- A 2024 Honda CR-V is cheaper to insure than a 2024 Nissan Rogue by an average of $86 per year, $1,618 compared to $1,704.

- Average car insurance cost per month for the Nissan Rogue is 5.1% more expensive than the Honda CR-V, at $135 versus $142, a difference of $7 per month.

- Out of 47 models in the 2024 small SUV segment, the Honda CR-V ranks 12th and the Nissan Rogue ranks 19th for most affordable car insurance.

- If affordable insurance is of upmost importance, the LX and LX AWD trims are the cheapest Honda CR-V models to insure, while the S 2WD and S AWD trims are the cheapest Nissan Rogue models to insure.

Is insurance cheaper for a Honda CR-V or Nissan Rogue?

For 2024 models, the model having cheaper average car insurance is the Honda CR-V. Insurance on a Honda CR-V costs an average of $1,618 per year, whereas insurance for the Nissan Rogue averages $1,704 per year.

Out of nine trim levels for the 2024 Honda CR-V, the cheapest car insurance rates are on the LX model at a cost of $1,534 per year, or $128 per month.

For the eight trim levels available for the Nissan Rogue, the cheapest 2024 model to insure is the S 2WD trim at a cost of $1,614 per year, or around $135 per month.

When all 17 trims of both models are combined and compared, the overall cheapest vehicle to insure is the Honda CR-V LX at an average cost of $1,534 per year, and the overall most expensive vehicle to insure is the Nissan Rogue Platinum AWD at an average cost of $1,786 per year.

The table shown below compares and ranks the annual and monthly cost of car insurance for 2024 Honda CR-V and Nissan Rogue models, showing average cost for every trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| CR-V LX | $1,534 | $128 |

| CR-V LX AWD | $1,566 | $131 |

| CR-V EX | $1,586 | $132 |

| CR-V EX AWD | $1,614 | $135 |

| Rogue S 2WD | $1,614 | $135 |

| CR-V Sport-L Hybrid | $1,618 | $135 |

| CR-V EX-L | $1,636 | $136 |

| CR-V Sport-L Hybrid AWD | $1,640 | $137 |

| Rogue S AWD | $1,650 | $138 |

| Rogue SV 2WD | $1,650 | $138 |

| CR-V EX-L AWD | $1,658 | $138 |

| Rogue SV AWD | $1,680 | $140 |

| CR-V Sport Touring Hybrid AWD | $1,706 | $142 |

| Rogue SL 2WD | $1,734 | $145 |

| Rogue SL AWD | $1,758 | $147 |

| Rogue Platinum 2WD | $1,764 | $147 |

| Rogue Platinum AWD | $1,786 | $149 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

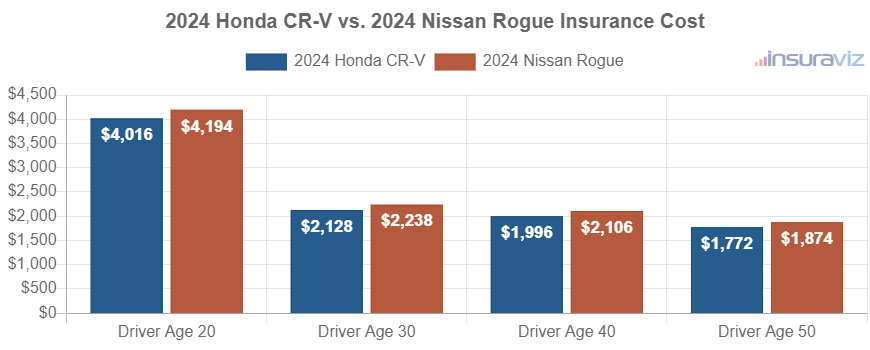

The chart shown below shows the average cost to insure both 2024 models rated for drivers aged 20 to 50. Insurance cost ranges from $1,438 to $3,254 per year for a 2024 Honda CR-V, and $1,518 to $3,402 for a 2024 Nissan Rogue for the illustrated age groups.

The next two tables show both 2024 models and all trim levels available for each one, plus an average rate for each model. The 2024 Honda CR-V reigns victorious over the 2024 Nissan Rogue for the cheapest average car insurance rates.

2024 Honda CR-V

$1,618

| 2024 Honda CR-V Trims | Rate |

|---|---|

| LX | $1,534 |

| LX AWD | 1,566 |

| EX | 1,586 |

| EX AWD | 1,614 |

| Sport-L Hybrid | 1,618 |

| EX-L | 1,636 |

| Sport-L Hybrid AWD | 1,640 |

| EX-L AWD | 1,658 |

| Sport Touring Hybrid AWD | 1,706 |

| 2024 Honda CR-V Average Rate | $1,618 |

2024 Nissan Rogue

$1,704

| 2024 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,614 |

| S AWD | 1,650 |

| SV 2WD | 1,650 |

| SV AWD | 1,680 |

| SL 2WD | 1,734 |

| SL AWD | 1,758 |

| Platinum 2WD | 1,764 |

| Platinum AWD | 1,786 |

| 2024 Nissan Rogue Average Rate | $1,704 |

2023 Honda CR-V vs. Nissan Rogue

When comparing 2023 Honda CR-V and Nissan Rogue models, the vehicle with the cheapest average car insurance rates is the Honda CR-V. Insurance cost for the Honda CR-V averages $1,564 per year, whereas insurance for the Nissan Rogue averages $1,696 per year.

For the seven trims available for the 2023 Honda CR-V, the cheapest model to insure is the EX model at an average cost of $1,514 per year.

Out of the 10 trim levels available for the Nissan Rogue, the cheapest 2023 trim level to insure is the S 2WD model at a cost of $1,594 per year, or about $133 per month.

When comparing both models at a trim-level basis, the overall cheapest vehicle to insure is the Honda CR-V EX at a cost of $1,514 per year, and the overall most expensive vehicle to insure is the Nissan Rogue Platinum AWD at an average of $1,770 per year.

The rate table below compares and ranks the cost of car insurance for 2023 Honda CR-V and Nissan Rogue models, with average rates for every trim level for each model.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| CR-V EX | $1,514 | $126 |

| CR-V EX AWD | $1,522 | $127 |

| CR-V Sport Hybrid | $1,540 | $128 |

| CR-V EX-L | $1,564 | $130 |

| CR-V Sport Hybrid AWD | $1,570 | $131 |

| CR-V EX-L AWD | $1,594 | $133 |

| Rogue S 2WD | $1,594 | $133 |

| Rogue S AWD | $1,626 | $136 |

| Rogue SV 2WD | $1,632 | $136 |

| CR-V Sport Touring Hybrid AWD | $1,644 | $137 |

| Rogue SV AWD | $1,666 | $139 |

| Rogue Midnight Edition 2WD | $1,710 | $143 |

| Rogue SL 2WD | $1,722 | $144 |

| Rogue Midnight Edition AWD | $1,738 | $145 |

| Rogue SL AWD | $1,744 | $145 |

| Rogue Platinum 2WD | $1,748 | $146 |

| Rogue Platinum AWD | $1,770 | $148 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 22, 2024

The chart shown below illustrates the average cost to insure both 2023 models for four different driver age groups. For a 2023 Honda CR-V, insurance cost ranges from $1,388 to $3,178 per year for the age groups used in the chart. A 2023 Nissan Rogue costs from $1,508 to $3,414 to insure per year.

The rate tables below display average car insurance cost by trim level for a 2023 Honda CR-V and Nissan Rogue, as well as an average rate for each model.

2023 Honda CR-V

$1,564

| 2023 Honda CR-V Trims | Rate |

|---|---|

| EX | $1,514 |

| EX AWD | 1,522 |

| Sport Hybrid | 1,540 |

| EX-L | 1,564 |

| Sport Hybrid AWD | 1,570 |

| EX-L AWD | 1,594 |

| Sport Touring Hybrid AWD | 1,644 |

| 2023 Honda CR-V Average Rate | $1,564 |

2023 Nissan Rogue

$1,696

| 2023 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,594 |

| S AWD | 1,626 |

| SV 2WD | 1,632 |

| SV AWD | 1,666 |

| Midnight Edition 2WD | 1,710 |

| SL 2WD | 1,722 |

| Midnight Edition AWD | 1,738 |

| SL AWD | 1,744 |

| Platinum 2WD | 1,748 |

| Platinum AWD | 1,770 |

| 2023 Nissan Rogue Average Rate | $1,696 |

2022 Honda CR-V vs. Nissan Rogue

Average car insurance rates for a 2022 Honda CR-V are $1,516 per year, whereas the 2022 Nissan Rogue costs an average of $1,696 per year, making the Honda CR-V the cheaper model to insure by $180 per year.

The exact cost of insurance can vary considerably depending on the trim level, however.

For a 2022 Honda CR-V, car insurance rates range from the cheapest rate of $1,426 per year for the LX model up to the most expensive rate of $1,618 for the Hybrid Touring model.

For a 2022 Nissan Rogue, rates range from $1,560 per year for the S 2WD model up to $1,828 for the most expensive to insure Platinum AWD model.

When comparing rates by trim level for both models, the overall cheapest vehicle to insure is the Honda CR-V LX at an average cost of $1,426 per year, and the overall most expensive vehicle to insure is the Nissan Rogue Platinum AWD at an average cost of $1,828 per year.

For a 2022 Honda CR-V, the cheapest models are the LX, Special Edition, and EX. The cheapest Nissan Rogue models include the S 2WD, S AWD, and SV 2WD. On a monthly basis, car insurance rates for all 2022 Honda CR-V and Nissan Rogue trim levels range from $119 to $152 per month.

The next table ranks the annual and monthly cost of car insurance for 2022 Honda CR-V and Nissan Rogue models, broken down by trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| CR-V LX | $1,426 | $119 |

| CR-V Special Edition | $1,436 | $120 |

| CR-V EX | $1,442 | $120 |

| CR-V Hybrid EX | $1,512 | $126 |

| CR-V EX-L | $1,534 | $128 |

| Rogue S 2WD | $1,560 | $130 |

| CR-V Hybrid EX-L | $1,566 | $131 |

| CR-V Touring | $1,602 | $134 |

| Rogue S AWD | $1,614 | $135 |

| CR-V Hybrid Touring | $1,618 | $135 |

| Rogue SV 2WD | $1,626 | $136 |

| Rogue SV AWD | $1,668 | $139 |

| Rogue SL 2WD | $1,720 | $143 |

| Rogue SL AWD | $1,774 | $148 |

| Rogue Platinum 2WD | $1,780 | $148 |

| Rogue Platinum AWD | $1,828 | $152 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on February 23, 2024

The bar chart below compares average Honda CR-V insurance to Nissan Rogue insurance for the 2022 model year. Rates are calculated for drivers aged 20, 30, 40 and 50.

How does insurance cost for a 2022 Honda CR-V compare to a Nissan Rogue?

- For a 19-year-old driver, insurance on a Honda CR-V costs an average of $4,315 per year and Nissan Rogue insurance costs an average of $4,799 per year, a difference of $484 per year.

- When compared to the national average car insurance rate of $1,883 per year, the Honda CR-V costs $367 less per year, while the Nissan Rogue costs $187 less per year.

- For an 18-year-old driver, insurance on a Honda CR-V costs an average of $4,737 per year and Nissan Rogue insurance costs an average of $5,255 per year, a difference of $518 per year.

- The cheapest 2022 Honda CR-V insurance is on the LX costing $1,426 per year. The cheapest 2022 Nissan Rogue to insure is the S 2WD costing $1,560 per year.

- Having an at-fault accident could increase insurance rates by up to $642 per year for the Honda CR-V and $716 for the Nissan Rogue.

- For a 17-year-old driver, insurance on a Honda CR-V costs an average of $5,312 per year and Nissan Rogue insurance costs an average of $5,913 per year, a difference of $601 per year.

The tables below detail insurance rates for all trim levels of 2022 CR-V and Rogue models. The 2022 Honda CR-V has an average insurance cost of $1,516 and the 2022 Nissan Rogue is $1,696, making the Honda CR-V cheaper by $180 per year.

2022 Honda CR-V

$1,516

| 2022 Honda CR-V Trims | Rate |

|---|---|

| LX | $1,426 |

| Special Edition | 1,436 |

| EX | 1,442 |

| Hybrid EX | 1,512 |

| EX-L | 1,534 |

| Hybrid EX-L | 1,566 |

| Touring | 1,602 |

| Hybrid Touring | 1,618 |

| 2022 Honda CR-V Average Rate | $1,516 |

2022 Nissan Rogue

$1,696

| 2022 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,560 |

| S AWD | 1,614 |

| SV 2WD | 1,626 |

| SV AWD | 1,668 |

| SL 2WD | 1,720 |

| SL AWD | 1,774 |

| Platinum 2WD | 1,780 |

| Platinum AWD | 1,828 |

| 2022 Nissan Rogue Average Rate | $1,696 |

2021 Honda CR-V vs Nissan Rogue

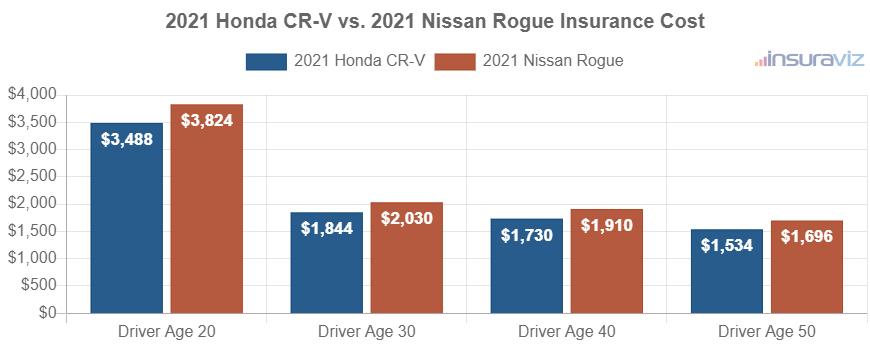

When comparing insurance cost for 2021 models, the Honda CR-V costs an average of $1,368 per year to insure and the Nissan Rogue costs $1,510, making the Honda CR-V the winner by $142.

The rate chart below demonstrates the average cost to insure both models for different driver ages. The average cost of car insurance ranges from $1,214 to $2,758 per year for a 2021 Honda CR-V, and $1,342 to $3,026 for a 2021 Nissan Rogue for the included driver ages.

Out of eight trim levels for the 2021 Honda CR-V, the cheapest insurance prices are on the EX 2WD model at a cost of $1,284 per year.

The 2021 Nissan Rogue has eight trim levels available, with the cheapest trim to insure being the S 2WD trim at an average cost of $1,412 per year, or $118 per month.

When average insurance prices for all 16 trim levels for the 2021 model year of both models are compared, the cheapest model and trim level to insure is the Honda CR-V EX 2WD at an average of $1,284 per year, and the most expensive vehicle to insure is the Nissan Rogue SV Sun and Sound AWD at a cost of $1,568 per year.

The next two rate tables display the average insurance cost by trim level for both 2021 models, including the average rate for each model.

2021 Honda CR-V

$1,368

| 2021 Honda CR-V Trims | Rate |

|---|---|

| EX 2WD | $1,284 |

| LX 2WD | 1,284 |

| LX 4WD | 1,320 |

| EX 4WD | 1,334 |

| EX-L 2WD | 1,386 |

| EX-L 4WD | 1,386 |

| Touring 2WD | 1,456 |

| Touring 4WD | 1,492 |

| 2021 Honda CR-V Average Rate | $1,368 |

2021 Nissan Rogue

$1,510

| 2021 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,412 |

| S AWD | 1,464 |

| SV 2WD | 1,464 |

| SV AWD | 1,464 |

| SL 2WD | 1,568 |

| SL AWD | 1,568 |

| SV Sun and Sound 2WD | 1,568 |

| SV Sun and Sound AWD | 1,568 |

| 2021 Nissan Rogue Average Rate | $1,510 |

2020 Honda CR-V vs Nissan Rogue

When comparing average insurance rates for the 2020 Honda CR-V and Nissan Rogue models, the Honda CR-V has cheaper rates by an average of $138 per year for 2020.

The next chart shows the average cost to insure the two models with different driver age groups. The average car insurance cost ranges from $1,178 to $2,674 per year for a 2020 Honda CR-V, and $1,304 to $2,938 for a 2020 Nissan Rogue for the included driver ages.

Out of eight trims for the 2020 Honda CR-V, the cheapest insurance rates are on the EX 2WD model at a cost of $1,248 per year. Out of the eight trim levels available for the Nissan Rogue, the cheapest 2020 model to insure is the S 2WD model at a cost of $1,372.

When comparing rates by trim level for both models, the lowest-cost model and trim to insure is the Honda CR-V EX 2WD at an average of $1,248 per year, and the most expensive model and trim level is the Nissan Rogue SV Sun and Sound AWD at an average of $1,520 per year.

The next two tables illustrate average car insurance cost by trim level for each 2020 model, as well as the overall average rate for each model.

2020 Honda CR-V

$1,328

| 2020 Honda CR-V Trims | Rate |

|---|---|

| EX 2WD | $1,248 |

| LX 2WD | 1,248 |

| LX 4WD | 1,282 |

| EX 4WD | 1,296 |

| EX-L 2WD | 1,348 |

| EX-L 4WD | 1,348 |

| Touring 2WD | 1,410 |

| Touring 4WD | 1,446 |

| 2020 Honda CR-V Average Rate | $1,328 |

2020 Nissan Rogue

$1,466

| 2020 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,372 |

| S AWD | 1,420 |

| SV 2WD | 1,420 |

| SV AWD | 1,420 |

| SL 2WD | 1,520 |

| SL AWD | 1,520 |

| SV Sun and Sound 2WD | 1,520 |

| SV Sun and Sound AWD | 1,520 |

| 2020 Nissan Rogue Average Rate | $1,466 |

2019 Honda CR-V vs Nissan Rogue

When comparing insurance rates for the 2019 Honda CR-V and Nissan Rogue models, the Honda CR-V is cheaper to insure by an average of $174 per year for 2019.

The chart shown below shows the average cost to insure the two models for drivers from age 20 to 50. Insurance cost ranges from $1,098 to $2,480 per year for a 2019 Honda CR-V, and $1,260 to $2,826 for a 2019 Nissan Rogue for the driver ages used.

The 2019 Honda CR-V has eight trims available, with the cheapest trim level to insure being the EX 2WD model at an average cost of $1,174 per year, or around $98 per month. For the 16 trim levels available for the Nissan Rogue, the cheapest 2019 trim to insure is the Sport S AWD Hatchback trim at a cost of $1,262 per year, or about $105 per month.

When rates are compared for the 24 trim levels of both 2019 models, the cheapest model and trim level to insure is the Honda CR-V EX 2WD at a cost of $1,174 per year. The overall most expensive vehicle to insure is the Nissan Rogue SL Hybrid AWD at a cost of $1,522 per year.

The tables shown below illustrate average cost to insure each trim level for a 2019 Honda CR-V and Nissan Rogue, plus an average rate for each model.

2019 Honda CR-V

$1,234

| 2019 Honda CR-V Trims | Rate |

|---|---|

| EX 2WD | $1,174 |

| LX 2WD | 1,174 |

| LX 4WD | 1,174 |

| EX 4WD | 1,222 |

| EX-L 2WD | 1,222 |

| EX-L 4WD | 1,270 |

| Touring 2WD | 1,270 |

| Touring 4WD | 1,366 |

| 2019 Honda CR-V Average Rate | $1,234 |

Be sure to see our comprehensive 2019 Honda CR-V insurance cost article.

2019 Nissan Rogue

$1,408

| 2019 Nissan Rogue Trims | Rate |

|---|---|

| Sport S AWD Hatchback | $1,262 |

| Sport S Hatchback | 1,262 |

| Sport SV AWD Hatchback | 1,310 |

| Sport SV Hatchback | 1,310 |

| Sport SL Hatchback | 1,358 |

| S 2WD | 1,378 |

| Sport SL AWD Hatchback | 1,406 |

| S AWD | 1,426 |

| SV 2WD | 1,426 |

| SV AWD | 1,426 |

| SV Hybrid 2WD | 1,426 |

| SV Hybrid AWD | 1,474 |

| SL 2WD | 1,522 |

| SL AWD | 1,522 |

| SL Hybrid 2WD | 1,522 |

| SL Hybrid AWD | 1,522 |

| 2019 Nissan Rogue Average Rate | $1,408 |

2018 Honda CR-V vs Nissan Rogue

When comparing average insurance cost for 2018 models, the Honda CR-V costs an average of $1,186 per year to insure and the Nissan Rogue costs $1,342, making the Honda CR-V the winner by $156 for the 2018 comparison year.

The next chart visualizes the average cost to insure both models for four different driver age groups. For a 2018 Honda CR-V, insurance cost ranges from $1,056 to $2,380 per year for the driver ages used. A 2018 Nissan Rogue costs from $1,202 to $2,684 to insure per year.

Out of 10 trims for the 2018 Honda CR-V, the cheapest car insurance rates are on the EX 2WD trim at a cost of $1,124 per year, or $94 per month.

The 2018 Nissan Rogue has 16 trims available, with the cheapest model to insure being the Sport S Hatchback model at an average cost of $1,166 per year.

When insurance rates for all 26 trims of both models are combined and sorted by cost, the cheapest model and trim level to insure is the Honda CR-V EX 2WD at an average cost of $1,124 per year. The most expensive vehicle to insure is the Nissan Rogue SL Hybrid AWD at an average cost of $1,500 per year.

The next two tables show average car insurance rates for each trim level, including an overall average rate.

2018 Honda CR-V

$1,186

| 2018 Honda CR-V Trims | Rate |

|---|---|

| EX 2WD | $1,124 |

| LX 2WD | 1,124 |

| LX 4WD | 1,124 |

| EX 4WD | 1,168 |

| EX-L 2WD | 1,168 |

| EX-L 4WD | 1,212 |

| EX-L Navigation 2WD | 1,212 |

| EX-L Navigation 4WD | 1,212 |

| Touring 2WD | 1,212 |

| Touring 4WD | 1,304 |

| 2018 Honda CR-V Average Rate | $1,186 |

2018 Nissan Rogue

$1,342

| 2018 Nissan Rogue Trims | Rate |

|---|---|

| Sport S Hatchback | $1,166 |

| Sport S AWD Hatchback | 1,212 |

| Sport SV Hatchback | 1,212 |

| Sport SV AWD Hatchback | 1,258 |

| Sport SL AWD Hatchback | 1,304 |

| Sport SL Hatchback | 1,304 |

| S 2WD | 1,326 |

| SV 2WD | 1,326 |

| S AWD | 1,372 |

| SV AWD | 1,372 |

| SV Hybrid 2WD | 1,372 |

| SV Hybrid AWD | 1,416 |

| SL 2WD | 1,448 |

| SL AWD | 1,450 |

| SL Hybrid 2WD | 1,454 |

| SL Hybrid AWD | 1,500 |

| 2018 Nissan Rogue Average Rate | $1,342 |

2017 Honda CR-V vs Nissan Rogue

When comparing insurance rates for 2017 models, a Honda CR-V costs an average of $1,138 per year to insure and a Nissan Rogue costs $1,300, making the Honda CR-V cheaper to insure by $162 per year for this comparison year.

The next chart illustrates the average cost to insure both 2017 models rated for multiple driver ages. Average insurance cost ranges from $1,012 to $2,278 per year for a 2017 Honda CR-V, and $1,166 to $2,606 for a 2017 Nissan Rogue for the illustrated age groups.

The 2017 Honda CR-V has 10 trims available, with the cheapest trim to insure being the EX 2WD trim at an average cost of $1,080 per year. For the 16 trims available for the Nissan Rogue, the cheapest 2017 model to insure is the Sport S Hatchback model at a cost of $1,128.

When car insurance rates for all 26 trim levels for both vehicles are compared, the lowest-cost model and trim level to insure is the Honda CR-V EX 2WD at an average of $1,080 per year, and the highest-cost model and trim is the Nissan Rogue Hybrid SL AWD costing an average of $1,470 per year.

The two tables below show average car insurance cost by trim level for a 2017 Honda CR-V and Nissan Rogue, plus the average rate for each model. The 2017 Honda CR-V has lower-cost car average car insurance rates than the 2017 Nissan Rogue.

2017 Honda CR-V

$1,138

| 2017 Honda CR-V Trims | Rate |

|---|---|

| EX 2WD | $1,080 |

| EX 4WD | 1,080 |

| LX 2WD | 1,080 |

| LX 4WD | 1,080 |

| EX-L 2WD | 1,124 |

| EX-L 4WD | 1,166 |

| EX-L Navigation 2WD | 1,166 |

| EX-L Navigation 4WD | 1,166 |

| Touring 2WD | 1,166 |

| Touring 4WD | 1,254 |

| 2017 Honda CR-V Average Rate | $1,138 |

2017 Nissan Rogue

$1,300

| 2017 Nissan Rogue Trims | Rate |

|---|---|

| Sport S Hatchback | $1,128 |

| Sport S AWD Hatchback | 1,172 |

| Sport SV Hatchback | 1,172 |

| Sport SV AWD Hatchback | 1,214 |

| S 2WD | 1,238 |

| Sport SL AWD Hatchback | 1,256 |

| Sport SL Hatchback | 1,256 |

| S AWD | 1,280 |

| SV 2WD | 1,302 |

| SV AWD | 1,324 |

| SL 2WD | 1,366 |

| Hybrid SV 2WD | 1,384 |

| Hybrid SV AWD | 1,384 |

| SL AWD | 1,410 |

| Hybrid SL 2WD | 1,470 |

| Hybrid SL AWD | 1,470 |

| 2017 Nissan Rogue Average Rate | $1,300 |

2016 Honda CR-V vs Nissan Rogue

For the 2016 Honda CR-V and Nissan Rogue models, the Honda CR-V is cheaper to insure by an average of $138 per year for this comparison year.

The chart shown below demonstrates the average cost to insure the two models for a range of driver ages. Average car insurance cost ranges from $982 to $2,170 per year for a 2016 Honda CR-V, and $1,108 to $2,462 for a 2016 Nissan Rogue for the included driver ages.

For the 12 trim levels available for the 2016 Honda CR-V, the cheapest model to insure is the LX 2WD model at an average cost of $1,022 per year, or about $85 per month.

Out of the six trim levels available for the Nissan Rogue, the cheapest 2016 trim to insure is the S 2WD model at a cost of $1,168.

When all 18 trims of both models are combined and compared, the cheapest trim to insure is the Honda CR-V LX 2WD at an average of $1,022 per year. The most expensive model and trim level is the Nissan Rogue SL AWD at a cost of $1,296 per year.

The tables shown below illustrate the average cost to insure all 2016 trim levels, including an overall average rate. The model with the cheapest auto insurance rates for 2016 is the Honda CR-V.

2016 Honda CR-V

$1,094

| 2016 Honda CR-V Trims | Rate |

|---|---|

| LX 2WD | $1,022 |

| EX 2WD | 1,060 |

| EX 4WD | 1,060 |

| LX 4WD | 1,060 |

| SE 2WD | 1,060 |

| SE 4WD | 1,060 |

| EX-L 2WD | 1,100 |

| EX-L 4WD | 1,100 |

| EX-L Navigation 2WD | 1,100 |

| EX-L Navigation 4WD | 1,140 |

| Touring 2WD | 1,140 |

| Touring 4WD | 1,216 |

| 2016 Honda CR-V Average Rate | $1,094 |

2016 Nissan Rogue

$1,232

| 2016 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,168 |

| S AWD | 1,200 |

| SV 2WD | 1,214 |

| SV AWD | 1,220 |

| SL 2WD | 1,292 |

| SL AWD | 1,296 |

| 2016 Nissan Rogue Average Rate | $1,232 |

2015 Honda CR-V vs Nissan Rogue

When comparing average insurance cost for 2015 models, the Honda CR-V costs an average of $1,044 per year to insure and the Nissan Rogue costs $1,160, making the Honda CR-V the winner by $116 for the 2015 comparison year.

The rate chart below demonstrates the average cost to insure both models rated for different driver ages. Average car insurance cost ranges from $940 to $2,076 per year for a 2015 Honda CR-V, and $1,044 to $2,320 for a 2015 Nissan Rogue for the included driver ages.

Out of 10 trims for the 2015 Honda CR-V, the cheapest insurance rates are on the LX 2WD trim at a cost of $976 per year.

The 2015 Nissan Rogue has eight trims available, with the cheapest model to insure being the Select S 2WD model at an average cost of $1,092 per year.

When looking at the aggregated rates by trim for both models, the cheapest vehicle to insure is the Honda CR-V LX 2WD at an average cost of $976 per year, and the most expensive vehicle to insure is the Nissan Rogue SL AWD at an average cost of $1,238 per year.

The two tables below display both 2015 models and all trim levels available for each one, as well as the overall average rate for each model. The winner for the 2015 car insurance battle is the Honda CR-V.

2015 Honda CR-V

$1,044

| 2015 Honda CR-V Trims | Rate |

|---|---|

| LX 2WD | $976 |

| EX 2WD | 1,012 |

| LX 4WD | 1,012 |

| EX 4WD | 1,038 |

| EX-L 2WD | 1,050 |

| EX-L 4WD | 1,050 |

| EX-L Navigation 2WD | 1,050 |

| EX-L Navigation 4WD | 1,086 |

| Touring 2WD | 1,086 |

| Touring 4WD | 1,086 |

| 2015 Honda CR-V Average Rate | $1,044 |

2015 Nissan Rogue

$1,160

| 2015 Nissan Rogue Trims | Rate |

|---|---|

| Select S 2WD | $1,092 |

| Select S AWD | 1,092 |

| S 2WD | 1,130 |

| S AWD | 1,166 |

| SV 2WD | 1,166 |

| SV AWD | 1,166 |

| SL 2WD | 1,238 |

| SL AWD | 1,238 |

| 2015 Nissan Rogue Average Rate | $1,160 |