- BMW 328i insurance costs an average of $1,532 per year, or around $128 per month, for full coverage.

- Ranked 10th out of 26 vehicles in the 2016 small luxury car segment, average car insurance rates for the BMW 328i cost $21 less per year than the segment average.

How much does BMW 328i insurance cost?

Insurance cost for a BMW 328i averages $1,532 a year for full coverage, or $128 on a monthly basis. You can expect to pay approximately $21 less each year for BMW 328i insurance compared to the small luxury cars average rate, and $351 less per year than the overall national average of $1,883.

The bar chart below demonstrates how average car insurance rates for a 2016 BMW 328i adjust based on a variety of driver ages and policy deductibles.

The data below details average car insurance rates for a BMW 328i for the 2013-2016 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2016 BMW 328i | $1,532 | $128 |

| 2015 BMW 328i | $1,512 | $126 |

| 2014 BMW 328i | $1,402 | $117 |

| 2013 BMW 328i | $1,386 | $116 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW 328i trim levels for each model year. Updated February 23, 2024

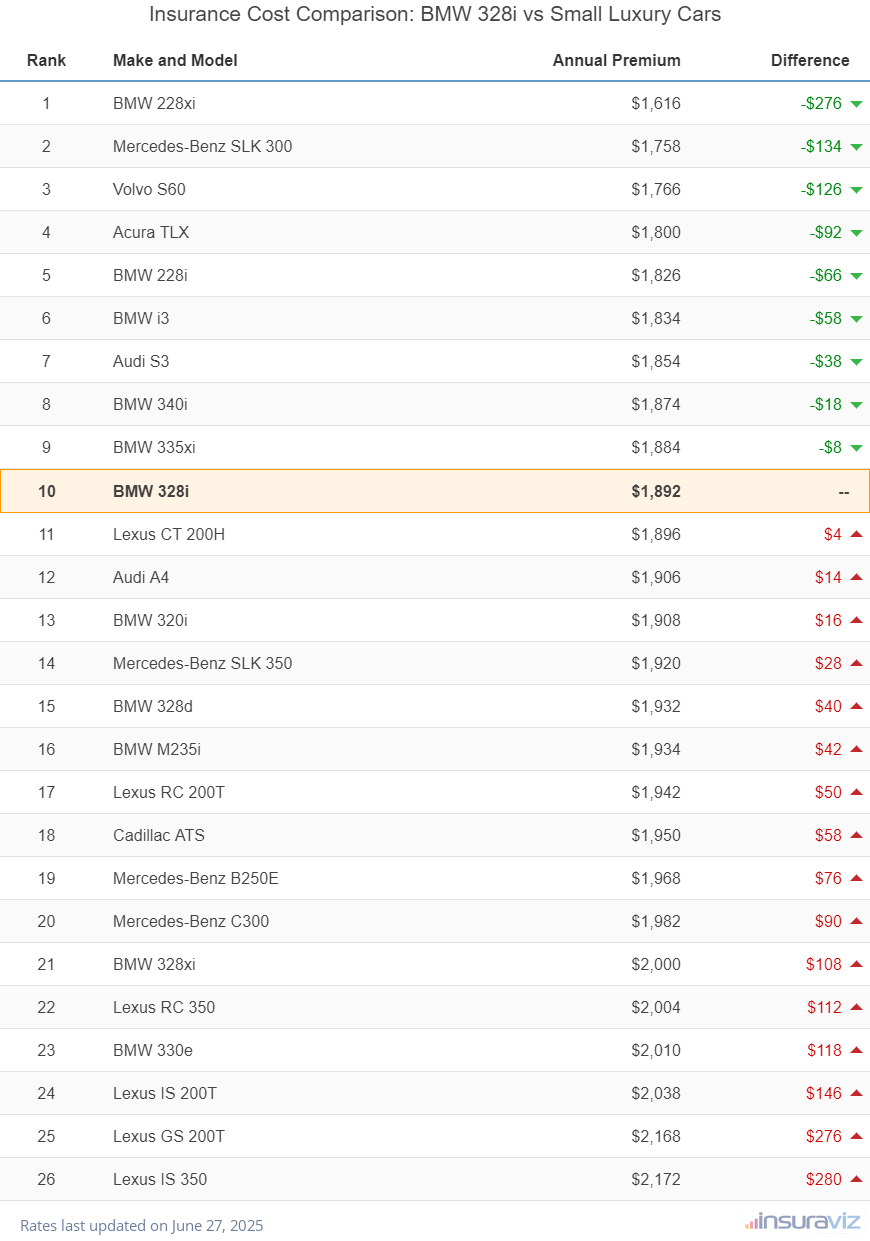

How does BMW 328i insurance cost rank?

The BMW 328i ranks 10th out of 26 comparison vehicles in the 2016 small luxury car segment for the most affordable car insurance rates. The 328i costs an average of $1,532 per year for full coverage insurance and the category average rate is $1,553 per year, a difference of $21 per year.

When compared to other popular compact luxury sedans, insurance rates for a BMW 328i cost $74 less per year than the Mercedes-Benz C300, $102 more than the Volvo S60, and $76 more than the Acura TLX.

The next table shows how average car insurance rates for a BMW 328i compare to all other compact luxury cars in America like the Audi A4, Lexus IS 350, and the BMW i3.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | BMW 228xi | $1,312 | -$220 |

| 2 | Mercedes-Benz SLK 300 | $1,428 | -$104 |

| 3 | Volvo S60 | $1,430 | -$102 |

| 4 | Acura TLX | $1,456 | -$76 |

| 5 | BMW 228i | $1,480 | -$52 |

| 6 | BMW i3 | $1,486 | -$46 |

| 7 | Audi S3 | $1,502 | -$30 |

| 8 | BMW 340i | $1,520 | -$12 |

| 9 | BMW 335xi | $1,528 | -$4 |

| 10 | BMW 328i | $1,532 | -- |

| 11 | Lexus CT 200H | $1,538 | $6 |

| 12 | BMW 320i | $1,540 | $8 |

| 13 | Audi A4 | $1,542 | $10 |

| 14 | Mercedes-Benz SLK 350 | $1,558 | $26 |

| 15 | BMW M235i | $1,562 | $30 |

| 16 | BMW 328d | $1,564 | $32 |

| 17 | Lexus RC 200T | $1,572 | $40 |

| 18 | Cadillac ATS | $1,580 | $48 |

| 19 | Mercedes-Benz B250E | $1,596 | $64 |

| 20 | Mercedes-Benz C300 | $1,606 | $74 |

| 21 | BMW 328xi | $1,620 | $88 |

| 22 | Lexus RC 350 | $1,630 | $98 |

| 23 | BMW 330e | $1,630 | $98 |

| 24 | Lexus IS 200T | $1,652 | $120 |

| 25 | Lexus GS 200T | $1,756 | $224 |

| 26 | Lexus IS 350 | $1,760 | $228 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2016 model year. Updated February 23, 2024

Supplementary rates and discounts

Some other noteworthy observations about insuring a BMW 328i as well as some money-saving tips and discounts include:

- Lower the cost of your policy by increasing deductibles. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $222 per year for a 40-year-old driver and $428 per year for a 20-year-old driver.

- Choosing a low deductible may not make good financial sense. Lowering deductibles from $500 to $250 could cost an additional $232 per year for a 40-year-old driver and $454 per year for a 20-year-old driver.

- It’s expensive to buy high-risk insurance. For a 30-year-old driver, the requirement to buy a high-risk policy could increase the cost by $1,874 or more per year.

- Violations and tickets cost more than a fine. In order to have the lowest 328i insurance rates, it’s necessary to avoid traffic citations. In fact, just a couple of minor traffic violations could raise insurance rates by at least $410 per year.

- Your occupation could lower your rates. Many car insurance providers offer policy discounts for being employed in occupations like scientists, firefighters, emergency medical technicians, high school and elementary teachers, architects, and others. By working in a profession that qualifies for this discount, you may save between $46 and $142 on your annual car insurance cost, depending on the age of the rated driver.

- Raise your credit for better rates. Maintaining a high credit score could save a minimum of $241 per year over a credit score ranging from 670-739. Conversely, a less-than-perfect credit score could cost around $279 more per year.