- Cadillac Escalade insurance cost averages $2,636 per year or around $220 per month, depending on the trim level.

- The Escalade Luxury 2WD trim level is the cheapest 2024 model to insure at around $2,410 per year, or $201 per month.

- The model with the most expensive insurance is the V ESV 4WD at $2,964 per year, or around $247 per month.

- The Escalade ranks seventh out of 13 large SUVs for insurance affordability, and costs 10.9% less than the average rate for similar luxury models.

How much does Cadillac Escalade car insurance cost?

Average car insurance rates for the Cadillac Escalade cost $2,636 a year, which is about $220 each month. With the average large luxury SUV insurance costing $2,939 per year, the Escalade is $303 cheaper.

Average monthly payments to insure a 2024 Escalade for full coverage cost from $201 per month on the Escalade Luxury 2WD model to $247 per month on the V ESV 4WD model.

When full coverage policy cost is broken down into individual coverages, comprehensive coverage costs approximately $584 a year, collision coverage will cost approximately $1,464, and the remaining liability and medical payments insurance costs an estimated $588.

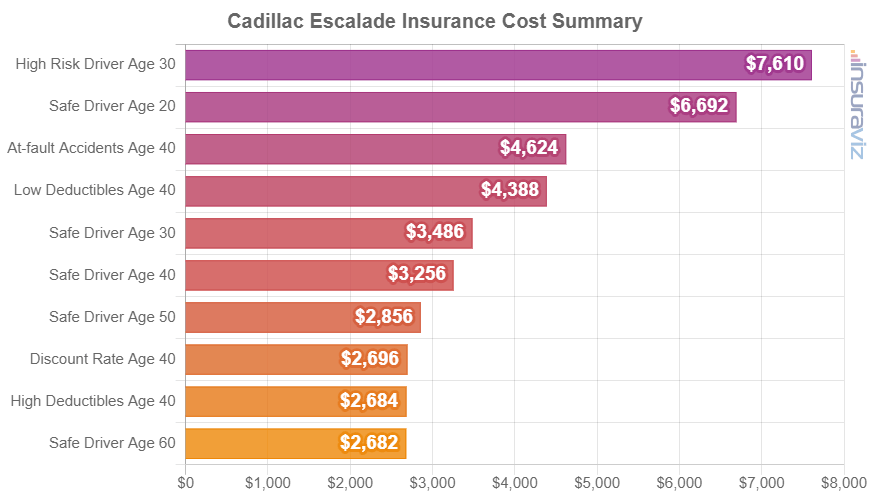

The chart below illustrates average 2024 Cadillac Escalade insurance cost using a variation of different driver ages and risk scenarios.

What does the cheapest Cadillac Escalade insurance cost?

The cheapest trim level of Cadillac Escalade to insure is the base Luxury 2WD model at $2,410 per year. The next cheapest trim is the base Luxury 4WD at $2,452 per year, and the third cheapest trim to insure is the ESV Luxury 2WD at $2,452 per year.

The most expensive trim levels of Cadillac Escalade to insure are the V ESV 4WD at $2,964 and the V 4WD at $2,948 per year. Those two trim levels will cost an extra $554 and $538 per year, respectively, over the least expensive base Luxury 2WD model.

The table below shows average Cadillac Escalade car insurance rates for both annual and 6-month policy terms, plus a monthly rate for budgeting purposes.

| 2024 Cadillac Escalade Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Luxury 2WD | $2,410 | $201 |

| Luxury 4WD | $2,452 | $204 |

| ESV Luxury 2WD | $2,452 | $204 |

| ESV Luxury 4WD | $2,490 | $208 |

| Premium Luxury 2WD | $2,506 | $209 |

| Premium Luxury 4WD | $2,540 | $212 |

| Sport 2WD | $2,558 | $213 |

| ESV Premium Luxury 2WD | $2,558 | $213 |

| Sport 4WD | $2,574 | $215 |

| ESV Sport 2WD | $2,588 | $216 |

| ESV Premium Luxury 4WD | $2,588 | $216 |

| ESV Sport 4WD | $2,622 | $219 |

| Sport Platinum 2WD | $2,686 | $224 |

| Premium Luxury Platinum 2WD | $2,700 | $225 |

| Sport Platinum 4WD | $2,710 | $226 |

| ESV Sport Platinum 2WD | $2,710 | $226 |

| Premium Luxury Platinum 4WD | $2,720 | $227 |

| ESV Premium Luxury Platinum 2WD | $2,720 | $227 |

| ESV Sport Platinum 4WD | $2,748 | $229 |

| ESV Premium Luxury Platinum 4WD | $2,748 | $229 |

| V 4WD | $2,948 | $246 |

| V ESV 4WD | $2,964 | $247 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

How does Escalade insurance cost rank?

The Cadillac Escalade ranks seventh out of 13 total vehicles in the 2024 full-size luxury SUV category. The Escalade costs an estimated $2,636 per year for full coverage insurance and the category average rate is $2,939 per year, a difference of $303 per year.

When compared to other large luxury SUVs, car insurance for a Cadillac Escalade costs $86 more per year than the Mercedes-Benz GLS450, $410 more than the Volvo XC90, $212 more than the BMW X7, and $798 less than the Land Rover Range Rover.

When compared to all vehicles (not just full-size luxury SUVs), average Cadillac Escalade insurance costs 33.3% more than the national average car insurance rate of $1,883 per year.

The table below shows how average Cadillac Escalade insurance rates compare to the entire large luxury SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Infiniti QX80 | $2,128 | -$508 |

| 2 | Volvo XC90 | $2,226 | -$410 |

| 3 | Lexus LX 600 | $2,382 | -$254 |

| 4 | BMW X7 | $2,424 | -$212 |

| 5 | Lincoln Navigator | $2,430 | -$206 |

| 6 | Mercedes-Benz GLS450 | $2,550 | -$86 |

| 7 | Cadillac Escalade | $2,636 | -- |

| 8 | BMW Alpina XB7 | $3,096 | $460 |

| 9 | Mercedes-Benz EQS 580 SUV | $3,404 | $768 |

| 10 | Land Rover Range Rover | $3,434 | $798 |

| 11 | Mercedes-Benz Maybach GLS 600 | $3,640 | $1,004 |

| 12 | Mercedes-Benz G550 | $3,772 | $1,136 |

| 13 | Mercedes-Benz G63 AMG | $4,080 | $1,444 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated February 22, 2024

There is a pretty good range of sticker prices within the full-size luxury SUV segment, ranging from the Volvo XC90 which costs around $62,000 up to the Mercedes-Maybach GLS 600 costing around $161,000.

But if we take the vehicles that are priced closest to the Escalade and compare the cost to insure them, we gain another useful metric for comparison.

The 2024 Escalade has an average MSRP of $104,735, which ranges from $82,790 to $154,090, depending upon trim level and package.

The vehicles in the large luxury SUV segment that have the most similar average MSRP to the Escalade are the Lexus LX 600, Lincoln Navigator, and BMW X7. The next list shows how both the purchase price and the cost of insurance for those three models compare to the Cadillac Escalade.

- Cadillac Escalade vs. Lexus LX 600 – Having an average sticker price of $108,652 ($92,915 to $133,490), the 2024 Lexus LX 600 costs $3,917 more than the average cost of the Escalade. Insurance on a 2024 Escalade costs an average of $254 more per year than the Lexus LX 600.

- Cadillac Escalade vs. Lincoln Navigator – The average MSRP for a 2024 Cadillac Escalade is $4,538 more expensive than the Lincoln Navigator, at $104,735 compared to $100,197. Car insurance for the Lincoln Navigator costs an average of $206 less than the Cadillac Escalade.

- Cadillac Escalade vs. BMW X7 – For a new model, the sticker price on the 2024 BMW X7 averages $9,435 less than the average sticker price for the Escalade ($95,300 compared to $104,735). Drivers can expect to pay an average of $212 less annually to insure the BMW X7 compared to an Escalade.

For a full list of head-to-head comparisons, please visit our insurance rate comparisons index for links to many other makes and models of vehicles.

How much does vehicle age affect insurance cost?

Choosing to insure a 2016 Cadillac Escalade rather than a new 2024 model could reduce the cost of insurance by around $988 per year. New vehicles cost more to replace if they are totaled in an accident, and older models suffer depreciation which means they are worth less.

The data below details average insurance rates for current and prior Cadillac Escalade model years. Yearly policy costs range from the least expensive value of $1,538 for a 2014 Cadillac Escalade to the most expensive rate of $2,636 for a 2024 model year.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Cadillac Escalade | $2,636 | $220 |

| 2023 Cadillac Escalade | $2,560 | $213 |

| 2022 Cadillac Escalade | $2,350 | $196 |

| 2021 Cadillac Escalade | $2,208 | $184 |

| 2020 Cadillac Escalade | $2,140 | $178 |

| 2019 Cadillac Escalade | $2,032 | $169 |

| 2018 Cadillac Escalade | $1,920 | $160 |

| 2017 Cadillac Escalade | $1,838 | $153 |

| 2016 Cadillac Escalade | $1,648 | $137 |

| 2015 Cadillac Escalade | $1,650 | $138 |

| 2014 Cadillac Escalade | $1,538 | $128 |

| 2013 Cadillac Escalade | $1,598 | $133 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Cadillac Escalade trim levels for each model year. Updated February 23, 2024

Additional Rates and Insights

Some additional details about Escalade auto insurance rates include:

- Improve your credit for cheaper auto insurance rates. In states that allow a driver’s personal credit information to be used as a rating factor, having a good credit rating over 800 could see savings as high as $414 per year when compared to a slightly lower credit rating between 670-739. Conversely, a lesser credit score could cost up to $480 more per year.

- Escalade insurance for teen drivers is expensive. Average rates for full coverage Escalade insurance costs $9,481 per year for a 16-year-old driver, $9,261 per year for a 17-year-old driver, and $8,437 per year for an 18-year-old driver.

- Don’t be a careless driver. Too many at-fault accidents will increase rates, potentially by an extra $3,902 per year for a 20-year-old driver and as much as $648 per year for a 60-year-old driver.

- Escalade insurance is expensive for high-risk drivers. For a 30-year-old driver, having too many accidents or violations could raise rates by $3,340 or more per year.

- Your profession could earn you policy discounts. Most car insurance companies offer policy discounts for certain professions like doctors, lawyers, police officers and law enforcement, nurses, architects, and other occupations. If you qualify, you could save between $79 and $185 on your yearly insurance bill, depending on the coverage levels.

- A clean driving record saves money. If you want to get the most budget-friendly Escalade insurance rates, it’s necessary to follow the law. Just a couple of blemishes on your driving record could end up increasing policy rates by as much as $718 per year. Being convicted of a major violation such as DUI and hit-and-run could raise rates by an additional $2,528 or more.

- The older you get, the cheaper insurance rates become. The difference in insurance cost for a Cadillac Escalade between a 50-year-old driver ($2,316 per year) and a 20-year-old driver ($5,428 per year) is $3,112, or a savings of 80.4%.