- Chevrolet Colorado car insurance costs $1,624 per year on average, or around $135 per month for full coverage.

- The Colorado WT 4WD trim level is the cheapest to insure at around $1,528 per year. The most expensive trim is the ZR2 Bison 4WD at $1,802 per year.

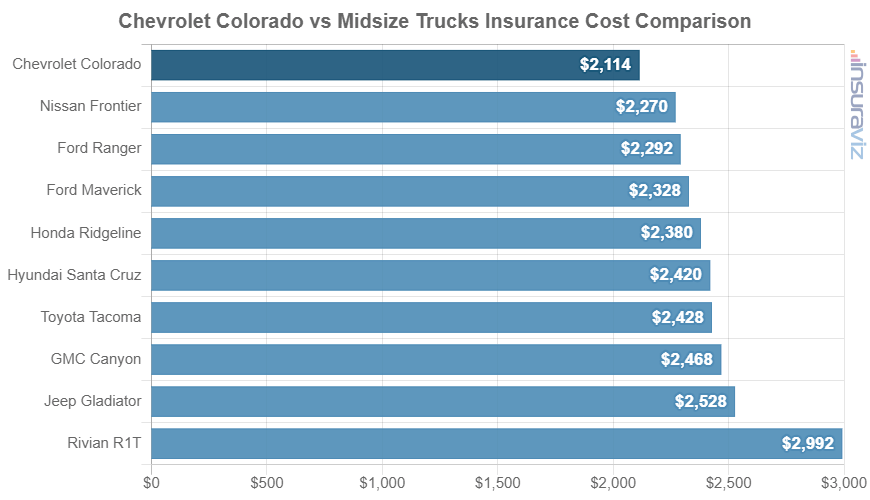

- The Colorado ranks first out of 10 midsize trucks for auto insurance affordability.

How much does Chevy Colorado insurance cost?

Chevy Colorado insurance rates average $1,624 per year, which is the equivalent of $135 a month. The Colorado costs $259 less per year than the overall U.S. average for all vehicles.

From an individual coverage perspective, comprehensive (or other-than-collision) coverage will cost about $456 a year, collision insurance costs about $644, and the remaining liability/medical is approximately $524.

Average cost per month to insure a Chevy Colorado pickup ranges from $127 to $150 depending on the trim level. A little later in this article, we will break down the average insurance rate for each Colorado trim level.

The chart below shows how average 2024 Chevrolet Colorado car insurance rates fluctuate based on the age of the driver and policy deductibles. The prices shown are for an annual policy, and range from the cheapest price of $1,148 per year for a 60-year-old driver with $1,000 deductibles to a high of $3,694 annually for a driver age 20 with deductibles of $250.

To help you comprehend the vast range of Colorado insurance rates, keep in mind that choosing a liability-only policy in the cheapest areas of Idaho or Virginia can cost as little as $248 a year.

For the same style of Chevrolet Colorado, a newly-licensed teen driver with an accident or two and maybe a couple of speeding tickets in urban Detroit, Michigan, could get a bill for $17,144 a year for a policy that provides full coverage.

There are literally billions of possible rate combinations when you factor in every possible variation and include geo-targeting by zip code. If you’re either looking for cheaper rates or just kicking the tires so to speak, we recommend getting a rate quote so you can eliminate the guessing.

Which Chevy Colorado trims are cheap to insure?

The cheapest trim levels of Chevy Colorado to insure are the WT 4WD, the WT 2WD, and the LT 4WD all at around $1,528 per year, or about $127 per month

The two most expensive trim levels of Chevrolet Colorado to insure are the ZR2 Bison 4WD and the ZR2 4WD at $1,716 per year. Those will cost an extra $274 per year over the cheapest WT 4WD model.

The next table displays the average annual and 6-month policy costs, plus a monthly amount for budgeting, for each 2024 Chevy Colorado package and trim level.

| 2024 Chevrolet Colorado Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| WT 4WD | $1,528 | $127 |

| WT 2WD | $1,544 | $129 |

| LT 4WD | $1,568 | $131 |

| LT 2WD | $1,594 | $133 |

| Trail Boss 4WD | $1,600 | $133 |

| Z71 4WD | $1,638 | $137 |

| ZR2 4WD | $1,716 | $143 |

| ZR2 Bison 4WD | $1,802 | $150 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

How do Chevrolet Colorado insurance rates compare?

The Chevy Colorado ranks first out of 10 total comparison vehicles in the 2024 midsize truck class. The Colorado costs an average of $1,624 per year for full coverage insurance, while the segment median rate is $1,911 annually, making the Colorado $287 cheaper per year.

When average rates are compared to other midsize trucks, insurance for a 2024 Chevy Colorado costs $296 less per year than the Toyota Tacoma, $190 less than the Ford Ranger, $172 less than the Nissan Frontier, and $374 less than the Jeep Gladiator.

The chart below ranks the cost to insure all midsize pickups for the 2024 model year, with the Chevrolet Colorado ranking first at an average annual cost of $1,624 (about $135 per month).

The 2024 Chevy Colorado has an average MSRP of $40,308, ranging from the cheapest WT 4WD model at $33,995 to the most expensive ZR2 Bison 4WD costing $60,095.

Using this average purchase price value, we can compare the Chevy Colorado to other vehicles in the midsize truck segment that have the most similar MSRP values.

The four trucks that are most similar in price to the Chevy Colorado are the Ford Ranger, Honda Ridgeline, Toyota Tacoma, and Nissan Frontier.

The next list shows how they compare to a Colorado for overall price and the cost of insurance.

- Compared to the Ford Ranger – The 2024 Chevrolet Colorado has an average MSRP that is $1,145 cheaper than the Ford Ranger ($40,308 versus $41,453). Buying insurance for the Ford Ranger costs an average of $190 more per year than the Chevrolet Colorado.

- Compared to the Honda Ridgeline – With an average dealer MSRP of $42,885 ($38,800 to $46,230), the Honda Ridgeline costs $2,577 more than the average sticker price for the Colorado. The average insurance cost for a Colorado compared to the Honda Ridgeline is $258 less per year.

- Compared to the Toyota Tacoma – For the 2024 model year, the MSRP on the Toyota Tacoma averages $2,720 less than the average MSRP for the Colorado ($37,588 compared to $40,308). Insurance on a Colorado costs an average of $296 less per year than the Toyota Tacoma.

- Compared to the Nissan Frontier – The 2024 Nissan Frontier sells for an average of $35,592 ($29,770 to $43,940), which is $4,716 cheaper than the average cost of the Colorado. The cost to insure a Chevrolet Colorado compared to the Nissan Frontier is $172 less every 12 months on average.

Chevrolet Colorado Insurance Cost by Model Year

There are quite a few factors that help determine how much you’ll pay to insure your Colorado. One of those is the age of the vehicle.

The table below shows average insurance rates on the Colorado back to the 2015 model year. These rates are for full-coverage insurance (including comprehensive and collision coverage), so rates for liability-only coverage on older models are considerably cheaper.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Chevrolet Colorado | $3,196 | $1,624 | $1,352 |

| 2023 Chevrolet Colorado | $3,030 | $1,534 | $1,278 |

| 2022 Chevrolet Colorado | $2,822 | $1,426 | $1,186 |

| 2021 Chevrolet Colorado | $2,812 | $1,406 | $1,172 |

| 2020 Chevrolet Colorado | $2,730 | $1,364 | $1,140 |

| 2019 Chevrolet Colorado | $2,956 | $1,460 | $1,220 |

| 2018 Chevrolet Colorado | $3,054 | $1,514 | $1,262 |

| 2017 Chevrolet Colorado | $2,910 | $1,440 | $1,206 |

| 2016 Chevrolet Colorado | $2,666 | $1,324 | $1,110 |

| 2015 Chevrolet Colorado | $2,640 | $1,306 | $1,100 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Colorado trim levels for each model year. Updated February 23, 2024

Additional Rates and Policy Information

Other important data observations about insuring a Chevrolet Colorado include:

- Gender affects car insurance rates. For a 2024 Chevrolet Colorado, a 20-year-old man pays an average rate of $3,196 per year, while a 20-year-old female will get a rate of $2,324, a difference of $872 per year. The females get the cheaper rate by far. But by age 50, the cost for male drivers is $1,446 and the cost for women is $1,410, a difference of only $36.

- The older you get, the cheaper insurance rates become. The difference in insurance rates for a 2024 Colorado between a 50-year-old driver ($1,446 per year) and a 30-year-old driver ($1,730 per year) is $284, or a savings of 17.9%.

- Be a careful driver and pay less. Causing too many accidents will raise rates, as much as $2,226 per year for a 20-year-old driver and as much as $654 per year for a 40-year-old driver.

- Car insurance is cheaper with higher deductibles. Raising your policy deductibles from $500 to $1,000 could save around $252 per year for a 40-year-old driver and $470 per year for a 20-year-old driver.

- Lower deductibles raise insurance costs. Cutting your deductibles from $500 to $250 could cost an additional $258 per year for a 40-year-old driver and $498 per year for a 20-year-old driver.