- Kia Forte insurance cost averages $2,342 per year, or around $195 per month for full coverage.

- 2024 Kia Forte car insurance rates range from $2,244 to $2,438 annually for an average driver, depending on trim level.

- When compared to other small cars, the Forte is one of the cheaper small cars to insure, costing $29 less per year on average.

How much does Kia Forte insurance cost?

Kia Forte insurance rates average $2,342 annually for full coverage, or about $195 a month. You can expect to pay approximately $29 less each year for Kia Forte insurance compared to similar vehicles, and $66 more per year than the $2,276 national average for all vehicles.

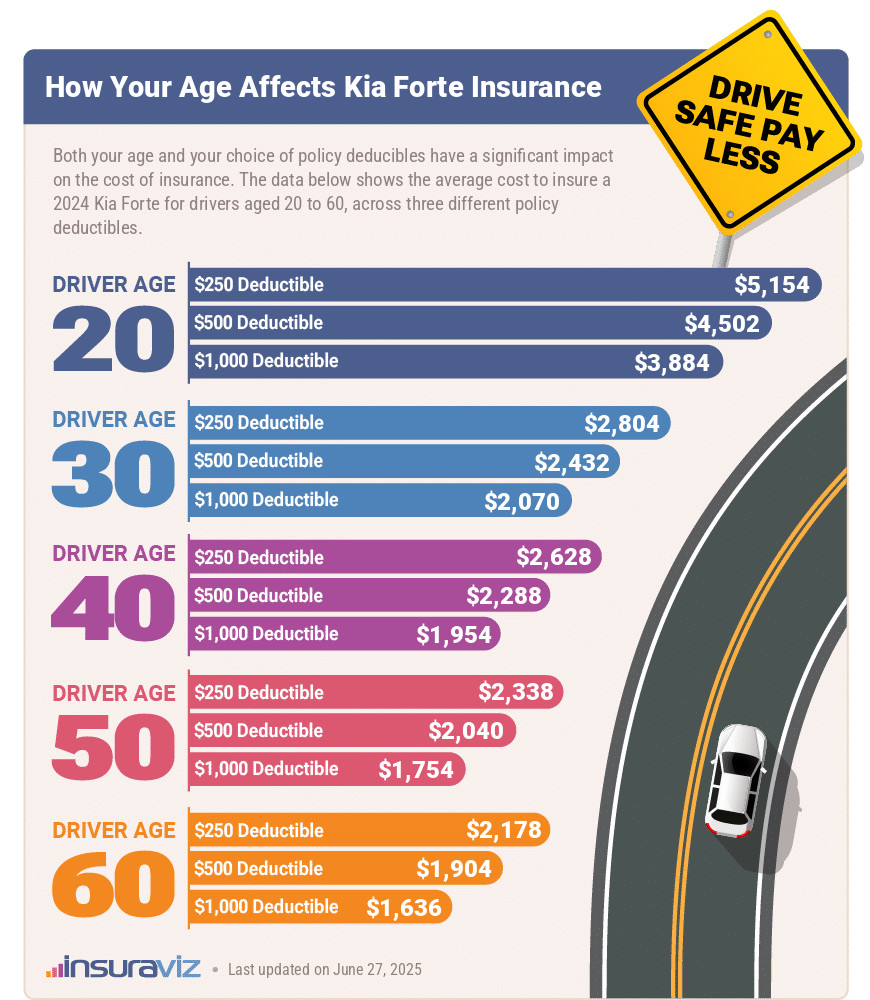

The infographic below details how average car insurance rates for the 2024 Kia Forte vary with differences in driver age and $250, $500, and $1,000 deductibles.

Some other key points to keep in mind when buying insurance on a Forte are:

- Avoiding accidents means cheaper Forte insurance. Causing too many accidents will raise rates, possibly up to $3,234 per year for a 20-year-old driver and as much as $962 per year for a 40-year-old driver.

- Age and gender affect car insurance rates. For a 2024 Kia Forte, a 20-year-old male pays an average price of $4,616 per year, while a 20-year-old female will get a rate of $3,360, a difference of $1,256 per year in the women’s favor by a large margin. But by age 50, the cost for male drivers is $2,092 and the cost for female drivers is $2,030, a difference of only $62.

- Expect to pay a lot for high-risk insurance. For a 40-year-old driver, having to buy a high-risk insurance policy could inflate rates by $2,772 or more per year.

- Raise your credit score for cheaper rates. In states that have insurance regulations that allow a policyholder’s credit data to be used for generating rates, having a credit score above 800 could possibly save as much as $368 per year over a credit rating between 670-739. Conversely, a weak credit rating could cost as much as $426 more per year.

- The cost to insure teen drivers is expensive. Average rates for full coverage Forte insurance costs $8,264 per year for a 16-year-old driver, $7,947 per year for a 17-year-old driver, and $7,020 per year for an 18-year-old driver.

What is the cheapest Kia Forte insurance?

With Kia Forte car insurance cost ranging from $2,244 to $2,438 annually for the average driver, the most affordable model to insure is the LX. The next cheapest trim level to insure is the LXS.

The two most expensive models of Kia Forte to insure are the GT Manual at $2,438 and the GT at $2,418 per year. Those two trim levels will cost an extra $194 and $174 per year, respectively, over the lowest cost LX model.

On average, drivers can plan on budgeting between $187 and $203 per month to insure a Forte for full coverage. These rates can change significantly, however, based on different policy limits, driver age, location, and the company you choose to insure with.

The table below shows average annual and 6-month insurance cost for a 2024 Kia Forte, breaking down rates by vehicle trim level.

| 2024 Kia Forte Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LX | $2,244 | $187 |

| LXS | $2,266 | $189 |

| GT-Line | $2,346 | $196 |

| GT | $2,418 | $202 |

| GT Manual | $2,438 | $203 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Kia Forte insurance cost comparison

The Kia Forte ranks eighth out of 15 total comparison vehicles in the small car category for the 2024 model year. The Forte costs an estimated $2,342 per year to insure for full coverage and the category median rate is $2,371 per year, a difference of $29 per year.

When compared directly to other small cars, Kia Forte insurance costs $218 more per year than the Honda Civic, $6 more than the Toyota Corolla, $142 more than the Nissan Sentra, and $266 less than the Hyundai Elantra.

The table below shows how Forte car insurance rates compare among the entire compact car segment. The table also includes a difference column that shows how much cheaper or more expensive each model is than the Kia Forte.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Toyota GR Corolla | $2,084 | -$258 |

| 2 | Nissan Leaf | $2,100 | -$242 |

| 3 | Honda Civic | $2,124 | -$218 |

| 4 | Nissan Sentra | $2,200 | -$142 |

| 5 | Subaru Impreza | $2,204 | -$138 |

| 6 | Toyota Prius | $2,242 | -$100 |

| 7 | Toyota Corolla | $2,336 | -$6 |

| 8 | Kia Forte | $2,342 | -- |

| 9 | Nissan Versa | $2,364 | $22 |

| 10 | Mitsubishi Mirage G4 | $2,422 | $80 |

| 11 | Volkswagen Jetta | $2,426 | $84 |

| 12 | Mazda 3 | $2,480 | $138 |

| 13 | Hyundai Elantra | $2,608 | $266 |

| 14 | Volkswagen Golf | $2,650 | $308 |

| 15 | Toyota Mirai | $2,986 | $644 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Comparing average overall car insurance rates gives a general picture of how models rank in the segment, but when shopping for a new car, consumers often want to know how the cost of insurance for a vehicle compares to models with similar sticker prices.

A 2024 Forte has an average MSRP of $22,410, ranging from $19,790 to $25,190, dependent upon the exact model purchased.

The five models that have the most similar sticker prices to the Kia Forte are the Nissan Sentra, Toyota Corolla, Subaru Impreza, Mitsubishi Mirage G4, and Volkswagen Jetta. The next list compares those models to the Forte for both purchase price and the average cost of a car insurance policy.

- Compared to the Nissan Sentra – Having an average price of $21,970 and ranging from $20,630 to $23,720, the Nissan Sentra costs $440 less than the Forte. Drivers can expect to pay an average of $142 less per year for insurance on the Nissan Sentra compared to a Forte.

- Compared to the Toyota Corolla – Having an average sticker price of $25,198 ($21,900 to $27,050), the Toyota Corolla costs $2,788 more than the average MSRP for the Forte. Insurance on a 2024 Kia Forte costs an average of $6 more per year than the Toyota Corolla.

- Compared to the Subaru Impreza – The Subaru Impreza retails for an average of $25,292 ($22,995 to $27,885), which is $2,882 more expensive than the average cost for the Forte. Insurance on a Kia Forte costs an average of $138 more annually than the Subaru Impreza.

- Compared to the Mitsubishi Mirage G4 – With an average MSRP of $18,595 ($17,795 to $19,295), the 2024 Mitsubishi Mirage G4 costs $3,815 less than the average MSRP for the Forte. Insurance on the Forte costs an average of $80 less annually than the Mitsubishi Mirage G4.

- Compared to the Volkswagen Jetta – With an average price of $26,265 ($21,435 to $31,785), the 2024 Volkswagen Jetta costs $3,855 more than the average cost for the Forte. The cost to insure a Kia Forte compared to the Volkswagen Jetta is $84 less per year on average.

Insurance rates for prior model years

Driving and insuring a 2013 Forte in place of a more expensive 2024 version could save an estimated $818 on a yearly basis. Even opting for a gently used 2018 model may save the average driver $218 on a yearly basis.

The following data table details estimated full coverage auto insurance policy costs for a Kia Forte for various model years. Yearly insurance rates range from a low of $1,472 for a 2014 Kia Forte to a high of $2,342 for a new 2024 model.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Kia Forte | $2,342 | $195 |

| 2023 Kia Forte | $2,286 | $191 |

| 2022 Kia Forte | $2,238 | $187 |

| 2021 Kia Forte | $2,020 | $168 |

| 2020 Kia Forte | $1,964 | $164 |

| 2019 Kia Forte | $1,908 | $159 |

| 2018 Kia Forte | $2,124 | $177 |

| 2017 Kia Forte | $2,060 | $172 |

| 2016 Kia Forte | $1,766 | $147 |

| 2015 Kia Forte | $1,692 | $141 |

| 2014 Kia Forte | $1,472 | $123 |

| 2013 Kia Forte | $1,524 | $127 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Kia Forte trim levels for each model year. Updated October 24, 2025

Eventually, vehicle owners will have to decide when to delete coverage for physical damage claims from the policy. As vehicles age and their value decreases from depreciation, the cost of having physical damage coverage exceeds the benefits provided by having it.

Deleting physical damage coverage from an older model Kia Forte could save in the ballpark of $672 annually, depending on the prior deductible level and the age of the driver.

Is a Kia Forte expensive to insure for teenage drivers?

Average Forte insurance rates for teenagers range from $6,457 to $8,264 for male drivers and $5,450 to $7,717 for female drivers. Teenage drivers (ages 16-19) have the most expensive car insurance rates due to their lack of experience and tendency to get into accidents.

The chart below shows average car insurance rates for both male and female teen drivers on a 2024 Kia Forte insured for full coverage.

Despite insurance being expensive for teens, there are some steps you can take to reduce the cost. The prices above reflect the cost to insure a new Forte. Buying a used model is generally cheaper to insure than a new one.

Another way to reduce the cost of insurance for a teen driver is to insure the vehicle for liability coverage only. It’s important to understand that if you do this, you do not have insurance coverage for claims like fender benders, fire, flood, or theft. Also, if you have a lienholder on the vehicle, you will not be permitted to carry liability only.

Some insurance companies provide discounts for driver training and good academic performance, so check with your company to see if you qualify for those.