- The average Mercedes Metris car insurance cost is $1,778 per year, or $148 per month for full coverage.

- When compared to other large vans, the Mercedes-Benz Metris is one of the more expensive large vans to insure, costing $242 more per year on average.

How much is Mercedes Metris insurance?

Mercedes-Benz Metris car insurance rates average $1,778 annually, or around $148 a month. With the average large van costing $1,536 a year to insure, the Mercedes-Benz Metris could cost an estimated $242 or more annually.

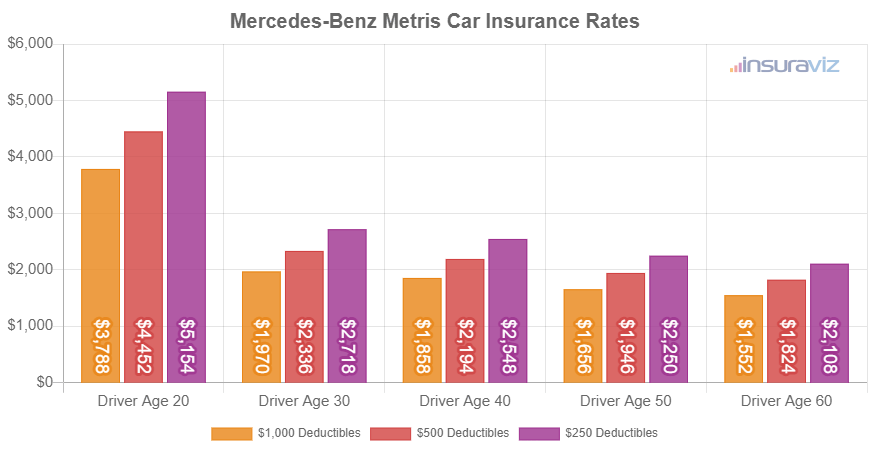

The chart below shows how Mercedes Metris insurance cost varies based on the age of the driver and coverage deductibles. The yearly premium cost range from the cheapest price of $1,258 per year for a 60-year-old driver with $1,000 comprehensive and collision deductibles to the most expensive rate of $4,176 annually for a driver age 20 with low physical damage deductibles.

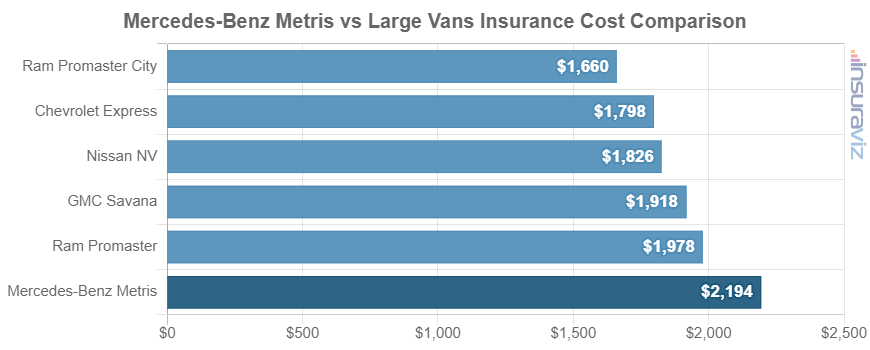

How does Metris insurance compare to other vans?

When compared to other vans, insurance for a Mercedes-Benz Metris costs $318 more per year than the Chevrolet Express, $176 more than the Ram Promaster, $222 more than the GMC Savana, and $300 more than the Nissan NV.

The Mercedes Metris ranks sixth out of six total vehicles in the large van class. The Metris costs an average of $1,778 per year to insure, while the segment average is $1,536 per year, a difference of $242 per year.

The chart below shows how Metris insurance cost compares to the rest of the large van segment.

Additional rates and ways to possible save on your next policy:

- Earn a discount from your job. Just about all auto insurance providers offer discounts for certain professions like firefighters, members of the military, architects, engineers, college professors, accountants, and other occupations. By getting this discount, you could save between $53 and $176 on your car insurance bill, depending on your policy.

- Qualify for discounts to lower insurance cost. Discounts may be available if the insureds work in certain occupations, insure their home and car with the same company, are claim-free, take a defensive driving course, or many other discounts which could save the average driver as much as $304 per year on the cost of insuring a Metris.

- Gender and age affect the rate you pay. For a 2021 Mercedes-Benz Metris, a 20-year-old male will have an average rate of $3,606 per year, while a 20-year-old woman pays an estimated $2,580, a difference of $1,026 per year. The females get the cheaper rate by far. But by age 50, the cost for a male driver is $1,578 and the rate for females is $1,538, a difference of only $40.

- As you age, car insurance rates tend to get cheaper. The difference in insurance cost for a Mercedes-Benz Metris between a 60-year-old driver ($1,478 per year) and a 20-year-old driver ($3,606 per year) is $2,128, or a savings of 83.7%.

- Insuring teenagers can be very expensive. Average rates for full coverage Metris insurance costs $6,442 per year for a 16-year-old driver, $6,229 per year for a 17-year-old driver, and $5,558 per year for an 18-year-old driver.

- High-risk drivers pay a lot more for insurance. For a 30-year-old driver, having to buy a high-risk policy due to excessive accidents and/or violations could trigger a rate increase of $2,220 or more per year.

- Safe drivers have lower car insurance rates. Being the cause of frequent accidents will raise rates, potentially by an extra $870 per year for a 30-year-old driver and even $552 per year for a 50-year-old driver.