- A 2024 Toyota Corolla has more affordable car insurance rates than a 2024 Kia Forte by an average of $6 per year, $2,336 compared to $2,342.

- For a 2024 Toyota Corolla, auto insurance rates range from $2,128 to $2,644 per year, while auto insurance for a 2024 Kia Forte ranges from $2,244 to $2,438.

- The Toyota Corolla costs $60 more per year than the average cost to insure a vehicle in the U.S. of $2,276, while the Kia Forte averages $66 more per year.

Is Toyota Corolla or Kia Forte insurance cheaper?

Insurance on a 2024 Toyota Corolla costs an average of $2,336 per year, and insurance for a Kia Forte costs an average of $2,342 per year, making the Toyota Corolla the cheapest to insure.

Out of 12 trims for the 2024 Toyota Corolla, the cheapest average insurance prices are on the LE model at a cost of $2,128 per year, or $177 per month. Out of the five trims available for the Kia Forte, the cheapest 2024 trim level to insure is the LX trim at a cost of $2,244 per year, or $187 per month.

When rates for all 17 trim levels for both vehicles are compared, the lowest-cost model and trim is the Toyota Corolla LE at a cost of $2,128 per year. The overall most expensive vehicle to insure is the Toyota Corolla XSE Hatchback at a cost of $2,644 per year.

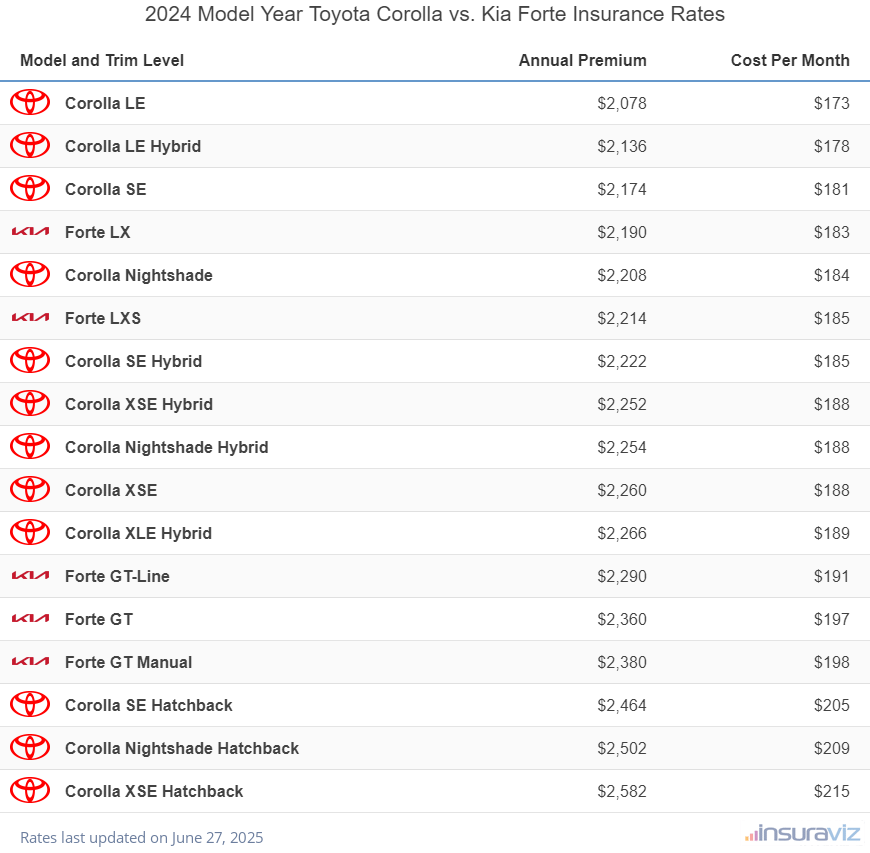

The table below compares and ranks the annual and monthly cost of car insurance for 2024 Toyota Corolla and Kia Forte models, with average rates for every trim level for each model.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Corolla LE | $2,128 | $177 |

| Corolla LE Hybrid | $2,188 | $182 |

| Corolla SE | $2,226 | $186 |

| Forte LX | $2,244 | $187 |

| Corolla Nightshade | $2,262 | $189 |

| Forte LXS | $2,266 | $189 |

| Corolla SE Hybrid | $2,276 | $190 |

| Corolla XSE Hybrid | $2,306 | $192 |

| Corolla Nightshade Hybrid | $2,308 | $192 |

| Corolla XSE | $2,314 | $193 |

| Corolla XLE Hybrid | $2,320 | $193 |

| Forte GT-Line | $2,346 | $196 |

| Forte GT | $2,418 | $202 |

| Forte GT Manual | $2,438 | $203 |

| Corolla SE Hatchback | $2,524 | $210 |

| Corolla Nightshade Hatchback | $2,562 | $214 |

| Corolla XSE Hatchback | $2,644 | $220 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

The chart below demonstrates the average cost to insure both models using different driver ages. For a 2024 Toyota Corolla, the average cost of car insurance ranges from $2,082 to $4,674 per year for the included driver ages. A 2024 Kia Forte costs from $2,092 to $4,616 to insure per year.

The tables shown below illustrate average car insurance cost by trim level for each 2024 model, as well as an average rate for each model. The 2024 Toyota Corolla has more affordable average car insurance than the 2024 Kia Forte.

2024 Toyota Corolla

$2,336

| 2024 Toyota Corolla Trims | Rate |

|---|---|

| LE | $2,128 |

| LE Hybrid | 2,188 |

| SE | 2,226 |

| Nightshade | 2,262 |

| SE Hybrid | 2,276 |

| XSE Hybrid | 2,306 |

| Nightshade Hybrid | 2,308 |

| XSE | 2,314 |

| XLE Hybrid | 2,320 |

| SE Hatchback | 2,524 |

| Nightshade Hatchback | 2,562 |

| XSE Hatchback | 2,644 |

| 2024 Toyota Corolla Average Rate | $2,336 |

2024 Kia Forte

$2,342

| 2024 Kia Forte Trims | Rate |

|---|---|

| LX | $2,244 |

| LXS | 2,266 |

| GT-Line | 2,346 |

| GT | 2,418 |

| GT Manual | 2,438 |

| 2024 Kia Forte Average Rate | $2,342 |

2023 Toyota Corolla vs. Kia Forte

For 2023 models, the model having cheaper average car insurance is the Toyota Corolla. Insurance rates on a Toyota Corolla cost an average of $2,186 per year, whereas insurance for a Kia Forte costs an average of $2,286 per year.

For the eight trims available for the 2023 Toyota Corolla, the cheapest trim level to insure is the LE trim at an average cost of $2,076 per year, or $173 per month. The 2023 Kia Forte has five trim levels available, with the cheapest trim to insure being the LX trim at an average cost of $2,192 per year.

When rates are compared for the 13 trim levels of both 2023 models, the cheapest model and trim level to insure is the Toyota Corolla LE at an average rate of $2,076 per year. The most expensive vehicle to insure is the Kia Forte GT Manual at an average cost of $2,382 per year.

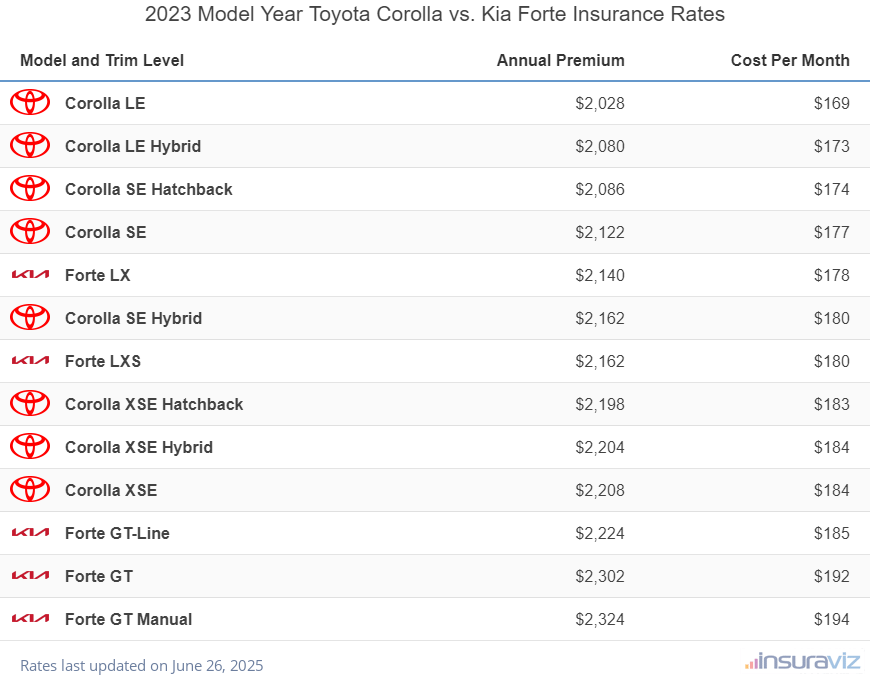

The table shown below ranks the 12-month and monthly car insurance cost for 2023 Toyota Corolla and Kia Forte models, with average rates for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Corolla LE | $2,076 | $173 |

| Corolla LE Hybrid | $2,128 | $177 |

| Corolla SE Hatchback | $2,134 | $178 |

| Corolla SE | $2,170 | $181 |

| Forte LX | $2,192 | $183 |

| Corolla SE Hybrid | $2,214 | $185 |

| Forte LXS | $2,214 | $185 |

| Corolla XSE Hatchback | $2,250 | $188 |

| Corolla XSE Hybrid | $2,256 | $188 |

| Corolla XSE | $2,262 | $189 |

| Forte GT-Line | $2,280 | $190 |

| Forte GT | $2,358 | $197 |

| Forte GT Manual | $2,382 | $199 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

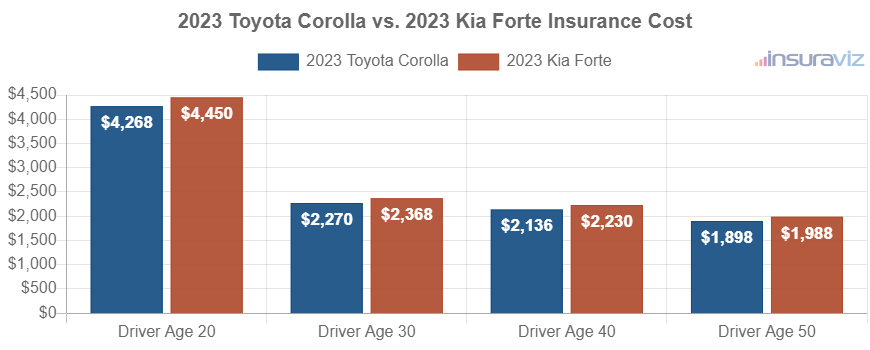

The chart shown below displays the average cost to insure both models for the 20, 30, 40, and 50-year-old driver age groups. The average car insurance cost ranges from $1,944 to $4,372 per year for a 2023 Toyota Corolla, and $2,036 to $4,560 for a 2023 Kia Forte for the included driver ages.

The next two tables display trim level insurance cost averages for both 2023 models, as well as an average rate for each model. The model with the cheapest average car insurance rates for 2023 is the Toyota Corolla.

2023 Toyota Corolla

$2,186

| 2023 Toyota Corolla Trims | Rate |

|---|---|

| LE | $2,076 |

| LE Hybrid | 2,128 |

| SE Hatchback | 2,134 |

| SE | 2,170 |

| SE Hybrid | 2,214 |

| XSE Hatchback | 2,250 |

| XSE Hybrid | 2,256 |

| XSE | 2,262 |

| 2023 Toyota Corolla Average Rate | $2,186 |

2023 Kia Forte

$2,286

| 2023 Kia Forte Trims | Rate |

|---|---|

| LX | $2,192 |

| LXS | 2,214 |

| GT-Line | 2,280 |

| GT | 2,358 |

| GT Manual | 2,382 |

| 2023 Kia Forte Average Rate | $2,286 |

2022 Toyota Corolla vs. Kia Forte

When comparing the Toyota Corolla and Kia Forte for the 2022 model year, the cheapest to insure is the Toyota Corolla. Insurance rates for the Toyota Corolla average $2,148 per year, and the Kia Forte averages $2,238 per year.

Vehicle trim level is a factor in determining how much you’ll pay, and the Corolla ranges from $2,046 per year for the L model up to $2,252 for the XSE Apex Edition model.

For the 2022 Kia Forte, rates range from $2,142 per year on the FE model up to $2,324 for the most expensive GT model.

The rate table below ranks the cost of car insurance for 2022 Toyota Corolla and Kia Forte models, with average rates for each trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Corolla L | $2,046 | $171 |

| Corolla LE | $2,062 | $172 |

| Corolla SE Hatchback | $2,106 | $176 |

| Corolla SE | $2,122 | $177 |

| Corolla SE Nightshade Edition Hatchback | $2,134 | $178 |

| Corolla SE Nightshade Edition | $2,142 | $179 |

| Forte FE | $2,142 | $179 |

| Corolla LE Hybrid | $2,156 | $180 |

| Corolla XLE | $2,174 | $181 |

| Corolla XSE Hatchback | $2,184 | $182 |

| Forte LXS | $2,190 | $183 |

| Corolla SE Apex Edition | $2,194 | $183 |

| Corolla XSE | $2,208 | $184 |

| Corolla XSE Apex Edition | $2,252 | $188 |

| Forte GT-Line | $2,256 | $188 |

| Forte GT Manual | $2,276 | $190 |

| Forte GT | $2,324 | $194 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

The chart shown below shows the average insurance cost for both 2022 models with different drivers at the wheel. For a 2022 Toyota Corolla, the average cost of car insurance ranges from $1,930 to $4,282 per year for the different drivers illustrated in the chart. Car insurance on a 2022 Kia Forte costs from $1,996 to $4,490 on average per year.

Out of 12 trims for a 2022 Toyota Corolla, the most affordable insurance prices are on the L model at a cost of $2,046 per year, or around $171 per month.

For the five trim and option levels available for the Kia Forte, the lowest-cost 2022 trim to insure is the FE trim at a cost of $2,142.

When comparing both models combined at a trim-level basis, the lowest-cost model and trim level to put coverage on is the Toyota Corolla L at a cost of $2,046 per year, and the most expensive vehicle to insure is the Kia Forte GT at an average of $2,324 per year.

The tables shown below detail the cost to insure the available trim levels for both 2022 models, along with an average cost for each model. The model with the cheapest car insurance rates for 2022 is the Toyota Corolla.

2022 Toyota Corolla

$2,148

| 2022 Toyota Corolla Trims | Rate |

|---|---|

| L | $2,046 |

| LE | 2,062 |

| SE Hatchback | 2,106 |

| SE | 2,122 |

| SE Nightshade Edition Hatchback | 2,134 |

| SE Nightshade Edition | 2,142 |

| LE Hybrid | 2,156 |

| XLE | 2,174 |

| XSE Hatchback | 2,184 |

| SE Apex Edition | 2,194 |

| XSE | 2,208 |

| XSE Apex Edition | 2,252 |

| 2022 Toyota Corolla Average Rate | $2,148 |

2022 Kia Forte

$2,238

| 2022 Kia Forte Trims | Rate |

|---|---|

| FE | $2,142 |

| LXS | 2,190 |

| GT-Line | 2,256 |

| GT Manual | 2,276 |

| GT | 2,324 |

| 2022 Kia Forte Average Rate | $2,238 |

2021 Toyota Corolla vs. Kia Forte

A 2021 Toyota Corolla costs $244 less per year to insure per year on average than a 2021 Kia Forte, a difference of 12.9%.

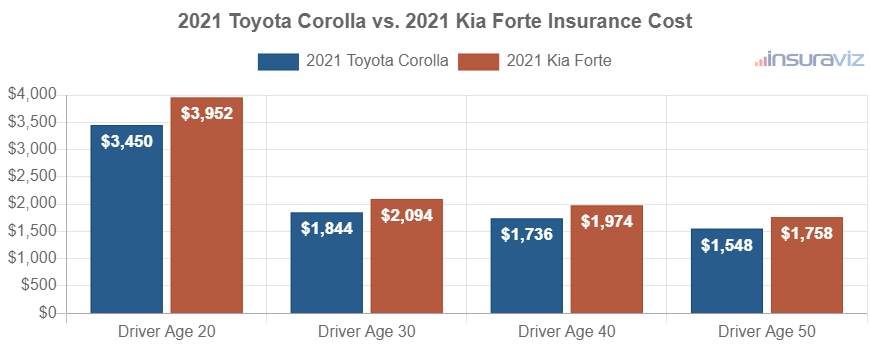

The rate chart below visualizes the average car insurance cost for both 2021 models for the 20, 30, 40, and 50-year-old driver age groups. Average car insurance cost ranges from $1,586 to $3,536 per year for a 2021 Toyota Corolla, and $1,798 to $4,050 on the 2021 Kia Forte.

For the 12 trims available for the 2021 Toyota Corolla, the cheapest trim to insure is the iM SE Hatchback trim at an average cost of $1,680 per year, or about $140 per month.

Out of the five different trim levels available for the Kia Forte, the lowest-cost 2021 trim to insure is the FE Sedan trim at a cost of $1,930 per year, or $161 per month.

When rates are compared for the 17 option levels of both 2021 models, the cheapest vehicle to insure is the Toyota Corolla iM SE Hatchback at an average cost of $1,680 per year. The most expensive trim is the Kia Forte GT Sedan at a cost of $2,108 per year.

The tables below show average car insurance cost by trim level for each 2021 model, including an overall average rate.

2021 Toyota Corolla

$1,776

| 2021 Toyota Corolla Trims | Rate |

|---|---|

| iM SE Hatchback | $1,680 |

| L Hatchback | 1,692 |

| L Sedan | 1,692 |

| LE Sedan | 1,724 |

| LE Premium Hatchback | 1,758 |

| Hybrid LE Sedan | 1,778 |

| SE Sedan | 1,778 |

| iM XSE Hatchback | 1,778 |

| SE Premium Hatchback | 1,844 |

| XLE Sedan | 1,844 |

| XSE Sedan | 1,844 |

| XLE Hatchback | 1,910 |

| 2021 Toyota Corolla Average Rate | $1,776 |

2021 Kia Forte

$2,020

| 2021 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,930 |

| LXS Sedan | 1,976 |

| EX Sedan | 2,044 |

| GT-Line Sedan | 2,044 |

| GT Sedan | 2,108 |

| 2021 Kia Forte Average Rate | $2,020 |

2020 Toyota Corolla vs. Kia Forte

When comparing car insurance rates for 2020 models, a Toyota Corolla costs an average of $1,730 per year to insure and a Kia Forte costs $1,964, making the Toyota Corolla cheaper to insure by $234 per year for this model year.

The next chart visualizes the average cost to insure the two models using different driver ages. Insurance cost ranges from $1,544 to $3,446 per year on a 2020 Toyota Corolla, and $1,748 to $3,938 on a 2020 Kia Forte for the different drivers illustrated in the chart.

Out of 12 trims for the 2020 Toyota Corolla, the most affordable rates are on the L Hatchback model at a cost of $1,646 per year.

For the five option levels available for the Kia Forte, the lowest-cost 2020 trim package to insure is the FE Sedan trim at a cost of $1,876.

When looking at the combined rates by trim for both models, the most affordable model and trim level to put coverage on is the Toyota Corolla L Hatchback at a cost of $1,646 per year. The highest-cost model and trim level is the Kia Forte GT Sedan at an average of $2,048 per year.

The tables below display all the available trims for both 2020 models, including the average rate for each model. The 2020 Toyota Corolla has more affordable average car insurance rates than the 2020 Kia Forte.

2020 Toyota Corolla

$1,730

| 2020 Toyota Corolla Trims | Rate |

|---|---|

| L Hatchback | $1,646 |

| L Sedan | 1,646 |

| iM SE Hatchback | 1,652 |

| LE Sedan | 1,676 |

| LE Premium Hatchback | 1,708 |

| Hybrid LE Sedan | 1,726 |

| SE Sedan | 1,726 |

| iM XSE Hatchback | 1,758 |

| SE Premium Hatchback | 1,790 |

| XLE Sedan | 1,790 |

| XSE Sedan | 1,790 |

| XLE Hatchback | 1,858 |

| 2020 Toyota Corolla Average Rate | $1,730 |

2020 Kia Forte

$1,964

| 2020 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,876 |

| LXS Sedan | 1,920 |

| EX Sedan | 1,986 |

| GT-Line Sedan | 1,986 |

| GT Sedan | 2,048 |

| 2020 Kia Forte Average Rate | $1,964 |

2019 Toyota Corolla vs. Kia Forte

When comparing insurance rates for 2019 models, a Toyota Corolla costs an average of $1,590 per year to insure and a Kia Forte costs $1,908, making the Toyota Corolla cheaper to insure by $318 per year.

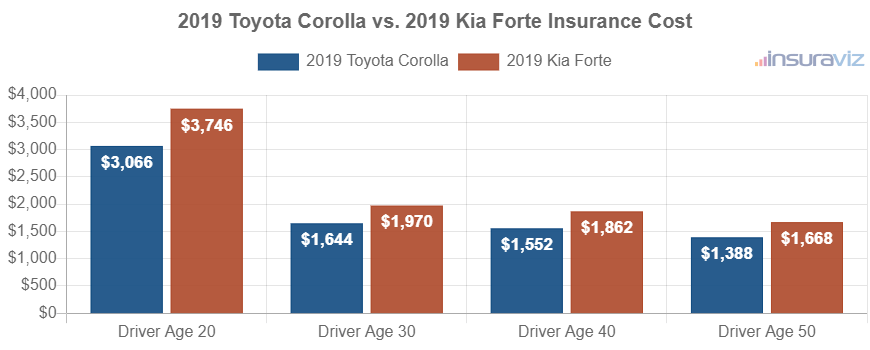

The next chart demonstrates the average insurance cost for both models using different driver ages. The average cost of full-coverage insurance ranges from $1,422 to $3,140 per year for the 2019 Toyota Corolla, and $1,710 to $3,838 for the 2019 Kia Forte for the driver examples in the chart.

For the 12 trim levels available for a 2019 Toyota Corolla, the cheapest trim level to insure is the L Hatchback model at an average cost of $1,552 per year.

The 2019 Kia Forte has four trims available, with the most affordable trim to insure being the FE Sedan trim at an average cost of $1,830 per year.

When rates are compared for the 16 trim levels of both 2019 models, the cheapest trim to buy insurance for is the Toyota Corolla L Hatchback at an average of $1,552 per year, and the most expensive model and trim level is the Kia Forte EX Sedan at an average of $1,964 per year.

The next two tables show trim level insurance rates for each 2019 model, including an overall average cost for each model. The model with the cheapest overall car insurance cost for 2019 is the Toyota Corolla.

2019 Toyota Corolla

$1,590

| 2019 Toyota Corolla Trims | Rate |

|---|---|

| L Hatchback | $1,552 |

| L Sedan | 1,552 |

| LE EcoHatchback | 1,552 |

| LE EcoSedan | 1,552 |

| LE Hatchback | 1,552 |

| LE Sedan | 1,552 |

| SE Hatchback | 1,614 |

| SE Sedan | 1,614 |

| XLE Hatchback | 1,632 |

| XLE Sedan | 1,632 |

| XSE Hatchback | 1,632 |

| XSE Sedan | 1,632 |

| 2019 Toyota Corolla Average Rate | $1,590 |

Be sure to see our comprehensive 2019 Toyota Corolla insurance cost article.

2019 Kia Forte

$1,908

| 2019 Kia Forte Trims | Rate |

|---|---|

| FE Sedan | $1,830 |

| LX Sedan | 1,912 |

| S Sedan | 1,930 |

| EX Sedan | 1,964 |

| 2019 Kia Forte Average Rate | $1,908 |

2018 Toyota Corolla vs. Kia Forte

When comparing average insurance cost for 2018 models, the Toyota Corolla costs an average of $1,922 per year to insure and the Kia Forte costs $2,124, making the Toyota Corolla the cheaper model to insure by $202 for this model year.

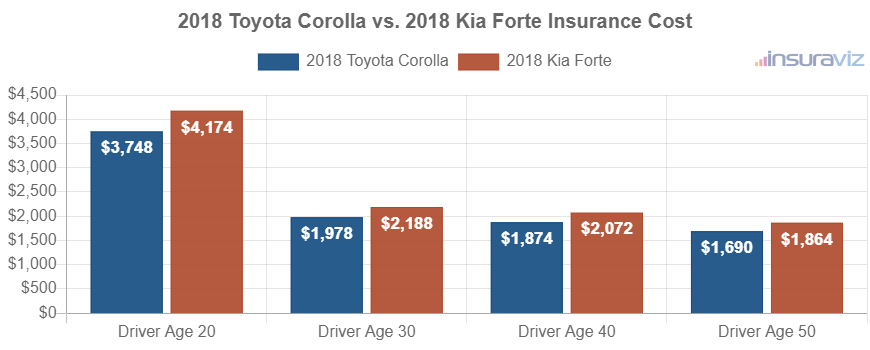

The chart below demonstrates the average cost to insure both models rated for multiple driver ages. For the 2018 Toyota Corolla, insurance cost ranges from $1,730 to $3,840 per year. Insurance on the 2018 Kia Forte ranges from $1,910 to $4,278 on average per year.

Out of six trims for a 2018 Toyota Corolla, the most affordable auto insurance rates are on the L Sedan model at a cost of $1,884 per year. Out of the seven trim and option levels available for a Kia Forte, the cheapest 2018 model to insure is the S Sedan trim at a cost of $1,760.

When insurance prices for all 13 trims of both models are combined and sorted by cost, the cheapest vehicle to put coverage on is the Kia Forte S Sedan at an average of $1,760 per year. The most expensive trim is the Kia Forte Forte5 SX Hatchback at an average of $2,336 per year.

The next two rate tables illustrate average car insurance rates for every trim level for both 2018 models, plus the average rate for each model. The model with the cheapest auto insurance rates for 2018 is the Toyota Corolla.

2018 Toyota Corolla

$1,922

| 2018 Toyota Corolla Trims | Rate |

|---|---|

| L Sedan | $1,884 |

| LE EcoSedan | 1,884 |

| LE Sedan | 1,884 |

| SE Sedan | 1,938 |

| XLE Sedan | 1,938 |

| XSE Sedan | 1,996 |

| 2018 Toyota Corolla Average Rate | $1,922 |

2018 Kia Forte

$2,124

| 2018 Kia Forte Trims | Rate |

|---|---|

| S Sedan | $1,760 |

| LX Sedan | 2,028 |

| Forte5 LX Hatchback | 2,124 |

| EX Sedan | 2,182 |

| SX Sedan | 2,182 |

| Forte5 EX Hatchback | 2,240 |

| Forte5 SX Hatchback | 2,336 |

| 2018 Kia Forte Average Rate | $2,124 |

2017 Toyota Corolla vs. Kia Forte

When comparing average insurance rates for 2017 models, a Toyota Corolla costs an average of $1,868 per year to insure and a Kia Forte costs $2,060, making the Toyota Corolla cheaper to insure by $192 per year for 2017.

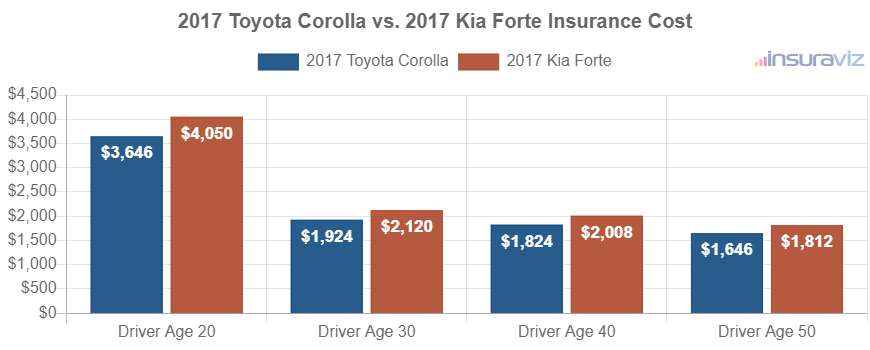

The chart below displays the average car insurance cost for both models using drivers aged 20 to 50. For the 2017 Toyota Corolla, average car insurance cost ranges from $1,684 to $3,734 per year. Auto insurance on a 2017 Kia Forte costs from $1,856 to $4,150 on average per year.

A 2017 Toyota Corolla has seven trim levels available, with the cheapest model to insure being the L Sedan trim at an average cost of $1,828 per year. Out of the six different trim levels available for a Kia Forte, the cheapest 2017 model to insure is the S Sedan trim at a cost of $1,896 per year, or about $158 per month.

When comparing combined rates for both models from a trim-level perspective, the most affordable model and trim level to insure is the Toyota Corolla L Sedan at an average cost of $1,828 per year. The most expensive trim is the Kia Forte SX Hatchback costing $2,168 per year.

The tables below display average car insurance cost by trim level for each 2017 model, including the average rate for each model.

2017 Toyota Corolla

$1,868

| 2017 Toyota Corolla Trims | Rate |

|---|---|

| L Sedan | $1,828 |

| LE EcoSedan | 1,828 |

| LE Sedan | 1,828 |

| 50th Anniversary Special Edition Sedan | 1,880 |

| SE Sedan | 1,888 |

| XLE Sedan | 1,900 |

| XSE Sedan | 1,934 |

| 2017 Toyota Corolla Average Rate | $1,868 |

2017 Kia Forte

$2,060

| 2017 Kia Forte Trims | Rate |

|---|---|

| S Sedan | $1,896 |

| LX Sedan | 2,000 |

| LX Hatchback | 2,062 |

| EX Hatchback | 2,116 |

| EX Sedan | 2,116 |

| SX Hatchback | 2,168 |

| 2017 Kia Forte Average Rate | $2,060 |

2016 Toyota Corolla vs. Kia Forte

A 2016 Toyota Corolla is $96 cheaper to insure per year on average than a 2016 Kia Forte, a difference of 5.6%.

The next chart demonstrates the average insurance cost for the two models for the 20, 30, 40, and 50-year-old driver age groups. For a 2016 Toyota Corolla, insurance cost ranges from $1,502 to $3,312 per year for the driver ages used. Auto insurance for a 2016 Kia Forte ranges from $1,592 to $3,550 on average per year.

Out of 11 Toyota Corolla trim levels, the most affordable 2016 model to insure is the L Sedan model at an average cost of $1,594 per year, or about $133 per month.

The 2016 Kia Forte has seven trim options available, with the lowest-cost trim to insure being the LX Sedan model at an average cost of $1,652 per year.

When rates for all 18 trim levels for both 2016 models are compared, the overall cheapest vehicle to insure is the Toyota Corolla L Sedan at a cost of $1,594 per year, and the overall most expensive vehicle to insure is the Kia Forte SX Hatchback at an average cost of $1,848 per year.

The two tables below break down trim level insurance rates for each 2016 model, plus an average rate for each model. The 2016 Toyota Corolla has more affordable average car insurance than the 2016 Kia Forte.

2016 Toyota Corolla

$1,670

| 2016 Toyota Corolla Trims | Rate |

|---|---|

| L Sedan | $1,594 |

| LE EcoPlus Sedan | 1,644 |

| LE EcoSedan | 1,644 |

| LE Plus Sedan | 1,644 |

| LE Sedan | 1,644 |

| S Plus Sedan | 1,644 |

| S Sedan | 1,644 |

| Special Edition Sedan | 1,694 |

| S Premium Sedan | 1,726 |

| LE EcoPremium Sedan | 1,734 |

| LE Premium Sedan | 1,744 |

| 2016 Toyota Corolla Average Rate | $1,670 |

2016 Kia Forte

$1,766

| 2016 Kia Forte Trims | Rate |

|---|---|

| LX Sedan | $1,652 |

| EX Coupe | 1,682 |

| SX Coupe | 1,732 |

| EX Sedan | 1,800 |

| LX Hatchback | 1,800 |

| EX Hatchback | 1,848 |

| SX Hatchback | 1,848 |

| 2016 Kia Forte Average Rate | $1,766 |

2015 Toyota Corolla vs. Kia Forte

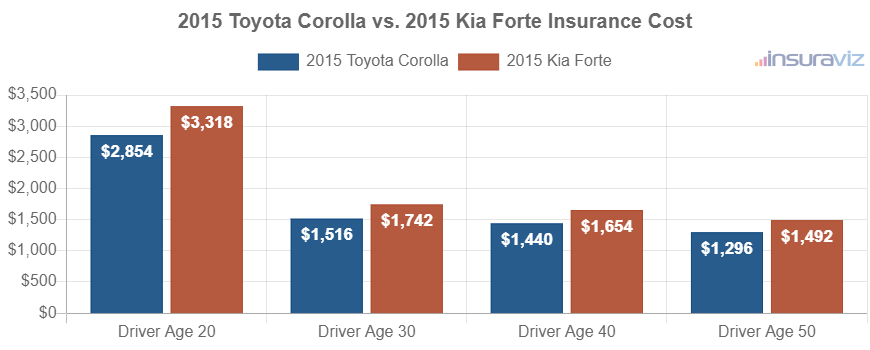

When comparing average insurance rates for 2015 models, a Toyota Corolla costs an average of $1,472 per year to insure and a Kia Forte costs $1,692, making the Toyota Corolla cheaper to insure by $220 per year.

The chart shown below visualizes the average cost to insure both models rated for a variety of different driver ages. The average full-coverage insurance policy ranges from $1,328 to $2,926 per year for the 2015 Toyota Corolla, and $1,528 to $3,400 for the 2015 Kia Forte for the five different driver ages shown in the chart.

Out of 10 Toyota Corolla trims, the most affordable 2015 trim to insure is the L Sedan trim at an average cost of $1,410 per year, or about $118 per month.

Out of the five different option levels available for a Kia Forte, the most affordable 2015 trim level to insure is the EX Coupe trim at a cost of $1,636 per year, or about $136 per month.

When car insurance rates for all 15 trim levels for both 2015 models are compared, the lowest-cost model and trim to buy insurance for is the Toyota Corolla L Sedan at an average of $1,410 per year, and the highest-cost model and trim level is the Kia Forte EX Hatchback at a cost of $1,774 per year.

The two tables below display both 2015 models and all trim levels available for each one, including an overall average cost for each model.

2015 Toyota Corolla

$1,472

| 2015 Toyota Corolla Trims | Rate |

|---|---|

| L Sedan | $1,410 |

| LE EcoPlus Sedan | 1,454 |

| LE EcoSedan | 1,454 |

| LE Plus Sedan | 1,454 |

| LE Sedan | 1,454 |

| S Plus Sedan | 1,454 |

| S Sedan | 1,454 |

| LE Premium Sedan | 1,502 |

| LE EcoPremium Sedan | 1,540 |

| S Premium Sedan | 1,540 |

| 2015 Toyota Corolla Average Rate | $1,472 |

2015 Kia Forte

$1,692

| 2015 Kia Forte Trims | Rate |

|---|---|

| EX Coupe | $1,636 |

| LX Sedan | 1,650 |

| SX Coupe | 1,682 |

| EX Sedan | 1,726 |

| EX Hatchback | 1,774 |

| 2015 Kia Forte Average Rate | $1,692 |