- Dodge Grand Caravan insurance costs an average of $1,776 per year, or about $148 per month for a policy with full coverage.

- The Dodge Grand Caravan is one of the cheaper 2020 models to insure, costing $160 less per year on average when compared to other minivans.

- Deleting comprehensive and collision coverage on an older Dodge Grand Caravan could save the average driver $756 per year, depending on the level of physical damage deductibles and the driver age.

How much does Dodge Grand Caravan insurance cost?

Dodge Grand Caravan car insurance costs an average of $1,776 a year for full coverage. Depending on the trim level being insured, monthly car insurance cost for a 2020 Dodge Grand Caravan ranges from $143 to $153.

For individual policy coverages, comprehensive coverage is around $398 a year, collision coverage costs an estimated $658, and the remaining liability and medical payments insurance is around $720.

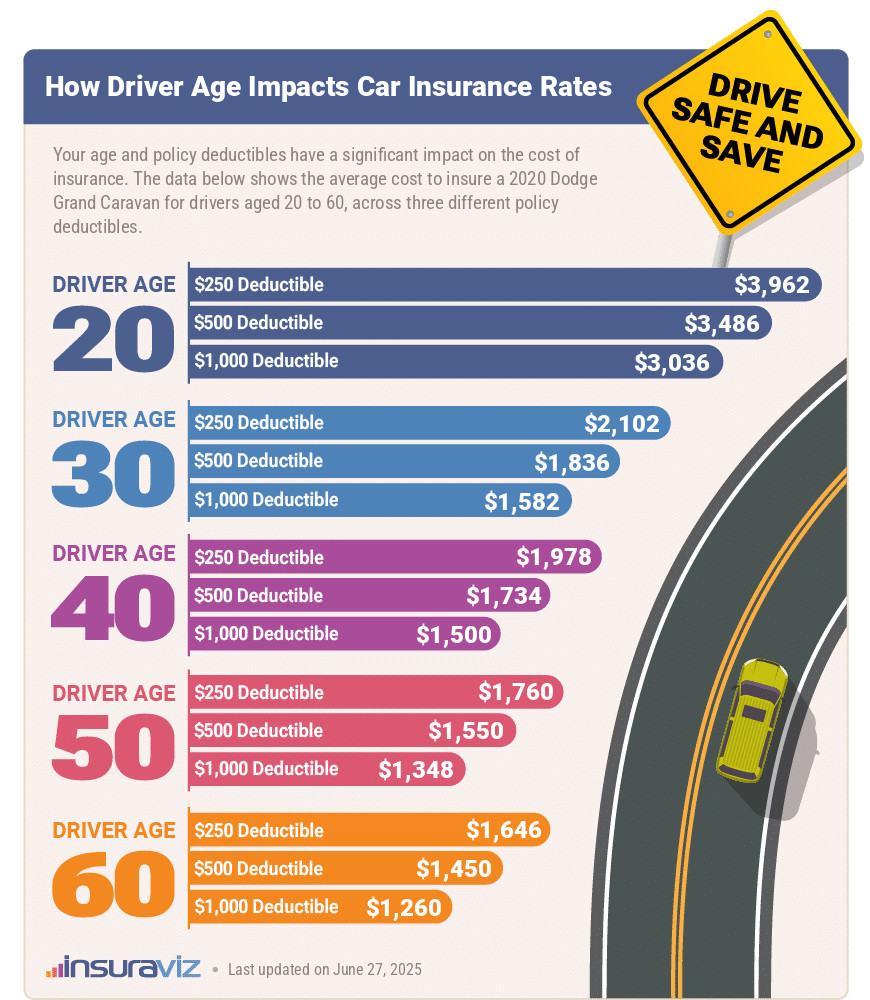

The infographic below demonstrates how Dodge Grand Caravan insurance cost changes with different driver ages and policy coverage deductibles.

Some additional insights into Dodge Grand Caravan insurance cost include:

- Grand Caravan insurance is expensive for high-risk drivers. For a 30-year-old driver, having to buy a high-risk insurance policy could end up with a rate increase of $2,208 or more per year.

- Higher physical damage deductibles lower policy cost. Boosting your deductibles from $500 to $1,000 could save around $242 per year for a 40-year-old driver and $462 per year for a 20-year-old driver.

- Low deductibles will increase rates. Dropping your deductibles from $500 to $250 could cost an additional $250 per year for a 40-year-old driver and $486 per year for a 20-year-old driver.

- Great credit can mean great car insurance rates. Insureds with excellent credit scores of 800+ could save as much as $279 per year over a good rating of 670-739. Conversely, a lower credit rating could cost up to $323 more per year.

- Avoid driving violations to reduce insurance rates. To pay the most reasonable price on Grand Caravan insurance rates, it pays to drive safely. A few minor traffic citations could result in spiking insurance rates by as much as $480 per year.

- Get cheaper rates by researching policy discounts. Discounts may be available if the policyholders insure their home and car with the same company, are military or federal employees, are away-from-home students, are accident-free, or many other policy discounts which could save the average driver as much as $302 per year on their insurance cost.

- Dodge Grand Caravan insurance for teen drivers is expensive. Average rates for full coverage Grand Caravan insurance costs $6,506 per year for a 16-year-old driver, $6,240 per year for a 17-year-old driver, and $5,473 per year for an 18-year-old driver.

How does Grand Caravan insurance cost compare?

The Dodge Grand Caravan ranks second out of five total comparison vehicles in the 2020 minivan category. The Grand Caravan costs an average of $1,776 per year for insurance, while the segment average rate is $1,936 per year, a difference of $160 per year.

When compared to other models in the segment, insurance for a Dodge Grand Caravan costs $342 less per year than the Honda Odyssey, $178 less than the Chrysler Pacifica, $316 less than the Toyota Sienna, and $34 more than the Kia Sedona.

When compared to all other vehicles (not just comparable minivans), the cost to insure a Dodge Caravan is $500 less per year than the overall national average car insurance rate of $2,276.

The table below shows the difference between Dodge Grand Caravan insurance cost and the rest of the minivan market for the 2020 model year.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Kia Sedona | $1,742 | -$34 |

| 2 | Dodge Grand Caravan | $1,776 | -- |

| 3 | Chrysler Pacifica | $1,954 | $178 |

| 4 | Toyota Sienna | $2,092 | $316 |

| 5 | Honda Odyssey | $2,118 | $342 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2020 model year. Updated October 24, 2025

Will buying an older model save on insurance?

Buying insurance for a 2013 Grand Caravan instead of a 2020 model could save up to $442 per year. Even choosing a gently used 2019 model will save $70 each year.

The following data table details average car insurance rates for a Dodge Grand Caravan for various driver age groups and model years. Policy costs range from the least expensive rate of $1,118 for a 60-year-old driver rated on a 2013 Dodge Grand Caravan to the most expensive value of $3,574 for a 20-year-old driving a 2020 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2020 Dodge Grand Caravan | $3,574 | $1,776 | $1,484 |

| 2019 Dodge Grand Caravan | $3,726 | $1,846 | $1,544 |

| 2018 Dodge Grand Caravan | $3,542 | $1,758 | $1,470 |

| 2017 Dodge Grand Caravan | $3,264 | $1,622 | $1,358 |

| 2016 Dodge Grand Caravan | $3,082 | $1,528 | $1,282 |

| 2015 Dodge Grand Caravan | $2,956 | $1,460 | $1,230 |

| 2014 Dodge Grand Caravan | $2,946 | $1,462 | $1,230 |

| 2013 Dodge Grand Caravan | $2,670 | $1,334 | $1,118 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Dodge Grand Caravan trim levels for each model year. Updated October 24, 2025

At some point as the vehicle gets older, it makes smart financial sense to eliminate comprehensive and collision coverage from a policy. As vehicles get older and lose value, the cost of having full coverage can easily outweigh the benefit.

Deleting physical damage coverage on an older Dodge Grand Caravan may save you $756 a year, depending on how high the deductibles were and the age of the rated driver.

The decision to drop full coverage is a personal one, as every driver’s situation is different. Just keep in mind that if you do remove physical damage coverage, it’s a good idea to make sure you have adequate savings if you need to buy a different vehicle.