If you think the current auto insurance policy on your Toyota Corolla is getting out of control, or you are just shopping around for affordable coverage for that perfect low-mileage used 2019 Corolla, we encourage you to look over a few of the rates and comparisons shown below.

This article primarily covers the cost difference between Corolla insurance rates and the rest of the compact car segment, but it also helps illustrate how things like the trim level of your Corolla, where you live, and your credit score can impact the rate you pay.

The rates in this article are updated very frequently, but to see real-time prices, don’t hesitate to get some free insurance quotes. There is no obligation and you may end up saving some money!

What to expect when insuring a 2019 Corolla

The average policyholder can plan on paying in the ballpark of $1,258 a year for a full coverage policy to insure a 2019 Toyota Corolla.

This average rate assumes a forty-year-old male driver with a clean driving record, but rates can vary substantially based on a ton of factors.

A few of these factors are driver age, the risk profile of the driver, and the deductibles on your policy.

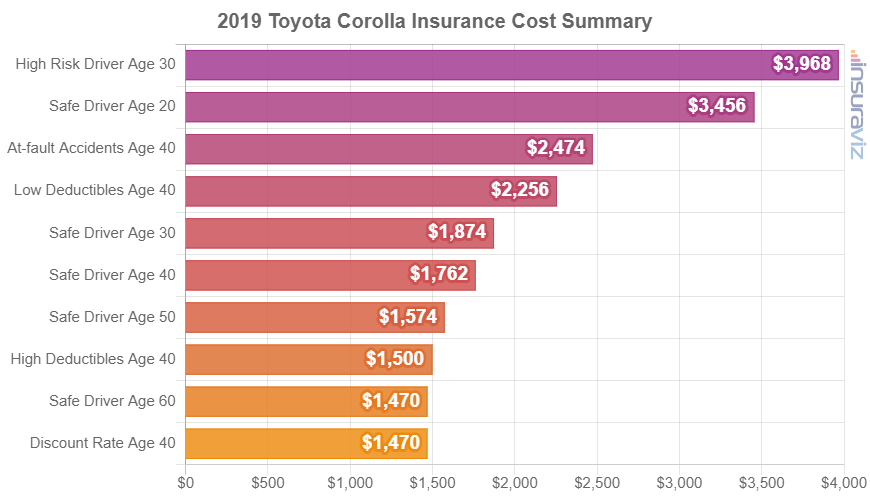

The cost summary chart below shows how much these factors can influence car insurance rates for a 2019 Toyota Corolla.

The average rate of $1,258 is the ‘Safe Driver Age 40’ bar in the chart. Rates are higher for younger drivers, as illustrated by the ‘Safe Driver Age 30’ and ‘Safe Driver Age 20’ bars, which are both more expensive than the average rate.

High deductibles make your policy cost less, which is illustrated by the ‘High Deductibles Age 40’ bar. Conversely, lowering your physical damage deductible raises the cost of your policy, as shown by the ‘Low Deductibles Age 40’ bar.

Higher-risk drivers, like those with at-fault accidents, DUIs, or speeding tickets, pay higher car insurance rates. The ‘At-fault Accidents Age 40’ bar and the ‘High Risk Driver Age 30’ bar illustrate how much more these drivers could pay than the average rate.

Lastly, the ‘Discount Rate Age 40’ bar in the chart shows how much policy discounts can cut the cost of insurance. The example driver qualifies for safe driver, multi-policy, multi-vehicle, and claim-free discounts, which add up to a significant savings.

2019 Toyota Corolla insurance rates by trim level

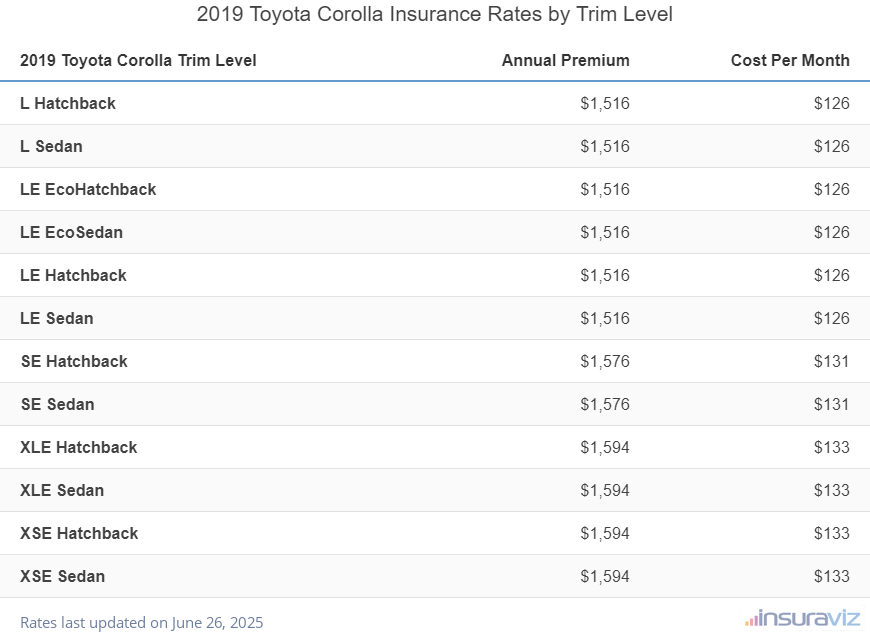

One of the rate-determining factors mentioned earlier is the actual trim level of the Corolla you’re insuring. As you add options and packages to a vehicle, the purchase price increases. As a result, the cost of insuring the vehicle generally increases as well.

The table below displays the average insurance cost for all 2019 Toyota Corolla models. Average prices are shown for both annual and semi-annual policy terms, as well as the monthly budget expense amount.

| 2019 Toyota Corolla Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| L Hatchback | $1,228 | $102 |

| L Sedan | $1,228 | $102 |

| LE EcoHatchback | $1,228 | $102 |

| LE EcoSedan | $1,228 | $102 |

| LE Hatchback | $1,228 | $102 |

| LE Sedan | $1,228 | $102 |

| SE Hatchback | $1,276 | $106 |

| SE Sedan | $1,276 | $106 |

| XLE Hatchback | $1,290 | $108 |

| XLE Sedan | $1,290 | $108 |

| XSE Hatchback | $1,290 | $108 |

| XSE Sedan | $1,290 | $108 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

The cheapest 2019 Corolla model to insure is the L Hatchback trim, at the average price of $1,228 per year, while the model with the most expensive insurance rates is the XSE Sedan at $1,290 per year.

When talking about young or higher-risk drivers, the cost difference can range even more.

As an example, when insuring a nineteen-year-old driver, rates on a 2019 Corolla can vary by $158.

2019 Toyota Corolla insurance versus the competition

When shopping for a different vehicle, it’s useful to know how the cost of insurance for each model will impact your budget.

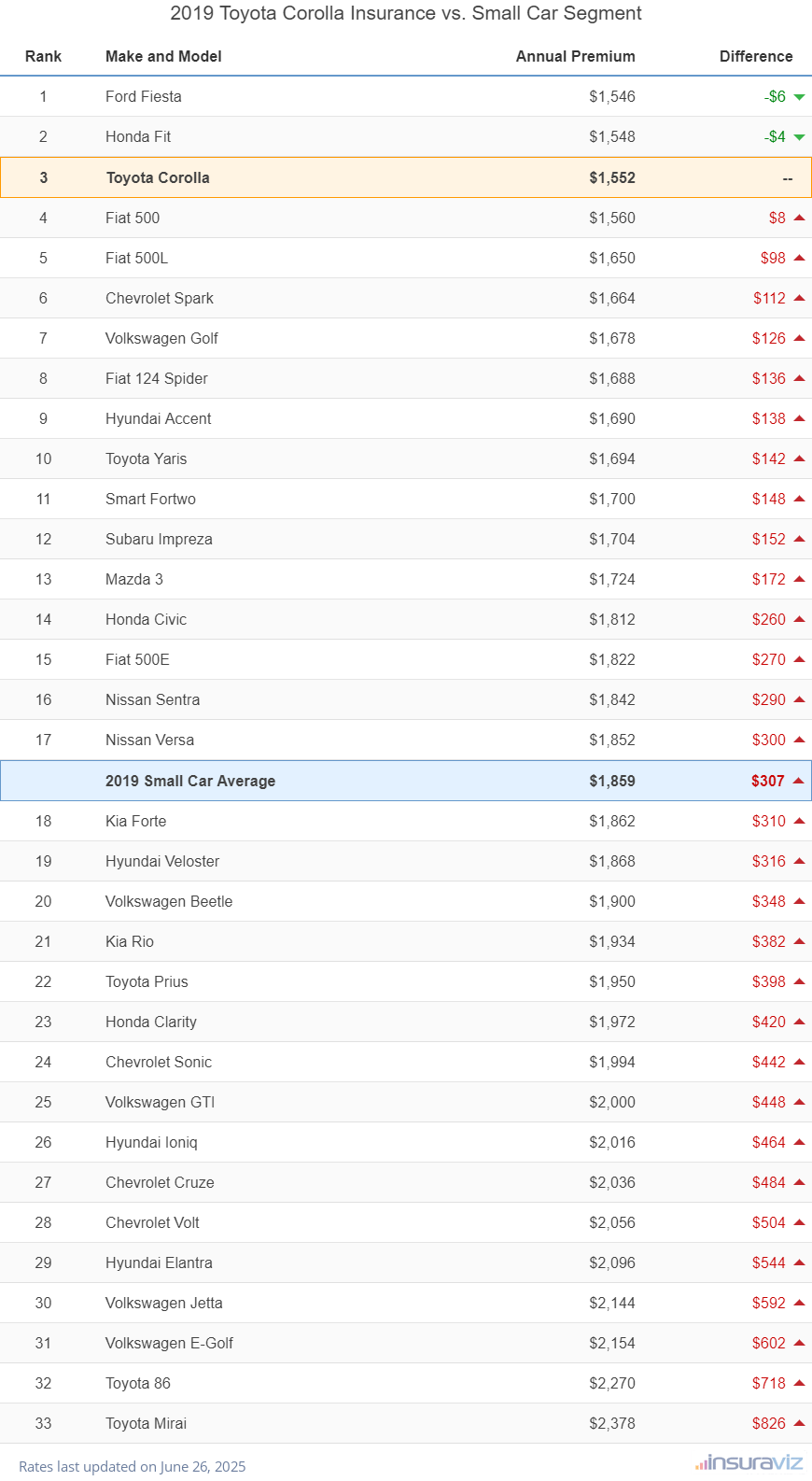

The 2019 Toyota Corolla is a great choice for cheap car insurance, as it ranks third out of 33 total comparison vehicles in the 2019 compact car segment for most affordable insurance prices.

The segment average policy cost is $1,506, while the Corolla costs an average of $1,258 per year, making the Corolla $248 cheaper than the segment average cost.

Now as we discussed in the previous section, it’s important to compare insurance costs for the exact trim levels of the vehicles you’re considering purchasing.

For example, even though the Corolla ranks third in the segment overall, the XSE Sedan trim level costs around $1,290 per year to insure. But if you’re also considering a Volkswagen Golf, the ALLTrack S 4Motion Station Wagon trim level costs around $1,244 per year, which is actually cheaper to insure than the top-level Corolla.

So that’s why it’s important to factor in the trim level of your vehicle when comparing car insurance rates. Average rates are great to an extent, but for exact figures, you need to consider the trim level as well.

The following table breaks down how average Corolla auto insurance cost compares to all other vehicles in the 2019 model year small car category. The Toyota Corolla rate is displayed in light orange and the segment average rate is shaded in light blue.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Ford Fiesta | $1,250 | -$8 |

| 2 | Honda Fit | $1,254 | -$4 |

| 3 | Toyota Corolla | $1,258 | -- |

| 4 | Fiat 500 | $1,264 | $6 |

| 5 | Fiat 500L | $1,336 | $78 |

| 6 | Chevrolet Spark | $1,348 | $90 |

| 7 | Volkswagen Golf | $1,358 | $100 |

| 8 | Fiat 124 Spider | $1,364 | $106 |

| 9 | Toyota Yaris | $1,366 | $108 |

| 10 | Hyundai Accent | $1,368 | $110 |

| 11 | Smart Fortwo | $1,372 | $114 |

| 12 | Subaru Impreza | $1,380 | $122 |

| 13 | Mazda 3 | $1,396 | $138 |

| 14 | Honda Civic | $1,472 | $214 |

| 15 | Fiat 500E | $1,474 | $216 |

| 16 | Nissan Sentra | $1,490 | $232 |

| 17 | Nissan Versa | $1,504 | $246 |

| 2019 Small Car Average | $1,506 | $248 | |

| 18 | Kia Forte | $1,508 | $250 |

| 19 | Hyundai Veloster | $1,512 | $254 |

| 20 | Volkswagen Beetle | $1,538 | $280 |

| 21 | Toyota Prius | $1,580 | $322 |

| 22 | Kia Rio | $1,584 | $326 |

| 23 | Honda Clarity | $1,598 | $340 |

| 24 | Chevrolet Sonic | $1,616 | $358 |

| 25 | Volkswagen GTI | $1,618 | $360 |

| 26 | Hyundai Ioniq | $1,634 | $376 |

| 27 | Chevrolet Cruze | $1,650 | $392 |

| 28 | Chevrolet Volt | $1,664 | $406 |

| 29 | Hyundai Elantra | $1,698 | $440 |

| 30 | Volkswagen Jetta | $1,736 | $478 |

| 31 | Volkswagen E-Golf | $1,742 | $484 |

| 32 | Toyota 86 | $1,836 | $578 |

| 33 | Toyota Mirai | $1,928 | $670 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each model. Updated February 22, 2024

As shown in the table above, the ‘Difference’ column specifies how much more or less the average rate is for each model when compared to the rate for the Toyota Corolla. Any green amounts indicate a less expensive rate for that particular model, while any visible red values indicate a higher rate.

As a quick example, the Volkswagen Jetta ranks 30th in the table and has an average rate of $1,736 per year. If you compare this rate to the Toyota Corolla, which has an average cost to insure of $1,258, the cost of the Volkswagen Jetta costs $478 more per year, so the color of the value is red.

The Toyota Corolla was the first car to use white reversing lights that every model now uses today.

Rates in larger U.S. cities

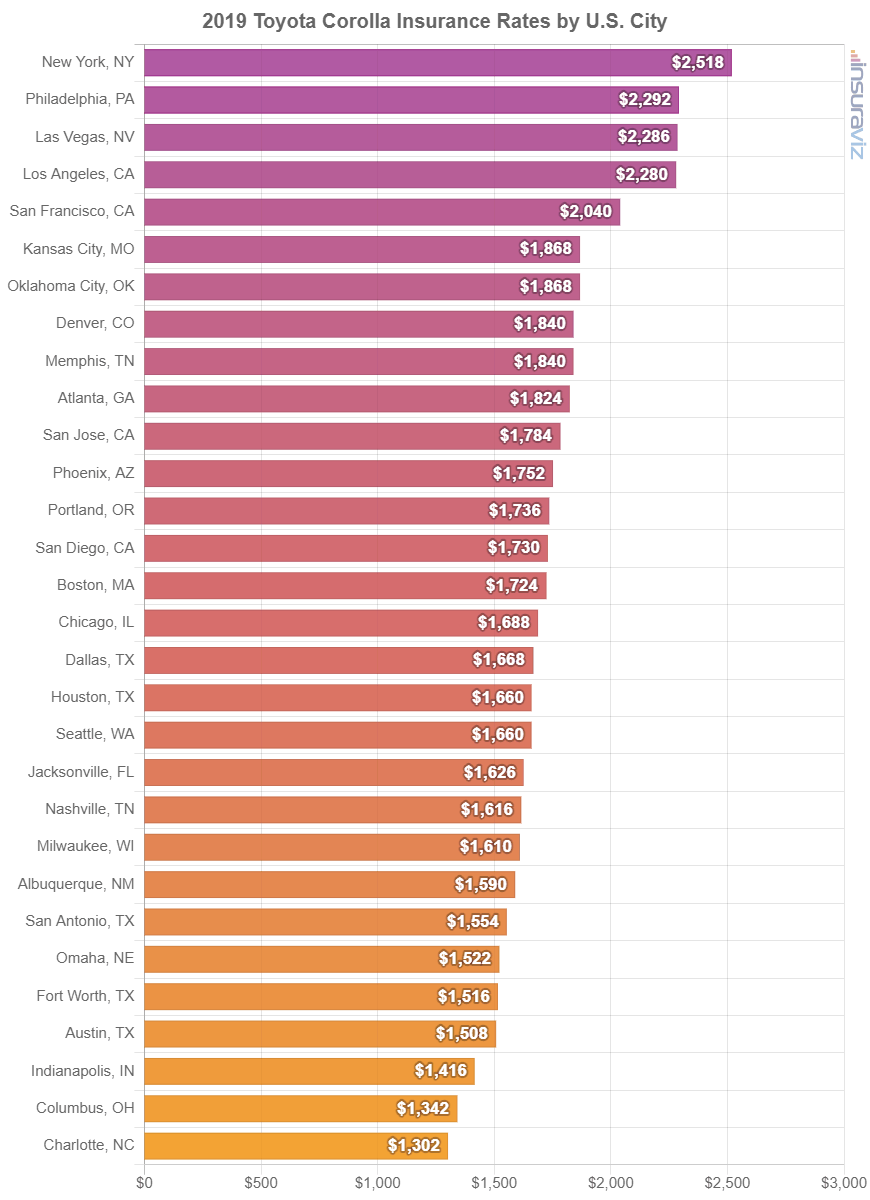

A significant factor that many people don’t realize the extent to which it affects car insurance rates is the city you live in.

Even within each city, there can be many different rates just depending on the neighborhood you live in. If you live in an area with low vehicle thefts and vandalism, then you’ll probably pay a lower rate than if you lived in an area that statistically has higher vehicle theft rates.

The chart below breaks out average car insurance rates for a 2019 Toyota Corolla in 35 of the largest metro areas in America.

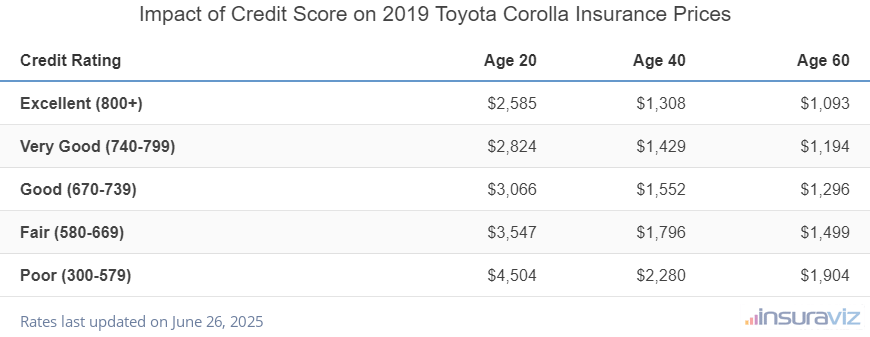

How does your credit score affect insurance rates?

Most car insurance companies take your credit score into consideration when determining rates. Not every state permits this, but the large majority do.

Credit-based insurance scores simply mean that your past credit decisions like how high of a balance you carry on your credit cards, if you’ve ever filed bankruptcy, or if you’re late on payments, will factor into your car insurance premium.

Why do insurers use credit scores as a factor in car insurance? Research has shown a correlation between the frequency of claims and driver credit levels. People with higher (better) credit scores tend to file fewer claims than people with lower credit scores.

Whether it’s a good or bad practice, insurance companies use any data they can in an attempt to forecast whether a particular driver profile will be an acceptable risk. The more accurately they can predict future claims, the more accurately they can set car insurance rates.

The table below shows how different credit levels can potentially impact the cost you pay to insure your 2019 Corolla.

| Credit Rating | Age 20 | Age 40 | Age 60 |

|---|---|---|---|

| Excellent (800+) | $2,096 | $1,060 | $885 |

| Very Good (740-799) | $2,290 | $1,159 | $967 |

| Good (670-739) | $2,486 | $1,258 | $1,050 |

| Fair (580-669) | $2,876 | $1,456 | $1,215 |

| Poor (300-579) | $3,652 | $1,848 | $1,542 |

Data Methodology: Rated drivers have no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all 2019 Toyota Corolla trim levels. Updated February 23, 2024

If your credit level isn’t great, there are things you can do to improve it, and hopefully, lower your car insurance rates a tad in the process.

The easiest way to improve your credit is to pay your bills on time, every time. Late payments are a big red flag on your credit report.

If you have a wallet full of credit cards, eliminate the ones you do not use frequently. Having too much credit extended can negatively impact your credit rating. Try to limit your credit cards to a maximum of three or four.

Also, don’t max out your credit cards. Keep your balances below thirty percent of your available credit. A maxed-out card is also a red flag.

If you don’t know your credit score, you can always get a free credit report from each of the three credit reporting agencies: Experian, Equifax, and TransUnion. But you don’t have to get three individual reports, since you can just go to annualcreditreport.com and get a free copy of your credit report.

There is tons of consumer information regarding your rights and what you can do to improve your credit on the FTC website as well.

Many insurance companies offer discounts if you are over a certain age and take a defensive driving course. The savings can range from five to ten percent, which is $63 to $126 per year for a 2019 Toyota Corolla.