- BMW 335i insurance cost averages $1,614 per year or around $135 per month, but can vary significantly based on location and driver age.

- The BMW 335i is one of the more expensive small luxury cars to insure on average, costing $151 more per year when compared to other small luxury cars.

How much does BMW 335i insurance cost?

Ranked 22nd out of 25 vehicles in the 2015 small luxury car class, the cost to insure a BMW 335i averages $1,614 annually for full coverage, or around $135 monthly. With the average small luxury car costing $1,463 a year to insure, the BMW 335i could cost around $151 or more on an annual basis.

The price summary chart below details average car insurance rates for a 2015 BMW 335i for some of the more common policy scenarios.

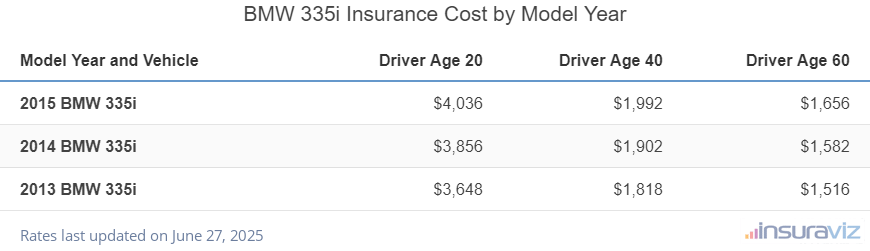

The following table shows the average BMW 335i car insurance rates for the 2013-2015 model years for five different age groups.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2015 BMW 335i | $3,268 | $1,614 | $1,342 |

| 2014 BMW 335i | $3,124 | $1,540 | $1,284 |

| 2013 BMW 335i | $2,956 | $1,472 | $1,228 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW 335i trim levels for each model year. Updated February 23, 2024

Where do BMW 335i insurance rates rank?

The BMW 335i ranks 22nd out of 25 total vehicles in the 2015 small luxury car category for insurance affordability. The 335i costs an average of $1,614 per year for full coverage insurance, while the category median rate is $1,463 annually, a difference of $151 per year.

When compared to other compact luxury models, insurance rates for a BMW 335i cost $116 more per year than the Mercedes-Benz C300, $334 more than the Volvo S60, and $318 more than the Acura TLX.

The following chart shows how average 2015 BMW 335i car insurance rates compare to the most popular small luxury cars like the Audi A4, Lexus IS 350, and the BMW i3. A table is also added following the chart that details the average insurance cost for all 25 models in the small luxury car category for the 2015 model year.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Mercedes-Benz SLK 250 | $1,120 | -$494 |

| 2 | Mercedes-Benz SLK 350 | $1,256 | -$358 |

| 3 | Volvo S60 | $1,280 | -$334 |

| 4 | BMW 328xi | $1,282 | -$332 |

| 5 | Acura TLX | $1,296 | -$318 |

| 6 | BMW 228xi | $1,304 | -$310 |

| 7 | Audi A4 | $1,372 | -$242 |

| 8 | Cadillac ATS | $1,412 | -$202 |

| 9 | Lexus IS 350 | $1,434 | -$180 |

| 10 | BMW 228i | $1,440 | -$174 |

| 11 | BMW 320i | $1,462 | -$152 |

| 12 | BMW i3 | $1,474 | -$140 |

| 13 | Audi S3 | $1,476 | -$138 |

| 14 | Lexus CT 200H | $1,488 | -$126 |

| 15 | Mercedes-Benz C300 | $1,498 | -$116 |

| 16 | Mercedes-Benz B-Electric Cell | $1,506 | -$108 |

| 17 | BMW 328i | $1,512 | -$102 |

| 18 | BMW 335xi | $1,532 | -$82 |

| 19 | BMW 328d | $1,534 | -$80 |

| 20 | Mercedes-Benz C250 | $1,582 | -$32 |

| 21 | BMW M235i | $1,600 | -$14 |

| 22 | BMW 335i | $1,614 | -- |

| 23 | BMW Activehybrid 3 | $1,650 | $36 |

| 24 | Lexus RC 350 | $1,698 | $84 |

| 25 | Lexus IS 250 | $1,744 | $130 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2015 model year. Updated February 23, 2024

Additional rates and insights

Some additional relevant rates and observations concerning the cost of insurance for a 335i include:

- Prepare for sticker shock for high-risk insurance. For a 40-year-old driver, having enough accidents and violations to require a high-risk insurance policy can cause a rate increase of $1,976 or more per year.

- Lower the cost of your policy by increasing deductibles. Increasing your policy deductibles from $500 to $1,000 could save around $242 per year for a 40-year-old driver and $474 per year for a 20-year-old driver.

- Low deductibles make insurance more expensive. Dropping your physical damage deductibles from $500 to $250 could cost an additional $252 per year for a 40-year-old driver and $506 per year for a 20-year-old driver.

- The older you are, the lower your insurance rates are. The difference in insurance cost on a 2015 335i between a 50-year-old driver ($1,434 per year) and a 20-year-old driver ($3,268 per year) is $1,834, or a savings of 78%.

- A good credit rating can save money. Drivers who maintain a credit score over 800 may save $253 per year when compared to a credit rating of 670-739. Conversely, a weak credit rating could cost around $294 more per year.

- Young males pay a lot more for insurance. For a 2015 BMW 335i, a 20-year-old male will have an average rate of $3,268 per year, while a 20-year-old female driver pays an estimated $2,342, a difference of $926 per year. The females get the cheaper rate by far. But by age 50, the rate for males is $1,434 and the female rate is $1,396, a difference of only $38.

- Fewer violations mean cheaper insurance rates. If you want to pay the most budget-friendly 335i insurance rates, it pays to follow traffic laws. In fact, just a couple of minor driving offenses could result in spiking policy costs by as much as $434 per year. Major misdemeanors such as a DUI could raise rates by an additional $1,512 or more.

- Save money due to your choice of occupation. Some auto insurance companies offer policy discounts for specific professions like members of the military, firefighters, architects, college professors, engineers, and others. If you qualify, you may save between $48 and $125 on your yearly insurance cost, depending on the age of the driver.