- A 2024 Nissan Pathfinder costs less to insure than a 2024 Toyota 4Runner by an average of $132 per year, $2,572 compared to $2,440.

- Out of 34 models in the 2024 midsize SUV category, the Toyota 4Runner ranks 26th and the Nissan Pathfinder ranks 22nd for overall insurance affordability.

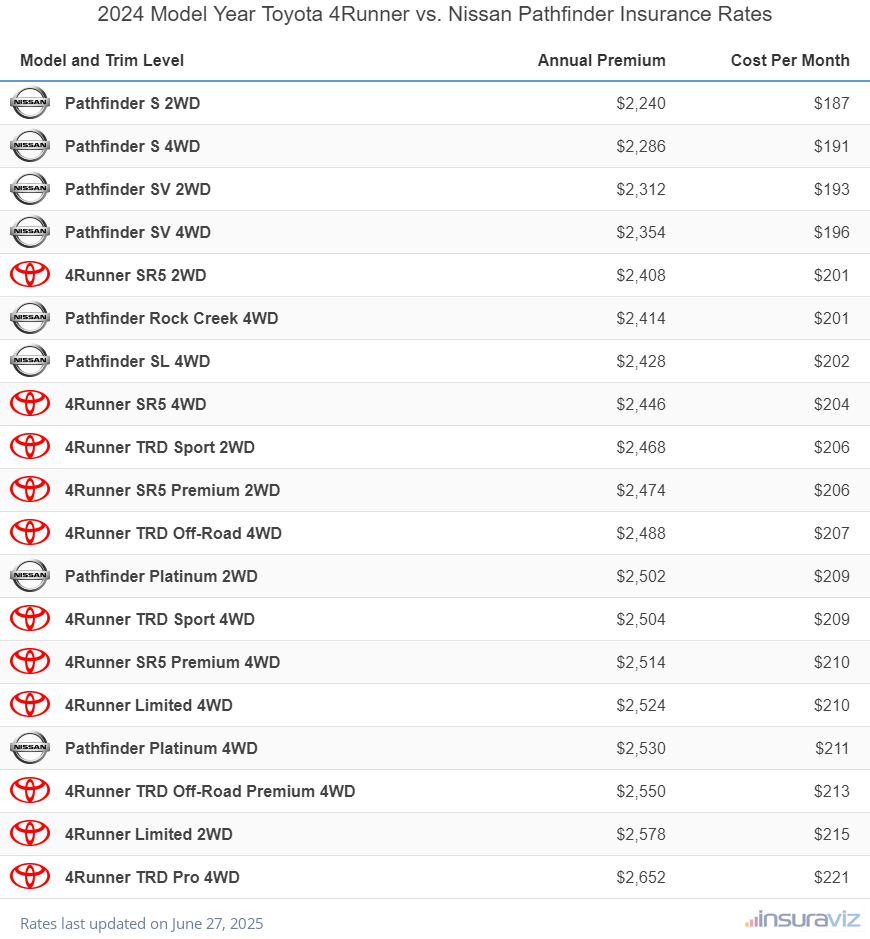

- For a 2024 model year Toyota 4Runner, auto insurance rates cost from $2,468 to $2,718 per year, while insurance for the 2024 Nissan Pathfinder ranges from $2,294 to $2,590, depending on the trim level being insured.

- The Toyota 4Runner SR5 2WD and the Nissan Pathfinder S 2WD are the trim levels that are cheapest to insure for each model, at $2,468 and $2,294 per year, respectively.

Is insurance cheaper for a 4Runner or Pathfinder?

For the 2024 model year, the model having the cheapest car insurance rates is the Nissan Pathfinder. Insurance on the Toyota 4Runner averages $2,572 per year, while insurance for a Nissan Pathfinder costs an average of $2,440 per year.

Out of 11 trim levels for the 2024 Toyota 4Runner, the cheapest car insurance rates are on the SR5 2WD trim at a cost of $2,468 per year, or about $206 per month. Out of the eight trim levels available for the Nissan Pathfinder, the cheapest 2024 trim level to insure is the S 2WD trim at a cost of $2,294.

When insurance rates for all 19 trims of both models are combined and sorted by cost, the cheapest vehicle to insure is the Nissan Pathfinder S 2WD at an average cost of $2,294 per year, and the most expensive model and trim level is the Toyota 4Runner TRD Pro 4WD at an average cost of $2,718 per year.

The table shown below ranks the yearly and monthly cost of car insurance for 2024 Toyota 4Runner and Nissan Pathfinder models, with average rates for each vehicle.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Pathfinder S 2WD | $2,294 | $191 |

| Pathfinder S 4WD | $2,340 | $195 |

| Pathfinder SV 2WD | $2,368 | $197 |

| Pathfinder SV 4WD | $2,410 | $201 |

| 4Runner SR5 2WD | $2,468 | $206 |

| Pathfinder Rock Creek 4WD | $2,472 | $206 |

| Pathfinder SL 4WD | $2,484 | $207 |

| 4Runner SR5 4WD | $2,508 | $209 |

| 4Runner TRD Sport 2WD | $2,530 | $211 |

| 4Runner SR5 Premium 2WD | $2,538 | $212 |

| 4Runner TRD Off-Road 4WD | $2,550 | $213 |

| Pathfinder Platinum 2WD | $2,562 | $214 |

| 4Runner TRD Sport 4WD | $2,564 | $214 |

| 4Runner SR5 Premium 4WD | $2,574 | $215 |

| 4Runner Limited 4WD | $2,584 | $215 |

| Pathfinder Platinum 4WD | $2,590 | $216 |

| 4Runner TRD Off-Road Premium 4WD | $2,614 | $218 |

| 4Runner Limited 2WD | $2,642 | $220 |

| 4Runner TRD Pro 4WD | $2,718 | $227 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

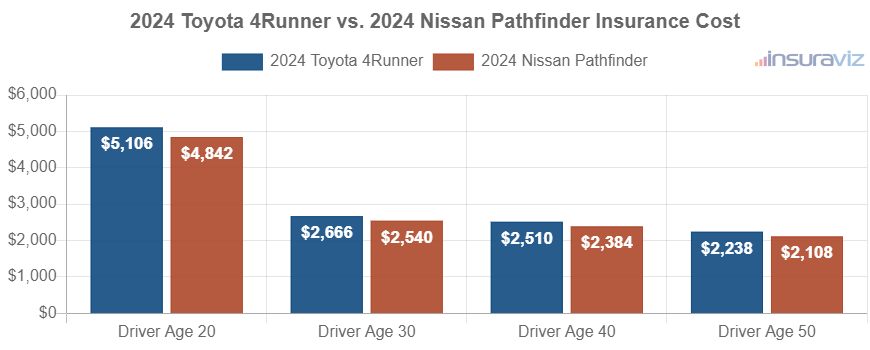

The chart below demonstrates the average cost to insure the two models rated for multiple driver ages. For a 2024 Toyota 4Runner, the average cost of car insurance ranges from $2,290 to $5,230 per year for the included driver ages. A 2024 Nissan Pathfinder costs from $2,160 to $4,964 to insure per year.

The rate tables below illustrate average car insurance cost by trim level for each 2024 model, plus an average rate for each model.

2024 Toyota 4Runner

$2,572

| 2024 Toyota 4Runner Trims | Rate |

|---|---|

| SR5 2WD | $2,468 |

| SR5 4WD | 2,508 |

| TRD Sport 2WD | 2,530 |

| SR5 Premium 2WD | 2,538 |

| TRD Off-Road 4WD | 2,550 |

| TRD Sport 4WD | 2,564 |

| SR5 Premium 4WD | 2,574 |

| Limited 4WD | 2,584 |

| TRD Off-Road Premium 4WD | 2,614 |

| Limited 2WD | 2,642 |

| TRD Pro 4WD | 2,718 |

| 2024 Toyota 4Runner Average Rate | $2,572 |

2024 Nissan Pathfinder

$2,440

| 2024 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $2,294 |

| S 4WD | 2,340 |

| SV 2WD | 2,368 |

| SV 4WD | 2,410 |

| Rock Creek 4WD | 2,472 |

| SL 4WD | 2,484 |

| Platinum 2WD | 2,562 |

| Platinum 4WD | 2,590 |

| 2024 Nissan Pathfinder Average Rate | $2,440 |

2023 Toyota 4Runner vs. Nissan Pathfinder

For 2023, the model having the cheapest rates is the Toyota 4Runner. Insurance rates for the Toyota 4Runner average $2,188 per year, while insurance for the Nissan Pathfinder averages $2,264 per year.

Out of 12 Toyota 4Runner trims, the cheapest 2023 trim to insure is the SR5 2WD trim at an average cost of $2,074 per year.

The 2023 Nissan Pathfinder has nine trim levels available, with the cheapest model to insure being the S 2WD model at an average cost of $2,128 per year, or about $177 per month.

When comparing rates by trim level for both models, the lowest-cost model and trim to insure is the Toyota 4Runner SR5 2WD at an average rate of $2,074 per year. The most expensive model and trim level is the Nissan Pathfinder Platinum 4WD costing $2,400 per year.

The rate table below compares and ranks the 12-month and monthly car insurance cost for 2023 Toyota 4Runner and Nissan Pathfinder models, showing average cost for every trim level.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 4Runner SR5 2WD | $2,074 | $173 |

| 4Runner SR5 4WD | $2,106 | $176 |

| 4Runner TRD Sport 2WD | $2,128 | $177 |

| Pathfinder S 2WD | $2,128 | $177 |

| 4Runner SR5 Premium 2WD | $2,140 | $178 |

| 4Runner TRD Off-Road 4WD | $2,160 | $180 |

| 4Runner SR5 Premium 4WD | $2,166 | $181 |

| 4Runner TRD Sport 4WD | $2,166 | $181 |

| Pathfinder S 4WD | $2,176 | $181 |

| Pathfinder SV 2WD | $2,192 | $183 |

| 4Runner TRD Off-Road Premium 4WD | $2,210 | $184 |

| 4Runner 40th Anniversary Special Edition | $2,230 | $186 |

| Pathfinder SV 4WD | $2,236 | $186 |

| 4Runner Limited 2WD | $2,256 | $188 |

| 4Runner Limited 4WD | $2,270 | $189 |

| Pathfinder SL 2WD | $2,270 | $189 |

| Pathfinder Rock Creek 4WD | $2,294 | $191 |

| Pathfinder SL 4WD | $2,300 | $192 |

| 4Runner TRD Pro 4WD | $2,330 | $194 |

| Pathfinder Platinum 2WD | $2,372 | $198 |

| Pathfinder Platinum 4WD | $2,400 | $200 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

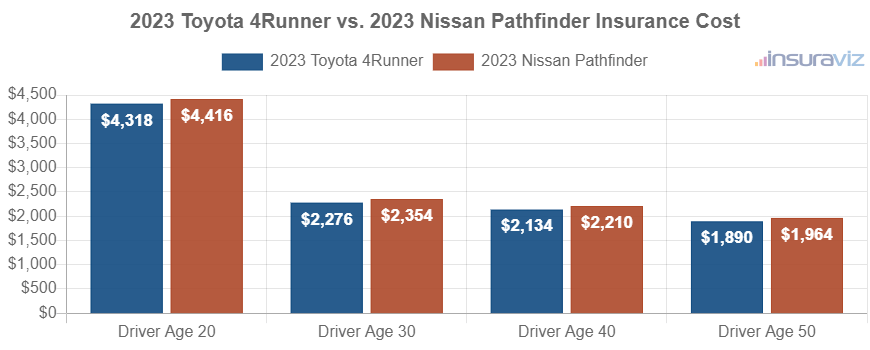

The chart below demonstrates the average cost to insure both 2023 models rated for multiple driver ages. For a 2023 Toyota 4Runner, average car insurance cost ranges from $1,936 to $4,422 per year for the driver ages used. A 2023 Nissan Pathfinder costs from $2,010 to $4,526 to insure per year.

The two tables below show the cost to insure the available trim levels for both 2023 models, plus the average rate for each model. The cheapest to insure for the 2023 model year is the Toyota 4Runner.

2023 Toyota 4Runner

$2,188

| 2023 Toyota 4Runner Trims | Rate |

|---|---|

| SR5 2WD | $2,074 |

| SR5 4WD | 2,106 |

| TRD Sport 2WD | 2,128 |

| SR5 Premium 2WD | 2,140 |

| TRD Off-Road 4WD | 2,160 |

| SR5 Premium 4WD | 2,166 |

| TRD Sport 4WD | 2,166 |

| TRD Off-Road Premium 4WD | 2,210 |

| 40th Anniversary Special Edition | 2,230 |

| Limited 2WD | 2,256 |

| Limited 4WD | 2,270 |

| TRD Pro 4WD | 2,330 |

| 2023 Toyota 4Runner Average Rate | $2,188 |

2023 Nissan Pathfinder

$2,264

| 2023 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $2,128 |

| S 4WD | 2,176 |

| SV 2WD | 2,192 |

| SV 4WD | 2,236 |

| SL 2WD | 2,270 |

| Rock Creek 4WD | 2,294 |

| SL 4WD | 2,300 |

| Platinum 2WD | 2,372 |

| Platinum 4WD | 2,400 |

| 2023 Nissan Pathfinder Average Rate | $2,264 |

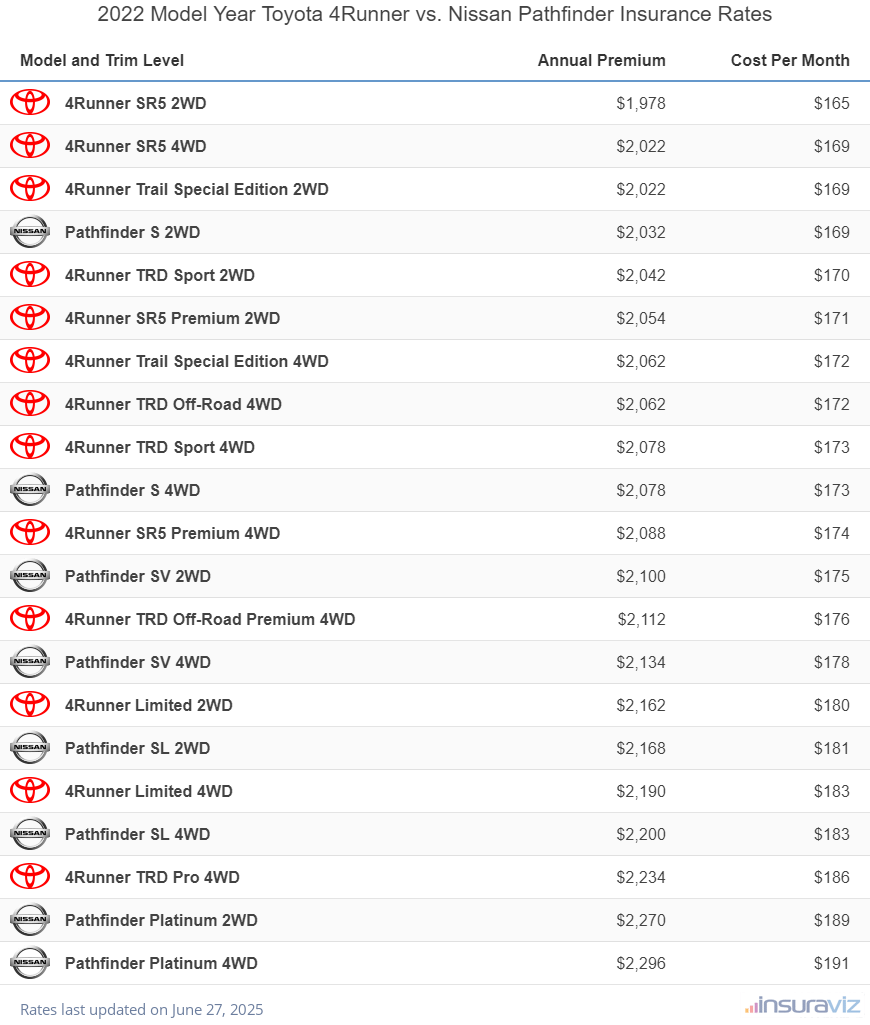

2022 Toyota 4Runner vs. Nissan Pathfinder

Insurance rates for a 2022 Toyota 4Runner average $2,134 per year, and insurance for a 2022 Nissan Pathfinder averages $2,210 per year, making the Toyota 4Runner the cheapest of the two to insure.

For a 2022 Toyota 4Runner, rates range from the cheapest price of $2,026 per year for the SR5 2WD model up to $2,286 for the TRD Pro 4WD model. For the 2022 Nissan Pathfinder, rates can range from $2,080 per year for the S 2WD model up to $2,352 on the Platinum 4WD model.

From a cost-per-month standpoint, average insurance rates for all 2022 Toyota 4Runner and Nissan Pathfinder models cost from $169 to $196 per month.

For the 2022 Toyota 4Runner, the lowest-cost trim levels to insure include the SR5 2WD, SR5 4WD, and Trail Special Edition 2WD. The lowest-cost Nissan Pathfinder trim levels to insure include the S 2WD, S 4WD, and SV 2WD.

The table below compares the cost of car insurance for 2022 Toyota 4Runner and Nissan Pathfinder models, with average rates for each vehicle.

| Model and Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 4Runner SR5 2WD | $2,026 | $169 |

| 4Runner SR5 4WD | $2,070 | $173 |

| 4Runner Trail Special Edition 2WD | $2,070 | $173 |

| Pathfinder S 2WD | $2,080 | $173 |

| 4Runner TRD Sport 2WD | $2,090 | $174 |

| 4Runner SR5 Premium 2WD | $2,104 | $175 |

| 4Runner Trail Special Edition 4WD | $2,110 | $176 |

| 4Runner TRD Off-Road 4WD | $2,110 | $176 |

| Pathfinder S 4WD | $2,126 | $177 |

| 4Runner TRD Sport 4WD | $2,130 | $178 |

| 4Runner SR5 Premium 4WD | $2,138 | $178 |

| Pathfinder SV 2WD | $2,148 | $179 |

| 4Runner TRD Off-Road Premium 4WD | $2,162 | $180 |

| Pathfinder SV 4WD | $2,184 | $182 |

| 4Runner Limited 2WD | $2,214 | $185 |

| Pathfinder SL 2WD | $2,218 | $185 |

| 4Runner Limited 4WD | $2,242 | $187 |

| Pathfinder SL 4WD | $2,254 | $188 |

| 4Runner TRD Pro 4WD | $2,286 | $191 |

| Pathfinder Platinum 2WD | $2,324 | $194 |

| Pathfinder Platinum 4WD | $2,352 | $196 |

Data Methodogy: Rated driver is a 40-year-old male with with good credit, a clean driving record, and no claims or at-fault accidents. Premium includes comprehensive and collision coverage with $500 deductibles. Liability limits are 100/300/100 and UM/UIM and medical payments coverage is included. Rates last updated on October 24, 2025

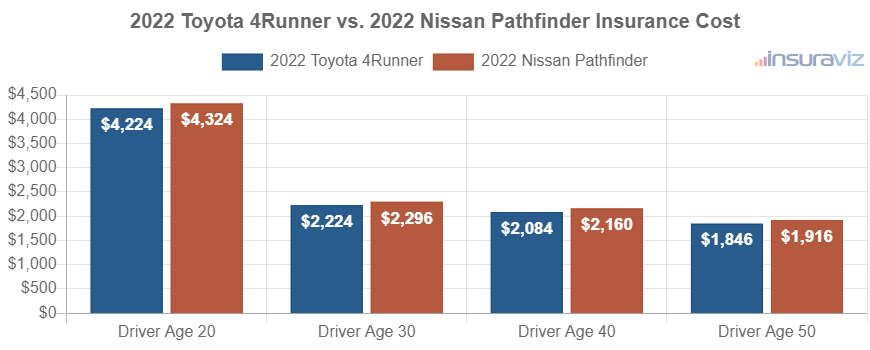

The chart below visualizes the average car insurance cost for the two models with different driver age groups. For a 2022 Toyota 4Runner, the average cost of car insurance ranges from $1,890 to $4,328 per year for the five driver ages sampled in the chart. Auto insurance on the 2022 Nissan Pathfinder costs from $1,964 to $4,430 on average per year.

Out of 13 Toyota 4Runner trim levels, the most affordable 2022 trim to insure is the SR5 2WD model at an average cost of $2,026 per year.

For the eight trims available for the Nissan Pathfinder, the most affordable 2022 model to insure is the S 2WD model at a cost of $2,080 per year, or $173 per month.

When all 21 trims of both models are combined and compared, the cheapest vehicle to put coverage on is the Toyota 4Runner SR5 2WD at an average of $2,026 per year, and the most expensive model and trim level is the Nissan Pathfinder Platinum 4WD costing an average of $2,352 per year.

The next two tables break down trim level insurance cost averages for both 2022 models, plus the average rate for each model. The 2022 Toyota 4Runner has lower-cost car average car insurance rates than the 2022 Nissan Pathfinder.

2022 Toyota 4Runner

$2,134

| 2022 Toyota 4Runner Trims | Rate |

|---|---|

| SR5 2WD | $2,026 |

| SR5 4WD | 2,070 |

| Trail Special Edition 2WD | 2,070 |

| TRD Sport 2WD | 2,090 |

| SR5 Premium 2WD | 2,104 |

| Trail Special Edition 4WD | 2,110 |

| TRD Off-Road 4WD | 2,110 |

| TRD Sport 4WD | 2,130 |

| SR5 Premium 4WD | 2,138 |

| TRD Off-Road Premium 4WD | 2,162 |

| Limited 2WD | 2,214 |

| Limited 4WD | 2,242 |

| TRD Pro 4WD | 2,286 |

| 2022 Toyota 4Runner Average Rate | $2,134 |

2022 Nissan Pathfinder

$2,210

| 2022 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $2,080 |

| S 4WD | 2,126 |

| SV 2WD | 2,148 |

| SV 4WD | 2,184 |

| SL 2WD | 2,218 |

| SL 4WD | 2,254 |

| Platinum 2WD | 2,324 |

| Platinum 4WD | 2,352 |

| 2022 Nissan Pathfinder Average Rate | $2,210 |

2021 Toyota 4Runner vs. Nissan Pathfinder

When comparing car insurance rates for the 2021 Toyota 4Runner and Nissan Pathfinder models, the Toyota 4Runner has cheaper rates by $50 per year for this model year.

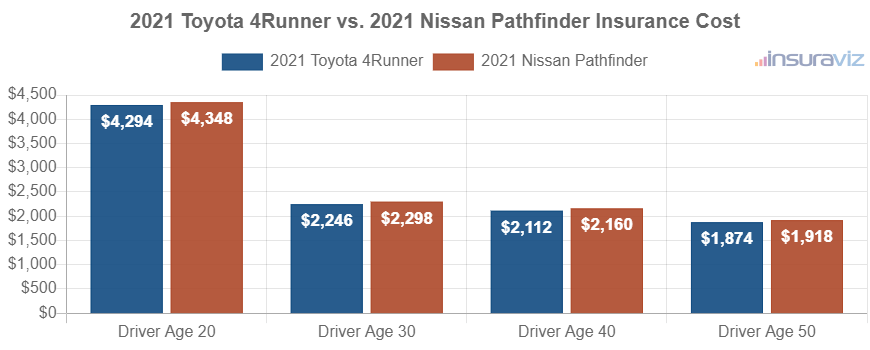

The chart shown below illustrates the average cost to insure the two models for the 20 to 50-year-old driver age groups. For the 2021 Toyota 4Runner, insurance cost ranges from $1,918 to $4,398 per year for the different drivers illustrated in the chart. Insurance on a 2021 Nissan Pathfinder ranges from $1,962 to $4,454 on average per year.

The 2021 Toyota 4Runner has 12 trims available, with the lowest-cost trim level to insure being the SR/5 2WD model at an average cost of $2,096 per year.

The 2021 Nissan Pathfinder has 10 trim options available, with the cheapest trim to insure being the S 2WD trim at an average cost of $2,044 per year.

When trim-level rates for both models are compared, the most affordable model and trim level to put coverage on is the Nissan Pathfinder S 2WD at an average cost of $2,044 per year, and the most expensive model and trim level is the Nissan Pathfinder SL Rock Creek Premium 4WD at a cost of $2,288 per year.

The tables shown below break down all the available trims for both 2021 models, including an overall average cost for each model.

2021 Toyota 4Runner

$2,162

| 2021 Toyota 4Runner Trims | Rate |

|---|---|

| SR/5 2WD | $2,096 |

| SR/5 4WD | 2,096 |

| SR/5 Premium 2WD | 2,096 |

| TRD Off-Road 4WD | 2,096 |

| Limited 2WD | 2,162 |

| SR/5 Premium 4WD | 2,162 |

| TRD Off-Road Premium 4WD | 2,162 |

| Venture 4WD | 2,162 |

| Limited 4WD | 2,230 |

| NightShade 4WD | 2,230 |

| Nightshade 2WD | 2,230 |

| TRD Pro 4WD | 2,230 |

| 2021 Toyota 4Runner Average Rate | $2,162 |

2021 Nissan Pathfinder

$2,212

| 2021 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $2,044 |

| S 4WD | 2,108 |

| SV 2WD | 2,154 |

| SL 2WD | 2,220 |

| SL 4WD | 2,220 |

| SV 4WD | 2,220 |

| Platinum 2WD | 2,288 |

| Platinum 4WD | 2,288 |

| SL Rock Creek Premium 2WD | 2,288 |

| SL Rock Creek Premium 4WD | 2,288 |

| 2021 Nissan Pathfinder Average Rate | $2,212 |

2020 Toyota 4Runner vs. Nissan Pathfinder

When comparing car insurance rates for 2020 models, the Toyota 4Runner costs $2,098 per year for full coverage and the Nissan Pathfinder costs $2,148, making the Toyota 4Runner the cheaper model by $50 for this comparison year.

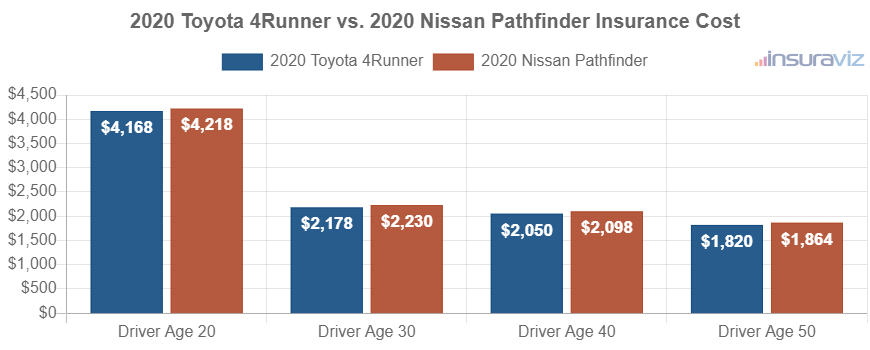

The chart shown below displays the average car insurance cost for the two models for the 20 to 50-year-old driver age groups. For the 2020 Toyota 4Runner, the average cost of car insurance ranges from $1,864 to $4,272 per year for the age groups used in the chart. A full-coverage policy for a 2020 Nissan Pathfinder ranges from $1,906 to $4,324 on average per year.

Out of 12 trim levels for a 2020 Toyota 4Runner, the most affordable average insurance prices are on the SR/5 2WD model at a cost of $2,036 per year. Out of the 10 option levels available for a Nissan Pathfinder, the most affordable 2020 trim level to insure is the S 2WD model at a cost of $1,986 per year, or around $166 per month.

When comparing aggregated rates for both models from a trim-level perspective, the cheapest model and trim level to put coverage on is the Nissan Pathfinder S 2WD at an average rate of $1,986 per year. The highest-cost model and trim is the Nissan Pathfinder SL Rock Creek Premium 4WD at an average of $2,218 per year.

The next tables detail trim level insurance rates for each 2020 model, as well as an average rate for each model. The 2020 Toyota 4Runner has cheaper average auto insurance rates than the 2020 Nissan Pathfinder.

2020 Toyota 4Runner

$2,098

| 2020 Toyota 4Runner Trims | Rate |

|---|---|

| SR/5 2WD | $2,036 |

| SR/5 4WD | 2,036 |

| SR/5 Premium 2WD | 2,036 |

| TRD Off-Road 4WD | 2,036 |

| Limited 2WD | 2,098 |

| SR/5 Premium 4WD | 2,098 |

| TRD Off-Road Premium 4WD | 2,098 |

| Venture 4WD | 2,098 |

| Limited 4WD | 2,162 |

| NightShade 4WD | 2,162 |

| Nightshade 2WD | 2,162 |

| TRD Pro 4WD | 2,162 |

| 2020 Toyota 4Runner Average Rate | $2,098 |

2020 Nissan Pathfinder

$2,148

| 2020 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $1,986 |

| S 4WD | 2,048 |

| SV 2WD | 2,092 |

| SL 2WD | 2,156 |

| SL 4WD | 2,156 |

| SV 4WD | 2,156 |

| Platinum 2WD | 2,218 |

| Platinum 4WD | 2,218 |

| SL Rock Creek Premium 2WD | 2,218 |

| SL Rock Creek Premium 4WD | 2,218 |

| 2020 Nissan Pathfinder Average Rate | $2,148 |

2019 Toyota 4Runner vs. Nissan Pathfinder

For 2019 Toyota 4Runner and Nissan Pathfinder models, the Toyota 4Runner costs less to insure by $276 per year.

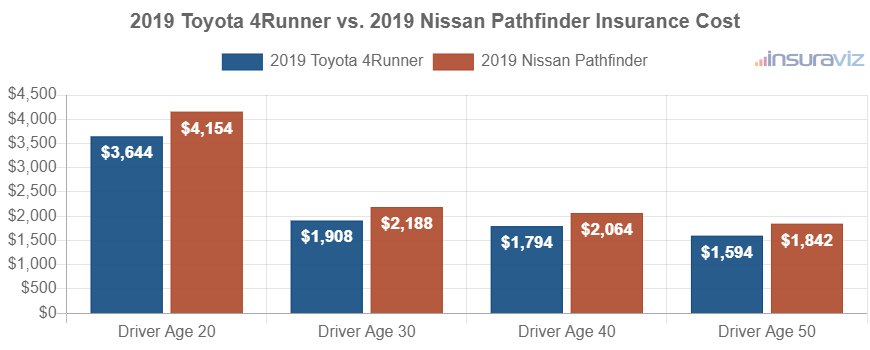

The rate chart below visualizes the average cost to insure both models for a range of driver ages. For the 2019 Toyota 4Runner, the average cost of car insurance ranges from $1,632 to $3,730 per year. Full-coverage car insurance on the 2019 Nissan Pathfinder costs from $1,886 to $4,258 on average per year.

For the nine trims available for the 2019 Toyota 4Runner, the cheapest trim to insure is the SR/5 2WD model at an average cost of $1,750 per year, or about $146 per month.

For the eight trim and option levels available for the Nissan Pathfinder, the lowest-cost 2019 trim level to insure is the S 2WD model at a cost of $1,990.

When all 17 trims of both models are combined and compared, the cheapest model and trim level to put coverage on is the Toyota 4Runner SR/5 2WD at an average cost of $1,750 per year, and the most expensive trim is the Nissan Pathfinder Platinum 4WD costing $2,216 per year.

The next two tables show the expected annual car insurance cost by trim level for both 2019 models, including an overall average rate.

2019 Toyota 4Runner

$1,838

| 2019 Toyota 4Runner Trims | Rate |

|---|---|

| SR/5 2WD | $1,750 |

| SR/5 4WD | 1,810 |

| SR/5 Premium 2WD | 1,810 |

| SR/5 Premium 4WD | 1,810 |

| TRD Off-Road 4WD | 1,810 |

| TRD Off-Road Premium 4WD | 1,810 |

| Limited 2WD | 1,872 |

| Limited 4WD | 1,932 |

| TRD Pro 4WD | 1,932 |

| 2019 Toyota 4Runner Average Rate | $1,838 |

2019 Nissan Pathfinder

$2,114

| 2019 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $1,990 |

| S 4WD | 1,990 |

| SV 2WD | 2,094 |

| SV 4WD | 2,094 |

| SL 2WD | 2,156 |

| SL 4WD | 2,156 |

| Platinum 2WD | 2,216 |

| Platinum 4WD | 2,216 |

| 2019 Nissan Pathfinder Average Rate | $2,114 |

2018 Toyota 4Runner vs. Nissan Pathfinder

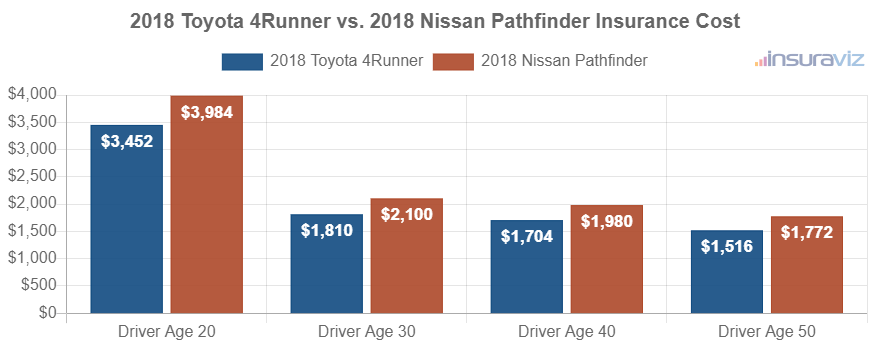

When comparing insurance rates for the 2018 Toyota 4Runner and Nissan Pathfinder models, the Toyota 4Runner has cheaper rates by an average of $282 per year for this comparison year.

The following chart illustrates the average insurance cost for the two models for the 20, 30, 40, and 50-year-old driver age groups. Insurance cost ranges from $1,552 to $3,536 per year for the 2018 Toyota 4Runner, and $1,812 to $4,082 for a 2018 Nissan Pathfinder for the included driver ages.

Out of nine Toyota 4Runner trim levels, the most affordable 2018 model to insure is the SR/5 2WD model at an average cost of $1,674 per year.

Out of the eight different option levels available for a Nissan Pathfinder, the most affordable 2018 model to insure is the S 2WD trim at a cost of $1,912 per year, or $159 per month.

When average insurance prices for all 17 trims of both models are combined and sorted by cost, the lowest-cost model and trim to insure is the Toyota 4Runner SR/5 2WD at an average cost of $1,674 per year. The highest-cost model and trim is the Nissan Pathfinder Platinum 4WD at an average cost of $2,124 per year.

The next two tables detail the average insurance cost by trim level for both 2018 models, plus an average rate for each model. The cheapest of the two models to insure for the 2018 model year is the Toyota 4Runner.

2018 Toyota 4Runner

$1,746

| 2018 Toyota 4Runner Trims | Rate |

|---|---|

| SR/5 2WD | $1,674 |

| SR/5 4WD | 1,732 |

| SR/5 Premium 2WD | 1,732 |

| SR/5 Premium 4WD | 1,732 |

| TRD Off-Road 4WD | 1,732 |

| TRD Off-Road Premium 4WD | 1,732 |

| Limited 2WD | 1,788 |

| Limited 4WD | 1,788 |

| TRD Pro 4WD | 1,788 |

| 2018 Toyota 4Runner Average Rate | $1,746 |

2018 Nissan Pathfinder

$2,028

| 2018 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $1,912 |

| S 4WD | 1,912 |

| SV 2WD | 2,010 |

| SV 4WD | 2,010 |

| SL 2WD | 2,068 |

| SL 4WD | 2,068 |

| Platinum 2WD | 2,124 |

| Platinum 4WD | 2,124 |

| 2018 Nissan Pathfinder Average Rate | $2,028 |

2017 Toyota 4Runner vs. Nissan Pathfinder

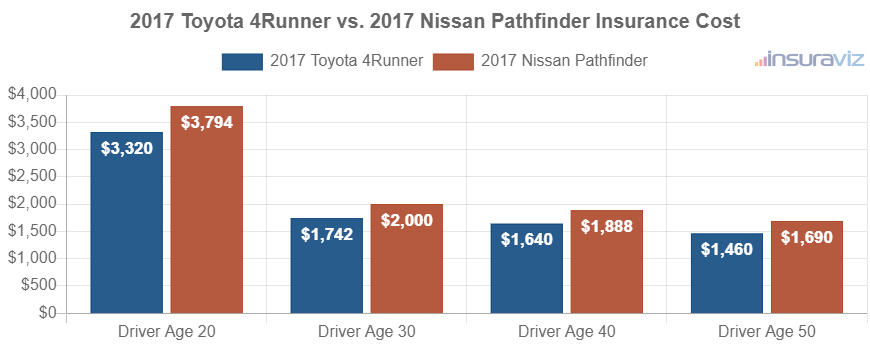

When comparing average insurance rates for 2017 models, a Toyota 4Runner costs an average of $1,680 per year to insure and a Nissan Pathfinder costs $1,934, making the Toyota 4Runner more affordable to insure by $254 per year for this model year.

The next chart visualizes the average cost to insure the two models with different driver age groups. For a 2017 Toyota 4Runner, average car insurance cost ranges from $1,496 to $3,400 per year. A full-coverage policy on the 2017 Nissan Pathfinder costs from $1,734 to $3,886 on average per year.

Out of nine Toyota 4Runner trims, the most affordable 2017 trim to insure is the SR/5 2WD model at an average cost of $1,614 per year.

For the eight different trim levels available for the Nissan Pathfinder, the most affordable 2017 trim to insure is the S S 2WD model at a cost of $1,796.

When comparing combined rates for both models from a trim-level perspective, the overall cheapest vehicle to insure is the Toyota 4Runner SR/5 2WD at an average cost of $1,614 per year, and the overall most expensive vehicle to insure is the Nissan Pathfinder Platinum Edition 4WD at an average of $2,050 per year.

The tables below detail average car insurance rates for each trim level, along with the average rate for each model.

2017 Toyota 4Runner

$1,680

| 2017 Toyota 4Runner Trims | Rate |

|---|---|

| SR/5 2WD | $1,614 |

| SR/5 4WD | 1,666 |

| SR/5 Premium 2WD | 1,666 |

| SR/5 Premium 4WD | 1,666 |

| TRD Off-Road 4WD | 1,666 |

| TRD Off-Road Premium 4WD | 1,666 |

| Limited 2WD | 1,720 |

| Limited 4WD | 1,720 |

| TRD Pro 4WD | 1,720 |

| 2017 Toyota 4Runner Average Rate | $1,680 |

2017 Nissan Pathfinder

$1,934

| 2017 Nissan Pathfinder Trims | Rate |

|---|---|

| S S 2WD | $1,796 |

| S 4WD | 1,850 |

| SV SV 2WD | 1,850 |

| SL SL 2WD | 1,940 |

| SV 4WD | 1,940 |

| SL 4WD | 1,994 |

| Platinum Edition 2WD | 2,050 |

| Platinum Edition 4WD | 2,050 |

| 2017 Nissan Pathfinder Average Rate | $1,934 |

2016 Toyota 4Runner vs. Nissan Pathfinder

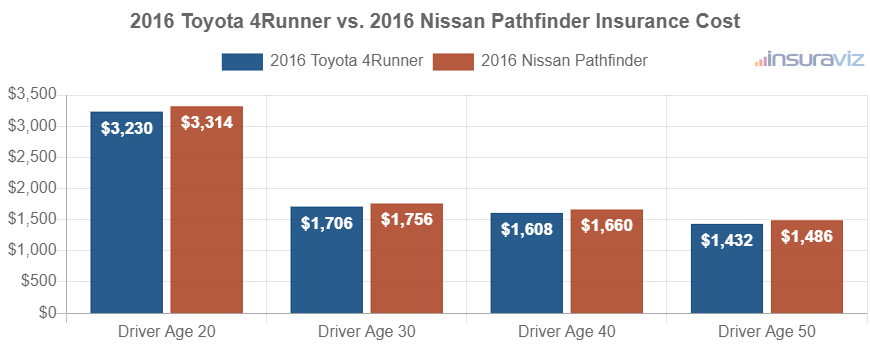

When comparing insurance cost for the 2016 Toyota 4Runner and Nissan Pathfinder models, the Toyota 4Runner has cheaper rates by an average of $52 per year.

The next chart displays the average cost to insure both models with different drivers at the wheel. For a 2016 Toyota 4Runner, insurance cost ranges from $1,468 to $3,306 per year for the five driver ages sampled in the chart. Insurance on the 2016 Nissan Pathfinder costs from $1,520 to $3,396 on average per year.

Out of nine Toyota 4Runner trim levels, the most affordable 2016 model to insure is the SR/5 2WD trim at an average cost of $1,590 per year, or around $133 per month.

Out of the eight trim options available for the Nissan Pathfinder, the cheapest 2016 trim to insure is the S 2WD model at a cost of $1,556 per year, or $130 per month.

When looking at the aggregated rates by trim level for both models, the most affordable model and trim level to insure is the Nissan Pathfinder S 2WD at a cost of $1,556 per year, and the most expensive trim is the Nissan Pathfinder Platinum Edition 4WD at a cost of $1,788 per year.

The next two tables illustrate all the available trims for both 2016 models, along with an average cost for each model. The 2016 Toyota 4Runner has cheaper average auto insurance rates than the 2016 Nissan Pathfinder.

2016 Toyota 4Runner

$1,646

| 2016 Toyota 4Runner Trims | Rate |

|---|---|

| SR/5 2WD | $1,590 |

| SR/5 4WD | 1,590 |

| SR/5 Premium 2WD | 1,640 |

| SR/5 Premium 4WD | 1,640 |

| Trail Edition 4WD | 1,640 |

| Trail Premium 4WD | 1,640 |

| Limited 2WD | 1,690 |

| Limited 4WD | 1,690 |

| TRD Pro 4WD | 1,690 |

| 2016 Toyota 4Runner Average Rate | $1,646 |

2016 Nissan Pathfinder

$1,698

| 2016 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $1,556 |

| S 4WD | 1,606 |

| SV 2WD | 1,688 |

| SV 4WD | 1,688 |

| SL 2WD | 1,738 |

| SL 4WD | 1,738 |

| Platinum Edition 2WD | 1,788 |

| Platinum Edition 4WD | 1,788 |

| 2016 Nissan Pathfinder Average Rate | $1,698 |

2015 Toyota 4Runner vs. Nissan Pathfinder

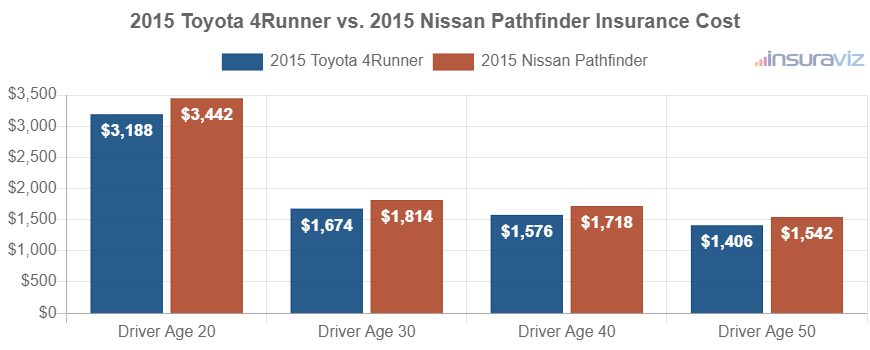

When comparing average insurance rates for 2015 models, a Toyota 4Runner costs an average of $1,614 per year to insure and a Nissan Pathfinder costs $1,758, making the Toyota 4Runner cheaper to insure by $144 per year for 2015.

The chart below displays the average cost to insure both models using different driver ages. The average cost of full-coverage insurance ranges from $1,440 to $3,264 per year for the 2015 Toyota 4Runner, and $1,580 to $3,526 for the 2015 Nissan Pathfinder for the driver ages used.

The 2015 Toyota 4Runner has nine trims available, with the cheapest trim to insure being the SR/5 2WD trim at an average cost of $1,572 per year. For the eight trims available for a Nissan Pathfinder, the lowest-cost 2015 trim package to insure is the S 2WD trim at a cost of $1,636.

When insurance rates for all 17 trim levels for the 2015 model year of both models are compared, the overall cheapest vehicle to buy insurance for is the Toyota 4Runner SR/5 2WD at an average of $1,572 per year. The most expensive trim is the Nissan Pathfinder Platinum Edition 4WD at an average cost of $1,850 per year.

The next tables break down trim level insurance rates for each 2015 model, along with the average rate for each model. The model with the cheapest car insurance rates for 2015 is the Toyota 4Runner.

2015 Toyota 4Runner

$1,614

| 2015 Toyota 4Runner Trims | Rate |

|---|---|

| SR/5 2WD | $1,572 |

| SR/5 4WD | 1,572 |

| SR/5 Premium 2WD | 1,572 |

| Trail Edition 4WD | 1,572 |

| SR/5 Premium 4WD | 1,618 |

| Trail Premium 4WD | 1,624 |

| Limited 2WD | 1,664 |

| Limited 4WD | 1,666 |

| TRD Pro 4WD | 1,670 |

| 2015 Toyota 4Runner Average Rate | $1,614 |

2015 Nissan Pathfinder

$1,758

| 2015 Nissan Pathfinder Trims | Rate |

|---|---|

| S 2WD | $1,636 |

| S 4WD | 1,682 |

| SV 2WD | 1,682 |

| SV 4WD | 1,760 |

| SL 2WD | 1,804 |

| SL 4WD | 1,804 |

| Platinum Edition 2WD | 1,850 |

| Platinum Edition 4WD | 1,850 |

| 2015 Nissan Pathfinder Average Rate | $1,758 |