- When insurance rates for 2024 models are compared, a Nissan Murano is generally cheaper to insure than a Honda Pilot by an average of $320 per year.

- Out of 34 models in the 2024 midsize SUV segment, the Nissan Murano ranks second and the Honda Pilot ranks 18th for car insurance affordability.

- If affordable car insurance is your top consideration, the SV FWD and SV AWD trims are the cheapest Nissan Murano models to insure, while the LX and LX AWD trims are the cheapest Honda Pilot models to insure.

Is insurance cheaper for a Nissan Murano or Honda Pilot?

For 2024 Nissan Murano and Honda Pilot models, the model with the lower car insurance rates is the Nissan Murano. Average car insurance rates for the Nissan Murano are $2,016 per year, and the Honda Pilot costs an average of $2,336 per year.

For the eight trim levels available for the 2024 Nissan Murano, the cheapest trim level to insure is the SV FWD trim at an average cost of $1,936 per year, or $161 per month.

For the 10 trims available for the Honda Pilot, the cheapest 2024 trim to insure is the LX model at a cost of $2,186.

When looking at the aggregated rates by trim for both models, the cheapest vehicle to insure is the Nissan Murano SV FWD at an average rate of $1,936 per year. The most expensive vehicle to insure is the Honda Pilot Elite AWD at an average cost of $2,482 per year.

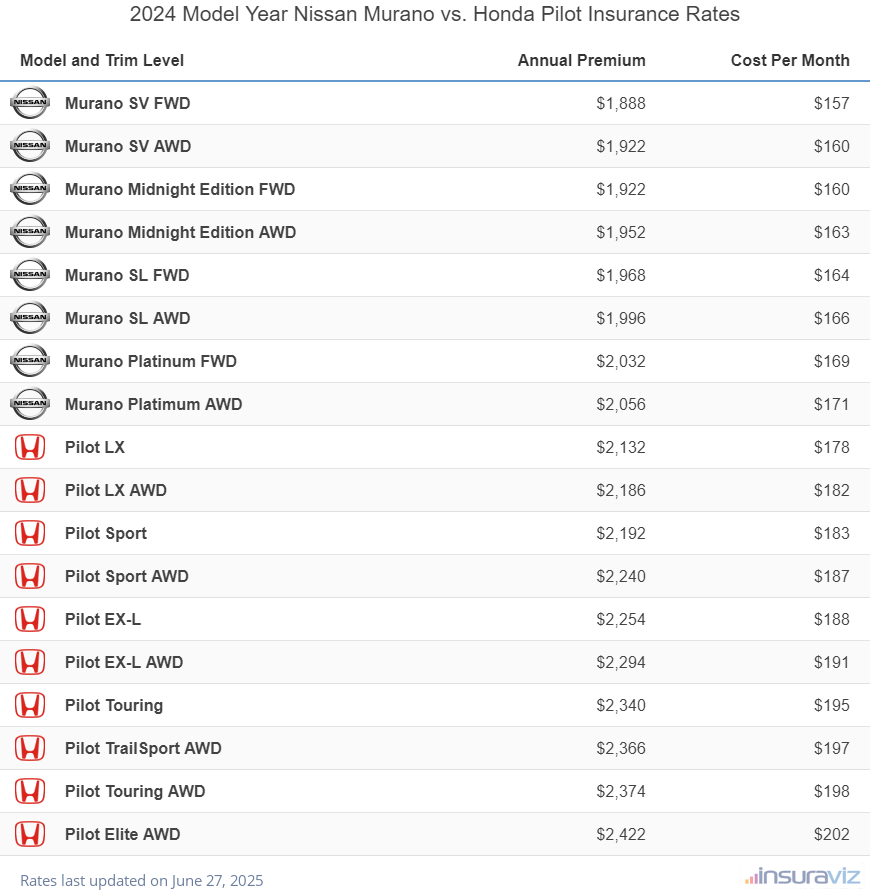

The table shown below compares and ranks the annual and monthly car insurance cost for 2024 Nissan Murano and Honda Pilot models, showing average cost by trim level for each model.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Murano SV FWD | $1,936 | $161 |

| Murano SV AWD | $1,970 | $164 |

| Murano Midnight Edition FWD | $1,970 | $164 |

| Murano Midnight Edition AWD | $2,002 | $167 |

| Murano SL FWD | $2,016 | $168 |

| Murano SL AWD | $2,044 | $170 |

| Murano Platinum FWD | $2,084 | $174 |

| Murano Platimum AWD | $2,108 | $176 |

| Pilot LX | $2,186 | $182 |

| Pilot LX AWD | $2,238 | $187 |

| Pilot Sport | $2,248 | $187 |

| Pilot Sport AWD | $2,294 | $191 |

| Pilot EX-L | $2,308 | $192 |

| Pilot EX-L AWD | $2,350 | $196 |

| Pilot Touring | $2,398 | $200 |

| Pilot TrailSport AWD | $2,426 | $202 |

| Pilot Touring AWD | $2,432 | $203 |

| Pilot Elite AWD | $2,482 | $207 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

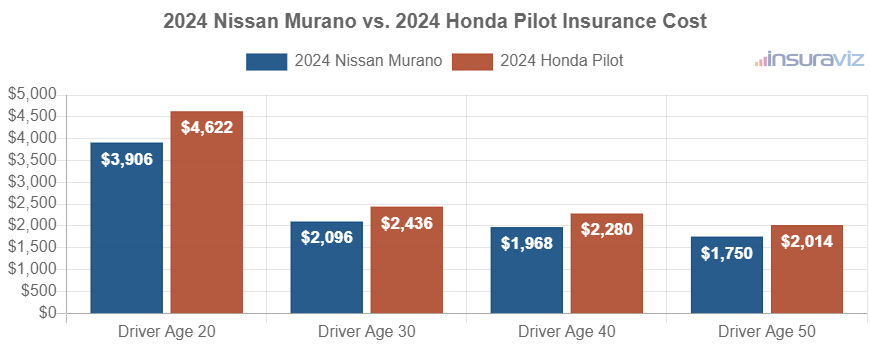

The chart shown below illustrates the average cost to insure both 2024 models with different driver age groups. Insurance cost ranges from $1,792 to $4,000 per year for a 2024 Nissan Murano, and $2,064 to $4,734 for a 2024 Honda Pilot for these driver ages.

The next tables illustrate trim level insurance rates for each 2024 model, including an overall average rate.

2024 Nissan Murano

$2,016

| 2024 Nissan Murano Trims | Rate |

|---|---|

| SV FWD | $1,936 |

| SV AWD | 1,970 |

| Midnight Edition FWD | 1,970 |

| Midnight Edition AWD | 2,002 |

| SL FWD | 2,016 |

| SL AWD | 2,044 |

| Platinum FWD | 2,084 |

| Platimum AWD | 2,108 |

| 2024 Nissan Murano Average Rate | $2,016 |

2024 Honda Pilot

$2,336

| 2024 Honda Pilot Trims | Rate |

|---|---|

| LX | $2,186 |

| LX AWD | 2,238 |

| Sport | 2,248 |

| Sport AWD | 2,294 |

| EX-L | 2,308 |

| EX-L AWD | 2,350 |

| Touring | 2,398 |

| TrailSport AWD | 2,426 |

| Touring AWD | 2,432 |

| Elite AWD | 2,482 |

| 2024 Honda Pilot Average Rate | $2,336 |

2023 Nissan Murano vs. Honda Pilot

Insurance rates for a 2023 Nissan Murano average $2,004 per year, whereas the 2023 Honda Pilot costs an average of $2,246 per year, making the Nissan Murano the cheaper model to insure.

Out of 10 trims for the 2023 Nissan Murano, the cheapest insurance rates are on the S 2WD model at a cost of $1,882 per year. The 2023 Honda Pilot has eight trims available, with the cheapest model to insure being the Sport trim at an average cost of $2,122 per year.

When comparing aggregated rates for both models from a trim-level perspective, the lowest-cost model and trim level to insure is the Nissan Murano S 2WD at an average cost of $1,882 per year. The highest-cost model and trim is the Honda Pilot Elite AWD costing $2,362 per year.

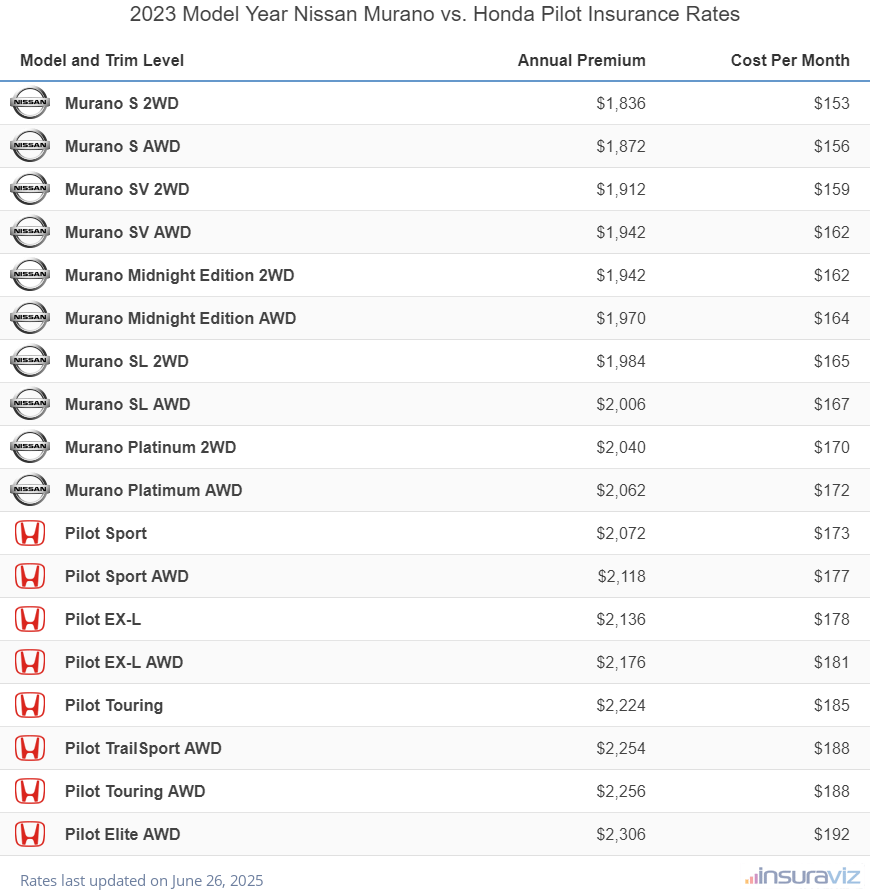

The rate table below compares and ranks the annual and monthly car insurance cost for 2023 Nissan Murano and Honda Pilot models, broken down by individual trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Murano S 2WD | $1,882 | $157 |

| Murano S AWD | $1,918 | $160 |

| Murano SV 2WD | $1,958 | $163 |

| Murano SV AWD | $1,990 | $166 |

| Murano Midnight Edition 2WD | $1,990 | $166 |

| Murano Midnight Edition AWD | $2,016 | $168 |

| Murano SL 2WD | $2,030 | $169 |

| Murano SL AWD | $2,054 | $171 |

| Murano Platinum 2WD | $2,090 | $174 |

| Murano Platimum AWD | $2,112 | $176 |

| Pilot Sport | $2,122 | $177 |

| Pilot Sport AWD | $2,168 | $181 |

| Pilot EX-L | $2,188 | $182 |

| Pilot EX-L AWD | $2,230 | $186 |

| Pilot Touring | $2,276 | $190 |

| Pilot TrailSport AWD | $2,308 | $192 |

| Pilot Touring AWD | $2,310 | $193 |

| Pilot Elite AWD | $2,362 | $197 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

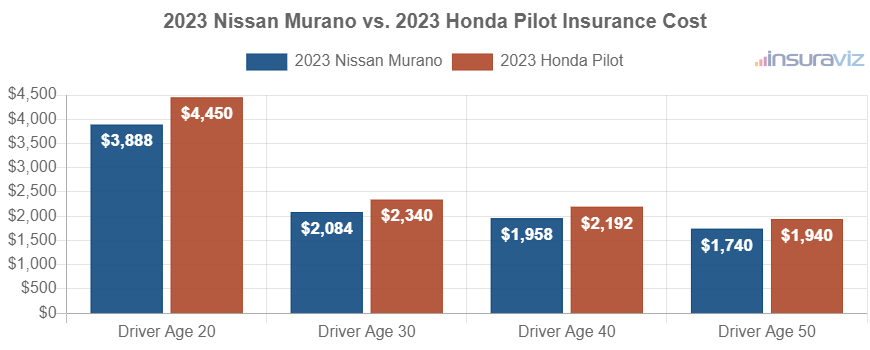

The next chart illustrates the average cost to insure both models using drivers aged 20 to 50. The average car insurance cost ranges from $1,782 to $3,984 per year for a 2023 Nissan Murano, and $1,986 to $4,558 for a 2023 Honda Pilot for the driver ages used.

The rate tables below illustrate average car insurance rates for each trim level, as well as the overall average rate for each model. The cheapest of the two models to insure for the 2023 model year is the Nissan Murano.

2023 Nissan Murano

$2,004

| 2023 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,882 |

| S AWD | 1,918 |

| SV 2WD | 1,958 |

| SV AWD | 1,990 |

| Midnight Edition 2WD | 1,990 |

| Midnight Edition AWD | 2,016 |

| SL 2WD | 2,030 |

| SL AWD | 2,054 |

| Platinum 2WD | 2,090 |

| Platimum AWD | 2,112 |

| 2023 Nissan Murano Average Rate | $2,004 |

2023 Honda Pilot

$2,246

| 2023 Honda Pilot Trims | Rate |

|---|---|

| Sport | $2,122 |

| Sport AWD | 2,168 |

| EX-L | 2,188 |

| EX-L AWD | 2,230 |

| Touring | 2,276 |

| TrailSport AWD | 2,308 |

| Touring AWD | 2,310 |

| Elite AWD | 2,362 |

| 2023 Honda Pilot Average Rate | $2,246 |

2022 Nissan Murano vs. Honda Pilot

Car insurance rates for a 2022 Nissan Murano cost an average of $2,030 per year, and insurance for a 2022 Honda Pilot costs an average of $2,220 per year, making the Nissan Murano the cheaper of the two models to insure.

For a 2022 Nissan Murano, rates range from the cheapest rate of $1,836 per year for the S 2WD model up to the highest rate of $2,180 for the Platimum AWD model. For a 2022 Honda Pilot, rates range from $2,072 per year for the Sport model up to $2,342 for the most expensive Black Edition model.

When rates are compared for both models, the overall cheapest vehicle to insure is the Nissan Murano S 2WD at an average cost of $1,836 per year. The most expensive model and trim level is the Honda Pilot Black Edition costing $2,342 per year.

For a 2022 Nissan Murano, the cheapest models are the S 2WD, S AWD, and SV 2WD. The cheapest Honda Pilot models include the Sport, Special Edition, and EX-L.

On a monthly basis, car insurance rates for all 2022 Nissan Murano and Honda Pilot trim levels range from $153 to $195 per month.

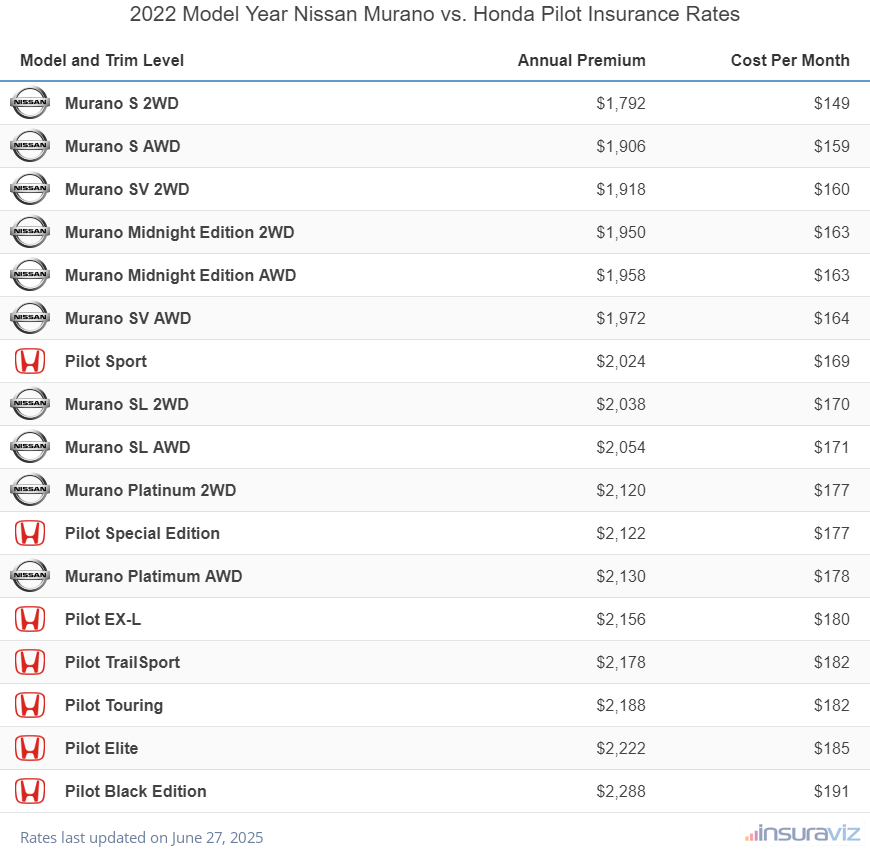

The table below ranks the annual and monthly car insurance cost for 2022 Nissan Murano and Honda Pilot models, with average rates for each vehicle.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Murano S 2WD | $1,836 | $153 |

| Murano S AWD | $1,952 | $163 |

| Murano SV 2WD | $1,966 | $164 |

| Murano Midnight Edition 2WD | $1,996 | $166 |

| Murano Midnight Edition AWD | $2,006 | $167 |

| Murano SV AWD | $2,018 | $168 |

| Pilot Sport | $2,072 | $173 |

| Murano SL 2WD | $2,086 | $174 |

| Murano SL AWD | $2,104 | $175 |

| Murano Platinum 2WD | $2,170 | $181 |

| Pilot Special Edition | $2,174 | $181 |

| Murano Platimum AWD | $2,180 | $182 |

| Pilot EX-L | $2,208 | $184 |

| Pilot TrailSport | $2,230 | $186 |

| Pilot Touring | $2,240 | $187 |

| Pilot Elite | $2,274 | $190 |

| Pilot Black Edition | $2,342 | $195 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

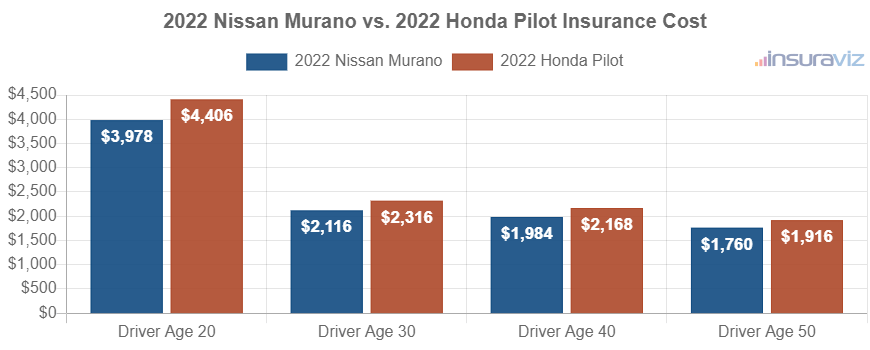

The diagram below plots average Nissan Murano insurance and a Honda Pilot insurance cost for the 2022 model year based on different rated driver ages.

Out of 10 Nissan Murano trims, the cheapest 2022 trim to insure is the S 2WD trim at an average cost of $1,836 per year.

For the seven trim levels available for the Honda Pilot, the cheapest 2022 model to insure is the Sport model at a cost of $2,072 per year, or $173 per month.

When looking at the aggregated rates by trim for both models, the lowest-cost model and trim to insure is the Nissan Murano S 2WD at an average rate of $1,836 per year, and the overall most expensive vehicle to insure is the Honda Pilot Black Edition costing $2,342 per year.

The rate tables below display the average insurance cost by trim level for both 2022 models, as well as the overall average rate for each model. The cheapest model to insure for the 2022 model year is the Nissan Murano.

2022 Nissan Murano

$2,030

| 2022 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,836 |

| S AWD | 1,952 |

| SV 2WD | 1,966 |

| Midnight Edition 2WD | 1,996 |

| Midnight Edition AWD | 2,006 |

| SV AWD | 2,018 |

| SL 2WD | 2,086 |

| SL AWD | 2,104 |

| Platinum 2WD | 2,170 |

| Platimum AWD | 2,180 |

| 2022 Nissan Murano Average Rate | $2,030 |

2022 Honda Pilot

$2,220

| 2022 Honda Pilot Trims | Rate |

|---|---|

| Sport | $2,072 |

| Special Edition | 2,174 |

| EX-L | 2,208 |

| TrailSport | 2,230 |

| Touring | 2,240 |

| Elite | 2,274 |

| Black Edition | 2,342 |

| 2022 Honda Pilot Average Rate | $2,220 |

2021 Nissan Murano vs. Honda Pilot

When comparing insurance cost for 2021 models, a Nissan Murano costs an average of $1,968 per year to insure and a Honda Pilot costs $1,976, making the Nissan Murano cheaper to insure by $8 per year for this comparison year.

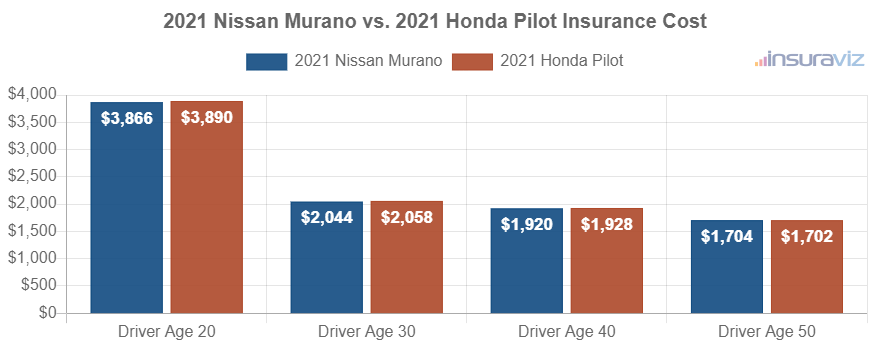

The chart below demonstrates the average cost to insure both 2021 models rated for a variety of different driver ages. Insurance cost ranges from $1,746 to $3,956 per year for a 2021 Nissan Murano, and $1,744 to $3,986 for a 2021 Honda Pilot for the included driver ages.

Out of 10 Nissan Murano trim levels, the cheapest 2021 model to insure is the S 2WD model at an average cost of $1,830 per year, or around $153 per month. The 2021 Honda Pilot has 14 trim levels available, with the cheapest model to insure being the LX 2WD trim at an average cost of $1,800 per year, or $150 per month.

When all 24 trims of both models are combined and compared, the most affordable model and trim level to insure is the Honda Pilot LX 2WD at an average of $1,800 per year. The most expensive trim is the Nissan Murano Platinum AWD at an average cost of $2,094 per year.

The next two rate tables show all the available trims for both 2021 models, plus an average rate for each model.

2021 Nissan Murano

$1,968

| 2021 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,830 |

| S AWD | 1,898 |

| SV 2WD | 1,898 |

| SL 2WD | 1,964 |

| SV Premium AWD | 1,964 |

| SV AWD | 1,974 |

| SV Premium 2WD | 1,978 |

| SL AWD | 2,030 |

| Platinum 2WD | 2,040 |

| Platinum AWD | 2,094 |

| 2021 Nissan Murano Average Rate | $1,968 |

2021 Honda Pilot

$1,976

| 2021 Honda Pilot Trims | Rate |

|---|---|

| LX 2WD | $1,800 |

| EX 2WD | 1,886 |

| LX 4WD | 1,886 |

| EX 4WD | 1,952 |

| EX-L 2WD | 1,952 |

| EX-L 4WD | 1,952 |

| EX-L Navi/Rear Entertainment 2WD | 1,952 |

| EX-L Navi/Rear Entertainment 4WD | 2,020 |

| Touring Navi 2WD | 2,020 |

| Touring Navi 4WD | 2,020 |

| Touring-7 2WD | 2,020 |

| Touring-7 4WD | 2,020 |

| Black 4WD | 2,084 |

| Elite Navi 4WD | 2,084 |

| 2021 Honda Pilot Average Rate | $1,976 |

2020 Nissan Murano vs. 2020 Honda Pilot

When comparing average insurance cost for 2020 models, the Nissan Murano costs an average of $1,908 per year to insure and the Honda Pilot costs $1,912, making the Nissan Murano the winner by $4.

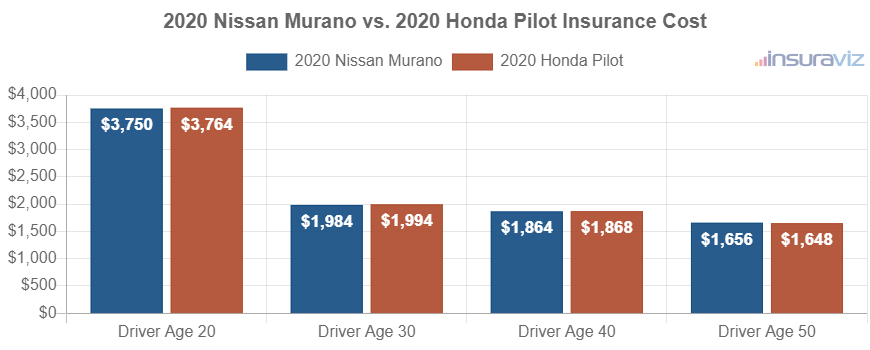

The chart below displays the average cost to insure both 2020 models for a range of driver ages. Insurance cost ranges from $1,694 to $3,842 per year for a 2020 Nissan Murano, and $1,690 to $3,860 for a 2020 Honda Pilot for these driver ages.

The 2020 Nissan Murano has 10 trim levels available, with the cheapest trim level to insure being the S 2WD trim at an average cost of $1,778 per year. For the 14 trims available for the Honda Pilot, the cheapest 2020 model to insure is the LX 2WD model at a cost of $1,746.

When comparing aggregated rates for both models from a trim-level perspective, the cheapest trim to insure is the Honda Pilot LX 2WD at an average of $1,746 per year, and the highest-cost model and trim is the Nissan Murano Platinum AWD at an average cost of $2,044 per year.

The tables shown below show the cost to insure the available trim levels for both 2020 models, including an overall average rate. The cheapest of the two models to insure for the 2020 model year is the Nissan Murano.

2020 Nissan Murano

$1,908

| 2020 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,778 |

| S AWD | 1,842 |

| SV 2WD | 1,842 |

| SL 2WD | 1,904 |

| SV Premium 2WD | 1,904 |

| SV Premium AWD | 1,904 |

| SV AWD | 1,916 |

| SL AWD | 1,968 |

| Platinum 2WD | 1,980 |

| Platinum AWD | 2,044 |

| 2020 Nissan Murano Average Rate | $1,908 |

2020 Honda Pilot

$1,912

| 2020 Honda Pilot Trims | Rate |

|---|---|

| LX 2WD | $1,746 |

| EX 2WD | 1,828 |

| LX 4WD | 1,828 |

| EX 4WD | 1,890 |

| EX-L 2WD | 1,890 |

| EX-L 4WD | 1,890 |

| EX-L Navi/Rear Entertainment 2WD | 1,890 |

| EX-L Navi/Rear Entertainment 4WD | 1,954 |

| Touring Navi 2WD | 1,954 |

| Touring Navi 4WD | 1,954 |

| Touring-7 2WD | 1,954 |

| Touring-7 4WD | 1,954 |

| Black 4WD | 2,018 |

| Elite Navi 4WD | 2,018 |

| 2020 Honda Pilot Average Rate | $1,912 |

2019 Nissan Murano vs. 2019 Honda Pilot

When comparing car insurance rates for 2019 models, the Nissan Murano costs an average of $1,900 per year to insure and the Honda Pilot costs $1,870, making the Honda Pilot the winner by $30.

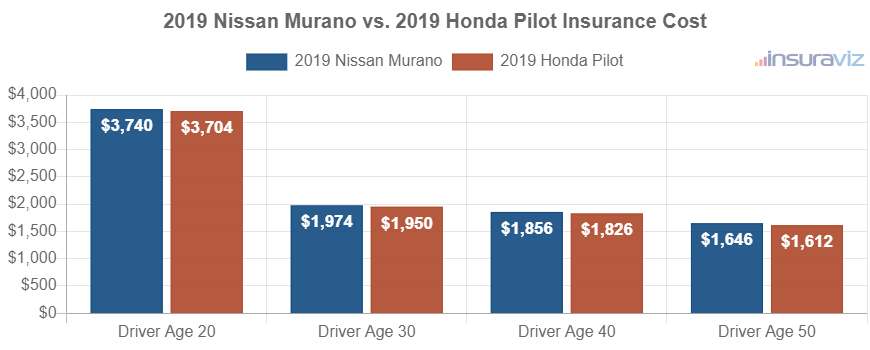

The rate chart below shows the average cost to insure the two models for drivers from age 20 to 50. For a 2019 Nissan Murano, insurance cost ranges from $1,688 to $3,830 per year. A 2019 Honda Pilot costs from $1,652 to $3,794 to insure per year.

The 2019 Nissan Murano has eight trims available, with the cheapest trim to insure being the S 2WD trim at an average cost of $1,786 per year, or about $149 per month.

The 2019 Honda Pilot has 14 trim levels available, with the cheapest model to insure being the LX 2WD trim at an average cost of $1,710 per year, or around $143 per month.

When looking at the aggregated rates by trim for both models, the overall cheapest vehicle to insure is the Honda Pilot LX 2WD at an average rate of $1,710 per year, and the most expensive trim is the Nissan Murano Platinum AWD at an average of $2,030 per year.

The next two rate tables show both 2019 models and all trim levels available for each one, plus an average rate for each model. The model with the cheapest car insurance rates for 2019 is the Honda Pilot.

2019 Nissan Murano

$1,900

| 2019 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,786 |

| S AWD | 1,786 |

| SV 2WD | 1,846 |

| SL 2WD | 1,908 |

| SV AWD | 1,908 |

| Platinum 2WD | 1,968 |

| SL AWD | 1,968 |

| Platinum AWD | 2,030 |

| 2019 Nissan Murano Average Rate | $1,900 |

2019 Honda Pilot

$1,870

| 2019 Honda Pilot Trims | Rate |

|---|---|

| LX 2WD | $1,710 |

| EX 2WD | 1,790 |

| LX 4WD | 1,790 |

| EX 4WD | 1,850 |

| EX-L 2WD | 1,850 |

| EX-L 4WD | 1,850 |

| EX-L Navi/Rear Entertainment 2WD | 1,850 |

| EX-L Navi/Rear Entertainment 4WD | 1,912 |

| Touring Navigation 2WD | 1,912 |

| Touring Navigation 4WD | 1,912 |

| Touring-7 2WD | 1,912 |

| Touring-7 4WD | 1,912 |

| Black 4WD | 1,972 |

| Elite Navigation 4WD | 1,972 |

| 2019 Honda Pilot Average Rate | $1,870 |

2018 Nissan Murano vs. 2018 Honda Pilot

For 2018 Nissan Murano and Honda Pilot models, the Honda Pilot has cheaper car insurance rates by an average of $16 per year for this model year.

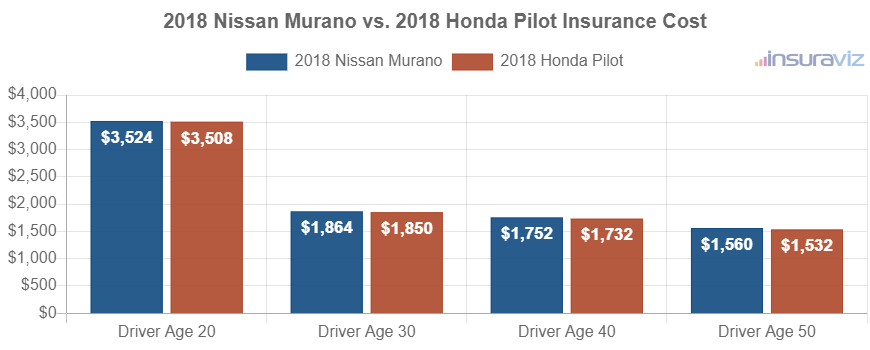

The chart shown below displays the average cost to insure the two models rated for multiple driver ages. For a 2018 Nissan Murano, the average car insurance cost ranges from $1,596 to $3,612 per year for the included driver ages. A 2018 Honda Pilot costs from $1,572 to $3,596 to insure per year.

Out of eight Nissan Murano trim levels, the cheapest 2018 model to insure is the S 2WD model at an average cost of $1,708 per year, or about $142 per month. Out of the 17 trims available for the Honda Pilot, the cheapest 2018 trim to insure is the LX 2WD trim at a cost of $1,654.

When looking at the aggregated rates by trim for both models, the cheapest trim to insure is the Honda Pilot LX 2WD at an average cost of $1,654 per year. The overall most expensive vehicle to insure is the Honda Pilot Elite Navigation 4WD at an average of $1,900 per year.

The next two rate tables show the cost to insure the available trim levels for both 2018 models, along with the average rate for each model.

2018 Nissan Murano

$1,794

| 2018 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,708 |

| S AWD | 1,708 |

| SV 2WD | 1,766 |

| SV AWD | 1,766 |

| SL 2WD | 1,822 |

| SL AWD | 1,822 |

| Platinum 2WD | 1,880 |

| Platinum AWD | 1,880 |

| 2018 Nissan Murano Average Rate | $1,794 |

2018 Honda Pilot

$1,778

| 2018 Honda Pilot Trims | Rate |

|---|---|

| LX 2WD | $1,654 |

| LX 4WD | 1,654 |

| EX 2WD | 1,728 |

| EX 4WD | 1,728 |

| EX Sensing 2WD | 1,728 |

| EX Sensing 4WD | 1,786 |

| EX-L 2WD | 1,786 |

| EX-L 4WD | 1,786 |

| EX-L Navigation 2WD | 1,786 |

| EX-L Navigation 4WD | 1,786 |

| EX-L Rear Entertainment 2WD | 1,786 |

| EX-L Sensing 2WD | 1,786 |

| EX-L Sensing 4WD | 1,786 |

| EX-L Rear Entertainment 4WD | 1,842 |

| Touring Navigation 2WD | 1,842 |

| Touring Navigation 4WD | 1,842 |

| Elite Navigation 4WD | 1,900 |

| 2018 Honda Pilot Average Rate | $1,778 |

2017 Nissan Murano vs. 2017 Honda Pilot

When comparing average insurance cost for 2017 models, the Nissan Murano costs an average of $1,708 per year to insure and the Honda Pilot costs $1,702, making the Honda Pilot the winner by $6 for this model year.

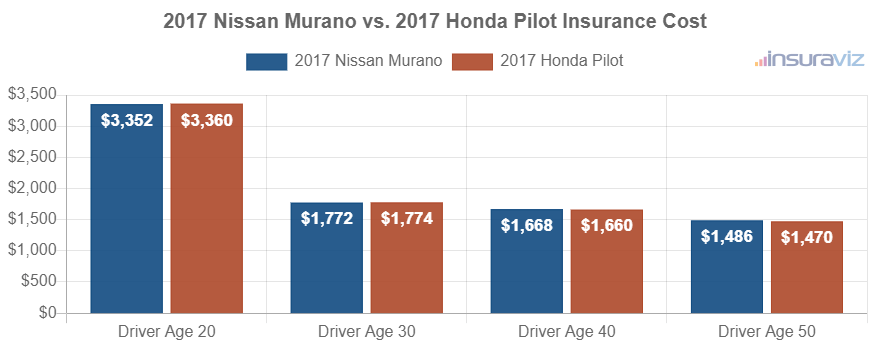

The chart below visualizes the average cost to insure both 2017 models for drivers aged 20 to 50. Average car insurance cost ranges from $1,522 to $3,432 per year for a 2017 Nissan Murano, and $1,506 to $3,444 for a 2017 Honda Pilot for the included driver ages.

For the eight trims available for the 2017 Nissan Murano, the cheapest model to insure is the S 2WD trim at an average cost of $1,592 per year. The 2017 Honda Pilot has 17 trims available, with the cheapest trim level to insure being the LX 2WD trim at an average cost of $1,588 per year, or $132 per month.

When looking at the aggregated rates by trim for both models, the cheapest model and trim level to insure is the Honda Pilot LX 2WD at an average cost of $1,588 per year, and the most expensive trim is the Honda Pilot Elite Navigation 4WD at an average cost of $1,820 per year.

The tables below display the average cost to insure all 2017 trim levels, as well as an average rate for each model.

2017 Nissan Murano

$1,708

| 2017 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,592 |

| S AWD | 1,646 |

| SV 2WD | 1,646 |

| SV AWD | 1,700 |

| Platinum 2WD | 1,754 |

| SL 2WD | 1,754 |

| SL AWD | 1,754 |

| Platinum AWD | 1,808 |

| 2017 Nissan Murano Average Rate | $1,708 |

2017 Honda Pilot

$1,702

| 2017 Honda Pilot Trims | Rate |

|---|---|

| LX 2WD | $1,588 |

| LX 4WD | 1,588 |

| EX 2WD | 1,658 |

| EX 4WD | 1,658 |

| EX Sensing 2WD | 1,658 |

| EX Sensing 4WD | 1,658 |

| EX-L 2WD | 1,714 |

| EX-L Sensing 4WD | 1,714 |

| EX-L Sensing 2WD | 1,718 |

| EX-L 4WD | 1,720 |

| EX-L Rear Entertainment 4WD | 1,720 |

| EX-L Rear Entertainment 2WD | 1,724 |

| EX-L Navigation 4WD | 1,728 |

| EX-L Navigation 2WD | 1,732 |

| Touring Navigation 2WD | 1,766 |

| Touring Navigation 4WD | 1,766 |

| Elite Navigation 4WD | 1,820 |

| 2017 Honda Pilot Average Rate | $1,702 |

2016 Nissan Murano vs. 2016 Honda Pilot

For 2016 Nissan Murano and Honda Pilot models, the Honda Pilot is cheaper to insure by an average of $6 per year.

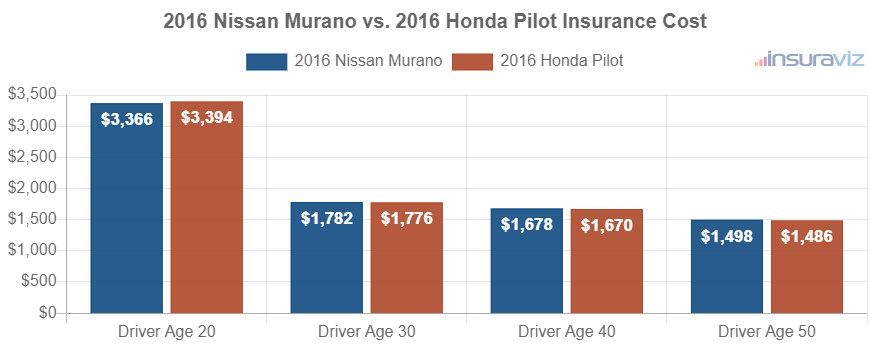

The chart shown below shows the average cost to insure both models for a range of driver ages. The average cost of car insurance ranges from $1,534 to $3,448 per year for a 2016 Nissan Murano, and $1,524 to $3,474 for a 2016 Honda Pilot for the example age groups.

The 2016 Nissan Murano has 12 trim levels available, with the cheapest trim level to insure being the S 2WD model at an average cost of $1,506 per year, or around $126 per month. For the 17 trims available for the Honda Pilot, the cheapest 2016 trim level to insure is the LX 2WD model at a cost of $1,544.

When comparing car insurance rates for both models by trim level, the lowest-cost model and trim level to insure is the Nissan Murano S 2WD at an average of $1,506 per year. The most expensive trim is the Nissan Murano Electric Platinum AWD costing $1,948 per year.

The tables shown below illustrate the average insurance cost by trim level for both 2016 models, plus an average rate for each model.

2016 Nissan Murano

$1,718

| 2016 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,506 |

| S AWD | 1,556 |

| SV 2WD | 1,556 |

| SV AWD | 1,606 |

| Platinum 2WD | 1,656 |

| SL 2WD | 1,656 |

| SL AWD | 1,656 |

| Platinum AWD | 1,706 |

| Electric SL 2WD | 1,918 |

| Electric SL AWD | 1,924 |

| Electric Platinum 2WD | 1,934 |

| Electric Platinum AWD | 1,948 |

| 2016 Nissan Murano Average Rate | $1,718 |

2016 Honda Pilot

$1,712

| 2016 Honda Pilot Trims | Rate |

|---|---|

| LX 2WD | $1,544 |

| EX 2WD | 1,594 |

| LX 4WD | 1,594 |

| EX 4WD | 1,692 |

| EX Sensing 2WD | 1,692 |

| EX Sensing 4WD | 1,692 |

| EX-L 2WD | 1,692 |

| EX-L 4WD | 1,740 |

| EX-L Navigation 2WD | 1,740 |

| EX-L Navigation 4WD | 1,740 |

| EX-L Rear Entertainment 2WD | 1,740 |

| EX-L Rear Entertainment 4WD | 1,740 |

| EX-L Sensing 2WD | 1,740 |

| EX-L Sensing 4WD | 1,740 |

| Touring Navigation 2WD | 1,790 |

| Touring Navigation 4WD | 1,790 |

| Elite Navigation 4WD | 1,840 |

| 2016 Honda Pilot Average Rate | $1,712 |

2015 Nissan Murano vs. 2015 Honda Pilot

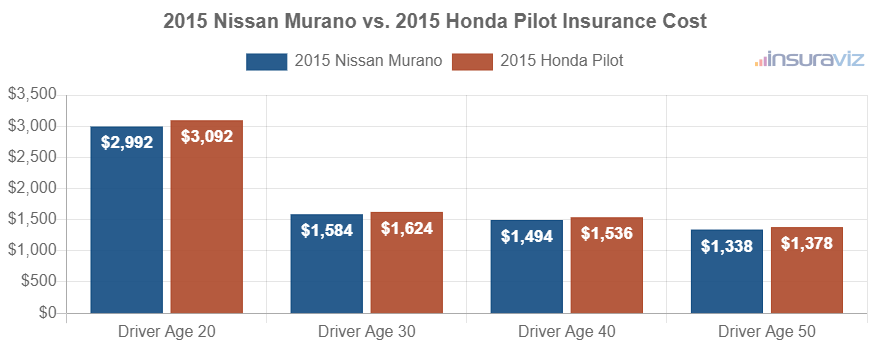

When comparing average insurance cost for 2015 models, the Nissan Murano costs an average of $1,532 per year to insure and the Honda Pilot costs $1,572, making the Nissan Murano the winner by $40 for this model year.

The chart shown below illustrates the average cost to insure both models for drivers from age 20 to 50. Average car insurance cost ranges from $1,368 to $3,066 per year for a 2015 Nissan Murano, and $1,410 to $3,170 for a 2015 Honda Pilot.

For the eight trims available for the 2015 Nissan Murano, the cheapest model to insure is the S 2WD model at an average cost of $1,434 per year, or around $120 per month.

For the 14 trim levels available for the Honda Pilot, the cheapest 2015 trim to insure is the SE 4WD trim at a cost of $1,396.

When comparing aggregated rates for both models from a trim-level perspective, the lowest-cost model and trim level to insure is the Honda Pilot SE 4WD at an average of $1,396 per year, and the most expensive vehicle to insure is the Honda Pilot Touring 4WD costing $1,670 per year.

The rate tables below display the expected annual car insurance cost by trim level for both 2015 models, as well as an average rate for each model. The cheapest of the two models to insure for the 2015 model year is the Nissan Murano.

2015 Nissan Murano

$1,532

| 2015 Nissan Murano Trims | Rate |

|---|---|

| S 2WD | $1,434 |

| S AWD | 1,478 |

| SV 2WD | 1,478 |

| SV AWD | 1,526 |

| Platinum 2WD | 1,570 |

| SL 2WD | 1,570 |

| SL AWD | 1,570 |

| Platinum AWD | 1,618 |

| 2015 Nissan Murano Average Rate | $1,532 |

2015 Honda Pilot

$1,572

| 2015 Honda Pilot Trims | Rate |

|---|---|

| SE 4WD | $1,396 |

| LX 2WD | 1,442 |

| EX 2WD | 1,488 |

| LX 4WD | 1,488 |

| EX 4WD | 1,578 |

| EX-L 2WD | 1,578 |

| SE 2WD | 1,578 |

| EX-L 4WD | 1,626 |

| EX-L Navigation 2WD | 1,626 |

| EX-L Navigation 4WD | 1,626 |

| EX-L RES 2WD | 1,626 |

| EX-L RES 4WD | 1,626 |

| Touring 2WD | 1,670 |

| Touring 4WD | 1,670 |

| 2015 Honda Pilot Average Rate | $1,572 |