The Ford F-150, America’s best-selling pickup truck for over four decades, is an icon on the roads and a reliable workhorse for countless individuals and businesses.

However, owning such a prized vehicle comes with the responsibility of securing the right insurance coverage. Whether you’re a proud Ford F-150 owner or considering joining the ranks, understanding the factors that influence its insurance costs is crucial.

In this comprehensive article, we’ll delve into the intricacies of insuring a Ford F-150, providing you with insights, tips, and strategies to navigate the often complicated task of finding the best insurance for your truck.

Ford F-150 Insurance at a Glance

- Average insurance cost for 2024 model: $2,124 per year or $177 per month

- Cheapest model to insure: XL Super Cab 4WD at $1,784 per year

- Other affordable models to insure: XL Regular Cab, XL Super Cab, XL Regular Cab 4WD

- Most expensive model to insure: Lightning Platinum Black Special Edition at $2,470 per year

- Other expensive models to insure: Lightning Platinum, Lightning Lariat Extended Range, Lightning Flash Extended Range

- Compared to 2024 model year all-vehicle average rate ($2,034): 4.3% more expensive

Driver profile: 40-year-old male, clean driving record, full coverage with $500 physical damage deductibles

Your age and F-150 insurance: What’s driving the costs?

Age is a key determinant when it comes to auto insurance rates, and owning a Ford F-150 is no exception. In this section, we’ll explore how your age can significantly impact the cost of insurance.

Whether you’re a new driver or a seasoned road warrior, understanding the relationship between your age and how much you’ll pay for F-150 insurance is essential to making informed decisions and securing the right coverage for your needs.

First let’s go over the overall average cost to insure a new F-150, then we’ll break rates down even further by showing how both driver age and policy deductibles can be major price factors.

2024 Ford F-150 insurance costs on average $2,124 per year, or about $177 if paid each month. When compared to the average insurance policy cost for the entire 2024 large truck segment, insurance rates for an F-150 are around $20 more expensive each year.

Average Ford F-150 insurance cost per month ranges from $149 to $206, depending on the trim level of the truck being insured.

Lower-cost work truck trim levels like the XL Regular Cab model tend to have the cheapest insurance rates, while tricked-out high-end trims like the Platinum and King Ranch models are more expensive to insure.

The chart below shows how average Ford F-150 car insurance rates vary based on the age of the driver and the policy deductibles. With all other factors staying constant, car insurance rates drop as driver age increases up to about age 65, at which point rates begin to increase. A policy with high deductibles will cost less than a comparable policy with a lower deductible option.

The average insurance cost we use for our analysis is a 40-year-old driver with $500 deductibles, which clocks in at $2,124 per year. Drivers see significant savings as they age from 20 to 30, with about a $1,350 difference in those ten years.

After the age of 30, rates will continue to fall at a slower pace unless an insurability factor changes. For example, a DUI or even a couple of speeding tickets would cause rates to increase, quite significantly in the case of a DWI/DUI.

Conversely, getting married, buying a home, or improving your credit rating can cause the cost of F-150 insurance to drop even more with age.

Ford F-150 insurance cost by policy coverage

There are three basic kinds of coverage on a car insurance policy, physical damage coverage, liability coverage, and medical coverage.

Physical damage coverage consists of comprehensive and collision insurance, which pays to repair your F-150 if you have an accident or weather-related claim that involves damage to your pickup.

Liability insurance pays for damages to other people’s property or their injuries if you are responsible or negligent.

Medical insurance or Personal Injury Protection pays for injuries to your vehicle’s occupants if you are in an accident. This is generally a lower limit of insurance than the coverage provided by personal injury liability insurance.

The table below breaks out the average cost of each of these coverages on a typical Ford F-150 insurance policy. It then compares each coverage to the average cost for all 2024 vehicles to see how the F-150 compares.

| Policy Coverage | 2024 Ford F150 | 2024 All Vehicle Average | Difference |

|---|---|---|---|

| Comprehensive | $506 | $520 | -2.7% |

| Collision | $982 | $960 | 2.3% |

| Liability | $446 | $388 | 13.9% |

| Med/PIP Other | $190 | $166 | 13.5% |

| Total Policy Cost | $2,124 | $2,034 | 4.3% |

Lower than average cost Higher than average cost

Data Methodology: Rated driver is a 40-year-old male with no driving violations or at-fault accidents in the prior three years. Coverage premiums are averaged for all trim levels available for the 2024 Ford F150. Updated February 23, 2024

Based on these results, the average cost of insurance on a 2024 F-150 is 4.3% more expensive than the overall national average insurance rate of $2,034 per year for all 2024 model year vehicles.

The cost of physical damage coverage (comprehensive and collision) tends to be cheaper on average for the F-150, but liability and medical expense coverage is just a little bit more expensive on average.

Keep in mind that these rates are averaged for all F-150 trim levels, so the exact model you drive will be slightly different than the average rates.

This also reinforces the importance of getting F-150 insurance quotes for the model you drive and your location rather than basing cost comparisons on average rates. To see how F-150 insurance prices compare in your area, simply enter your zip code under the table above and click the GO button.

In the next section, we compare insurance prices for all F-150 trim levels for the 2024 model year.

If you’re a safe driver, a usage-based program could reduce the cost of car insurance. Drivers can save an average of $198 per year when insuring a 2024 Ford F-150.

Ford F-150 insurance: How trim levels impact your rates

In general, the higher the trim level of the F-150 you buy, the more it will cost to insure it. Upper-end trims like the Lariat, Platinum, and King Ranch high a higher replacement cost value than lower-end XL and XLT models, so insurance rates are higher for those models.

The Ford F-150 with the cheapest insurance rates is the XL Super Cab 4WD model with the 6 1/2 or 8 feet bed. This stands to reason, as the XL model is the cheapest trim level with a base MSRP of $46,195.

Adding 4-wheel drive does increase the cost, but when historical insurance loss data is factored in, the 4-wheel drive models of the F-150 generally have lower property damage and bodily injury liability claims than 2-wheel drive models. This results in more favorable insurance rates when purchasing the 4WD option.

Rates increase throughout the lineup, topping out at the $100,090 Lightning Platinum Black Special Edition model, which has an average annual insurance cost of $2,470.

The table below breaks out average Ford F-150 car insurance rates by trim level for the 2024 model year.

| 2024 Ford F150 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| XL Super Cab 4WD | $1,784 | $149 |

| XL Regular Cab | $1,790 | $149 |

| XL Super Cab | $1,874 | $156 |

| XL Regular Cab 4WD | $1,886 | $157 |

| XL SuperCrew | $1,914 | $160 |

| STX Super Cab | $1,920 | $160 |

| XLT Super Cab | $1,970 | $164 |

| XL SuperCrew 4WD | $1,982 | $165 |

| XLT SuperCrew | $1,998 | $167 |

| XLT Super Cab 4WD | $2,026 | $169 |

| XLT SuperCrew 4WD | $2,050 | $171 |

| Tremor SuperCrew 4WD | $2,128 | $177 |

| Lariat SuperCrew | $2,134 | $178 |

| Lariat SuperCrew 4WD | $2,166 | $181 |

| Lightning Pro | $2,178 | $182 |

| King Ranch SuperCrew | $2,186 | $182 |

| Platinum SuperCrew | $2,186 | $182 |

| Platinum SuperCrew 4WD | $2,186 | $182 |

| Raptor SuperCrew 4WD | $2,204 | $184 |

| King Ranch SuperCrew 4WD | $2,206 | $184 |

| Lightning XLT Standard Range | $2,230 | $186 |

| Lightning XLT Extended Range | $2,342 | $195 |

| Lightning Lariat Standard Range | $2,352 | $196 |

| Lightning Flash Extended Range | $2,358 | $197 |

| Lightning Lariat Extended Range | $2,392 | $199 |

| Lightning Platinum | $2,442 | $204 |

| Lightning Platinum Black Special Edition | $2,470 | $206 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 22, 2024

Comparing F-150 insurance rates by model year

As a vehicle gets older, it depreciates in value and is worth less (classic cars excluded). A new 2024 Ford F-150 averages around $2,124 per year to insure, while a model that is 8 or 9 years old would cost around $400 less per year to insure for the same coverages.

The difference in cost is primarily due to the reduced payout an insurance company would be required to pay if the vehicle is totaled and the loss is covered on the policy. Thankfully, vehicles are not damaged beyond repair very often, so the $400 savings is fairly minor considering the claim payout difference could exceed $50,000 or more.

The table below demonstrates how the average Ford F-150 insurance cost decreases as the age of your truck increases. At some point, drivers have to weigh the benefit of having full coverage with the savings provided by only insuring for liability only. This table assumes full coverage for all model years.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Ford F150 | $4,294 | $2,124 | $1,758 |

| 2023 Ford F150 | $3,748 | $1,876 | $1,556 |

| 2022 Ford F150 | $3,360 | $1,672 | $1,394 |

| 2021 Ford F150 | $3,432 | $1,690 | $1,408 |

| 2020 Ford F150 | $3,330 | $1,642 | $1,366 |

| 2019 Ford F150 | $3,136 | $1,542 | $1,286 |

| 2018 Ford F150 | $2,956 | $1,456 | $1,218 |

| 2017 Ford F150 | $2,834 | $1,398 | $1,170 |

| 2016 Ford F150 | $2,708 | $1,336 | $1,116 |

| 2015 Ford F150 | $2,728 | $1,342 | $1,122 |

| 2014 Ford F150 | $2,468 | $1,216 | $1,024 |

| 2013 Ford F150 | $2,384 | $1,182 | $994 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ford F150 trim levels for each model year. Updated February 23, 2024

As new safety features like crash avoidance braking, adaptive cruise control, and lane keep assist are introduced and adopted into new models, insurance rates can actually end up being lower for new models.

Any technology that lowers the frequency or severity of liability or physical damage claims translates into better insurance rates. For the Ford F-150, the 2015 model year redesign included 31 new safety innovations. The effect on insurance rates can be seen the following year when insurance rates actually dropped for the 2016 model year.

The F-150 moniker debuted for the 1975 model year. Prior to that, it was known as the F-100. Today, Ford’s Dearborn, MI, assembly plant cranks out a new F-150 every 52 seconds.

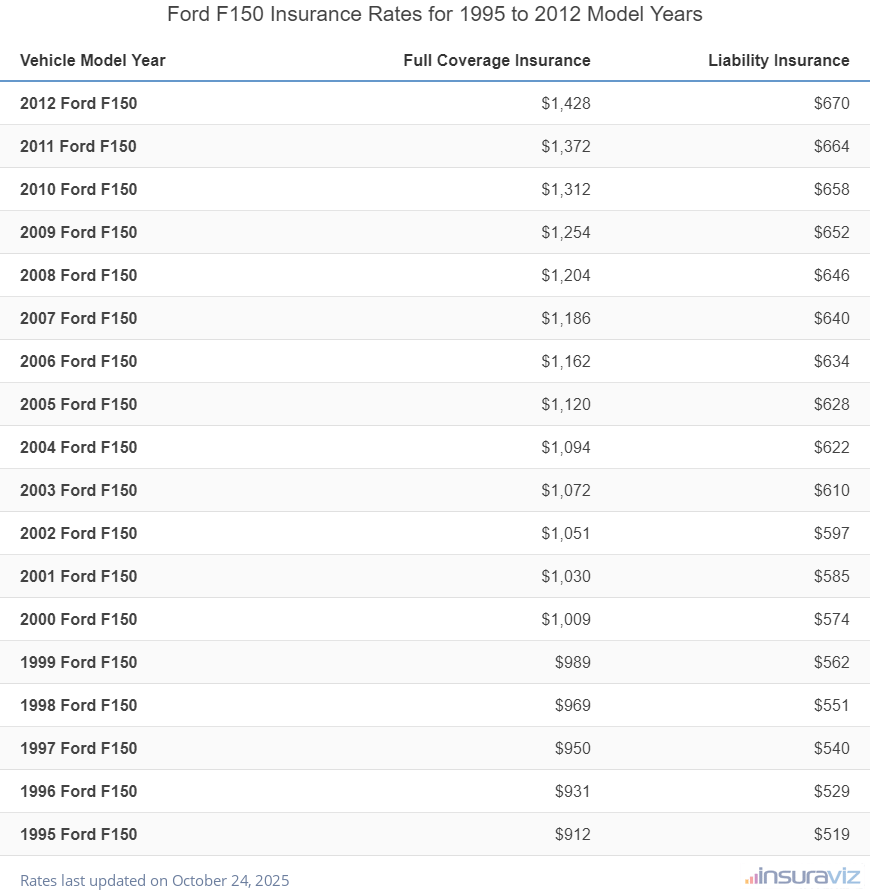

As mentioned earlier, there comes a day when you have to make the decision to remove full coverage on your truck and just pay for liability insurance only.

The table below shows the average insurance cost for older F-150 model years, with the average rate for both full coverage and liability-only insurance included.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Ford F150 | $1,130 | $530 |

| 2011 Ford F150 | $1,086 | $526 |

| 2010 Ford F150 | $1,036 | $520 |

| 2009 Ford F150 | $992 | $516 |

| 2008 Ford F150 | $952 | $512 |

| 2007 Ford F150 | $938 | $506 |

| 2006 Ford F150 | $920 | $502 |

| 2005 Ford F150 | $886 | $496 |

| 2004 Ford F150 | $864 | $492 |

| 2003 Ford F150 | $847 | $482 |

| 2002 Ford F150 | $830 | $473 |

| 2001 Ford F150 | $813 | $463 |

| 2000 Ford F150 | $797 | $454 |

| 1999 Ford F150 | $781 | $445 |

| 1998 Ford F150 | $765 | $436 |

| 1997 Ford F150 | $750 | $427 |

| 1996 Ford F150 | $735 | $419 |

| 1995 Ford F150 | $720 | $410 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated February 23, 2024

Ford F-150 vs. full-size truck market: Full analysis

In the competitive 2024 half-ton truck segment, Ford F-150 insurance cost ranks fourth. With a segment average insurance cost of $2,104, the F-150 averages about $20 less per year.

When compared to all vehicles (not just other large trucks) it also fares well. When compared to all 2024 model year vehicles (not just half-ton pickups), insurance on the Ford F-150 costs 4.3% more than the overall national average insurance rate of $2,034 per year.

The chart below shows how well Ford F-150 insurance compares to all other large trucks including the #2 and #3 selling trucks, the Chevy Silverado 1500 and the Ram 1500.

With an average sticker price of $61,950, ranging from the cheapest XL Super Cab 4WD model at $46,195 to the most expensive Lightning Platinum Black Special Edition costing $100,090, the full-size half-ton pickups closest in price to the Ford F-150 for the 2024 model year are the Ram Truck, GMC Sierra, Toyota Tundra, and Chevrolet Silverado.

Here’s how those four models compare to a 2024 Ford F-150 for both average purchase price and insurance cost.

- Ford F150 vs. Ram Truck – The average MSRP for a 2024 Ford F150 is $473 more expensive than the Ram Truck, at $61,950 compared to $61,477. The cost to insure a Ford F-150 compared to the Ram Truck is $72 less annually on average.

- Ford F150 vs. GMC Sierra – The GMC Sierra has an average retail price of $60,319, ranging from $39,695 to $107,000, which is $1,631 cheaper than the Ford F-150. Insurance on a 2024 Ford F-150 costs an average of $28 more every 12 months than the GMC Sierra.

- Ford F150 vs. Toyota Tundra – The Toyota Tundra has an average retail price of $57,264, ranging from $39,965 to $78,845, which is $4,686 cheaper than the Ford F-150. Insuring the Ford F-150 compared to the Toyota Tundra costs an average of $134 less per year.

- Ford F150 vs. Chevrolet Silverado – The average MSRP for a 2024 Ford F150 is $7,199 more expensive than the Chevrolet Silverado, at $61,950 compared to $54,751. The average insurance cost for a 2024 Ford F-150 compared to the Chevrolet Silverado is $26 more annually.

The F-150 is the best-selling truck in America for good reason. It’s loaded with features, is easy on the eyes, and can also check the “affordable truck insurance” box.

And averaging less than the average insurance rate for all 2024 vehicles, the Ford F-150 should be fairly easy on the wallet when the car insurance bill comes (depending on trim level and options, of course).

Additional F-150 insurance cost comparisons

- Ford F150 vs. Ford F250 Super Duty

- Ford F150 vs. Ford Ranger

- Ford F150 vs. Nissan Titan

- Ford F150 vs. Ford Expedition

F-150 safety features that may reduce your premium

Insurance companies typically calculate premiums based on the risk associated with the driver, the vehicle, and their interaction.

When it comes to the 2024 Ford F-150, specific safety features not only help protect the occupants in the event of a crash but can also reduce the likelihood of accidents, leading to potential savings on car insurance.

Safety features of the 2024 Ford F-150 that could lower your rates

Ford Co-Pilot360 Technology

Ford’s Co-Pilot360 suite of safety features is available starting with the XLT trim. Co-Pilot360 Assist 2.0 is available as standard on the Limited model and as an option on Lariat, King Ranch, and Platinum models.

- Pre-Collision Assist with Automatic Emergency Braking (AEB) – This system can detect a potential collision with a vehicle or pedestrian in front of you. It can alert you to a potential crash and even apply the brakes if you fail to take corrective action. Insurance companies may offer discounts for vehicles with AEB because it helps to prevent front-end collisions.

- Blind Spot Information System (BLIS) with Trailer Coverage – BLIS helps detect and alert you to vehicles in your blind spot. For a truck that’s often used for towing, the trailer coverage extension is crucial.

- Lane-Keeping System – This feature helps to keep the vehicle centered in its lane and can alert the driver or even steer the vehicle back into the lane if it begins to drift.

- Rear View Camera with Dynamic Hitch Assist – This feature gives drivers a clear view behind the truck, making it easier to reverse safely and hitch trailers without assistance.

- Auto High-Beam Headlamps – Enhancing visibility at night, these headlamps can switch between high and low beams automatically.

Active Drive Assist

An evolution of adaptive cruise control and lane-centering technology, Active Drive Assist can enable hands-free driving on more than 100,000 miles of pre-mapped divided highways in the United States and Canada.

By maintaining safe speeds and reducing driver fatigue, systems like these can lead to lower accident rates, which insurers often reward with lower premiums.

Post-Collision Braking

This feature can potentially lessen the severity of a secondary collision by automatically applying moderate brake pressure when an initial collision is detected. Reducing the impact of secondary crashes not only improves safety for occupants but can also minimize the extent of property damage, potentially leading to fewer insurance claims.

Cross-Traffic Alert

This aids drivers when pulling out of parking spaces by warning of traffic that may be crossing behind them. It’s particularly useful in busy parking lots or on streets with obstructed views, helping to prevent collisions.

Reverse Brake Assist

This can detect both stationary and moving objects behind the vehicle, providing audible and visual warnings and even applying the brakes if necessary to avoid an impact. Preventing reverse accidents can help reduce claims for low-speed impacts, which can help keep insurance premiums down.

Insurance companies evaluate the effectiveness of these safety features based on historical accident data and their own claims experiences.

It is important to note that safety features discounts can vary significantly between insurers and may also depend on state regulations and other factors.

What is the best insurance for an F-150?

There are a lot of great insurance companies available, but each one has its pros and cons.

What you consider the best insurance may not necessarily be the best insurance for your neighbor or coworker. Maybe you prefer to handle your insurance on your phone, or maybe you’d prefer to have a local agent to talk to about your concerns.

Finding the best insurance for an F-150 really comes down to what you prioritize as the most important aspects of your insurance coverage.

See our Car Insurance 101 article titled The Smart Driver’s Guide to Shopping for Car Insurance for more information on different ways to find the best coverage for your F-150.

We put together a list of five companies that may be worth considering when buying insurance for your Ford. A few of the strong points (and the not-so-strong points) are listed for each one.

These are all larger companies, most of which you have probably heard of. But it’s worth pointing out that there are many smaller companies that can also insure your F-150 just as well.

Those companies may only insure vehicles in a state or two, and the easiest way to find them is probably to contact an independent insurance agent.

Without further ado, here is our list of some of the companies we recommend for finding the best insurance for your F-150.

Progressive

Estimated Progressive car insurance rate on a 2024 Ford F-150: $1,827 per year

Pros

- Offers non-owner car insurance coverage

- Will file SR-22/FR-44 forms with the state if they are mandated from a prior conviction

- Perks are available like accident forgiveness and a vanishing deductible

Cons

- Progressive doesn’t have the strongest claim ratings with J.D. Power

- Drivers in their teens and early twenties may find rates are a little higher than some other companies

Get a Quote Or read more about auto insurance coverages offered at Progressive.com

Nationwide

Estimated Nationwide car insurance rate on a 2024 Ford F-150: $2,103 per year

Pros

- They generally have a low amount of customer complaints filed with state insurance departments

- Offers additional coverage like accident forgiveness, gap insurance, and a vanishing deductible

- The company offers a usage-based discount program, SmartRide, for drivers who want to be monitored to save money

Cons

- Expensive average rates for drivers with prior bodily injury liability claims

- Prices are higher for drivers with a bad driving record or prior accidents

Get a Quote Or read more about auto insurance coverages offered at Nationwide.com

GEICO

Estimated GEICO car insurance rate on a 2024 Ford F-150: $1,763 per year

Pros

- Insureds can make payments or file claims via a smartphone app

- On average, GEICO tends to have cheaper insurance rates than a lot of other companies

- They have consistently strong financial ratings with rating agencies like AM Best and Moody’s

Cons

- The company doesn’t provide gap insurance coverage

- They do not offer coverage for ridesharing for drivers who are employed by Lyft or Uber

Get a Quote Or read more about auto insurance coverages offered at GEICO.com

State Farm

Estimated State Farm car insurance rate on a 2024 Ford F-150: $2,018 per year

Pros

- Good renewal discount of about 14% if you have at least three years of longevity

- Competitive prices if you’ve had a speeding ticket or two

- Good price if you’re adding a teen to your policy

Cons

- High insurance rates for drivers with below-average credit

- Average rates are higher for drivers with prior accidents or major violations like a DUI

Get a Quote Or read more about auto insurance coverages offered at StateFarm.com

Safeco

Estimated Safeco car insurance rate on a 2024 Ford F-150: $1,869 per year

Pros

- Safeco offers optional coverages like a diminishing deductible, new car replacement, and accident forgiveness

- Offers claims-free cash back

- They offer a usage-based program called RightTrack for drivers who want to try to save some money

Cons

- The company doesn’t give the option to buy loan/lease gap coverage

- Does not offer non-owner auto insurance coverage

Get a Quote Or read more about auto insurance coverages offered at Safeco.com

USAA

Estimated USAA car insurance rate on a 2024 Ford F-150: $1,444 per year

Pros

- Rates are decent for drivers with accidents, tickets, and even a DUI

- Average prices are good for both teens and drivers over the age of 60

- Extends optional rideshare coverage for drivers who are employed by companies like Uber and Lyft

Cons

- The savings for bundling home and auto is less than most other insurers

- There are more affordable options when adding a teenage driver to a policy

- Only offers car insurance to active military members, veterans, and their immediate families

Get a Quote Or read more about auto insurance coverages offered at USAA.com

During his career as an independent insurance agent,

During his career as an independent insurance agent,