- When comparing 2022 models (Avalon production ended with the 2022 model), a Toyota Avalon has cheaper car insurance rates than a Nissan Maxima by an average of $144 per year.

- Out of four models in the 2022 large car segment, the Nissan Maxima ranks third and the Toyota Avalon ranks first for insurance affordability.

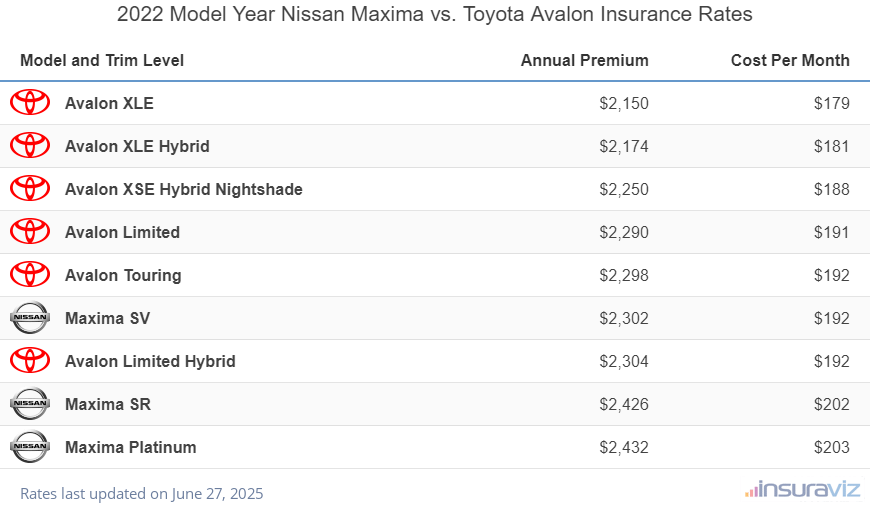

- If the cheapest insurance payments are a high priority, the SV and SR trims are the cheapest Nissan Maxima models to insure, while the XLE and XLE Hybrid trims are the cheapest Toyota Avalon models to insure.

Is a Nissan Maxima or Toyota Avalon cheaper to insure?

For 2022, the model having cheaper average car insurance is the Toyota Avalon. Insurance rates on a Nissan Maxima cost an average of $2,442 per year, while insurance for the Toyota Avalon costs an average of $2,298 per year.

Within each model, however, the cost of car insurance varies greatly for different trim levels. For a 2022 Nissan Maxima, average insurance rates range from $2,356 per year for the SV model up to $2,490 for the Platinum model. For a 2022 Toyota Avalon, rates can range from $2,200 per year for the XLE model up to $2,358 for the most expensive to insure Limited Hybrid model.

When comparing both models at a trim-level basis, the cheapest model and trim level is the Toyota Avalon XLE at an average of $2,200 per year, and the most expensive model and trim level is the Nissan Maxima Platinum costing $2,490 per year.

For a 2022 Nissan Maxima, the cheapest models are the SV, SR, and Platinum. The cheapest Toyota Avalon models include the XLE, XLE Hybrid, and XSE Hybrid Nightshade. From a monthly standpoint, insurance rates for all 2022 Nissan Maxima and Toyota Avalon models and trims range from $183 to $208 per month.

For pre-2022 models, average insurance premiums for a Maxima and an Avalon compare as shown below. Click any model year to view the full comparison data.

- Cheapest 2021 Model – Toyota Avalon ($2,328 vs. Nissan Maxima at $2,412)

- Cheapest 2020 Model – Toyota Avalon ($2,260 vs. Nissan Maxima at $2,338)

- Cheapest 2019 Model – Toyota Avalon ($2,048 vs. Nissan Maxima at $2,294)

- Cheapest 2018 Model – Toyota Avalon ($1,922 vs. Nissan Maxima at $2,192)

- Cheapest 2017 Model – Toyota Avalon ($1,848 vs. Nissan Maxima at $2,078)

- Cheapest 2016 Model – Toyota Avalon ($1,722 vs. Nissan Maxima at $1,992)

The rate table below compares the annual and monthly car insurance cost for 2022 Nissan Maxima and Toyota Avalon models, with average rates for every trim level for each model.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Avalon XLE | $2,200 | $183 |

| Avalon XLE Hybrid | $2,226 | $186 |

| Avalon XSE Hybrid Nightshade | $2,304 | $192 |

| Avalon Limited | $2,344 | $195 |

| Avalon Touring | $2,352 | $196 |

| Maxima SV | $2,356 | $196 |

| Avalon Limited Hybrid | $2,358 | $197 |

| Maxima SR | $2,484 | $207 |

| Maxima Platinum | $2,490 | $208 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

The bar chart below shows how average Nissan Maxima insurance rates compare to average Toyota Avalon insurance rates for the 2022 model year.

The tables below detail insurance rates for all trim levels of 2022 Maxima and Avalon models. The 2022 Nissan Maxima has an average insurance cost of $2,442 and the 2022 Toyota Avalon is $2,298, making the Toyota Avalon cheaper by $144 per year.

2022 Nissan Maxima

$2,442

| 2022 Nissan Maxima Trims | Rate |

|---|---|

| SV | $2,356 |

| SR | 2,484 |

| Platinum | 2,490 |

| 2022 Nissan Maxima Average Rate | $2,442 |

2022 Toyota Avalon

$2,298

| 2022 Toyota Avalon Trims | Rate |

|---|---|

| XLE | $2,200 |

| XLE Hybrid | 2,226 |

| XSE Hybrid Nightshade | 2,304 |

| Limited | 2,344 |

| Touring | 2,352 |

| Limited Hybrid | 2,358 |

| 2022 Toyota Avalon Average Rate | $2,298 |

2021 Nissan Maxima vs Toyota Avalon

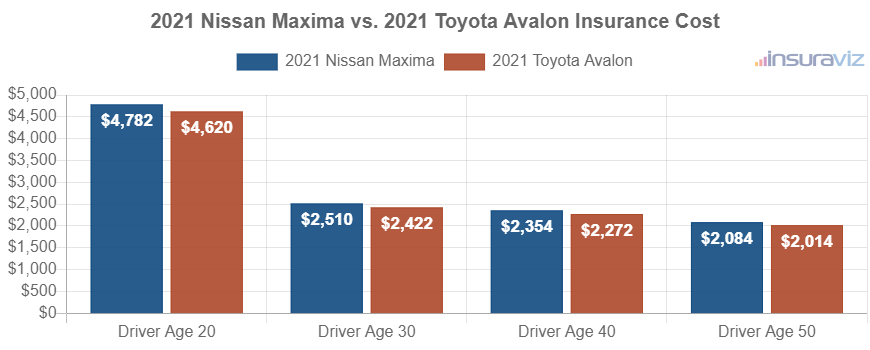

When comparing insurance cost for 2021 models, the Nissan Maxima costs an average of $2,412 per year to insure and the Toyota Avalon costs $2,328, making the Toyota Avalon the winner by $84 for this model year.

The rate chart below visualizes the average cost to insure both 2021 models for drivers aged 20 to 50. The average cost of car insurance ranges from $2,134 to $4,898 per year for a 2021 Nissan Maxima, and $2,064 to $4,732 for a 2021 Toyota Avalon for the age groups used in this illustration.

The 2021 Nissan Maxima has five trims available, with the cheapest trim to insure being the 3.5 S Sedan trim at an average cost of $2,314 per year, or about $193 per month. Out of the seven trims available for the Toyota Avalon, the cheapest 2021 trim level to insure is the XLE Sedan 6 Cyl Gas trim at a cost of $2,162 per year, or about $180 per month.

When comparing car insurance rates for both models by trim level, the overall cheapest vehicle to insure is the Toyota Avalon XLE Sedan 6 Cyl Gas at an average cost of $2,162 per year. The most expensive model and trim level is the Nissan Maxima Platinum Sedan at an average cost of $2,492 per year.

The two tables below illustrate trim level insurance rates for each 2021 model, including the average rate for each model. The cheapest model to insure for the 2021 model year is the Toyota Avalon.

2021 Nissan Maxima

$2,412

| 2021 Nissan Maxima Trims | Rate |

|---|---|

| 3.5 S Sedan | $2,314 |

| 3.5 SL Sedan | 2,380 |

| 3.5 SV Sedan | 2,380 |

| 3.5 SR Sedan | 2,492 |

| Platinum Sedan | 2,492 |

| 2021 Nissan Maxima Average Rate | $2,412 |

2021 Toyota Avalon

$2,328

| 2021 Toyota Avalon Trims | Rate |

|---|---|

| XLE Sedan 6 Cyl Gas | $2,162 |

| Limited Sedan 6 Cyl Gas | 2,294 |

| Touring Sedan 6 Cyl Gas | 2,294 |

| XSE Sedan 6 Cyl Gas | 2,314 |

| Hybrid XLE Sedan HEV | 2,360 |

| Hybrid Limited Sedan HEV | 2,426 |

| Hybrid XSE Sedan HEV | 2,444 |

| 2021 Toyota Avalon Average Rate | $2,328 |

2020 Nissan Maxima vs Toyota Avalon

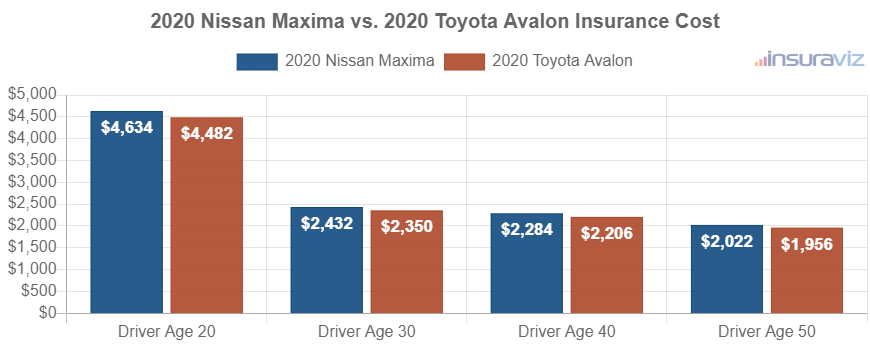

For 2020 Nissan Maxima and Toyota Avalon models, the Toyota Avalon is cheaper to insure by an average of $78 per year.

The chart shown below demonstrates the average cost to insure both models with different driver age groups. Average insurance cost ranges from $2,070 to $4,750 per year for a 2020 Nissan Maxima, and $2,002 to $4,590 for a 2020 Toyota Avalon for the example age groups.

For the five trims available for the 2020 Nissan Maxima, the cheapest model to insure is the 3.5 S Sedan model at an average cost of $2,246 per year, or around $187 per month. The 2020 Toyota Avalon has seven trim levels available, with the cheapest model to insure being the XLE Sedan 6 Cyl Gas model at an average cost of $2,098 per year.

When comparing rates by trim level for both models, the cheapest model and trim level to insure is the Toyota Avalon XLE Sedan 6 Cyl Gas at an average cost of $2,098 per year, and the most expensive trim is the Nissan Maxima Platinum Sedan at an average cost of $2,416 per year.

The next tables show trim level insurance rates for each 2020 model, including an overall average rate. The 2020 Toyota Avalon defeats the 2020 Nissan Maxima for cheapest auto insurance rates.

2020 Nissan Maxima

$2,338

| 2020 Nissan Maxima Trims | Rate |

|---|---|

| 3.5 S Sedan | $2,246 |

| 3.5 SL Sedan | 2,308 |

| 3.5 SV Sedan | 2,308 |

| 3.5 SR Sedan | 2,416 |

| Platinum Sedan | 2,416 |

| 2020 Nissan Maxima Average Rate | $2,338 |

2020 Toyota Avalon

$2,260

| 2020 Toyota Avalon Trims | Rate |

|---|---|

| XLE Sedan 6 Cyl Gas | $2,098 |

| Limited Sedan 6 Cyl Gas | 2,226 |

| Touring Sedan 6 Cyl Gas | 2,226 |

| XSE Sedan 6 Cyl Gas | 2,246 |

| Hybrid XLE Sedan HEV | 2,290 |

| Hybrid Limited Sedan HEV | 2,352 |

| Hybrid XSE Sedan HEV | 2,372 |

| 2020 Toyota Avalon Average Rate | $2,260 |

2019 Nissan Maxima vs Toyota Avalon

When comparing insurance cost for the 2019 Nissan Maxima and Toyota Avalon models, the Toyota Avalon is cheaper by an average of $246 per year for this model year.

The chart below demonstrates the average cost to insure both 2019 models rated for a variety of different driver ages. For a 2019 Nissan Maxima, average car insurance cost ranges from $2,032 to $4,664 per year for the driver ages used. A 2019 Toyota Avalon costs from $1,814 to $4,158 to insure per year.

Out of five Nissan Maxima trims, the cheapest 2019 model to insure is the 3.5 S Sedan model at an average cost of $2,238 per year.

For the seven trim levels available for the Toyota Avalon, the cheapest 2019 model to insure is the XLE Sedan model at a cost of $1,914.

When rates for all 12 trim levels for the 2019 model year of both models are compared, the cheapest model and trim level to insure is the Toyota Avalon XLE Sedan at an average of $1,914 per year, and the most expensive model and trim level is the Nissan Maxima Platinum Sedan at an average cost of $2,402 per year.

The rate tables below display the average cost to insure all 2019 trim levels, plus the average rate for each model. The model with the cheapest overall car insurance cost for 2019 is the Toyota Avalon.

2019 Nissan Maxima

$2,294

| 2019 Nissan Maxima Trims | Rate |

|---|---|

| 3.5 S Sedan | $2,238 |

| 3.5 SV Sedan | 2,238 |

| 3.5 SL Sedan | 2,298 |

| 3.5 SR Sedan | 2,298 |

| Platinum Sedan | 2,402 |

| 2019 Nissan Maxima Average Rate | $2,294 |

2019 Toyota Avalon

$2,048

| 2019 Toyota Avalon Trims | Rate |

|---|---|

| XLE Sedan | $1,914 |

| XSE Sedan | 2,012 |

| Limited Sedan | 2,036 |

| Touring Sedan | 2,036 |

| Hybrid XLE Sedan | 2,072 |

| Hybrid Limited Sedan | 2,134 |

| Hybrid XSE Sedan | 2,134 |

| 2019 Toyota Avalon Average Rate | $2,048 |

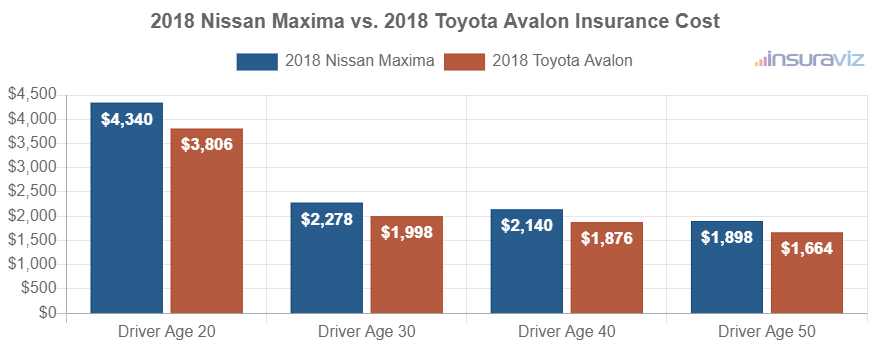

2018 Nissan Maxima vs Toyota Avalon

When comparing average insurance cost for 2018 models, the Nissan Maxima costs an average of $2,192 per year to insure and the Toyota Avalon costs $1,922, making the Toyota Avalon the winner by $270 for this model year.

The chart shown below visualizes the average cost to insure both 2018 models with different ages of drivers. Insurance cost ranges from $1,944 to $4,446 per year for a 2018 Nissan Maxima, and $1,704 to $3,896 for a 2018 Toyota Avalon for the age groups used in the chart.

Out of five Nissan Maxima trim levels, the cheapest 2018 trim to insure is the 3.5 S Sedan trim at an average cost of $2,138 per year, or around $178 per month. For the eight trims available for the Toyota Avalon, the cheapest 2018 trim to insure is the XLE Plus Sedan trim at a cost of $1,828.

When all 13 trims of both models are combined and compared, the lowest-cost model and trim to insure is the Toyota Avalon XLE Plus Sedan at an average of $1,828 per year, and the most expensive model and trim level is the Nissan Maxima Platinum Sedan at an average of $2,292 per year.

The next two rate tables display average car insurance rates for each trim level, along with an average cost for each model. The 2018 Toyota Avalon wins out over the 2018 Nissan Maxima for the cheapest average car insurance rates.

2018 Nissan Maxima

$2,192

| 2018 Nissan Maxima Trims | Rate |

|---|---|

| 3.5 S Sedan | $2,138 |

| 3.5 SV Sedan | 2,138 |

| 3.5 SL Sedan | 2,196 |

| 3.5 SR Sedan | 2,196 |

| Platinum Sedan | 2,292 |

| 2018 Nissan Maxima Average Rate | $2,192 |

2018 Toyota Avalon

$1,922

| 2018 Toyota Avalon Trims | Rate |

|---|---|

| XLE Plus Sedan | $1,828 |

| XLE Sedan | 1,828 |

| XLE Premium Sedan | 1,886 |

| Touring Sedan | 1,902 |

| Limited Sedan | 1,942 |

| Hybrid XLE Plus Sedan | 1,978 |

| Hybrid XLE Premium Sedan | 1,978 |

| Hybrid Limited Sedan | 2,034 |

| 2018 Toyota Avalon Average Rate | $1,922 |

2017 Nissan Maxima vs Toyota Avalon

When comparing car insurance rates for the 2017 Nissan Maxima and Toyota Avalon models, the Toyota Avalon has cheaper rates by an average of $230 per year for this comparison year.

The chart below visualizes the average cost to insure the two models with different driver age groups. For a 2017 Nissan Maxima, insurance cost ranges from $1,846 to $4,210 per year for the age groups used in this illustration. A 2017 Toyota Avalon costs from $1,640 to $3,742 to insure per year.

Out of five trims for the 2017 Nissan Maxima, the cheapest rates are on the 3.5 S Sedan trim at a cost of $2,000 per year, or $167 per month.

The 2017 Toyota Avalon has eight trim levels available, with the cheapest model to insure being the XLE Plus Sedan model at an average cost of $1,758 per year, or about $147 per month.

When comparing car insurance rates for both models by trim level, the lowest-cost model and trim to insure is the Toyota Avalon XLE Plus Sedan at a cost of $1,758 per year. The most expensive vehicle to insure is the Nissan Maxima Platinum Sedan at an average cost of $2,110 per year.

The tables shown below show both 2017 models and all trim levels available for each one, plus an average rate for each model. The cheapest to insure for the 2017 model year is the Toyota Avalon.

2017 Nissan Maxima

$2,078

| 2017 Nissan Maxima Trims | Rate |

|---|---|

| 3.5 S Sedan | $2,000 |

| 3.5 SV Sedan | 2,056 |

| 3.5 SL Sedan | 2,110 |

| 3.5 SR Sedan | 2,110 |

| Platinum Sedan | 2,110 |

| 2017 Nissan Maxima Average Rate | $2,078 |

2017 Toyota Avalon

$1,848

| 2017 Toyota Avalon Trims | Rate |

|---|---|

| XLE Plus Sedan | $1,758 |

| XLE Sedan | 1,758 |

| XLE Premium Sedan | 1,814 |

| Touring Sedan | 1,830 |

| Limited Sedan | 1,866 |

| Hybrid XLE Plus Sedan | 1,898 |

| Hybrid XLE Premium Sedan | 1,898 |

| Hybrid Limited Sedan | 1,954 |

| 2017 Toyota Avalon Average Rate | $1,848 |

2016 Nissan Maxima vs Toyota Avalon

When comparing car insurance rates for 2016 models, a Nissan Maxima costs an average of $1,992 per year to insure and a Toyota Avalon costs $1,722, making the Toyota Avalon cheaper to insure by $270 per year for this comparison year.

The chart below illustrates the average cost to insure both 2016 models using different driver ages. Insurance cost ranges from $1,772 to $4,034 per year for a 2016 Nissan Maxima, and $1,532 to $3,468 for a 2016 Toyota Avalon for the included driver ages.

Out of five Nissan Maxima trims, the cheapest 2016 model to insure is the 3.5 S Sedan trim at an average cost of $1,922 per year.

The 2016 Toyota Avalon has eight trim levels available, with the cheapest trim to insure being the XLE Sedan trim at an average cost of $1,524 per year.

When rates for all 13 trim levels for both vehicles are compared, the lowest-cost model and trim level to insure is the Toyota Avalon XLE Sedan at an average rate of $1,524 per year, and the most expensive vehicle to insure is the Nissan Maxima Platinum Sedan at an average of $2,022 per year.

The next two rate tables illustrate average car insurance cost by trim level for a 2016 Nissan Maxima and Toyota Avalon, along with the average rate for each model. The cheapest of the two models to insure for the 2016 model year is the Toyota Avalon.

2016 Nissan Maxima

$1,992

| 2016 Nissan Maxima Trims | Rate |

|---|---|

| 3.5 S Sedan | $1,922 |

| 3.5 SV Sedan | 1,972 |

| 3.5 SL Sedan | 2,022 |

| 3.5 SR Sedan | 2,022 |

| Platinum Sedan | 2,022 |

| 2016 Nissan Maxima Average Rate | $1,992 |

2016 Toyota Avalon

$1,722

| 2016 Toyota Avalon Trims | Rate |

|---|---|

| XLE Sedan | $1,524 |

| XLE Plus Sedan | 1,574 |

| XLE Premium Sedan | 1,574 |

| XLE Touring Sedan | 1,624 |

| Limited Sedan | 1,672 |

| Hybrid XLE Plus Sedan | 1,922 |

| Hybrid XLE Premium Sedan | 1,922 |

| Hybrid Limited Sedan | 1,972 |

| 2016 Toyota Avalon Average Rate | $1,722 |