- Chevy Silverado insurance cost averages $2,098 per year, or about $175 per month for a policy with full coverage.

- The cheapest Silverado insurance is on the EV WT trim level, costing an average of $1,778 per year. At the high end, the Silverado EV RST First Edition is the most expensive to insure at $2,486 for an annual policy.

- Insuring a used Chevrolet Silverado instead of a new 2024 model may save around $860 or more each year.

- In a comparison of large U.S. car insurance companies, USAA, GEICO, and Progressive had some of the best Silverado insurance rates.

We all know that our Silverado is more than just a truck. It’s a trusted friend that’s always got our back. But when it comes to keeping our trusty companion safe, having the right insurance in place is crucial.

We’re here to make the complex world of insurance a little less daunting and a lot more friendly. Get ready to explore the ins and outs of insuring your Silverado, compare costs, and walk away with the knowledge to make smart decisions.

Whether you’re already part of the Silverado family or thinking about it, we’ve got your back with the insights you need to protect your investment and keep those good vibes rolling!

Comparing Silverado insurance rates by driver age

When it comes to insuring your Chevrolet Silverado, there’s no one-size-fits-all approach. Your age can significantly influence the cost of your insurance.

Chevy Silverado insurance for a safe 40-year-old driver costs an average of $2,098 a year, or about $175 per month for the 2024 model.

The table below shows how average insurance rates compare for the 2024, 2021, and 2018 model year Silverados. Rates are included for different driver ages along with the cheapest and most expensive models to insure for each model year.

| 2024 Chevrolet Silverado | 2021 Chevrolet Silverado | 2018 Chevrolet Silverado | |

|---|---|---|---|

| Average Insurance Cost Per Year | $2,098 | $1,864 | $1,636 |

| Insurance Cost Per Month | $175 | $155 | $136 |

| 16-year-old Driver | $7,659 | $6,838 | $6,029 |

| 18-year-old Driver | $6,567 | $5,857 | $5,138 |

| 20-year-old Driver | $4,264 | $3,796 | $3,332 |

| 25-year-old Driver | $2,438 | $2,438 | $2,438 |

| 30-year-old Driver | $2,234 | $1,980 | $1,740 |

| 40-year-old Driver | $2,098 | $1,864 | $1,636 |

| 50-year-old Driver | $1,866 | $1,656 | $1,458 |

| 60-year-old Driver | $1,748 | $1,552 | $1,364 |

| Cheapest Model to Insure | EV WT | WT Regular Cab 4WD | WT Regular Cab 4WD |

| Cheapest Insurance Cost | $1,778 | $1,642 | $1,498 |

| Most Expensive Model to Insure | EV RST First Edition | High Country Crew Cab 2WD | High Country Crew Cab 2WD |

| Most Expensive Insurance Cost | $2,486 | $2,108 | $1,808 |

| Calculate Your Rates Custom rates based on your risk profile | Calculate | Calculate | Calculate |

Data Methodology: Average cost is based on a 40-year-old male driver with a clean driving record. Other driver ages also have no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle for that specific model year. Updated February 23, 2024

If you have or need full coverage insurance on your Silverado, then you’re going to have to choose a deductible for the comprehensive and collision coverages.

A deductible is the amount you agree to pay out of pocket in the event of a covered claim before your insurance policy kicks in to cover the remaining costs. When you opt for a higher deductible, you are essentially taking on more financial responsibility in the event of an accident or other covered incident.

Companies offer a variety of options for deductibles, but the usual range starts at around $100 and can go up to $1,500 or more.

If you opt for a higher deductible, say $1,000 or $1,500, you’ll have to pay more if you have a covered incident. However, in exchange for taking on a greater portion of the initial costs, your insurance provider will typically reward you with lower monthly or yearly premiums. This can result in significant savings over time.

The chart below illustrates how 2024 Chevy Silverado insurance can fluctuate with differences in both driver age and policy deductibles.

If you’re a younger driver, you will pay higher insurance prices than a more mature driver, if all other variables remain constant.

As shown in the first table, insurance rates for a teen driver on a Silverado are much higher than even the rates for the 20-year-old driver in the chart above.

The data also clearly illustrates how much the price of insurance can vary depending on the deductible you choose. For the average 40-year-old driver, the cost difference between a $250 and $1,000 deductible policy on a 2024 Silverado is $638 per year.

The cost difference between high and low-deductible policies is even more pronounced for a 20-year-old driver. For a 2024 Silverado, the difference in insurance cost is $1,264 per year.

Choosing your Silverado model: Insurance implications

Vehicle trim levels can impact car insurance rates due to factors such as the vehicle’s market value, repair and replacement costs, theft risk, safety features, repair parts, driving behavior, and available discounts.

The list below shows how each of these factors can impact the price you pay to insure your Silverado.

- Vehicle Value: One of the most significant factors influencing car insurance rates is the value of the vehicle. Higher trim levels often come with more features, advanced technology, and enhanced performance, which can significantly increase the overall value of the car. Insurers typically consider the vehicle’s market value when determining insurance premiums. Therefore, a higher trim level, with its higher market value, is likely to result in higher insurance rates.

- Repair and Replacement Costs: In the event of an accident or damage to the vehicle, insurance companies need to consider the cost of repairing or replacing it. Higher trim levels often have more expensive components, materials, and specialized features that can increase repair or replacement costs. As a result, insurers may charge higher premiums to cover these potential expenses.

- Theft Risk: Certain trim levels may be more appealing to thieves due to their added features or desirability. A higher trim level with advanced technology and premium features can make a vehicle a more attractive target for theft. Consequently, insurance companies may charge higher rates to cover the increased theft risk associated with these trim levels.

- Safety Features: Some trim levels may include advanced safety features, such as adaptive cruise control, lane-keeping assist, and automatic emergency braking. These features can reduce the likelihood of accidents and lower the severity of collisions when they do occur. Insurance companies often offer discounts for vehicles equipped with such safety features, which can partially offset the increased cost of insuring a higher trim level.

- Repair and Replacement Parts: Higher trim levels may have unique or specialized parts that are more expensive to repair or replace. Insurance providers may take these higher costs into account when determining insurance rates for these vehicles.

- Driving Behavior: The type of driver who chooses a higher trim level may have different driving habits or a more responsible driving history. If the driver’s behavior is considered safer, it can lead to lower insurance rates regardless of the vehicle trim level.

- Insurance Discounts: Conversely, some insurers may offer discounts for vehicles with higher trim levels, especially if these include advanced safety features or anti-theft devices. These discounts can help mitigate the increased insurance costs associated with certain trim levels.

With that said, let’s take a look at rates for each of the trims available for the 2024 Silverado.

The cheapest Chevrolet Silverado insurance rates can be found on the EV WT at an average of $1,778 per year, or about $148 per month. The second cheapest model is the WT Regular Cab 4WD at $1,870 per year, and the third cheapest trim level to insure is the WT Double Cab 4WD at $1,916 per year.

On the opposite end of the cost spectrum, the three highest cost Silverado trim levels to insure are the Chevrolet Silverado ZR2 Crew Cab 4WD, the EV Trail Boss, and the EV RST First Edition trim levels at $2,286, $2,314, and $2,486 per year, respectively.

In general, as the invoice price goes up with additional add-ons and options, the price of insurance also goes up. The Silverado is no exception to this rule, as the high-cost trims generally have the most expensive insurance rates.

The next table shows average car insurance rates for a 2024 Silverado, including a monthly budget amount, for each available trim level.

| 2024 Chevrolet Silverado Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| EV WT | $1,778 | $148 |

| WT Regular Cab 4WD | $1,870 | $156 |

| WT Double Cab 4WD | $1,916 | $160 |

| WT Regular Cab 2WD | $1,924 | $160 |

| WT Crew Cab 4WD | $1,966 | $164 |

| Custom Double Cab 4WD | $1,988 | $166 |

| WT Double Cab 2WD | $2,018 | $168 |

| Custom Crew Cab 4WD | $2,034 | $170 |

| LT Double Cab 4WD | $2,066 | $172 |

| RST Crew Cab 2WD | $2,066 | $172 |

| Custom Trail Boss 4WD | $2,072 | $173 |

| WT Crew Cab 2WD | $2,078 | $173 |

| RST Double Cab 4WD | $2,082 | $174 |

| EV RST | $2,092 | $174 |

| Custom Double Cab 2WD | $2,102 | $175 |

| LT Crew Cab 4WD | $2,104 | $175 |

| RST Crew Cab 4WD | $2,116 | $176 |

| LTZ Crew Cab 2WD | $2,150 | $179 |

| Custom Crew Cab 2WD | $2,152 | $179 |

| LT Trail Boss Crew Cab 4WD | $2,160 | $180 |

| LT Double Cab 2WD | $2,190 | $183 |

| LTZ Crew Cab 4WD | $2,192 | $183 |

| High Country Crew Cab 4WD | $2,216 | $185 |

| LT Crew Cab 2WD | $2,230 | $186 |

| ZR2 Crew Cab 4WD | $2,286 | $191 |

| EV Trail Boss | $2,314 | $193 |

| EV RST First Edition | $2,486 | $207 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

With a potential difference of over $400 per year just based the trim level of Silverado you’re insuring, it’s essential for Silverado owners to consider these rates and factors when choosing a trim level. Also, it’s important to obtain insurance quotes based on the specific vehicle trim level to make an informed decision about insurance coverage.

Save on Silverado insurance: New vs. used insurance rates

Insuring a 2013 Silverado instead of a new 2024 model could reduce insurance cost by $860 or more each year. A 2016 Silverado would save around $580, and a 2019 model could save $370 per year.

As a vehicle gets older, it depreciates and its actual cash value (or replacement cost) decreases. Newer vehicles often have higher repair costs due to more technology and more complex repair requirements.

On the other hand, newer vehicles may have more advanced safety features, which can lead to lower rates.

In general, expect the cost of insurance to be lower on pre-owned Silverado models than new models.

The next table shows the average Chevrolet Silverado insurance rates from a new 2024 model back to a 2013 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Chevrolet Silverado | $4,264 | $2,098 | $1,748 |

| 2023 Chevrolet Silverado | $4,102 | $2,016 | $1,680 |

| 2022 Chevrolet Silverado | $3,798 | $1,862 | $1,548 |

| 2021 Chevrolet Silverado | $3,796 | $1,864 | $1,552 |

| 2020 Chevrolet Silverado | $3,688 | $1,810 | $1,508 |

| 2019 Chevrolet Silverado | $3,518 | $1,724 | $1,434 |

| 2018 Chevrolet Silverado | $3,332 | $1,636 | $1,364 |

| 2017 Chevrolet Silverado | $3,182 | $1,564 | $1,304 |

| 2016 Chevrolet Silverado | $3,064 | $1,510 | $1,264 |

| 2015 Chevrolet Silverado | $2,832 | $1,400 | $1,172 |

| 2014 Chevrolet Silverado | $2,696 | $1,332 | $1,116 |

| 2013 Chevrolet Silverado | $2,474 | $1,238 | $1,042 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Silverado trim levels for each model year. Updated February 23, 2024

Insurance for pre-owned models is generally cheaper because of factors like depreciation, lower repair costs, and the vehicle’s age. However, insurance premiums are highly individual and depend on various factors, including the specific make and model of the vehicle (see the trim-level rate analysis above), your location, driving history, and coverage choices.

It’s crucial to compare insurance quotes and consider your unique circumstances when making decisions about car insurance for both new and pre-owned vehicles.

Full coverage vs. liability-only for older Silverado models

The point at which you insure your Silverado for liability insurance only is purely a personal decision. There is a general guideline that when the cost of comprehensive and collision insurance costs more than 10% of the vehicle value, it’s time to start thinking about removing it.

Here are some situations where it may make sense to begin considering removing full coverage from your Silverado.

- It’s getting old: If your vehicle is older and its market value has significantly depreciated, it may no longer be cost-effective to maintain full coverage. The cost of the coverage may exceed the potential payout in the event of a claim.

- You have adequate savings: If you have the financial means to repair or replace your vehicle out of pocket in case of an accident, it might make sense to reduce your coverage. However, ensure you have the necessary funds readily available.

- You paid off your loan: If you’ve paid off your car loan or lease, you have more flexibility in choosing your coverage. You’re no longer obligated to maintain full coverage just to satisfy lender requirements.

- Coverage is too expensive: If the cost of full coverage premiums is straining your budget, transitioning to liability-only coverage can significantly reduce your insurance costs.

- You don’t drive very much: If you’re driving your vehicle infrequently or if it’s not your primary mode of transportation, you might consider reducing coverage.

- Better use of funds: Consider how much you could save by reducing coverage and whether those savings could be put to better use elsewhere, such as paying off debts, building an emergency fund, or investing.

The table below shows the average liability-only insurance cost for Chevy Silverado 1500 models from 1995 through 2012. The cost of full-coverage insurance is also included in order to compare the difference in price between the two.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Chevrolet Silverado | $1,186 | $608 |

| 2011 Chevrolet Silverado | $1,142 | $602 |

| 2010 Chevrolet Silverado | $1,096 | $596 |

| 2009 Chevrolet Silverado | $1,054 | $592 |

| 2008 Chevrolet Silverado | $1,014 | $586 |

| 2007 Chevrolet Silverado | $1,000 | $580 |

| 2006 Chevrolet Silverado | $980 | $574 |

| 2005 Chevrolet Silverado | $948 | $568 |

| 2004 Chevrolet Silverado | $928 | $564 |

| 2003 Chevrolet Silverado | $909 | $553 |

| 2002 Chevrolet Silverado | $891 | $542 |

| 2001 Chevrolet Silverado | $873 | $531 |

| 2000 Chevrolet Silverado | $856 | $520 |

| 1999 Chevrolet Silverado | $839 | $510 |

| 1998 Chevrolet Silverado | $822 | $500 |

| 1997 Chevrolet Silverado | $806 | $490 |

| 1996 Chevrolet Silverado | $790 | $480 |

| 1995 Chevrolet Silverado | $774 | $470 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated February 23, 2024

It’s crucial to make a well-informed decision when considering the removal of full coverage. Weigh the potential savings against the risks and your financial situation. If you decide to reduce your coverage, consult with your insurance provider to adjust your policy accordingly.

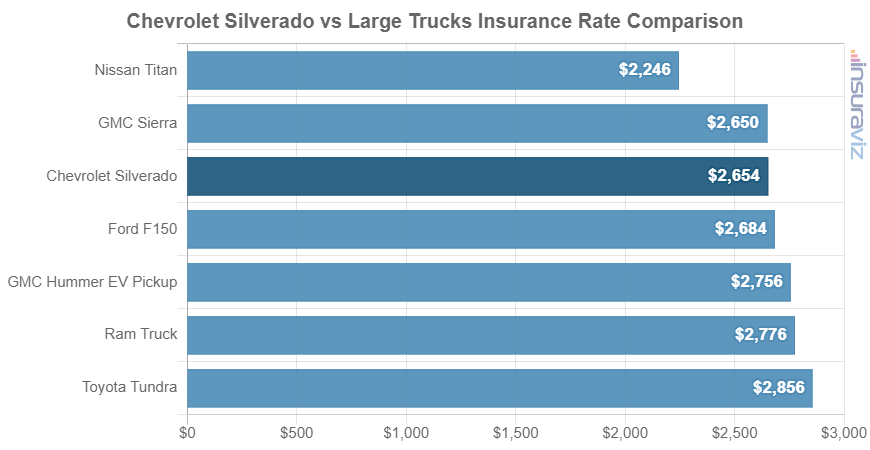

Is Silverado Insurance cheaper than other pickup brands?

If you haven’t bought a Silverado yet and are considering the insurance cost between different truck brands and models, then the data below may be of considerable interest.

When compared to other full-size half-ton pickups, Chevy Silverado insurance costs $26 less per year than the Ford F150, is $98 less than the Ram Truck, and costs $2 more than the GMC Sierra 1500 for 2024 models.

These differences may not seem too significant, but it’s important to point out that if you’re comparing significantly different trim levels between two models, you definitely want to compare rates based on the specific trim for each truck.

The reason being is insurance rates can vary significantly between lower-end models and top-end models of any vehicle. As an example, if you’re considering a high-end Silverado like the High Country, but you’re also considering a mid-level or low-end Ram or F-150, then the rates can be much different between those specific models than the average amounts noted above.

The 2024 Chevrolet Silverado ranks third out of seven total comparison vehicles in the full-size half-ton truck class. The Silverado costs an average of $2,098 per year to insure for full coverage, while the segment average rate is $2,104 annually, a difference of $6 per year.

The chart below highlights where the Silverado ranks in comparison to the other pickups in a head-to-head insurance cost comparison.

Purchase price vs. insurance price

How does the cost of Silverado insurance compare to the pickup trucks with the most similar purchase price? This is an important metric when deciding between two different truck models.

With an average MSRP of $54,751, the cost to purchase a 2024 Chevrolet Silverado ranges from $39,900 to $105,000, before delivery and documentation fees.

The half-ton pickup models closest in price to the Silverado for the 2024 model year are the Nissan Titan, Toyota Tundra, GMC Sierra, and Ram Truck. Here’s how they compare to the Chevrolet Silverado for price and insurance cost.

- Compared to the Nissan Titan – The Nissan Titan has an average retail price of $53,494, ranging from $45,770 to $62,750, which is $1,257 cheaper than the average cost for the Chevrolet Silverado. The cost to insure a Chevrolet Silverado compared to the Nissan Titan is $322 more annually on average.

- Compared to the Toyota Tundra – The sticker price on the 2024 Toyota Tundra averages $2,513 more than the average sticker price for the Chevrolet Silverado ($57,264 compared to $54,751). Insuring a 2024 Chevrolet Silverado compared to the Toyota Tundra costs an average of $160 less annually.

- Compared to the GMC Sierra – The average MSRP for a 2024 Chevrolet Silverado is $5,568 cheaper than the GMC Sierra, at $54,751 compared to $60,319. Insuring the Chevrolet Silverado compared to the GMC Sierra costs an average of $2 more each year.

- Compared to the Ram Truck – The purchase price for the 2024 Ram Truck averages $6,726 more than the average MSRP for the Chevrolet Silverado ($61,477 compared to $54,751). The average insurance cost for a 2024 Chevrolet Silverado compared to the Ram Truck is $98 less per year.

Our insurance cost comparison page has additional Silverado comparisons, plus many other makes and models.

Which company has the best insurance for a Silverado?

If the cheapest price is your top priority, USAA, GEICO, and Progressive ranked at the top of our comparison of Silverado insurance rates, at estimated rates of $1,542, $1,850, and $2,022 per year.

However, if policy price is not your primary decision-making factor, then there are a lot of other things to consider. Some consumers want top-notch claims handling and others might want a full suite of online or mobile tools to manage their policy and track claims.

Additionally, some people like having the ability to walk into a local insurance agent’s office and sit down to discuss their insurance coverages.

In this comparison, we only considered large companies that had nearly universal coverage for all U.S. states. Smaller companies like Auto-Owners, Erie Insurance, American Family, and Shelter Insurance do not sell car insurance in every state but are definitely worth considering if you have access to them where you live.

USAA takes top honors in this comparison, but you can only buy from them if you are a veteran, active military, or a family member of either.

So for the majority of us, GEICO, Progressive, and State Farm are the number one, two, and three companies in the rate comparison.

Understand that these rates are averages for all Silverado models and locations. Where you live makes a huge difference in the cost of car insurance. To see how your rates may differ from the average, simply enter your Zip Code under the chart and click the GO button.

Also, understand that no company is necessarily the best choice for every driver. Each one has positive and negative aspects of how they do business.

We put together a list of some of the pros and cons for each company shown in the chart to illustrate the importance of choosing a company that meets your individual needs.

1. USAA

Estimated USAA rate on a 2024 Chevrolet Silverado: $1,542 per year

Pros

- Policy cost is the same whether you pay as a monthly payment or in full

- They offer discounts for low-mileage drivers or vehicle storage

- They offer a usage-based policy option called SafePilot to help you save money on your insurance

Cons

- Less expensive options are available when adding a teen to a parent’s policy

- Only offers insurance to active military members, veterans, and their immediate families

Get a Quote Or read more about auto insurance coverages offered at USAA.com

2. GEICO

Estimated GEICO rate on a 2024 Chevrolet Silverado: $1,850 per year

Pros

- Offer a usage-based program, DriveEasy, for drivers who want to be monitored to save money

- They have extra perks like federal employee and military discounts, accident forgiveness, and a car-buying program

- On average, GEICO tends to have more affordable rates than the majority of other companies

Cons

- Rates are above average for drivers with an accident or DUI

- Have a below-average claim satisfaction rating in J.D. Power surveys

Get a Quote Or read more about auto insurance coverages offered at GEICO.com

3. Progressive

Estimated Progressive rate on a 2024 Chevrolet Silverado: $2,022 per year

Pros

- Rates may be better than other companies for drivers with at-fault accidents on their record

- Provides non-owner coverage for people who need coverage but do not own a car

- Will file SR-22/FR-44 forms with the state if they are needed

Cons

- Senior drivers and teenagers may find more attractive pricing elsewhere

- Does not offer new car replacement

Get a Quote Or read more about auto insurance coverages offered at Progressive.com

4. State Farm

Estimated State Farm rate on a 2024 Chevrolet Silverado: $2,134 per year

Pros

- They have strong financial ratings with agencies like J.D. Power and AM Best

- They generally have a low amount of complaints filed with state insurance departments

- Competitive rates if you’ve had a speeding ticket or two

Cons

- Don’t give customers the ability to buy gap coverage unless you finance through State Farm Bank

- Your local State Farm agent can’t quote your insurance with other providers so it will take some work on your part to shop around

Get a Quote Or read more about auto insurance coverages offered at StateFarm.com

5. Liberty Mutual

Estimated Liberty Mutual rate on a 2024 Chevrolet Silverado: $2,346 per year

Pros

- Has excellent ratings with AM Best, Moody’s, and Standard & Poor’s

- They offer a usage-based discount program, RightTrack, to help you save money on your insurance

- Has optional coverages like loan/lease gap coverage and new car replacement

Cons

- Expensive average rates for both drivers under the age of 25 and drivers over the age of 60

- Liberty Mutual tends to have more complaints filed by customers with state regulators

Get a Quote Or read more about auto insurance coverages offered at LibertyMutual.com

6. Allstate

Estimated Allstate rate on a 2024 Chevrolet Silverado: $2,551 per year

Pros

- They offer a usage-based discount program, Drivewise, to help save money on insurance

- Coverages are available like a disappearing deductible, gap insurance, and accident forgiveness

- Provides coverage for ridesharing for drivers who are employed by Uber or Lyft

Cons

- Rates are not great for drivers with a DUI, speeding tickets, or poor credit

- Allstate has some of the most expensive rates for both teenage and senior citizen drivers

- Average rates are higher for drivers with a lapse in coverage or at-fault car accidents

Get a Quote Or read more about auto insurance coverages offered at Allstate.com

During his career as an independent insurance agent,

During his career as an independent insurance agent,