- At an average cost of $2,154 per year, a 2024 Mazda CX-5 has cheaper car insurance rates than a 2024 Nissan Rogue by $198 per year.

- For a 2024 model year Nissan Rogue, insurance prices range from $2,044 to $2,258 per year, while auto insurance for a 2024 Mazda CX-5 costs from $1,834 to $2,068.

- Out of 47 models in the 2024 small SUV class, the Nissan Rogue ranks 19th and the Mazda CX-5 ranks eighth for average car insurance affordability.

Is a Nissan Rogue or Mazda CX-5 cheaper to insure?

For 2024 models, the model with the lower car insurance rates is the Mazda CX-5. Insurance cost for the Nissan Rogue averages $2,154 per year, and the Mazda CX-5 costs an average of $1,956 per year.

Out of eight trim levels for the 2024 Nissan Rogue, the cheapest car insurance rates are on the S 2WD model at a cost of $2,044 per year, or about $170 per month. For the eight trims available for the Mazda CX-5, the cheapest 2024 trim to insure is the 2.5 S Select model at a cost of $1,834.

When rates are compared for the 16 trim levels of both 2024 models, the cheapest vehicle to insure is the Mazda CX-5 2.5 S Select at an average of $1,834 per year. The most expensive vehicle to insure is the Nissan Rogue Platinum AWD at an average of $2,258 per year.

The table below ranks the 12-month and monthly car insurance cost for 2024 Nissan Rogue and Mazda CX-5 models, broken down by trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| CX-5 2.5 S Select | $1,834 | $153 |

| CX-5 2.5 S Preferred | $1,868 | $156 |

| CX-5 2.5 S Carbon Edition | $1,902 | $159 |

| CX-5 2.5 S Premium | $1,946 | $162 |

| CX-5 2.5 S Premium Plus | $2,002 | $167 |

| CX-5 2.5 Carbon Turbo | $2,010 | $168 |

| CX-5 2.5 Turbo Premium | $2,022 | $169 |

| Rogue S 2WD | $2,044 | $170 |

| CX-5 2.5 Turbo Signature | $2,068 | $172 |

| Rogue S AWD | $2,086 | $174 |

| Rogue SV 2WD | $2,088 | $174 |

| Rogue SV AWD | $2,124 | $177 |

| Rogue SL 2WD | $2,194 | $183 |

| Rogue SL AWD | $2,224 | $185 |

| Rogue Platinum 2WD | $2,230 | $186 |

| Rogue Platinum AWD | $2,258 | $188 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

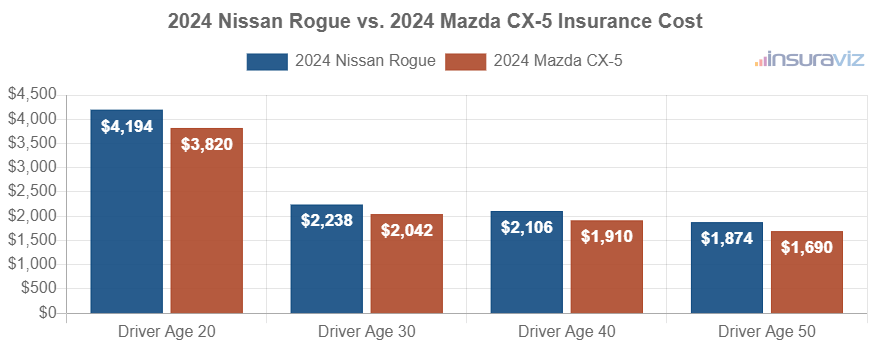

The chart below illustrates the average cost to insure both models rated for multiple driver ages. The average cost of car insurance ranges from $1,920 to $4,300 per year for a 2024 Nissan Rogue, and $1,730 to $3,916 for a 2024 Mazda CX-5 for the included age groups.

The next two tables show trim level insurance rates for each 2024 model, including an overall average cost for each model.

2024 Nissan Rogue

$2,154

| 2024 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $2,044 |

| S AWD | 2,086 |

| SV 2WD | 2,088 |

| SV AWD | 2,124 |

| SL 2WD | 2,194 |

| SL AWD | 2,224 |

| Platinum 2WD | 2,230 |

| Platinum AWD | 2,258 |

| 2024 Nissan Rogue Average Rate | $2,154 |

2024 Mazda CX-5

$1,956

| 2024 Mazda CX-5 Trims | Rate |

|---|---|

| 2.5 S Select | $1,834 |

| 2.5 S Preferred | 1,868 |

| 2.5 S Carbon Edition | 1,902 |

| 2.5 S Premium | 1,946 |

| 2.5 S Premium Plus | 2,002 |

| 2.5 Carbon Turbo | 2,010 |

| 2.5 Turbo Premium | 2,022 |

| 2.5 Turbo Signature | 2,068 |

| 2024 Mazda CX-5 Average Rate | $1,956 |

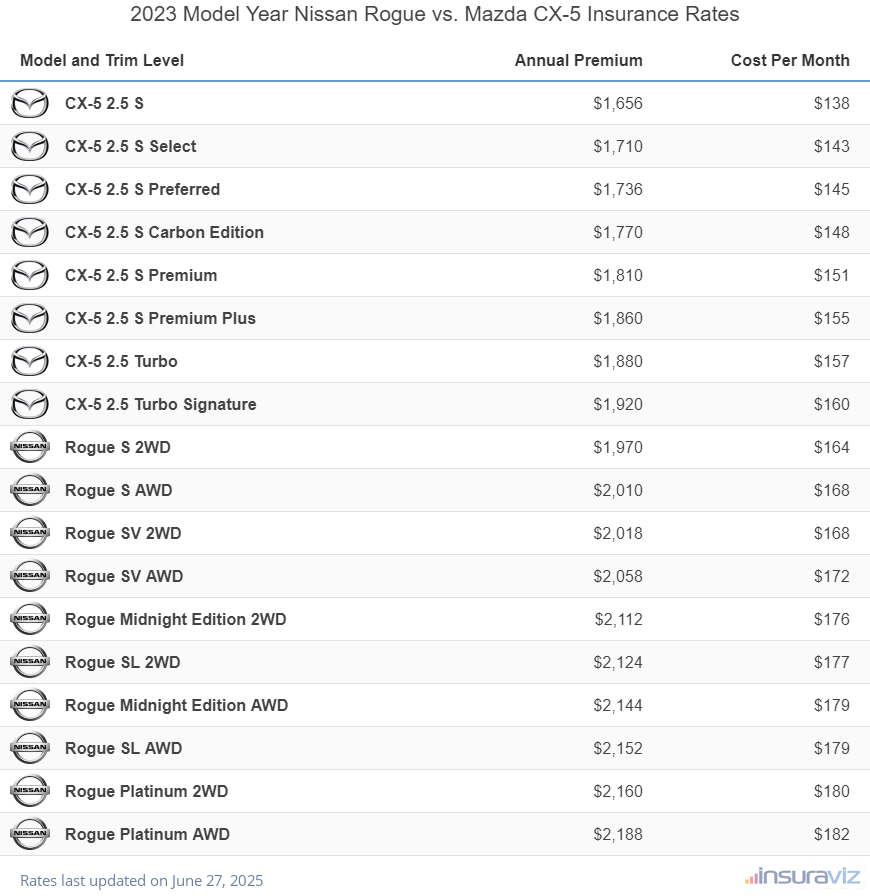

2023 Nissan Rogue vs. Mazda CX-5

For new Rogue and CX-5 models, the cheapest model to insure is the Mazda CX-5. Average insurance rates for the Nissan Rogue are $2,144 per year, whereas insurance for a Mazda CX-5 averages $1,840 per year.

For the 10 trim levels available for the 2023 Nissan Rogue, the cheapest model to insure is the S 2WD model at an average cost of $2,016 per year, or $168 per month.

Out of the eight trim levels available for the Mazda CX-5, the cheapest 2023 trim level to insure is the 2.5 S trim at a cost of $1,698 per year, or $142 per month.

When insurance prices for all 18 trims of both models are combined and sorted by cost, the overall cheapest vehicle to insure is the Mazda CX-5 2.5 S at an average of $1,698 per year, and the most expensive model and trim level is the Nissan Rogue Platinum AWD at an average of $2,238 per year.

The next table ranks the annual and monthly car insurance cost for 2023 Nissan Rogue and Mazda CX-5 models, with average cost for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| CX-5 2.5 S | $1,698 | $142 |

| CX-5 2.5 S Select | $1,754 | $146 |

| CX-5 2.5 S Preferred | $1,782 | $149 |

| CX-5 2.5 S Carbon Edition | $1,816 | $151 |

| CX-5 2.5 S Premium | $1,858 | $155 |

| CX-5 2.5 S Premium Plus | $1,906 | $159 |

| CX-5 2.5 Turbo | $1,928 | $161 |

| CX-5 2.5 Turbo Signature | $1,968 | $164 |

| Rogue S 2WD | $2,016 | $168 |

| Rogue S AWD | $2,058 | $172 |

| Rogue SV 2WD | $2,066 | $172 |

| Rogue SV AWD | $2,106 | $176 |

| Rogue Midnight Edition 2WD | $2,160 | $180 |

| Rogue SL 2WD | $2,176 | $181 |

| Rogue Midnight Edition AWD | $2,198 | $183 |

| Rogue SL AWD | $2,204 | $184 |

| Rogue Platinum 2WD | $2,210 | $184 |

| Rogue Platinum AWD | $2,238 | $187 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

The rate chart below shows the average cost to insure both 2023 models rated for multiple driver ages. Insurance cost ranges from $1,904 to $4,316 per year for a 2023 Nissan Rogue, and $1,618 to $3,644 for a 2023 Mazda CX-5 for the illustrated age groups.

The next two rate tables show trim level insurance cost averages for both 2023 models, plus the average rate for each model.

2023 Nissan Rogue

$2,144

| 2023 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $2,016 |

| S AWD | 2,058 |

| SV 2WD | 2,066 |

| SV AWD | 2,106 |

| Midnight Edition 2WD | 2,160 |

| SL 2WD | 2,176 |

| Midnight Edition AWD | 2,198 |

| SL AWD | 2,204 |

| Platinum 2WD | 2,210 |

| Platinum AWD | 2,238 |

| 2023 Nissan Rogue Average Rate | $2,144 |

2023 Mazda CX-5

$1,840

| 2023 Mazda CX-5 Trims | Rate |

|---|---|

| 2.5 S | $1,698 |

| 2.5 S Select | 1,754 |

| 2.5 S Preferred | 1,782 |

| 2.5 S Carbon Edition | 1,816 |

| 2.5 S Premium | 1,858 |

| 2.5 S Premium Plus | 1,906 |

| 2.5 Turbo | 1,928 |

| 2.5 Turbo Signature | 1,968 |

| 2023 Mazda CX-5 Average Rate | $1,840 |

2022 Nissan Rogue vs. Mazda CX-5

Car insurance for a 2022 Nissan Rogue averages $2,142 per year, whereas insurance for a Mazda CX-5 costs an average of $1,668 per year, making the Mazda CX-5 the cheaper option by $474 per year.

Average insurance rates for the Rogue range from the cheapest price of $1,972 per year for the S 2WD model up to the highest rate of $2,308 for the Platinum AWD model. For the 2022 Mazda CX-5, rates range from $1,520 per year for the S model up to $1,770 on the S Preferred model.

The next table compares the annual and monthly car insurance cost for 2022 Nissan Rogue and Mazda CX-5 models, showing average premium cost for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| CX-5 S | $1,520 | $127 |

| CX-5 S Select | $1,576 | $131 |

| CX-5 S Carbon Edition | $1,636 | $136 |

| CX-5 S Premium | $1,662 | $139 |

| CX-5 S Premium Plus | $1,690 | $141 |

| CX-5 Turbo | $1,730 | $144 |

| CX-5 Turbo Signature | $1,756 | $146 |

| CX-5 S Preferred | $1,770 | $148 |

| Rogue S 2WD | $1,972 | $164 |

| Rogue S AWD | $2,040 | $170 |

| Rogue SV 2WD | $2,052 | $171 |

| Rogue SV AWD | $2,106 | $176 |

| Rogue SL 2WD | $2,174 | $181 |

| Rogue SL AWD | $2,240 | $187 |

| Rogue Platinum 2WD | $2,248 | $187 |

| Rogue Platinum AWD | $2,308 | $192 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

The following chart illustrates the average car insurance cost for both models for drivers aged 20 to 50. Average full-coverage insurance ranges from $1,902 to $4,324 per year on a 2022 Nissan Rogue, and $1,470 to $3,302 on the 2022 Mazda CX-5 for the driver ages used.

For the eight trims available for the 2022 Nissan Rogue, the cheapest trim level to insure is the S 2WD trim at an average cost of $1,972 per year, or about $164 per month.

For the eight different trim levels available for a Mazda CX-5, the cheapest 2022 model to insure is the S model at a cost of $1,520 per year, or about $127 per month.

When all 16 trims of both models are combined and compared, the lowest-cost model and trim level to insure is the Mazda CX-5 S at a cost of $1,520 per year. The most expensive trim is the Nissan Rogue Platinum AWD at a cost of $2,308 per year.

The next two tables illustrate average car insurance cost by trim level for each 2022 model, including an overall average cost for each model. The 2022 Mazda CX-5 has cheaper average auto insurance rates than the 2022 Nissan Rogue.

2022 Nissan Rogue

$2,142

| 2022 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,972 |

| S AWD | 2,040 |

| SV 2WD | 2,052 |

| SV AWD | 2,106 |

| SL 2WD | 2,174 |

| SL AWD | 2,240 |

| Platinum 2WD | 2,248 |

| Platinum AWD | 2,308 |

| 2022 Nissan Rogue Average Rate | $2,142 |

2022 Mazda CX-5

$1,668

| 2022 Mazda CX-5 Trims | Rate |

|---|---|

| S | $1,520 |

| S Select | 1,576 |

| S Carbon Edition | 1,636 |

| S Premium | 1,662 |

| S Premium Plus | 1,690 |

| Turbo | 1,730 |

| Turbo Signature | 1,756 |

| S Preferred | 1,770 |

| 2022 Mazda CX-5 Average Rate | $1,668 |

2021 Nissan Rogue vs. Mazda CX-5

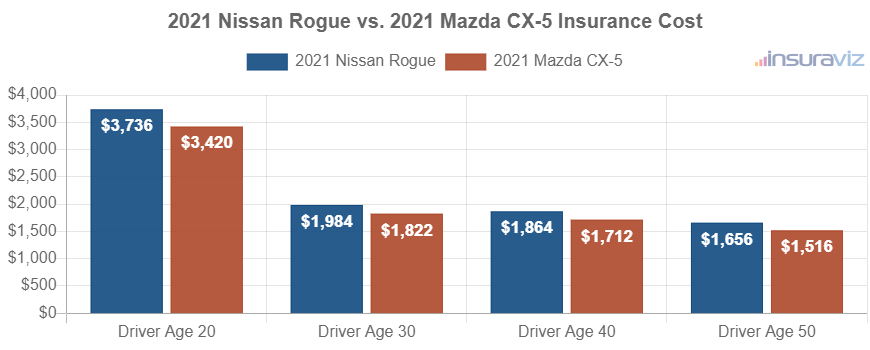

When comparing insurance rates for 2021 models, a Nissan Rogue costs an average of $1,910 per year to insure and a Mazda CX-5 costs $1,752, making the Mazda CX-5 more affordable to insure by $158 per year.

The next chart displays the average cost to insure the two models for four different driver age groups. The average full-coverage insurance policy ranges from $1,696 to $3,824 per year for the 2021 Nissan Rogue, and $1,554 to $3,504 on a 2021 Mazda CX-5 for the five different driver ages shown in the chart.

A 2021 Nissan Rogue has eight trims available, with the cheapest trim to insure being the S 2WD model at an average cost of $1,784 per year.

The 2021 Mazda CX-5 has eight different trims available, with the lowest-cost trim level to insure being the Sport 2WD trim at an average cost of $1,596 per year, or $133 per month.

When looking at the combined rates by trim level for both models, the cheapest model and trim level to put coverage on is the Mazda CX-5 Sport 2WD at a cost of $1,596 per year, and the highest-cost model and trim level is the Nissan Rogue SV Sun and Sound AWD costing an average of $1,984 per year.

The tables below break down the expected annual car insurance cost by trim level for both 2021 models, along with an average cost for each model. The model with the cheapest car insurance rates for 2021 is the Mazda CX-5.

2021 Nissan Rogue

$1,910

| 2021 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,784 |

| S AWD | 1,850 |

| SV 2WD | 1,850 |

| SV AWD | 1,850 |

| SL 2WD | 1,984 |

| SL AWD | 1,984 |

| SV Sun and Sound 2WD | 1,984 |

| SV Sun and Sound AWD | 1,984 |

| 2021 Nissan Rogue Average Rate | $1,910 |

2021 Mazda CX-5

$1,752

| 2021 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,596 |

| Sport AWD | 1,660 |

| Touring 2WD | 1,660 |

| Touring AWD | 1,726 |

| Grand Touring 2WD | 1,794 |

| Grand Touring AWD | 1,794 |

| Grand Touring Reserve AWD | 1,860 |

| Signature AWD | 1,926 |

| 2021 Mazda CX-5 Average Rate | $1,752 |

2020 Nissan Rogue vs. Mazda CX-5

When comparing insurance cost for 2020 models, the Nissan Rogue costs $1,852 per year for a full-coverage policy and the Mazda CX-5 costs $1,700, making the Mazda CX-5 the winner by $152.

The chart shown below displays the average car insurance cost for both models rated for different driver ages. For a 2020 Nissan Rogue, average car insurance cost ranges from $1,648 to $3,712 per year for the five driver age examples in the chart. Auto insurance for a 2020 Mazda CX-5 ranges from $1,508 to $3,398 on average per year.

Out of eight Nissan Rogue trims, the cheapest 2020 model to insure is the S 2WD model at an average cost of $1,734 per year. For the eight trim and option levels available for a Mazda CX-5, the lowest-cost 2020 model to insure is the Sport 2WD trim at a cost of $1,550.

When comparing car insurance rates for both models by trim level, the cheapest vehicle to insure is the Mazda CX-5 Sport 2WD at an average of $1,550 per year. The most expensive vehicle to insure is the Nissan Rogue SV Sun and Sound AWD at an average cost of $1,924 per year.

The tables below detail average car insurance cost by trim level for each 2020 model, along with the average rate for each model. The cheapest to insure for the 2020 model year is the Mazda CX-5.

2020 Nissan Rogue

$1,852

| 2020 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,734 |

| S AWD | 1,796 |

| SV 2WD | 1,796 |

| SV AWD | 1,796 |

| SL 2WD | 1,924 |

| SL AWD | 1,924 |

| SV Sun and Sound 2WD | 1,924 |

| SV Sun and Sound AWD | 1,924 |

| 2020 Nissan Rogue Average Rate | $1,852 |

2020 Mazda CX-5

$1,700

| 2020 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,550 |

| Sport AWD | 1,612 |

| Touring 2WD | 1,612 |

| Touring AWD | 1,676 |

| Grand Touring 2WD | 1,740 |

| Grand Touring AWD | 1,740 |

| Grand Touring Reserve AWD | 1,802 |

| Signature AWD | 1,866 |

| 2020 Mazda CX-5 Average Rate | $1,700 |

2019 Nissan Rogue vs. Mazda CX-5

For the 2019 Nissan Rogue and Mazda CX-5 models, the Mazda CX-5 is cheaper to insure by $20 per year for this comparison year.

The rate chart below demonstrates the average cost to insure both 2019 models using different driver ages. The average cost of full-coverage insurance ranges from $1,610 to $3,618 per year on the 2019 Nissan Rogue, and $1,586 to $3,606 on the 2019 Mazda CX-5 for the illustrated age groups.

For the 16 trim levels available for the 2019 Nissan Rogue, the lowest-cost trim to insure is the Sport S AWD Hatchback trim at an average cost of $1,616 per year, or about $135 per month. For the eight trim levels available for the Mazda CX-5, the most affordable 2019 trim level to insure is the Sport 2WD model at a cost of $1,646.

When rates are compared for the 24 different trims of both 2019 models, the cheapest trim to put coverage on is the Nissan Rogue Sport S AWD Hatchback at an average rate of $1,616 per year. The most expensive vehicle to insure is the Mazda CX-5 Signature AWD at an average cost of $1,950 per year.

The two tables below show trim level insurance cost averages for both 2019 models, along with the average rate for each model. The winner for the 2019 car insurance comparison is the Mazda CX-5.

2019 Nissan Rogue

$1,802

| 2019 Nissan Rogue Trims | Rate |

|---|---|

| Sport S AWD Hatchback | $1,616 |

| Sport S Hatchback | 1,616 |

| Sport SV AWD Hatchback | 1,678 |

| Sport SV Hatchback | 1,678 |

| Sport SL Hatchback | 1,738 |

| S 2WD | 1,764 |

| Sport SL AWD Hatchback | 1,800 |

| S AWD | 1,824 |

| SV 2WD | 1,824 |

| SV AWD | 1,824 |

| SV Hybrid 2WD | 1,824 |

| SV Hybrid AWD | 1,886 |

| SL 2WD | 1,946 |

| SL AWD | 1,946 |

| SL Hybrid 2WD | 1,946 |

| SL Hybrid AWD | 1,946 |

| 2019 Nissan Rogue Average Rate | $1,802 |

2019 Mazda CX-5

$1,782

| 2019 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,646 |

| Sport AWD | 1,646 |

| Touring 2WD | 1,706 |

| Touring AWD | 1,768 |

| Grand Touring 2WD | 1,828 |

| Grand Touring AWD | 1,828 |

| Grand Touring Reserve AWD | 1,890 |

| Signature AWD | 1,950 |

| 2019 Mazda CX-5 Average Rate | $1,782 |

2018 Nissan Rogue vs. Mazda CX-5

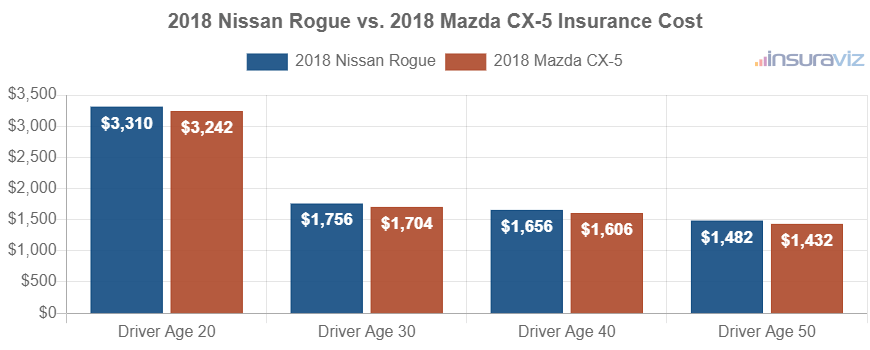

When comparing insurance rates for 2018 models, the Nissan Rogue costs $1,696 per year for full coverage and the Mazda CX-5 costs $1,644, making the Mazda CX-5 the cheaper model by $52.

The rate chart below visualizes the average insurance cost for both models for a range of driver ages. The average cost of car insurance ranges from $1,518 to $3,396 per year for a 2018 Nissan Rogue, and $1,466 to $3,320 on a 2018 Mazda CX-5 for the age groups used in the chart.

Out of 16 Nissan Rogue trim levels, the cheapest 2018 trim level to insure is the Sport S Hatchback trim at an average cost of $1,476 per year, or about $123 per month. The 2018 Mazda CX-5 has six different option levels available, with the lowest-cost trim level to insure being the Sport 2WD trim at an average cost of $1,576 per year, or around $131 per month.

When comparing both models combined at a trim-level basis, the cheapest vehicle to insure is the Nissan Rogue Sport S Hatchback at a cost of $1,476 per year. The highest-cost model and trim level is the Nissan Rogue SL Hybrid AWD costing an average of $1,896 per year.

The tables shown below show average car insurance cost by trim level for each 2018 model, as well as the overall average rate for each model. The winner for the 2018 car insurance rate comparison is the Mazda CX-5.

2018 Nissan Rogue

$1,696

| 2018 Nissan Rogue Trims | Rate |

|---|---|

| Sport S Hatchback | $1,476 |

| Sport S AWD Hatchback | 1,534 |

| Sport SV Hatchback | 1,534 |

| Sport SV AWD Hatchback | 1,588 |

| Sport SL AWD Hatchback | 1,646 |

| Sport SL Hatchback | 1,646 |

| S 2WD | 1,676 |

| SV 2WD | 1,676 |

| S AWD | 1,732 |

| SV AWD | 1,732 |

| SV Hybrid 2WD | 1,732 |

| SV Hybrid AWD | 1,790 |

| SL 2WD | 1,830 |

| SL AWD | 1,834 |

| SL Hybrid 2WD | 1,838 |

| SL Hybrid AWD | 1,896 |

| 2018 Nissan Rogue Average Rate | $1,696 |

2018 Mazda CX-5

$1,644

| 2018 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,576 |

| Sport AWD | 1,576 |

| Touring 2WD | 1,634 |

| Touring AWD | 1,634 |

| Grand Touring 2WD | 1,692 |

| Grand Touring AWD | 1,748 |

| 2018 Mazda CX-5 Average Rate | $1,644 |

2017 Nissan Rogue vs. Mazda CX-5

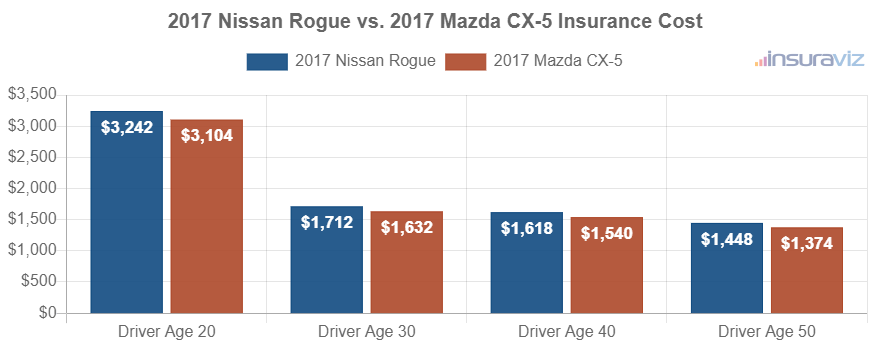

When comparing car insurance rates for the 2017 Nissan Rogue and Mazda CX-5 models, the Mazda CX-5 is cheaper to insure by $82 per year for this model year.

The chart below displays the average car insurance cost for both 2017 models for the 20 to 50-year-old driver age groups. The average car insurance cost ranges from $1,482 to $3,322 per year for the 2017 Nissan Rogue, and $1,408 to $3,178 on the 2017 Mazda CX-5 for the five driver ages sampled in the chart.

Out of 16 trims for the 2017 Nissan Rogue, the most affordable rates are on the Sport S Hatchback trim at a cost of $1,436 per year, or about $120 per month. For the six trim and option levels available for a Mazda CX-5, the lowest-cost 2017 model to insure is the Sport 2WD model at a cost of $1,522.

When trim-level rates for both models are compared, the most affordable model and trim level to insure is the Nissan Rogue Sport S Hatchback at an average cost of $1,436 per year. The highest-cost model and trim level is the Nissan Rogue Hybrid SL AWD costing $1,868 per year.

The rate tables below break down trim level insurance cost averages for both 2017 models, plus the average rate for each model. The cheapest to insure for the 2017 model year is the Mazda CX-5.

2017 Nissan Rogue

$1,658

| 2017 Nissan Rogue Trims | Rate |

|---|---|

| Sport S Hatchback | $1,436 |

| Sport S AWD Hatchback | 1,492 |

| Sport SV Hatchback | 1,492 |

| Sport SV AWD Hatchback | 1,546 |

| S 2WD | 1,576 |

| Sport SL AWD Hatchback | 1,600 |

| Sport SL Hatchback | 1,600 |

| S AWD | 1,632 |

| SV 2WD | 1,658 |

| SV AWD | 1,686 |

| SL 2WD | 1,740 |

| Hybrid SV 2WD | 1,760 |

| Hybrid SV AWD | 1,760 |

| SL AWD | 1,792 |

| Hybrid SL 2WD | 1,868 |

| Hybrid SL AWD | 1,868 |

| 2017 Nissan Rogue Average Rate | $1,658 |

2017 Mazda CX-5

$1,576

| 2017 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,522 |

| Sport AWD | 1,522 |

| Touring 2WD | 1,522 |

| Touring AWD | 1,576 |

| Grand Touring 2WD | 1,630 |

| Grand Touring AWD | 1,682 |

| 2017 Mazda CX-5 Average Rate | $1,576 |

2016 Nissan Rogue vs. Mazda CX-5

When comparing insurance rates for 2016 models, the Nissan Rogue costs an average of $1,556 per year to insure and the Mazda CX-5 costs $1,468, making the Mazda CX-5 the cheaper model to insure by $88 for this comparison year.

The next chart shows the average car insurance cost for both models with different ages of drivers. The average full-coverage insurance policy ranges from $1,398 to $3,114 per year for the 2016 Nissan Rogue, and $1,314 to $2,978 on the 2016 Mazda CX-5 for the illustrated age groups.

Out of six Nissan Rogue trims, the cheapest 2016 model to insure is the S 2WD trim at an average cost of $1,474 per year. Out of the six trims available for the Mazda CX-5, the lowest-cost 2016 model to insure is the Sport 2WD trim at a cost of $1,352 per year, or about $113 per month.

When trim-level rates for both models are compared, the most affordable model and trim level to buy insurance for is the Mazda CX-5 Sport 2WD at a cost of $1,352 per year, and the most expensive model and trim level is the Nissan Rogue SL AWD costing $1,638 per year.

The next two tables break down trim level insurance cost averages for both 2016 models, along with an average cost for each model. The 2016 Mazda CX-5 takes the win over the 2016 Nissan Rogue for cheapest car insurance rates.

2016 Nissan Rogue

$1,556

| 2016 Nissan Rogue Trims | Rate |

|---|---|

| S 2WD | $1,474 |

| S AWD | 1,514 |

| SV 2WD | 1,532 |

| SV AWD | 1,540 |

| SL 2WD | 1,632 |

| SL AWD | 1,638 |

| 2016 Nissan Rogue Average Rate | $1,556 |

2016 Mazda CX-5

$1,468

| 2016 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,352 |

| Sport AWD | 1,452 |

| Touring 2WD | 1,452 |

| Touring AWD | 1,486 |

| Grand Touring 2WD | 1,534 |

| Grand Touring AWD | 1,534 |

| 2016 Mazda CX-5 Average Rate | $1,468 |

2015 Nissan Rogue vs. Mazda CX-5

For 2015 Nissan Rogue and Mazda CX-5 models, the Mazda CX-5 has cheaper car insurance rates by $202 per year for this model year.

The chart shown below shows the average cost to insure both models rated for a variety of different driver ages. For the 2015 Nissan Rogue, average insurance cost ranges from $1,320 to $2,932 per year for the different drivers illustrated in the chart. Auto insurance for the 2015 Mazda CX-5 ranges from $1,128 to $2,534 on average per year.

A 2015 Nissan Rogue has eight trim levels available, with the lowest-cost model to insure being the Select S 2WD trim at an average cost of $1,380 per year, or $115 per month.

For the six option levels available for the Mazda CX-5, the cheapest 2015 trim package to insure is the Sport 2WD model at a cost of $1,168 per year, or about $97 per month.

When looking at the aggregated rates by trim level for both models, the overall cheapest vehicle to put coverage on is the Mazda CX-5 Sport 2WD at an average rate of $1,168 per year, and the most expensive model and trim level is the Nissan Rogue SL AWD at an average of $1,564 per year.

The tables below break down both 2015 models and all trim levels available for each one, as well as an average rate for each model. The 2015 Mazda CX-5 has cheaper overall car insurance rates than the 2015 Nissan Rogue.

2015 Nissan Rogue

$1,466

| 2015 Nissan Rogue Trims | Rate |

|---|---|

| Select S 2WD | $1,380 |

| Select S AWD | 1,380 |

| S 2WD | 1,426 |

| S AWD | 1,472 |

| SV 2WD | 1,472 |

| SV AWD | 1,472 |

| SL 2WD | 1,564 |

| SL AWD | 1,564 |

| 2015 Nissan Rogue Average Rate | $1,466 |

2015 Mazda CX-5

$1,264

| 2015 Mazda CX-5 Trims | Rate |

|---|---|

| Sport 2WD | $1,168 |

| Sport AWD | 1,260 |

| Touring 2WD | 1,260 |

| Grand Touring 2WD | 1,292 |

| Touring AWD | 1,292 |

| Grand Touring AWD | 1,306 |

| 2015 Mazda CX-5 Average Rate | $1,264 |