- Nissan Altima insurance costs $2,598 per year for a full coverage policy, depending on the trim level.

- The cheapest Altima to insure is the S trim level at an average cost of $2,452 per year. The most expensive is the SR VC-Turbo at $2,760 annually.

- Out of 11 vehicles in the 2024 midsize car segment, the Altima ranks 10th for insurance affordability.

- Our top insurance company pick is Progressive due to their low average prices, user-friendly policy management tools, and selection of optional coverages.

How much does Nissan Altima insurance cost?

Nissan Altima insurance costs an average of $2,598 annually for full coverage. Monthly insurance cost for the Altima averages $217 and ranges from $204 to $230, depending on the trim level.

Expect to pay about $151 more annually to insure a Nissan Altima compared to the average rate for all 2024 midsize sedans. When compared to all other 2024 vehicles, not just midsize cars, drivers can expect to pay around 1% more than the overall average rate of $2,572 per year.

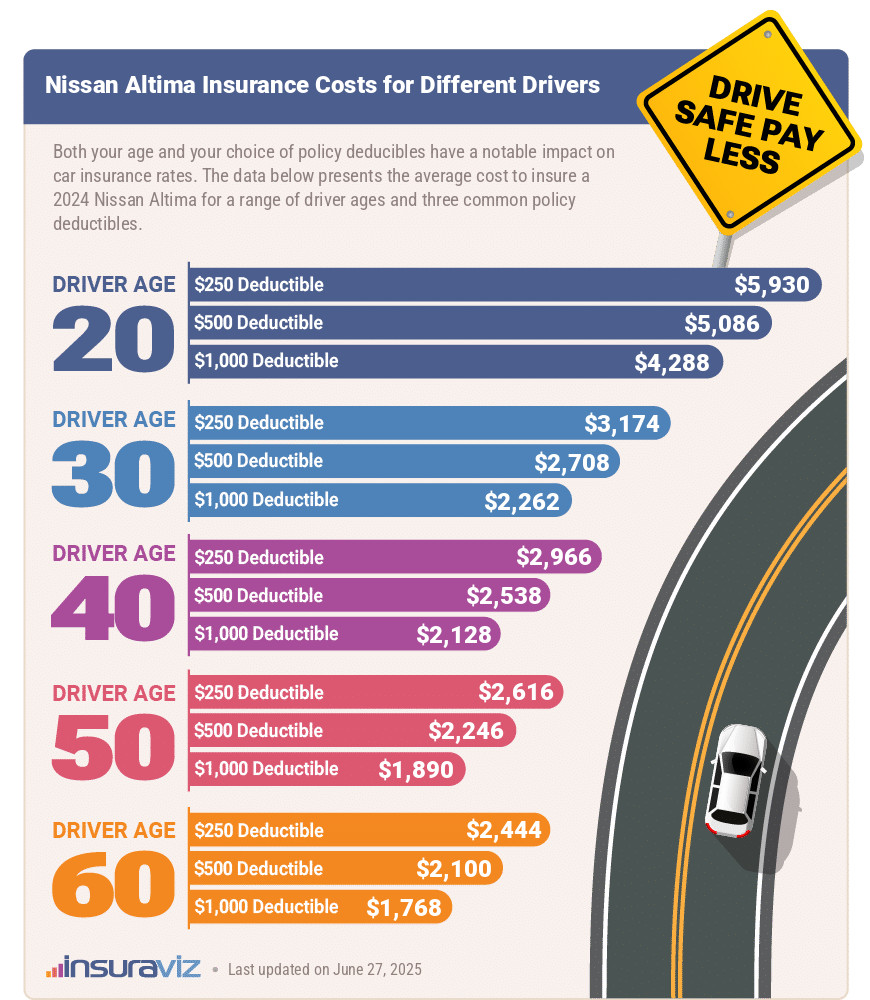

The following infographic illustrates how average Altima car insurance rates vary depending on the age of the driver and a range of policy deductibles. Average cost in the chart below ranges from $1,812 per year for a 60-year-old driver with high physical damage deductibles to $6,080 per year for a 20-year-old driver with $250 physical damage deductibles.

The data in the graphic above affirms two important things about car insurance. First, younger drivers pay more than more mature drivers. Second, higher-deductible policies are cheaper than low-deductible policies.

Driver age and your policy deductibles are two factors that have a pretty large impact on the rate you’ll pay.

If possible, bundle your car insurance with the same company as your home insurance. Doing this can save an average of $286 per year when insuring a 2024 Nissan Altima.

Another factor that contributes to the overall cost of a car insurance policy is the age of the vehicle. Older models generally cost less to insure due to having a lower replacement cost, which is similar to its market value.

The table below shows average Nissan Altima car insurance rates for the 2010 to 2024 model years and for rated drivers aged 20 through 60.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Nissan Altima | $5,212 | $2,598 | $2,152 |

| 2023 Nissan Altima | $5,004 | $2,488 | $2,068 |

| 2022 Nissan Altima | $4,946 | $2,448 | $2,038 |

| 2021 Nissan Altima | $4,424 | $2,196 | $1,826 |

| 2020 Nissan Altima | $4,296 | $2,132 | $1,774 |

| 2019 Nissan Altima | $4,218 | $2,088 | $1,738 |

| 2018 Nissan Altima | $4,118 | $2,044 | $1,710 |

| 2017 Nissan Altima | $3,938 | $1,956 | $1,638 |

| 2016 Nissan Altima | $3,506 | $1,752 | $1,464 |

| 2015 Nissan Altima | $3,198 | $1,596 | $1,338 |

| 2014 Nissan Altima | $3,184 | $1,584 | $1,326 |

| 2013 Nissan Altima | $3,132 | $1,558 | $1,308 |

| 2012 Nissan Altima | $3,069 | $1,527 | $1,282 |

| 2011 Nissan Altima | $3,008 | $1,496 | $1,256 |

| 2010 Nissan Altima | $2,948 | $1,466 | $1,231 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Nissan Altima trim levels for each model year. Updated October 24, 2025

What is the cheapest Nissan Altima insurance?

The cheapest Nissan Altima insurance will be on models like the S and SV trims. Average rates for those models cost around $2,452 per year, or about $204 per month.

As a general rule, the lower the MSRP is for the Altima model you buy, the cheaper the insurance will be. Adding extra options and packages, or moving up to higher-end trim levels, is pretty much guaranteed to increase the cost of insurance.

At the high end of the Nissan Altima insurance cost range, the three most expensive Altima models to insure are the SL, the SL AWD, and the SR VC-Turbo trim levels at around $2,686, $2,724, and $2,760 per year, respectively.

The next table shows average prices for annual and 6-month car insurance policies, plus a monthly budget amount, for each 2024 Nissan Altima model trim level.

| 2024 Nissan Altima Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S | $2,452 | $204 |

| SV | $2,490 | $208 |

| SR | $2,542 | $212 |

| SV AWD | $2,548 | $212 |

| SR AWD | $2,592 | $216 |

| SL | $2,686 | $224 |

| SL AWD | $2,724 | $227 |

| SR VC-Turbo | $2,760 | $230 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How does Altima insurance rank against competitors?

The Nissan Altima ranks 10th out of 11 comparison vehicles in the 2024 midsize car category for car insurance affordability. The Altima costs an average of $2,598 per year to insure for full coverage, while the segment median rate is $2,447 per year, a difference of $151 per year.

When compared to the top-selling other midsize cars, car insurance for a 2024 Nissan Altima costs $20 more per year than the Toyota Camry, $282 more than the Honda Accord, $220 less than the Tesla Model 3, and $272 more than the Chevrolet Malibu.

The chart table shows how well average Altima insurance rates fare against the rest of the 2024 midsize car segment for car insurance affordability.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Kia K5 | $2,312 | -$286 |

| 2 | Honda Accord | $2,316 | -$282 |

| 3 | Chevrolet Malibu | $2,326 | -$272 |

| 4 | Volkswagen Arteon | $2,358 | -$240 |

| 5 | Subaru Legacy | $2,368 | -$230 |

| 6 | Hyundai Ioniq 6 | $2,386 | -$212 |

| 7 | Toyota Crown | $2,428 | -$170 |

| 8 | Hyundai Sonata | $2,432 | -$166 |

| 9 | Toyota Camry | $2,578 | -$20 |

| 10 | Nissan Altima | $2,598 | -- |

| 11 | Tesla Model 3 | $2,818 | $220 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

The Nissan Altima is not one of the cheaper midsize cars to insure, and it never really has been. But, there are some things you can do to help make sure you’re getting the cheapest rates possible.

The list below details some steps you can take to proactively reduce the cost of your car insurance or just keep rates low if they’re already affordable.

- Research discounts to save money. Discounts may be available if the policyholders belong to certain professional organizations, insure multiple vehicles on the same policy, are loyal customers, are homeowners, or many other discounts which could save the average driver as much as $440 per year.

- High-risk drivers pay a lot more for insurance. For a 20-year-old driver, having to buy a high-risk insurance policy can increase the cost by $4,060 or more per year. Keeping a clean driving record is one of the best ways to ensure your rates stay low.

- Get cheaper rates because of your employer. The large majority of auto insurance providers offer discounts for having a job in professions like doctors, the military, lawyers, police officers and law enforcement, high school and elementary teachers, college professors, and others. If you can get this discount applied to your policy, you may save between $78 and $233 on your annual car insurance bill, depending on the policy coverages selected.

- Be a careful driver and save. Having a few at-fault accidents can really raise rates, as much as $3,682 per year for a 20-year-old driver and as much as $622 per year for a 60-year-old driver. This goes hand-in-hand with keeping your driving record clean and staying claim-free is a good way to earn a significant discount.

- Insuring teenagers can be very expensive. Average rates for full coverage Altima car insurance costs $9,182 per year for a 16-year-old driver, $8,908 per year for a 17-year-old driver, and $8,002 per year for an 18-year-old driver. Young drivers are the most expensive age group to insure so if you’re adding a teen to your policy, brace yourself for a pretty sizeable premium.

Top discounts to save on Nissan Altima insurance

As mentioned above, discounts are a great way to reduce the cost of car insurance. Some discounts are automatically applied to your policy, but others may require you to ask your agent or company representative about them.

Every car insurance company in America offers a slightly different set of discounts, and the discount percentages will be different for each company as well.

The table below shows the discounts that can get you the biggest savings and the estimated average savings when insuring a 2024 Nissan Altima.

The larger companies that offer each discount are also listed, but these discounts are also offered by many smaller companies as well.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $364 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $286 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $242 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $205 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $195 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated October 24, 2025

There are also many other smaller discounts that you ask your current or prospective company about.

These include discounts like a paid-in-full discount, good student discount, homeowner discount, and senior citizen discount.

There are many ways to make car insurance cheaper, and discounts are probably the easiest way since they don’t require anything more than just asking about them and seeing if you qualify.

Which company is best for Altima insurance?

One of the hardest things to do as a consumer is narrow down and find the best car insurance company. Everyone has different needs and priorities, so that means the best company for you may not necessarily be the best company for someone else.

Having worked with many of the larger insurance companies, and a lot of smaller ones as well, we recommend checking with the companies below as a start to finding the best Nissan Altima insurance.

We recommend comparing rates between at least five different car insurance companies in order to find the best rates. Include several major companies (Progressive, State Farm, GEICO, etc.) as well as smaller companies in your area.

Pros and cons are shown for each company, and links are provided if you wish to do your own homework on the coverages offered by each company.

1. Progressive

Estimated Progressive car insurance rate on a 2024 Nissan Altima: $2,520 per year

Pros

- Excellent online and mobile policy management and claims tracking

- They have optional coverage for ridesharing for insureds who make a side income with companies like Uber or Lyft

- Coverages are available like accident forgiveness, gap insurance, and a vanishing deductible

Cons

- Progressive doesn’t have strong claim ratings with J.D. Power

- Above-average prices for drivers under than age of 25

Get a Quote Or read more about auto insurance coverages offered at Progressive.com

2. Nationwide

Estimated Nationwide car insurance rate on a 2024 Nissan Altima: $2,572 per year

Pros

- They generally have a low amount of customer complaints filed with state insurance departments

- Has optional coverages like gap insurance and accident forgiveness

- They offer a usage-based price option (SmartRide) for drivers who might be able to save money

Cons

- Expensive rates for drivers with prior bodily injury liability claims

- Rates are above average for drivers with accidents or major violations

Get a Quote Or read more about auto insurance coverages offered at Nationwide.com

3. State Farm

Estimated State Farm car insurance rate on a 2024 Nissan Altima: $2,468 per year

Pros

- Favorable renewal discount of about 14% if you are a loyal customer

- Affordable rates if you tend to get speeding tickets

- Good average rates when adding a teen driver to a policy

Cons

- Expensive rates for drivers who have a poor credit rating

- Average prices are not great for drivers with a DUI or an accident

Get a Quote Or read more about auto insurance coverages offered at StateFarm.com

4. Auto-Owners

Estimated Auto-Owners car insurance rate on a 2024 Nissan Altima: $2,052 per year

Pros

- Average rates are good for drivers with prior accidents

- Offers additional coverage like accident forgiveness and gap insurance

- Coverages are available like deductible waiver and a common loss deductible

Cons

- They will not take higher-risk drivers requiring an SR-22

- Expensive insurance rates for drivers with poor credit

- Only sells car insurance in 26 states

Get a Quote Or read more about auto insurance coverages offered at Auto-owners.com

5. Liberty Mutual

Estimated Liberty Mutual car insurance rate on a 2024 Nissan Altima: $3,066 per year

Pros

- Perks are available like new car replacement and loan/lease gap coverage

- They offer a usage-based discount program called RightTrack for drivers who think they can save money

- Offers non-owner auto insurance coverage

Cons

- Liberty Mutual has below-average claim handling scores in nationwide surveys

- Higher average rates for teenagers

Get a Quote Or read more about auto insurance coverages offered at LibertyMutual.com

During his career as an independent insurance agent,

During his career as an independent insurance agent,