- Nissan Titan XD car insurance rates average $2,654 per year (about $221 per month) for full coverage, depending on driver age.

- The cheapest Titan XD model to insure is the SV Crew Cab 4WD trim at an estimated $2,530 per year.

- The Titan XD Platinum Reserve Crew Cab 4WD is the most expensive to insure at $2,778 per year.

- When compared to other heavy duty trucks, the Nissan Titan XD is one of the cheaper heavy duty trucks to insure, costing $105 less per year on average.

How much does Nissan Titan XD insurance cost?

Nissan Titan XD insurance averages around $2,654 annually, or around $221 on a monthly basis. On average, expect to pay around $105 less each year to insure a Nissan Titan XD as compared to the average rate for heavy duty trucks, and $378 more per year than the all-vehicle national average of $2,276.

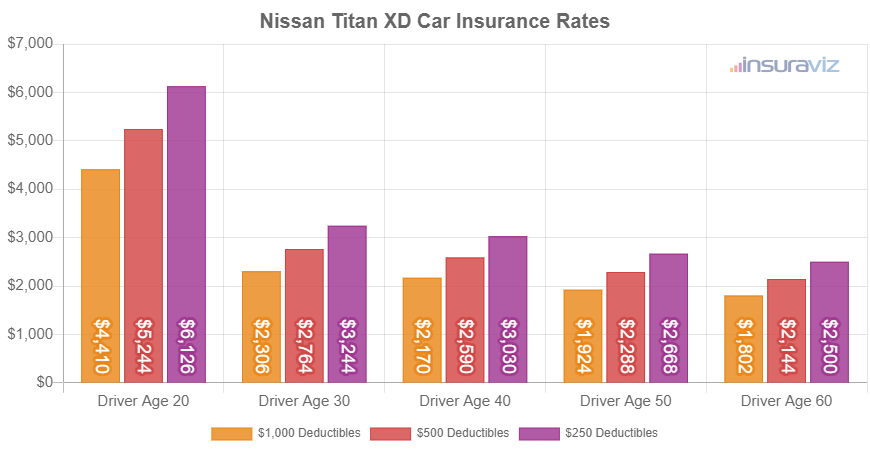

The rate summary chart below details how Titan XD auto insurance rates can be different with changes in the rated driver age and the deductibles for comprehensive and collision coverage.

The data below details average Nissan Titan XD insurance policy costs from the 2016 to the 2024 model years and for different driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Nissan Titan XD | $5,374 | $2,654 | $2,196 |

| 2023 Nissan Titan XD | $5,288 | $2,606 | $2,158 |

| 2022 Nissan Titan XD | $4,990 | $2,458 | $2,046 |

| 2021 Nissan Titan XD | $4,936 | $2,416 | $2,012 |

| 2020 Nissan Titan XD | $4,796 | $2,348 | $1,956 |

| 2019 Nissan Titan XD | $4,680 | $2,286 | $1,906 |

| 2018 Nissan Titan XD | $4,544 | $2,224 | $1,856 |

| 2017 Nissan Titan XD | $4,210 | $2,070 | $1,726 |

| 2016 Nissan Titan XD | $3,942 | $1,942 | $1,616 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Nissan Titan XD trim levels for each model year. Updated October 24, 2025

The rate table below displays the estimated annual and 6-month policy costs, plus a monthly amount for budgeting, for each 2024 Nissan Titan XD model package and trim level.

| 2024 Nissan Titan XD Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SV Crew Cab 4WD | $2,530 | $211 |

| PRO-4X Crew Cab 4WD | $2,652 | $221 |

| Platinum Reserve Crew Cab 4WD | $2,778 | $232 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How do Titan XD insurance rates compare?

When compared to other heavy duty trucks, average insurance prices for a Nissan Titan XD cost $22 more per year than the Chevrolet Silverado HD 2500, $408 less than the Ram Truck 2500, and $112 more than the GMC Sierra 3500.

The Nissan Titan XD ranks fifth out of 10 total comparison vehicles in the 2024 model year heavy duty truck category for auto insurance affordability. The Titan XD costs an average of $2,654 per year to insure for full coverage and the class average cost is $2,759 annually, a difference of $105 per year.

The next table shows how average Nissan Titan XD car insurance rates compare to the rest of the heavy-duty truck segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | GMC Sierra 2500 HD | $2,440 | -$214 |

| 2 | GMC Sierra 3500 | $2,542 | -$112 |

| 3 | Chevrolet Silverado HD 3500 | $2,564 | -$90 |

| 4 | Chevrolet Silverado HD 2500 | $2,632 | -$22 |

| 5 | Nissan Titan XD | $2,654 | -- |

| 6 | Ford F450 Super Duty | $2,868 | $214 |

| 7 | Ford F250 Super Duty | $2,884 | $230 |

| 8 | Ford F350 Super Duty | $2,904 | $250 |

| 9 | Ram Truck 3500 | $3,036 | $382 |

| 10 | Ram Truck 2500 | $3,062 | $408 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Additional rates and observations

With car insurance rates having so many variables that determine cost, it’s difficult to present all possible scenarios that can affect the rate you’ll pay. The list below contains some additional situations that could impact your rates, plus some ways to potentially cut the cost.

- Insurance for teenage drivers is expensive. Average rates for full coverage Titan XD insurance costs $9,482 per year for a 16-year-old driver, $9,208 per year for a 17-year-old driver, $8,287 per year for an 18-year-old driver, and $7,525 per year for a 19-year-old driver.

- High-risk drivers pay a lot more for insurance. For a 40-year-old driver, having a high frequency of accidents or violations can potentially increase rates by $3,242 or more per year.

- As you get older, Nissan Titan XD car insurance rates tend to be cheaper. The difference in insurance cost for a Nissan Titan XD between a 60-year-old driver ($2,196 per year) and a 20-year-old driver ($5,374 per year) is $3,178, or a savings of 84%.

- Cheaper rates come with better credit scores. Having a high credit score of 800+ could save around $417 per year when compared to a credit rating between 670-739. Conversely, a weaker credit score below 579 could cost as much as $483 more per year.

- Get better rates due to your employment. The vast majority of insurance companies offer discounts for working in professions like architects, emergency medical technicians, scientists, dentists, accountants, firefighters, and others. If you can get this discount applied to your policy, you could save between $80 and $233 on your annual insurance bill, depending on the policy coverages.

- Research discounts to lower the cost. Discounts may be available if the insureds take a defensive driving course, insure their home and car with the same company, choose electronic billing, are military or federal employees, drive low annual mileage, or many other discounts which could save the average driver as much as $454 per year.

- Safer drivers pay lower rates. Having at-fault accidents will cost you more, possibly as much as $3,826 per year for a 20-year-old driver and as much as $648 per year for a 60-year-old driver.