- With nine models in the 2024 large SUV segment, the Chevrolet Tahoe ranks first and the Toyota Sequoia ranks ninth for most affordable car insurance rates.

- When comparing the newest 2024 models, a Chevrolet Tahoe is generally cheaper to insure than a Toyota Sequoia by around $750 per year.

- The Chevrolet Tahoe LS 2WD and the Toyota Sequoia SR5 2WD are the trim levels with the most affordable insurance for each model, costing $2,108 and $2,820 per year, respectively.

Is a Tahoe or Sequoia cheaper to insure?

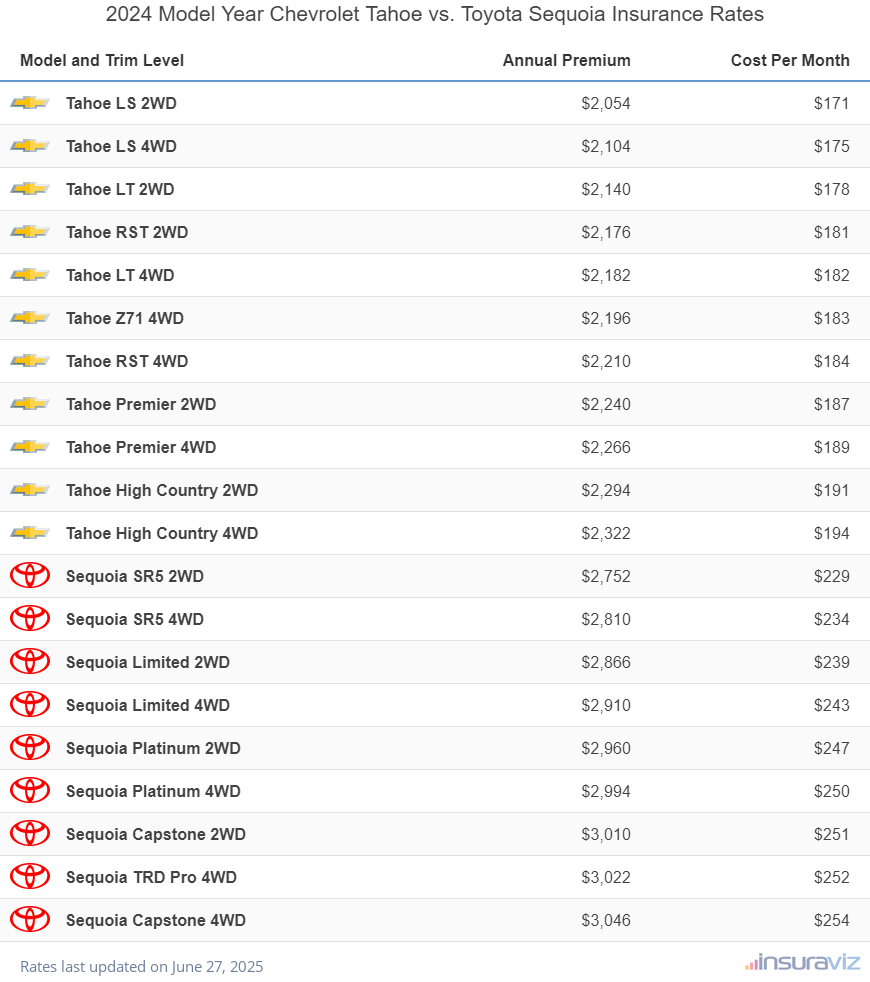

For 2024 Chevrolet Tahoe and Toyota Sequoia models, the vehicle with the cheapest average car insurance rates is the Chevrolet Tahoe. Insurance on a Chevrolet Tahoe costs an average of $2,252 per year, whereas the Toyota Sequoia costs an average of $3,002 per year.

For the 11 trims available for the 2024 Chevrolet Tahoe, the cheapest model to insure is the LS 2WD model at an average cost of $2,108 per year.

For the nine trims available for the Toyota Sequoia, the cheapest 2024 model to insure is the SR5 2WD trim at a cost of $2,820.

When comparing rates by trim level for both models, the cheapest vehicle to insure is the Chevrolet Tahoe LS 2WD at an average cost of $2,108 per year. The overall most expensive vehicle to insure is the Toyota Sequoia Capstone 4WD at a cost of $3,122 per year.

The table shown below compares and ranks the 12-month and monthly car insurance cost for 2024 Chevrolet Tahoe and Toyota Sequoia models, with average rates for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Tahoe LS 2WD | $2,108 | $176 |

| Tahoe LS 4WD | $2,158 | $180 |

| Tahoe LT 2WD | $2,194 | $183 |

| Tahoe RST 2WD | $2,230 | $186 |

| Tahoe LT 4WD | $2,238 | $187 |

| Tahoe Z71 4WD | $2,252 | $188 |

| Tahoe RST 4WD | $2,264 | $189 |

| Tahoe Premier 2WD | $2,294 | $191 |

| Tahoe Premier 4WD | $2,322 | $194 |

| Tahoe High Country 2WD | $2,350 | $196 |

| Tahoe High Country 4WD | $2,380 | $198 |

| Sequoia SR5 2WD | $2,820 | $235 |

| Sequoia SR5 4WD | $2,878 | $240 |

| Sequoia Limited 2WD | $2,936 | $245 |

| Sequoia Limited 4WD | $2,982 | $249 |

| Sequoia Platinum 2WD | $3,034 | $253 |

| Sequoia Platinum 4WD | $3,068 | $256 |

| Sequoia Capstone 2WD | $3,084 | $257 |

| Sequoia TRD Pro 4WD | $3,098 | $258 |

| Sequoia Capstone 4WD | $3,122 | $260 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

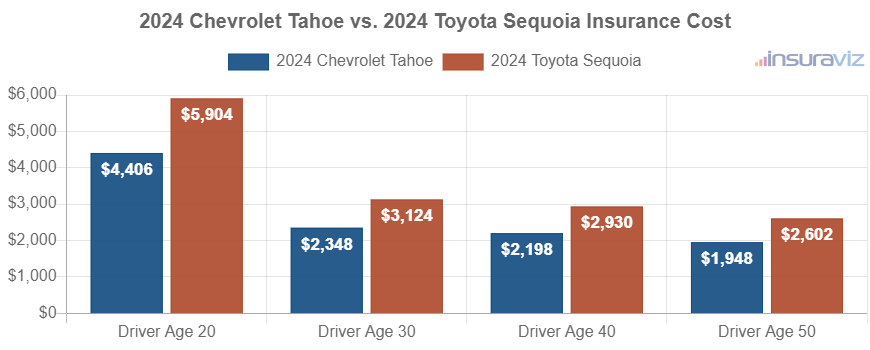

The chart shown below displays the average cost to insure the two models for four different driver age groups. The average car insurance cost ranges from $1,994 to $4,514 per year for a 2024 Chevrolet Tahoe, and $2,668 to $6,048 for a 2024 Toyota Sequoia for the age groups used in the chart.

The tables shown below display the cost to insure the available trim levels for both 2024 models, including an overall average cost for each model.

2024 Chevrolet Tahoe

$2,252

| 2024 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,108 |

| LS 4WD | 2,158 |

| LT 2WD | 2,194 |

| RST 2WD | 2,230 |

| LT 4WD | 2,238 |

| Z71 4WD | 2,252 |

| RST 4WD | 2,264 |

| Premier 2WD | 2,294 |

| Premier 4WD | 2,322 |

| High Country 2WD | 2,350 |

| High Country 4WD | 2,380 |

| 2024 Chevrolet Tahoe Average Rate | $2,252 |

2024 Toyota Sequoia

$3,002

| 2024 Toyota Sequoia Trims | Rate |

|---|---|

| SR5 2WD | $2,820 |

| SR5 4WD | 2,878 |

| Limited 2WD | 2,936 |

| Limited 4WD | 2,982 |

| Platinum 2WD | 3,034 |

| Platinum 4WD | 3,068 |

| Capstone 2WD | 3,084 |

| TRD Pro 4WD | 3,098 |

| Capstone 4WD | 3,122 |

| 2024 Toyota Sequoia Average Rate | $3,002 |

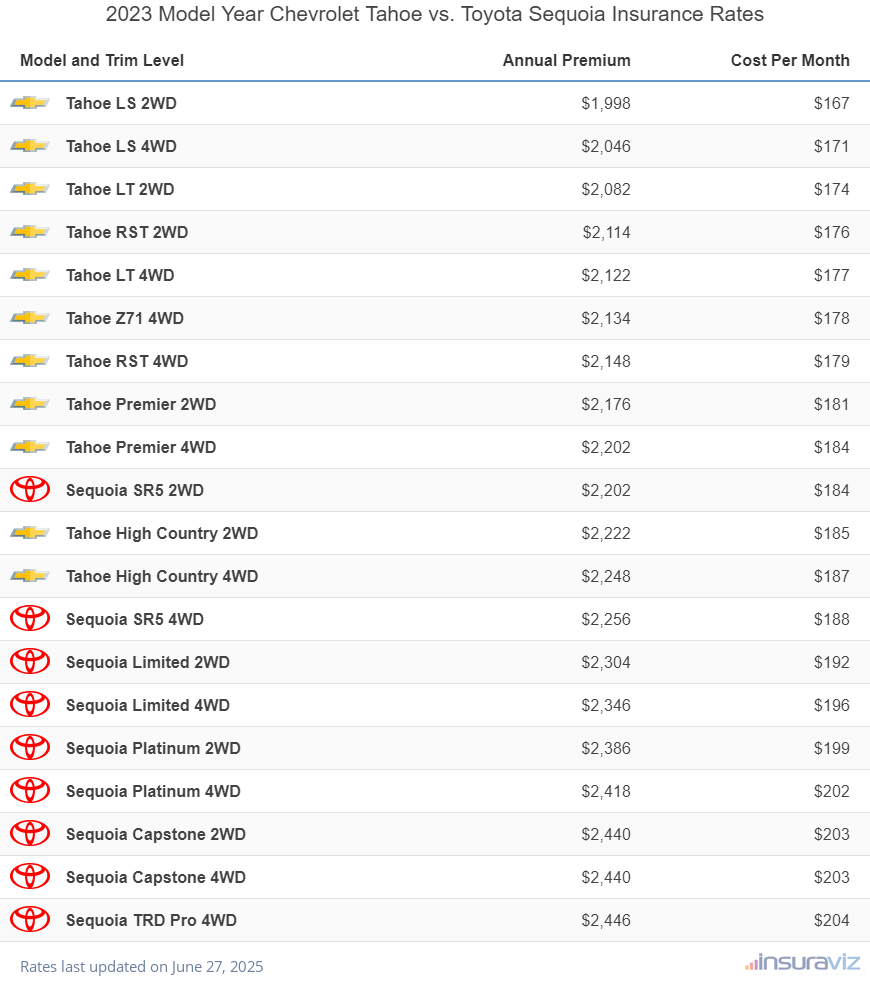

2023 Chevrolet Tahoe vs. Toyota Sequoia

Car insurance on a 2023 Chevrolet Tahoe costs an average of $2,188 per year, whereas insurance for a 2023 Toyota Sequoia costs an average of $2,418 per year, making the Chevrolet Tahoe the cheaper model to insure.

For the 11 trim levels available for the 2023 Chevrolet Tahoe, the cheapest model to insure is the LS 2WD trim at an average cost of $2,046 per year, or $171 per month.

For the nine trim levels available for the Toyota Sequoia, the cheapest 2023 model to insure is the SR5 2WD trim at a cost of $2,256 per year, or $188 per month.

When rates are compared for the 20 trim levels of both 2023 models, the cheapest trim to insure is the Chevrolet Tahoe LS 2WD at an average rate of $2,046 per year, and the overall most expensive vehicle to insure is the Toyota Sequoia TRD Pro 4WD at a cost of $2,506 per year.

The table shown below ranks the annual and monthly car insurance cost for 2023 Chevrolet Tahoe and Toyota Sequoia models, broken down by individual trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Tahoe LS 2WD | $2,046 | $171 |

| Tahoe LS 4WD | $2,096 | $175 |

| Tahoe LT 2WD | $2,130 | $178 |

| Tahoe RST 2WD | $2,164 | $180 |

| Tahoe LT 4WD | $2,172 | $181 |

| Tahoe Z71 4WD | $2,184 | $182 |

| Tahoe RST 4WD | $2,200 | $183 |

| Tahoe Premier 2WD | $2,228 | $186 |

| Tahoe Premier 4WD | $2,256 | $188 |

| Sequoia SR5 2WD | $2,256 | $188 |

| Tahoe High Country 2WD | $2,276 | $190 |

| Tahoe High Country 4WD | $2,304 | $192 |

| Sequoia SR5 4WD | $2,312 | $193 |

| Sequoia Limited 2WD | $2,360 | $197 |

| Sequoia Limited 4WD | $2,400 | $200 |

| Sequoia Platinum 2WD | $2,444 | $204 |

| Sequoia Platinum 4WD | $2,478 | $207 |

| Sequoia Capstone 2WD | $2,498 | $208 |

| Sequoia Capstone 4WD | $2,498 | $208 |

| Sequoia TRD Pro 4WD | $2,506 | $209 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

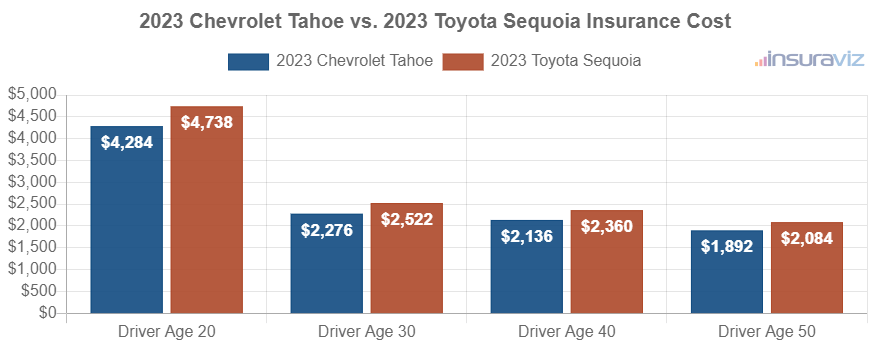

The rate chart below displays the average cost to insure both models for the 20, 30, 40, and 50-year-old driver age groups. Insurance cost ranges from $1,938 to $4,390 per year for a 2023 Chevrolet Tahoe, and $2,136 to $4,852 for a 2023 Toyota Sequoia for the included age groups.

The rate tables below illustrate the expected annual car insurance cost by trim level for both 2023 models, along with the average rate for each model. The 2023 Chevrolet Tahoe defeats the 2023 Toyota Sequoia for cheapest auto insurance rates.

2023 Chevrolet Tahoe

$2,188

| 2023 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,046 |

| LS 4WD | 2,096 |

| LT 2WD | 2,130 |

| RST 2WD | 2,164 |

| LT 4WD | 2,172 |

| Z71 4WD | 2,184 |

| RST 4WD | 2,200 |

| Premier 2WD | 2,228 |

| Premier 4WD | 2,256 |

| High Country 2WD | 2,276 |

| High Country 4WD | 2,304 |

| 2023 Chevrolet Tahoe Average Rate | $2,188 |

2023 Toyota Sequoia

$2,418

| 2023 Toyota Sequoia Trims | Rate |

|---|---|

| SR5 2WD | $2,256 |

| SR5 4WD | 2,312 |

| Limited 2WD | 2,360 |

| Limited 4WD | 2,400 |

| Platinum 2WD | 2,444 |

| Platinum 4WD | 2,478 |

| Capstone 2WD | 2,498 |

| Capstone 4WD | 2,498 |

| TRD Pro 4WD | 2,506 |

| 2023 Toyota Sequoia Average Rate | $2,418 |

2022 Chevrolet Tahoe vs. Toyota Sequoia

Car insurance for a 2022 Chevrolet Tahoe averages $2,198 per year, while insurance for a 2022 Toyota Sequoia costs an average of $2,280 per year, making the Chevrolet Tahoe the cheaper model to insure by $82 per year.

When comparing rates for both models from a trim-level perspective, the cheapest trim to insure is the Chevrolet Tahoe LS 2WD at an average of $2,046 per year. The most expensive trim is the Toyota Sequoia TRD Pro 4WD at an average of $2,386 per year.

For a 2022 Chevrolet Tahoe, the cheapest models are the LS 2WD, LS 4WD, and LT 2WD. The cheapest Toyota Sequoia models include the SR5 2WD, TRD Sport 2WD, and SR5 4WD.

From a monthly standpoint, car insurance rates for all 2022 Chevrolet Tahoe and Toyota Sequoia models cost from $171 to $199 per month.

The rate table below ranks the yearly and monthly cost of car insurance for 2022 Chevrolet Tahoe and Toyota Sequoia models, showing average cost by trim level for each model.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Tahoe LS 2WD | $2,046 | $171 |

| Tahoe LS 4WD | $2,098 | $175 |

| Tahoe LT 2WD | $2,132 | $178 |

| Sequoia SR5 2WD | $2,138 | $178 |

| Tahoe LT 4WD | $2,178 | $182 |

| Tahoe RST 2WD | $2,178 | $182 |

| Sequoia TRD Sport 2WD | $2,192 | $183 |

| Tahoe Z71 4WD | $2,204 | $184 |

| Sequoia SR5 4WD | $2,204 | $184 |

| Tahoe RST 4WD | $2,216 | $185 |

| Tahoe Premier 2WD | $2,236 | $186 |

| Sequoia TRD Sport 4WD | $2,240 | $187 |

| Tahoe Premier 4WD | $2,270 | $189 |

| Sequoia Limited 2WD | $2,284 | $190 |

| Tahoe High Country 2WD | $2,292 | $191 |

| Sequoia Limited 4WD | $2,298 | $192 |

| Sequoia Nightshade Special Edition 2WD | $2,310 | $193 |

| Tahoe High Country 4WD | $2,320 | $193 |

| Sequoia Nightshade Special Edition 4WD | $2,320 | $193 |

| Sequoia Platinum 2WD | $2,338 | $195 |

| Sequoia Platinum 4WD | $2,358 | $197 |

| Sequoia TRD Pro 4WD | $2,386 | $199 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

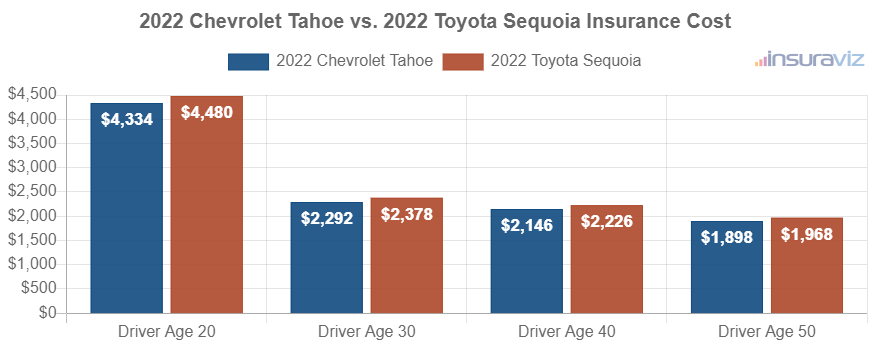

The rate chart below demonstrates the average cost to insure both models rated for multiple driver ages. The average cost of car insurance ranges from $1,946 to $4,438 per year for a 2022 Chevrolet Tahoe, and $2,016 to $4,590 on a 2022 Toyota Sequoia for the age groups included in the chart

Out of 11 Chevrolet Tahoe trim levels, the cheapest 2022 model to insure is the LS 2WD trim at an average cost of $2,046 per year.

The 2022 Toyota Sequoia has 11 trim levels available, with the cheapest model to insure being the SR5 2WD model at an average cost of $2,138 per year, or around $178 per month.

When trim-level rates for both models are compared, the cheapest model and trim level to put coverage on is the Chevrolet Tahoe LS 2WD at an average of $2,046 per year, and the most expensive trim is the Toyota Sequoia TRD Pro 4WD at an average of $2,386 per year.

The tables shown below display average car insurance cost by trim level for each 2022 model, as well as an average rate for each model. The 2022 Chevrolet Tahoe is the winner over the 2022 Toyota Sequoia for cheapest car insurance cost.

2022 Chevrolet Tahoe

$2,198

| 2022 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,046 |

| LS 4WD | 2,098 |

| LT 2WD | 2,132 |

| LT 4WD | 2,178 |

| RST 2WD | 2,178 |

| Z71 4WD | 2,204 |

| RST 4WD | 2,216 |

| Premier 2WD | 2,236 |

| Premier 4WD | 2,270 |

| High Country 2WD | 2,292 |

| High Country 4WD | 2,320 |

| 2022 Chevrolet Tahoe Average Rate | $2,198 |

2022 Toyota Sequoia

$2,280

| 2022 Toyota Sequoia Trims | Rate |

|---|---|

| SR5 2WD | $2,138 |

| TRD Sport 2WD | 2,192 |

| SR5 4WD | 2,204 |

| TRD Sport 4WD | 2,240 |

| Limited 2WD | 2,284 |

| Limited 4WD | 2,298 |

| Nightshade Special Edition 2WD | 2,310 |

| Nightshade Special Edition 4WD | 2,320 |

| Platinum 2WD | 2,338 |

| Platinum 4WD | 2,358 |

| TRD Pro 4WD | 2,386 |

| 2022 Toyota Sequoia Average Rate | $2,280 |

2021 Chevrolet Tahoe vs. Toyota Sequoia

A 2021 Chevrolet Tahoe costs $22 less per year to insure per year on average than a 2021 Toyota Sequoia, a difference of 1%.

The following chart displays the average car insurance cost for the two models rated for a variety of different driver ages. For a 2021 Chevrolet Tahoe, average insurance cost ranges from $1,968 to $4,496 per year for the driver examples in the chart. A full-coverage policy for a 2021 Toyota Sequoia costs from $1,978 to $4,538 on average per year.

For the six trims available for the 2021 Chevrolet Tahoe, the cheapest model to insure is the LS 2WD model at an average cost of $2,116 per year, or about $176 per month. Out of the 13 trim and option levels available for the Toyota Sequoia, the cheapest 2021 trim to insure is the SR/5 2WD trim at a cost of $2,124 per year, or around $177 per month.

When looking at the combined rates by trim for both models, the cheapest vehicle to buy insurance for is the Chevrolet Tahoe LS 2WD at an average of $2,116 per year. The most expensive vehicle to insure is the Toyota Sequoia Platinum 4WD at an average cost of $2,320 per year.

The next tables display all the available trims for both 2021 models, including the average rate for each model. The winner for the 2021 car insurance battle is the Chevrolet Tahoe.

2021 Chevrolet Tahoe

$2,218

| 2021 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,116 |

| LS 4WD | 2,182 |

| LT 2WD | 2,182 |

| LT 4WD | 2,248 |

| Premier 2WD | 2,268 |

| Premier 4WD | 2,314 |

| 2021 Chevrolet Tahoe Average Rate | $2,218 |

2021 Toyota Sequoia

$2,240

| 2021 Toyota Sequoia Trims | Rate |

|---|---|

| SR/5 2WD | $2,124 |

| SR/5 4WD | 2,188 |

| SR/5 Premium 2WD | 2,188 |

| TRD Sport 2WD | 2,188 |

| LTD 2WD | 2,254 |

| LTD 4WD | 2,254 |

| SR/5 Premium 4WD | 2,254 |

| TRD Pro 4WD | 2,254 |

| TRD Sport 4WD | 2,254 |

| TRD Sport Premium 2WD | 2,254 |

| TRD Sport Premium 4WD | 2,254 |

| Platinum 2WD | 2,320 |

| Platinum 4WD | 2,320 |

| 2021 Toyota Sequoia Average Rate | $2,240 |

2020 Chevrolet Tahoe vs. Toyota Sequoia

A 2020 Chevrolet Tahoe costs $20 less per year to insure per year on average than a 2020 Toyota Sequoia, a difference of 0.9%.

The chart shown below displays the average car insurance cost for the two models for drivers from age 20 to 50. For a 2020 Chevrolet Tahoe, average insurance cost ranges from $1,910 to $4,364 per year for the included age groups. Car insurance for a 2020 Toyota Sequoia costs from $1,920 to $4,404 on average per year.

Out of six trim levels for the 2020 Chevrolet Tahoe, the cheapest insurance rates are on the LS 2WD trim at a cost of $2,054 per year. The 2020 Toyota Sequoia has 13 trim and option levels available, with the cheapest model to insure being the SR/5 2WD trim at an average cost of $2,056 per year, or $171 per month.

When rates are compared for the 19 different trims of both 2020 models, the overall cheapest vehicle to buy insurance for is the Chevrolet Tahoe LS 2WD at a cost of $2,054 per year. The most expensive vehicle to insure is the Toyota Sequoia Platinum 4WD at a cost of $2,268 per year.

The next two tables display the cost to insure the available trim levels for both 2020 models, along with an average cost for each model.

2020 Chevrolet Tahoe

$2,152

| 2020 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $2,054 |

| LS 4WD | 2,118 |

| LT 2WD | 2,118 |

| LT 4WD | 2,180 |

| Premier 2WD | 2,200 |

| Premier 4WD | 2,246 |

| 2020 Chevrolet Tahoe Average Rate | $2,152 |

2020 Toyota Sequoia

$2,172

| 2020 Toyota Sequoia Trims | Rate |

|---|---|

| SR/5 2WD | $2,056 |

| SR/5 4WD | 2,120 |

| SR/5 Premium 2WD | 2,120 |

| TRD Sport 2WD | 2,120 |

| LTD 2WD | 2,184 |

| LTD 4WD | 2,184 |

| SR/5 Premium 4WD | 2,184 |

| TRD Pro 4WD | 2,184 |

| TRD Sport 4WD | 2,184 |

| TRD Sport Premium 2WD | 2,184 |

| TRD Sport Premium 4WD | 2,206 |

| Platinum 2WD | 2,246 |

| Platinum 4WD | 2,268 |

| 2020 Toyota Sequoia Average Rate | $2,172 |

2019 Chevrolet Tahoe vs. Toyota Sequoia

When comparing insurance cost for the 2019 Chevrolet Tahoe and Toyota Sequoia models, the Chevrolet Tahoe has cheaper rates by an average of $126 per year.

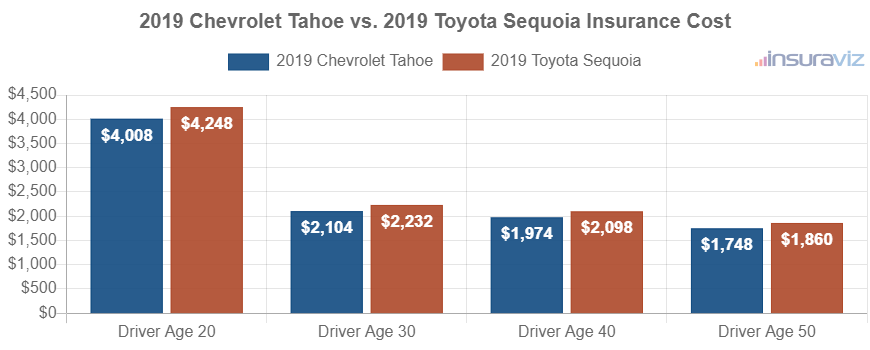

The chart below demonstrates the average car insurance cost for both 2019 models for drivers from age 20 to 50. For a 2019 Chevrolet Tahoe, average insurance cost ranges from $1,792 to $4,104 per year for the five driver age examples in the chart. Full-coverage insurance on a 2019 Toyota Sequoia ranges from $1,908 to $4,352 on average per year.

Out of nine trim levels for the 2019 Chevrolet Tahoe, the cheapest car insurance rates are on the LS 2WD model at a cost of $1,932 per year, or about $161 per month.

For the eight trims available for the Toyota Sequoia, the cheapest 2019 trim level to insure is the SR/5 2WD trim at a cost of $2,072 per year, or $173 per month.

When comparing both models combined at a trim-level basis, the cheapest model and trim level to insure is the Chevrolet Tahoe LS 2WD at an average cost of $1,932 per year. The highest-cost model and trim level is the Toyota Sequoia Platinum 4WD costing an average of $2,194 per year.

The next tables display average car insurance rates for each trim level, including the average rate for each model.

2019 Chevrolet Tahoe

$2,022

| 2019 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,932 |

| LS 4WD | 1,994 |

| LT 2WD | 1,994 |

| Police Edition 2WD | 1,994 |

| Police Edition 4WD | 1,994 |

| LT 4WD | 2,054 |

| SSV 4WD | 2,054 |

| Premier 2WD | 2,072 |

| Premier 4WD | 2,116 |

| 2019 Chevrolet Tahoe Average Rate | $2,022 |

2019 Toyota Sequoia

$2,148

| 2019 Toyota Sequoia Trims | Rate |

|---|---|

| SR/5 2WD | $2,072 |

| SR/5 4WD | 2,072 |

| TRD Sport 2WD | 2,134 |

| TRD Sport 4WD | 2,134 |

| Limited 2WD | 2,194 |

| Limited 4WD | 2,194 |

| Platinum 2WD | 2,194 |

| Platinum 4WD | 2,194 |

| 2019 Toyota Sequoia Average Rate | $2,148 |

2018 Chevrolet Tahoe vs. Toyota Sequoia

For the 2018 Chevrolet Tahoe and Toyota Sequoia models, the Chevrolet Tahoe has cheaper car insurance cost by an average of $146 per year.

The chart shown below displays the average cost to insure both 2018 models using drivers aged 20 to 50. For a 2018 Chevrolet Tahoe, average car insurance cost ranges from $1,706 to $3,896 per year for the sample drivers in the chart. Insurance for a 2018 Toyota Sequoia costs from $1,838 to $4,184 on average per year.

The 2018 Chevrolet Tahoe has nine trim levels available, with the cheapest trim to insure being the LS 2WD trim at an average cost of $1,846 per year, or $154 per month.

For the eight different trims available for the Toyota Sequoia, the cheapest 2018 trim level to insure is the SR/5 2WD model at a cost of $1,984 per year, or about $165 per month.

When comparing aggregated rates for both models from a trim-level perspective, the lowest-cost model and trim level to put coverage on is the Chevrolet Tahoe LS 2WD at an average rate of $1,846 per year. The most expensive trim is the Toyota Sequoia Platinum 4WD costing an average of $2,156 per year.

The next tables show both 2018 models and all trim levels available for each one, along with the average rate for each model.

2018 Chevrolet Tahoe

$1,924

| 2018 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,846 |

| LS Police Edition 2WD | 1,846 |

| LS 4WD | 1,902 |

| LS Police Edition 4WD | 1,902 |

| LT 2WD | 1,902 |

| LT 4WD | 1,960 |

| SSV 4WD | 1,960 |

| Premier 2WD | 1,978 |

| Premier 4WD | 2,018 |

| 2018 Chevrolet Tahoe Average Rate | $1,924 |

2018 Toyota Sequoia

$2,070

| 2018 Toyota Sequoia Trims | Rate |

|---|---|

| SR/5 2WD | $1,984 |

| SR/5 4WD | 2,042 |

| TRD Sport 2WD | 2,042 |

| TRD Sport 4WD | 2,042 |

| Limited 2WD | 2,098 |

| Limited 4WD | 2,098 |

| Platinum 2WD | 2,098 |

| Platinum 4WD | 2,156 |

| 2018 Toyota Sequoia Average Rate | $2,070 |

2017 Chevrolet Tahoe vs. Toyota Sequoia

For 2017 Chevrolet Tahoe and Toyota Sequoia models, the Chevrolet Tahoe costs less to insure by $124 per year for this comparison year.

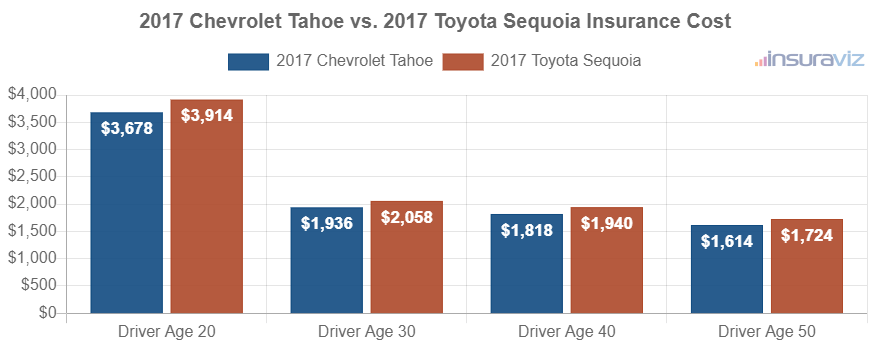

The chart shown below demonstrates the average insurance cost for both 2017 models for a range of driver ages. The average cost of car insurance ranges from $1,652 to $3,766 per year on a 2017 Chevrolet Tahoe, and $1,766 to $4,010 for a 2017 Toyota Sequoia for the five age groups shown in the chart

The 2017 Chevrolet Tahoe has nine trims available, with the cheapest trim to insure being the LS 2WD model at an average cost of $1,776 per year, or about $148 per month.

For the six option levels available for the Toyota Sequoia, the cheapest 2017 trim to insure is the SR/5 2WD trim at a cost of $1,910 per year, or $159 per month.

When rates for all 15 trim levels for both vehicles are compared, the lowest-cost model and trim level to insure is the Chevrolet Tahoe LS 2WD at an average rate of $1,776 per year, and the overall most expensive vehicle to insure is the Toyota Sequoia Platinum 4WD at an average cost of $2,072 per year.

The rate tables below detail the cost to insure the available trim levels for both 2017 models, plus the average rate for each model. The 2017 Chevrolet Tahoe takes the trophy over the 2017 Toyota Sequoia for cheapest overall car insurance cost.

2017 Chevrolet Tahoe

$1,860

| 2017 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,776 |

| LS 4WD | 1,830 |

| LS Police Edition 2WD | 1,830 |

| LT 2WD | 1,830 |

| LS Police Edition 4WD | 1,882 |

| LT 4WD | 1,882 |

| SSV 4WD | 1,882 |

| Premier 2WD | 1,898 |

| Premier 4WD | 1,936 |

| 2017 Chevrolet Tahoe Average Rate | $1,860 |

2017 Toyota Sequoia

$1,984

| 2017 Toyota Sequoia Trims | Rate |

|---|---|

| SR/5 2WD | $1,910 |

| SR/5 4WD | 1,910 |

| Limited 2WD | 1,964 |

| Limited 4WD | 2,018 |

| Platinum 2WD | 2,030 |

| Platinum 4WD | 2,072 |

| 2017 Toyota Sequoia Average Rate | $1,984 |

2016 Chevrolet Tahoe vs. Toyota Sequoia

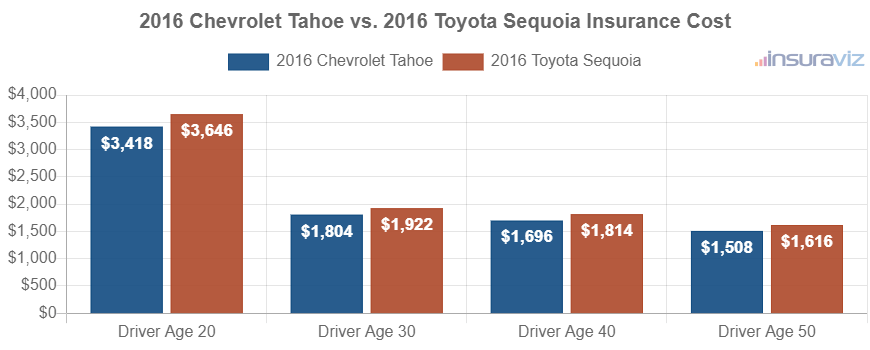

When comparing car insurance rates for the 2016 Chevrolet Tahoe and Toyota Sequoia models, the Chevrolet Tahoe is cheaper to insure by $118 per year for 2016.

The chart shown below illustrates the average insurance cost for both models rated for a variety of different driver ages. For a 2016 Chevrolet Tahoe, the average car insurance cost ranges from $1,548 to $3,500 per year for the included age groups. A full-coverage policy for a 2016 Toyota Sequoia costs from $1,656 to $3,738 on average per year.

The 2016 Chevrolet Tahoe has nine trims available, with the cheapest trim to insure being the LS 2WD trim at an average cost of $1,674 per year, or $140 per month.

For the six trim options available for the Toyota Sequoia, the cheapest 2016 trim to insure is the SR/5 2WD model at a cost of $1,756.

When rates for all 15 trims of both models are combined and sorted by cost, the cheapest model and trim level to put coverage on is the Chevrolet Tahoe LS 2WD at an average cost of $1,674 per year. The most expensive model and trim level is the Toyota Sequoia Platinum 4WD costing an average of $1,904 per year.

The two tables below show average car insurance cost by trim level for a 2016 Chevrolet Tahoe and Toyota Sequoia, including an overall average cost for each model.

2016 Chevrolet Tahoe

$1,738

| 2016 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,674 |

| LS 4WD | 1,674 |

| LS Police Edition 2WD | 1,724 |

| LS Police Edition 4WD | 1,724 |

| LT 2WD | 1,724 |

| LT 4WD | 1,772 |

| SSV 4WD | 1,772 |

| LTZ 2WD | 1,788 |

| LTZ 4WD | 1,788 |

| 2016 Chevrolet Tahoe Average Rate | $1,738 |

2016 Toyota Sequoia

$1,856

| 2016 Toyota Sequoia Trims | Rate |

|---|---|

| SR/5 2WD | $1,756 |

| SR/5 4WD | 1,806 |

| Limited 2WD | 1,856 |

| Limited 4WD | 1,904 |

| Platinum 2WD | 1,904 |

| Platinum 4WD | 1,904 |

| 2016 Toyota Sequoia Average Rate | $1,856 |

2015 Chevrolet Tahoe vs. Toyota Sequoia

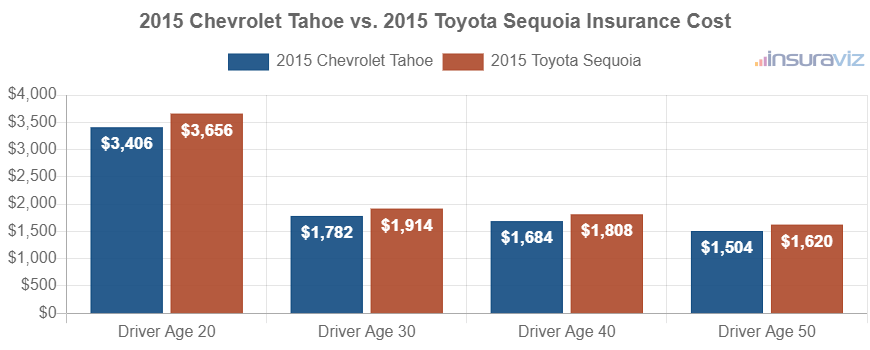

For the 2015 Chevrolet Tahoe and Toyota Sequoia models, the Chevrolet Tahoe has cheaper car insurance rates by $128 per year.

The next chart illustrates the average car insurance cost for both 2015 models for different driver ages. Average insurance cost ranges from $1,540 to $3,490 per year on a 2015 Chevrolet Tahoe, and $1,660 to $3,746 for a 2015 Toyota Sequoia for the different drivers illustrated in the chart

Out of nine Chevrolet Tahoe trim levels, the cheapest 2015 trim level to insure is the LS 2WD model at an average cost of $1,640 per year.

The 2015 Toyota Sequoia has six trims available, with the cheapest trim to insure being the SR/5 2WD model at an average cost of $1,760 per year, or around $147 per month.

When comparing car insurance rates for both models by trim level, the most affordable model and trim level to buy insurance for is the Chevrolet Tahoe LS 2WD at an average cost of $1,640 per year. The most expensive model and trim level is the Toyota Sequoia Platinum 4WD costing $1,898 per year.

The next two tables break down average car insurance cost by trim level for each 2015 model, plus an average rate for each model. The model with the cheapest average car insurance rates for 2015 is the Chevrolet Tahoe.

2015 Chevrolet Tahoe

$1,724

| 2015 Chevrolet Tahoe Trims | Rate |

|---|---|

| LS 2WD | $1,640 |

| LS 4WD | 1,688 |

| LS Police Edition 2WD | 1,688 |

| LT 2WD | 1,688 |

| LS Police Edition 4WD | 1,732 |

| LT 4WD | 1,732 |

| SSV 4WD | 1,732 |

| LTZ 2WD | 1,780 |

| LTZ 4WD | 1,824 |

| 2015 Chevrolet Tahoe Average Rate | $1,724 |

2015 Toyota Sequoia

$1,852

| 2015 Toyota Sequoia Trims | Rate |

|---|---|

| SR/5 2WD | $1,760 |

| SR/5 4WD | 1,806 |

| Limited 2WD | 1,852 |

| Limited 4WD | 1,898 |

| Platinum 2WD | 1,898 |

| Platinum 4WD | 1,898 |

| 2015 Toyota Sequoia Average Rate | $1,852 |