- Nissan Quest car insurance costs an average of $1,434 per year or around $120 per month, but can vary based on the limits of the policy.

- Quest insurance ranges from $1,326 to $1,540 annually for an average driver, depending on trim level.

- When compared to other 2017 midsize minivans, the Nissan Quest is one of the more expensive midsize minivans to insure, costing $46 more per year on average.

How much does Nissan Quest car insurance cost?

Average car insurance cost for a Nissan Quest is $1,434 per year, or around $120 a month. For individual policy coverages, liability/medical is about $554 a year, collision coverage is about $572, and the remaining comprehensive costs approximately $308.

The following chart displays average annual car insurance cost for a Nissan Quest using a range of driver ages and risk profiles.

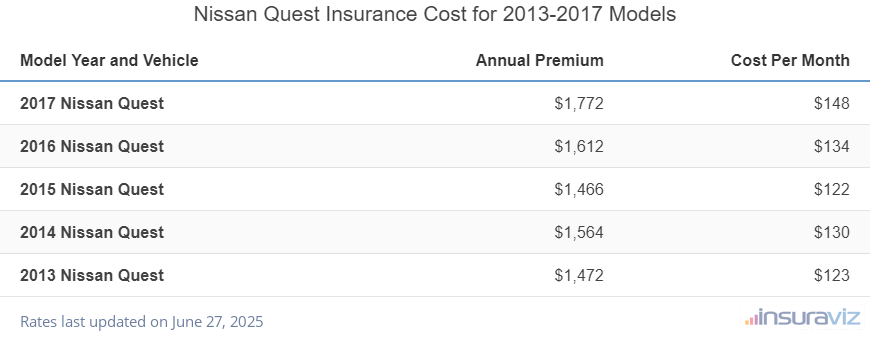

The next table details average Nissan Quest insurance rates for the 2013-2017 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2017 Nissan Quest | $1,434 | $120 |

| 2016 Nissan Quest | $1,304 | $109 |

| 2015 Nissan Quest | $1,190 | $99 |

| 2014 Nissan Quest | $1,266 | $106 |

| 2013 Nissan Quest | $1,192 | $99 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Nissan Quest trim levels for each model year. Updated February 23, 2024

The table below shows annual and 6-month policy costs, plus a monthly budget estimate, for each Nissan Quest trim level.

| 2017 Nissan Quest Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S 2WD | $1,326 | $111 |

| SV 2WD | $1,414 | $118 |

| SL 2WD | $1,456 | $121 |

| Platinum 2WD | $1,540 | $128 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 22, 2024

How do Quest insurance rates compare?

When insurance prices are compared to other midsize minivan models, auto insurance rates for a Nissan Quest cost $152 more per year than the Dodge Grand Caravan, $82 more than the Honda Odyssey, and $134 more than the Chrysler Pacifica.

The Nissan Quest ranks fifth out of six total vehicles in the midsize minivan class for most affordable insurance cost. The Quest costs an average of $1,434 per year for a car insurance policy with full coverage and the class average cost is $1,388 annually, a difference of $46 per year.

The table below shows how average Quest car insurance cost compares to the top 10 best-selling midsize minivans like the Toyota Sienna, Kia Sedona, and the Honda Odyssey.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Dodge Grand Caravan | $1,282 | -$152 |

| 2 | Chrysler Pacifica | $1,300 | -$134 |

| 3 | Honda Odyssey | $1,352 | -$82 |

| 4 | Kia Sedona | $1,400 | -$34 |

| 5 | Nissan Quest | $1,434 | -- |

| 6 | Toyota Sienna | $1,562 | $128 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2017 model year. Updated February 23, 2024

Other rates and insights

A few additional notable conclusions regarding the cost to insure a Nissan Quest include:

- Rated driver gender affects the rate you pay. For 2017 Nissan Quest insurance, a 20-year-old man will pay about $2,910 per year, while a 20-year-old female will pay $2,090, a difference of $820 per year in the women’s favor by a large margin. But by age 50, male rates are $1,282 and rates for female drivers are $1,242, a difference of only $40.

- Nissan Quest insurance rates for teenagers are high. Average rates for full coverage Quest insurance costs $5,280 per year for a 16-year-old driver, $5,075 per year for a 17-year-old driver, $4,469 per year for an 18-year-old driver, and $4,091 per year for a 19-year-old driver.

- Raising deductibles makes insurance more affordable. Raising the comprehensive and collision deductibles from $500 to $1,000 could save around $200 per year for a 40-year-old driver and $392 per year for a 20-year-old driver.

- Decreasing deductibles will cost more. Lowering your physical damage coverage deductibles from $500 to $250 could cost an additional $208 per year for a 40-year-old driver and $412 per year for a 20-year-old driver.

- High-risk auto insurance costs more. For a 20-year-old driver, having enough accidents and violations to require a high-risk insurance policy can potentially increase rates by $2,292 or more per year.

- Clean up your credit for better rates. Having an excellent credit rating above 800 could save around $225 per year versus a credit rating between 670-739. Conversely, a not-so-perfect credit rating could cost around $261 more per year.

- Tickets and violations cost money. To get the lowest-priced Nissan Quest car insurance rates, it’s necessary to to be a conservative driver. Just a couple of minor traffic violations have the ramification of increasing insurance policy rates by up to $392 per year. Serious misdemeanor violations like DWI or reckless driving could raise rates by an additional $1,356 or more.