD | $1,808 |

| 2LT AWD | 1,866 |

| 3LT 2WD | 1,882 |

| 3LT AWD | 1,928 |

| Premier 2WD | 1,940 |

| RS 2WD | 1,940 |

| EV 1LT | 1,958 |

| Premier AWD | 1,986 |

| RS AWD | 1,986 |

| EV 2LT | 1,992 |

| EV RS | 2,042 |

| EV SS | 2,162 |

| 2024 Chevrolet Blazer Average Rate | $1,958 |

2023 Chevrolet Tahoe vs. Chevrolet Blazer

When comparing 2023 Chevrolet Tahoe and Chevrolet Blazer models, the cheaper model to insure on average is the Chevrolet Tahoe. Insurance rates on a Chevrolet Tahoe cost an average of $1,730 per year, while the Chevrolet Blazer costs an average of $1,868 per year.

For a 2023 Chevrolet Tahoe, car insurance rates range from the cheapest rate of $1,618 per year for the LS 2WD model up to $1,822 for the High Country 4WD model.

For a 2023 Chevrolet Blazer, rates can range from $1,760 per year for the 2LT 2WD model up to $1,936 on the most expensive RS AWD model.

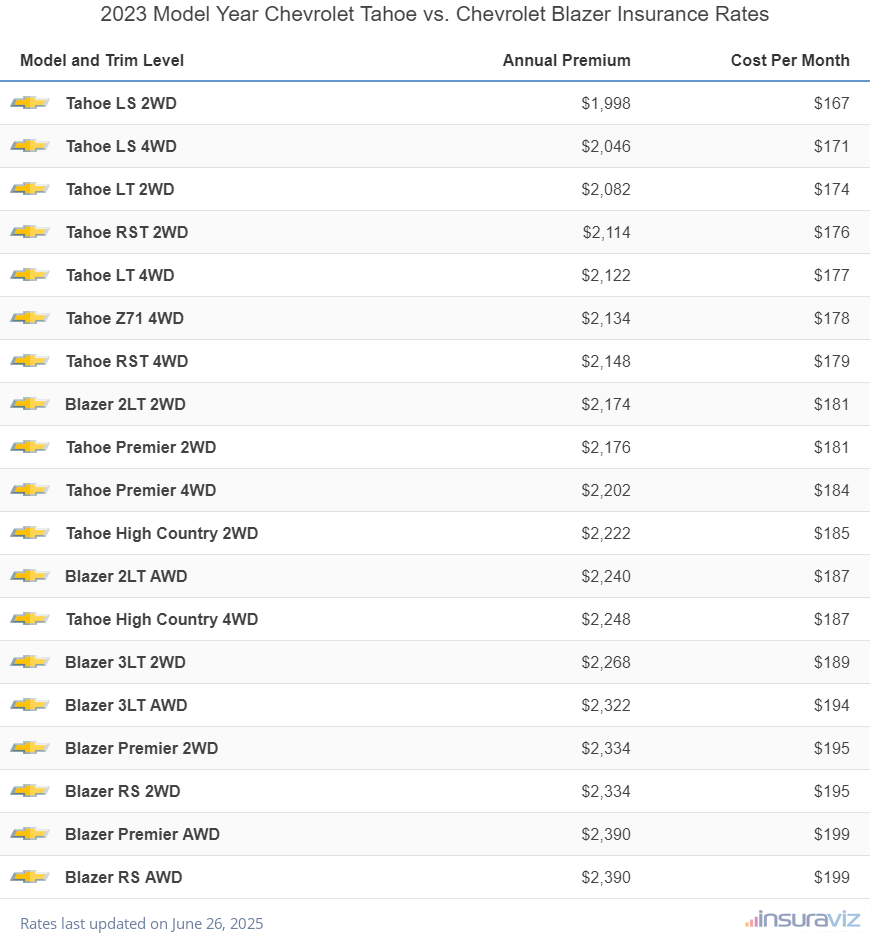

The table shown below ranks the yearly and monthly cost of car insurance for 2023 Chevrolet Tahoe and Chevrolet Blazer models, with the cost to insure each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Tahoe LS 2WD | $1,618 | $135 |

| Tahoe LS 4WD | $1,658 | $138 |

| Tahoe LT 2WD | $1,684 | $140 |

| Tahoe RST 2WD | $1,712 | $143 |

| Tahoe LT 4WD | $1,718 | $143 |

| Tahoe Z71 4WD | $1,728 | $144 |

| Tahoe RST 4WD | $1,740 | $145 |

| Blazer 2LT 2WD | $1,760 | $147 |

| Tahoe Premier 2WD | $1,762 | $147 |

| Tahoe Premier 4WD | $1,784 | $149 |

| Tahoe High Country 2WD | $1,800 | $150 |

| Blazer 2LT AWD | $1,814 | $151 |

| Tahoe High Country 4WD | $1,822 | $152 |

| Blazer 3LT 2WD | $1,836 | $153 |

| Blazer 3LT AWD | $1,880 | $157 |

| Blazer Premier 2WD | $1,892 | $158 |

| Blazer RS 2WD | $1,892 | $158 |

| Blazer Premier AWD | $1,936 | $161 |

| Blazer RS AWD | $1,936 | $161 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 22, 2024

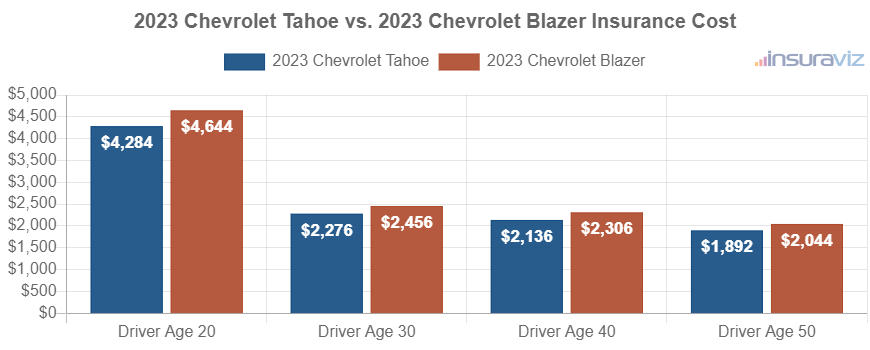

The next chart shows the average insurance cost for the two models for drivers from ages 20 to 50. Average insurance cost ranges from $1,532 to $3,474 per year on the 2023 Chevrolet Tahoe, and $1,658 to $3,764 on the 2023 Chevrolet Blazer for the age groups used in the chart.

Out of 11 Chevrolet Tahoe trim levels, the most affordable 2023 model to insure is the LS 2WD model at an average cost of $1,618 per year, or about $135 per month. For the eight different trims available for a Chevrolet Blazer, the most affordable 2023 trim package to insure is the 2LT 2WD trim at a cost of $1,760 per year, or around $147 per month.

When rates for all 19 trim levels for both vehicles are combined and compared, the most affordable model and trim level to buy insurance for is the Chevrolet Tahoe LS 2WD at an average rate of $1,618 per year, and the most expensive vehicle to insure is the Chevrolet Blazer RS AWD at an average cost of $1,936 per year.

The tables below detail average car insurance cost by trim level for each 2023 model, plus the average rate for each model.

2023 Chevrolet Tahoe

$1,730

| 2023 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,618 |

| LS 4WD | 1,658 |

| LT 2WD | 1,684 |

| RST 2WD | 1,712 |

| LT 4WD | 1,718 |

| Z71 4WD | 1,728 |

| RST 4WD | 1,740 |

| Premier 2WD | 1,762 |

| Premier 4WD | 1,784 |

| High Country 2WD | 1,800 |

| High Country 4WD | 1,822 |

| 2023 Chevrolet Tahoe Average Rate | $1,730 |

2023 Chevrolet Blazer

$1,868

| 2023 Chevrolet Blazer Trims | Rate |

|---|---|

| 2LT 2WD | $1,760 |

| 2LT AWD | 1,814 |

| 3LT 2WD | 1,836 |

| 3LT AWD | 1,880 |

| Premier 2WD | 1,892 |

| RS 2WD | 1,892 |

| Premier AWD | 1,936 |

| RS AWD | 1,936 |

| 2023 Chevrolet Blazer Average Rate | $1,868 |

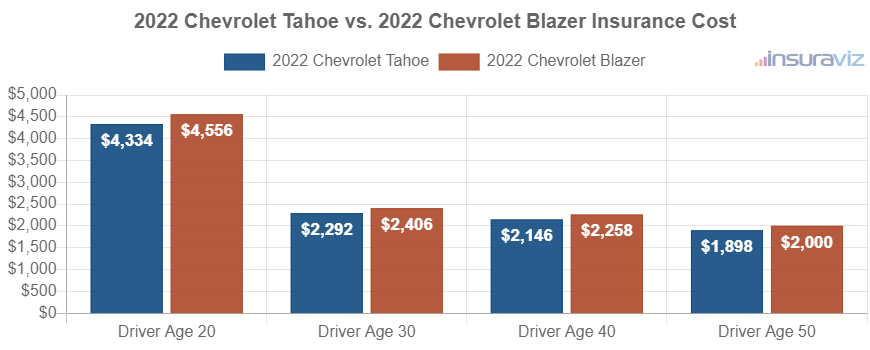

2022 Chevrolet Tahoe vs. Chevrolet Blazer

When comparing car insurance rates for 2022 models, the Chevrolet Tahoe costs an average of $1,738 per year to insure and the Chevrolet Blazer costs $1,828, making the Chevrolet Tahoe the cheaper model by $90 for this comparison year.

The following chart visualizes the average cost to insure the two models with different driver age groups. Average full-coverage insurance ranges from $1,540 to $3,510 per year on a 2022 Chevrolet Tahoe, and $1,622 to $3,692 for a 2022 Chevrolet Blazer for the different drivers illustrated in the chart.

Out of 11 trim levels for the 2022 Chevrolet Tahoe, the cheapest car insurance rates are on the LS 2WD trim at a cost of $1,618 per year.

For the eight different trims available for a Chevrolet Blazer, the most affordable 2022 trim level to insure is the 2LT 2WD model at a cost of $1,720 per year, or about $143 per month.

When comparing car insurance rates for both models by trim level, the lowest-cost model and trim to buy insurance for is the Chevrolet Tahoe LS 2WD at an average of $1,618 per year. The most expensive model and trim level is the Chevrolet Blazer RS AWD at an average cost of $1,898 per year.

The tables shown below show the average cost to insure each trim level for a 2022 Chevrolet Tahoe and Chevrolet Blazer, plus the average rate for each model. The winner for the 2022 car insurance rate comparison is the Chevrolet Tahoe.

2022 Chevrolet Tahoe

$1,738

| 2022 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,618 |

| LS 4WD | 1,660 |

| LT 2WD | 1,686 |

| LT 4WD | 1,724 |

| RST 2WD | 1,724 |

| Z71 4WD | 1,744 |

| RST 4WD | 1,754 |

| Premier 2WD | 1,770 |

| Premier 4WD | 1,798 |

| High Country 2WD | 1,812 |

| High Country 4WD | 1,834 |

| 2022 Chevrolet Tahoe Average Rate | $1,738 |

2022 Chevrolet Blazer

$1,828

| 2022 Chevrolet Blazer Trims | Rate |

|---|---|

| 2LT 2WD | $1,720 |

| 2LT AWD | 1,774 |

| 3LT 2WD | 1,800 |

| 3LT AWD | 1,842 |

| Premier 2WD | 1,854 |

| RS 2WD | 1,854 |

| Premier AWD | 1,898 |

| RS AWD | 1,898 |

| 2022 Chevrolet Blazer Average Rate | $1,828 |

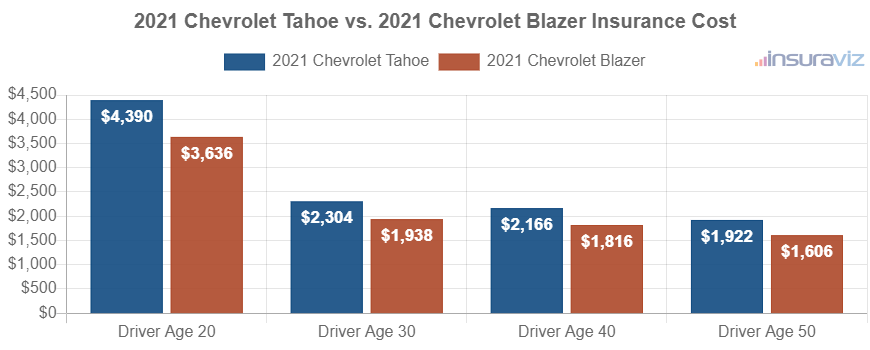

2021 Chevrolet Tahoe vs. Chevrolet Blazer

When comparing car insurance rates for the 2021 Chevrolet Tahoe and Chevrolet Blazer models, the Chevrolet Blazer is cheaper to insure by $282 per year for 2021.

The rate chart below shows the average insurance cost for both 2021 models for drivers aged 20 to 50. For the 2021 Chevrolet Tahoe, average insurance prices vary from $1,558 to $3,556 per year for the age groups used in this illustration. Full-coverage insurance on a 2021 Chevrolet Blazer costs from $1,304 to $2,948 on average per year.

A 2021 Chevrolet Tahoe has six trims available, with the most affordable trim level to insure being the LS 2WD model at an average cost of $1,672 per year, or $139 per month. For the seven trims available for a Chevrolet Blazer, the lowest-cost 2021 model to insure is the L 2WD model at a cost of $1,314.

When comparing both models combined at a trim-level basis, the overall cheapest vehicle to put coverage on is the Chevrolet Blazer L 2WD at a cost of $1,314 per year, and the most expensive trim is the Chevrolet Tahoe Premier 4WD at a cost of $1,830 per year.

The next two rate tables break down average car insurance rates for every trim level for both 2021 models, including an overall average cost for each model. The 2021 Chevrolet Blazer has lower-cost car average car insurance rates than the 2021 Chevrolet Tahoe.

2021 Chevrolet Tahoe

$1,754

| 2021 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,672 |

| LS 4WD | 1,726 |

| LT 2WD | 1,726 |

| LT 4WD | 1,778 |

| Premier 2WD | 1,794 |

| Premier 4WD | 1,830 |

| 2021 Chevrolet Tahoe Average Rate | $1,754 |

2021 Chevrolet Blazer

$1,472

| 2021 Chevrolet Blazer Trims | Rate |

|---|---|

| L 2WD | $1,314 |

| LT 2WD | 1,400 |

| LT 4WD | 1,446 |

| Premier 2WD | 1,522 |

| RS 2WD | 1,522 |

| RS 4WD | 1,522 |

| Premier 4WD | 1,576 |

| 2021 Chevrolet Blazer Average Rate | $1,472 |

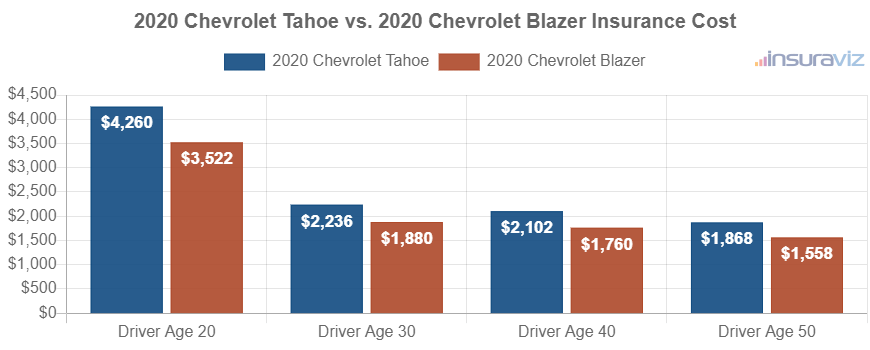

2020 Chevrolet Tahoe vs. Chevrolet Blazer

When comparing average insurance rates for 2020 models, a Chevrolet Tahoe costs an average of $1,702 per year to insure while a Chevrolet Blazer costs $1,428, making the Chevrolet Blazer cheaper to insure by $274 per year.

The rate chart below demonstrates the average cost to insure the two models for drivers from ages 20 to 50. For a 2020 Chevrolet Tahoe, the average car insurance cost ranges from $1,512 to $3,452 per year for the age groups included in the chart. Full-coverage insurance on a 2020 Chevrolet Blazer ranges from $1,266 to $2,854 on average per year.

Out of six trims for a 2020 Chevrolet Tahoe, the cheapest car insurance rates are on the LS 2WD trim at a cost of $1,626 per year, or around $136 per month. For the seven trim options available for the Chevrolet Blazer, the most affordable 2020 model to insure is the L 2WD model at a cost of $1,278 per year, or around $107 per month.

When comparing combined rates for both models from a trim-level perspective, the cheapest vehicle to put coverage on is the Chevrolet Blazer L 2WD at an average cost of $1,278 per year, and the most expensive model and trim level is the Chevrolet Tahoe Premier 4WD costing an average of $1,776 per year.

The tables below display average car insurance rates for every trim level for both 2020 models, including an overall average rate. The 2020 Chevrolet Blazer wins out over the 2020 Chevrolet Tahoe for the cheapest overall car insurance rates.

2020 Chevrolet Tahoe

$1,702

| 2020 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,626 |

| LS 4WD | 1,676 |

| LT 2WD | 1,676 |

| LT 4WD | 1,726 |

| Premier 2WD | 1,740 |

| Premier 4WD | 1,776 |

| 2020 Chevrolet Tahoe Average Rate | $1,702 |

2020 Chevrolet Blazer

$1,428

| 2020 Chevrolet Blazer Trims | Rate |

|---|---|

| L 2WD | $1,278 |

| LT 2WD | 1,360 |

| LT 4WD | 1,402 |

| Premier 2WD | 1,476 |

| RS 2WD | 1,476 |

| RS 4WD | 1,476 |

| Premier 4WD | 1,528 |

| 2020 Chevrolet Blazer Average Rate | $1,428 |

2019 Chevrolet Tahoe vs. Chevrolet Blazer

A 2019 Chevrolet Blazer is $36 cheaper to insure per year on average than a 2019 Chevrolet Tahoe, a difference of 2.3%.

The next chart illustrates the average insurance cost for the two models for the 20, 30, 40, and 50-year-old driver age groups. A full-coverage car insurance policy ranges from $1,416 to $3,248 per year for the 2019 Chevrolet Tahoe, and $1,386 to $3,154 for a 2019 Chevrolet Blazer for the age groups used in this illustration.

Out of nine Chevrolet Tahoe trim levels, the most affordable 2019 trim level to insure is the LS 2WD trim at an average cost of $1,528 per year, or about $127 per month. For the seven trim levels available for the Chevrolet Blazer, the lowest-cost 2019 trim to insure is the L 2WD trim at a cost of $1,412 per year, or around $118 per month.

When looking at the aggregated rates by trim for both models, the cheapest model and trim level to buy insurance for is the Chevrolet Blazer L 2WD at an average cost of $1,412 per year. The overall most expensive vehicle to insure is the Chevrolet Tahoe Premier 4WD at an average cost of $1,672 per year.

The next tables detail the average insurance cost by trim level for both 2019 models, including an overall average cost for each model.

2019 Chevrolet Tahoe

$1,598

| 2019 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,528 |

| LS 4WD | 1,576 |

| LT 2WD | 1,576 |

| Police Edition 2WD | 1,576 |

| Police Edition 4WD | 1,576 |

| LT 4WD | 1,624 |

| SSV 4WD | 1,624 |

| Premier 2WD | 1,638 |

| Premier 4WD | 1,672 |

| 2019 Chevrolet Tahoe Average Rate | $1,598 |

2019 Chevrolet Blazer

$1,562

| 2019 Chevrolet Blazer Trims | Rate |

|---|---|

| L 2WD | $1,412 |

| LT 2WD | 1,508 |

| LT 4WD | 1,556 |

| Premier 2WD | 1,604 |

| RS 2WD | 1,604 |

| RS 4WD | 1,604 |

| Premier 4WD | 1,652 |

| 2019 Chevrolet Blazer Average Rate | $1,562 |