- BMW 335i insurance cost averages $2,038 per year or around $170 per month, but can vary significantly based on location and driver age.

- The BMW 335i is one of the more expensive small luxury cars to insure on average, costing $190 more per year when compared to other small luxury cars.

How much does BMW 335i insurance cost?

Ranked 22nd out of 25 vehicles in the 2015 small luxury car class, the cost to insure a BMW 335i averages $2,038 annually for full coverage, or around $170 monthly. With the average small luxury car costing $1,848 a year to insure, the BMW 335i could cost around $190 or more on an annual basis.

The price summary chart below details average car insurance rates for a 2015 BMW 335i for some of the more common policy scenarios.

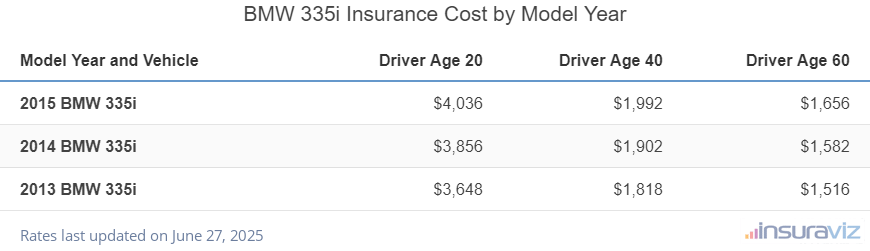

The following table shows the average BMW 335i car insurance rates for the 2013-2015 model years for five different age groups.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2015 BMW 335i | $4,134 | $2,038 | $1,696 |

| 2014 BMW 335i | $3,950 | $1,946 | $1,620 |

| 2013 BMW 335i | $3,736 | $1,862 | $1,550 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW 335i trim levels for each model year. Updated October 24, 2025

Where do BMW 335i insurance rates rank?

The BMW 335i ranks 22nd out of 25 total vehicles in the 2015 small luxury car category for insurance affordability. The 335i costs an average of $2,038 per year for full coverage insurance, while the category median rate is $1,848 annually, a difference of $190 per year.

When compared to other compact luxury models, insurance rates for a BMW 335i cost $146 more per year than the Mercedes-Benz C300, $420 more than the Volvo S60, and $400 more than the Acura TLX.

The following chart shows how average 2015 BMW 335i car insurance rates compare to the most popular small luxury cars like the Audi A4, Lexus IS 350, and the BMW i3. A table is also added following the chart that details the average insurance cost for all 25 models in the small luxury car category for the 2015 model year.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Mercedes-Benz SLK 250 | $1,412 | -$626 |

| 2 | Mercedes-Benz SLK 350 | $1,588 | -$450 |

| 3 | Volvo S60 | $1,618 | -$420 |

| 4 | BMW 328xi | $1,622 | -$416 |

| 5 | Acura TLX | $1,638 | -$400 |

| 6 | BMW 228xi | $1,648 | -$390 |

| 7 | Audi A4 | $1,734 | -$304 |

| 8 | Cadillac ATS | $1,784 | -$254 |

| 9 | Lexus IS 350 | $1,810 | -$228 |

| 10 | BMW 228i | $1,822 | -$216 |

| 11 | BMW 320i | $1,848 | -$190 |

| 12 | BMW i3 | $1,862 | -$176 |

| 13 | Audi S3 | $1,864 | -$174 |

| 14 | Lexus CT 200H | $1,880 | -$158 |

| 15 | Mercedes-Benz C300 | $1,892 | -$146 |

| 16 | Mercedes-Benz B-Electric Cell | $1,900 | -$138 |

| 17 | BMW 328i | $1,912 | -$126 |

| 18 | BMW 335xi | $1,932 | -$106 |

| 19 | BMW 328d | $1,942 | -$96 |

| 20 | Mercedes-Benz C250 | $2,002 | -$36 |

| 21 | BMW M235i | $2,024 | -$14 |

| 22 | BMW 335i | $2,038 | -- |

| 23 | BMW Activehybrid 3 | $2,084 | $46 |

| 24 | Lexus RC 350 | $2,148 | $110 |

| 25 | Lexus IS 250 | $2,204 | $166 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2015 model year. Updated October 24, 2025

Additional rates and insights

Some additional relevant rates and observations concerning the cost of insurance for a 335i include:

- Prepare for sticker shock for high-risk insurance. For a 40-year-old driver, having enough accidents and violations to require a high-risk insurance policy can cause a rate increase of $2,502 or more per year.

- Lower the cost of your policy by increasing deductibles. Increasing your policy deductibles from $500 to $1,000 could save around $308 per year for a 40-year-old driver and $602 per year for a 20-year-old driver.

- Low deductibles make insurance more expensive. Dropping your physical damage deductibles from $500 to $250 could cost an additional $318 per year for a 40-year-old driver and $636 per year for a 20-year-old driver.

- The older you are, the lower your insurance rates are. The difference in insurance cost on a 2015 335i between a 50-year-old driver ($1,812 per year) and a 20-year-old driver ($4,134 per year) is $2,322, or a savings of 78.1%.

- A good credit rating can save money. Drivers who maintain a credit score over 800 may save $320 per year when compared to a credit rating of 670-739. Conversely, a weak credit rating could cost around $371 more per year.

- Young males pay a lot more for insurance. For a 2015 BMW 335i, a 20-year-old male will have an average rate of $4,134 per year, while a 20-year-old female driver pays an estimated $2,962, a difference of $1,172 per year. The females get the cheaper rate by far. But by age 50, the rate for males is $1,812 and the female rate is $1,762, a difference of only $50.

- Fewer violations mean cheaper insurance rates. If you want to pay the most budget-friendly 335i insurance rates, it pays to follow traffic laws. In fact, just a couple of minor driving offenses could result in spiking policy costs by as much as $552 per year. Major misdemeanors such as a DUI could raise rates by an additional $1,916 or more.

- Save money due to your choice of occupation. Some auto insurance companies offer policy discounts for specific professions like members of the military, firefighters, architects, college professors, engineers, and others. If you qualify, you may save between $61 and $158 on your yearly insurance cost, depending on the age of the driver.