- Hyundai Azera car insurance averages $1,952 per year or around $163 per month.

- The cheapest Azera to insure is the base Sedan model at an estimated $1,926 per year. The most expensive is the Limited Sedan at $1,982 annually.

- The Hyundai Azera costs only $34 less per year on average to insure when compared to the large sedan segment average cost.

How much does Hyundai Azera car insurance cost?

Ranked fifth out of 10 vehicles in the large car class, Hyundai Azera insurance rates average $1,952 a year for full coverage, or about $163 if paid each month. With the average large car costing $1,986 a year to insure, the Hyundai Azera would save around $34 or more annually.

The next price chart illustrates average car insurance rates on a 2017 Azera using a range of different policy rating factors.

The next table details the average cost to insure a Hyundai Azera for the 2012 through 2017 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2017 Hyundai Azera | $1,952 | $163 |

| 2016 Hyundai Azera | $1,846 | $154 |

| 2015 Hyundai Azera | $1,654 | $138 |

| 2014 Hyundai Azera | $1,644 | $137 |

| 2013 Hyundai Azera | $1,738 | $145 |

| 2012 Hyundai Azera | $1,703 | $142 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Hyundai Azera trim levels for each model year. Updated October 24, 2025

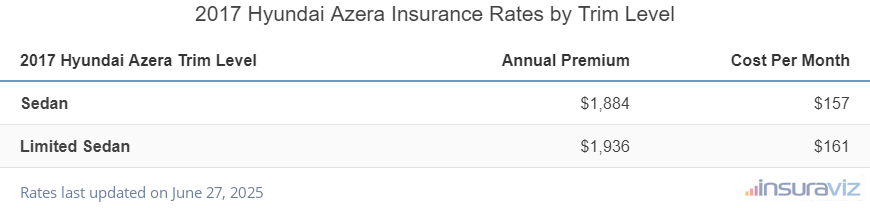

The rate table below details average auto insurance prices for annual and 6-month policy terms, including a monthly budget estimate, for each Hyundai Azera package and trim level.

| 2017 Hyundai Azera Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sedan | $1,926 | $161 |

| Limited Sedan | $1,982 | $165 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

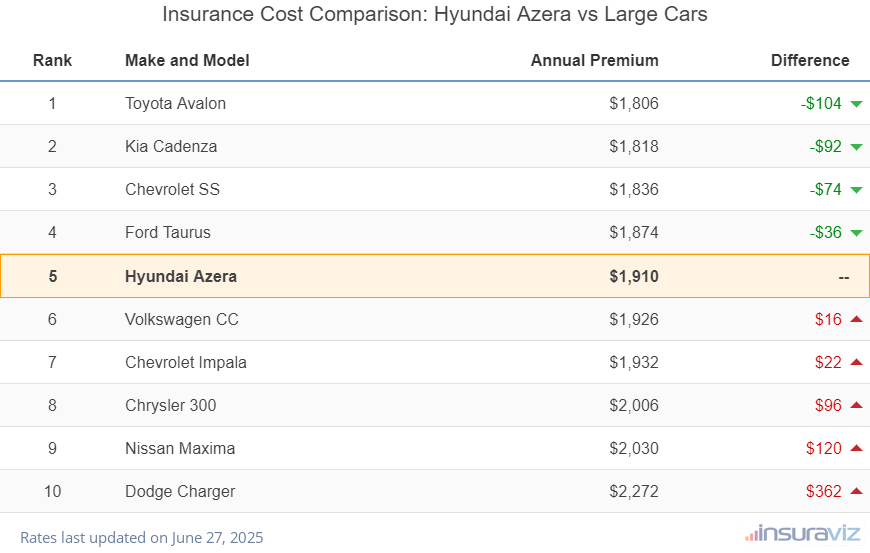

How does Hyundai Azera insurance cost rank?

The Hyundai Azera ranks fifth out of 10 comparison vehicles in the 2017 model year large car category for most affordable auto insurance rates. The Azera costs an average of $1,952 per year to insure for full coverage, while the segment median cost is $1,986 annually, a difference of $34 per year.

When compared directly to specific models in the large car segment, auto insurance rates for a Hyundai Azera cost $374 less per year than the Dodge Charger, $26 less than the Chevrolet Impala, and $126 less than the Nissan Maxima.

The following table shows how well Hyundai Azera car insurance rates compare to other large sedans like the Chrysler 300, Toyota Avalon, and the Ford Taurus.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Toyota Avalon | $1,848 | -$104 |

| 2 | Kia Cadenza | $1,860 | -$92 |

| 3 | Chevrolet SS | $1,880 | -$72 |

| 4 | Ford Taurus | $1,916 | -$36 |

| 5 | Hyundai Azera | $1,952 | -- |

| 6 | Volkswagen CC | $1,970 | $18 |

| 7 | Chevrolet Impala | $1,978 | $26 |

| 8 | Chrysler 300 | $2,052 | $100 |

| 9 | Nissan Maxima | $2,078 | $126 |

| 10 | Dodge Charger | $2,326 | $374 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2017 model year. Updated October 24, 2025

Other Azera insurance rates and insights

Some additional rates and insights when insuring a Hyundai Azera include:

- Driver gender affects car insurance rates. For a 2017 Hyundai Azera, a 20-year-old man pays an average price of $3,936 per year, while a 20-year-old female will pay an average of $2,834, a difference of $1,102 per year. The females get the cheaper rate by far. But by age 50, the cost for a male driver is $1,742 and the cost for a female driver is $1,692, a difference of only $50.

- Safe drivers pay less. Multiple at-fault accidents raise rates, potentially up to $952 per year for a 30-year-old driver and as much as $500 per year for a 60-year-old driver.

- More mature drivers get better rates than young drivers. The difference in 2017 Hyundai Azera insurance cost between a 40-year-old driver ($1,952 per year) and a 20-year-old driver ($3,936 per year) is $1,984, or a savings of 67.4%.

- Policy discounts mean cheaper Azera insurance. Discounts may be available if the policyholders choose electronic billing, work in certain occupations, drive a vehicle with safety or anti-theft features, are loyal customers, sign their policy early, or many other policy discounts which could save the average driver as much as $330 per year.

- Raise your credit score for cheaper rates. Having an excellent credit rating above 800 may save up to $306 per year when compared to a credit score ranging from 670-739. Conversely, a lower credit rating could cost around $355 more per year.