- Ram 1500 insurance costs an average of $2,776 per year for full coverage, depending on the trim level.

- The cheapest Ram 1500 insurance is on the Tradesman Crew Cab 4WD costing an average of $2,452 per year. The most expensive is the TRX Final Edition 4WD at $3,036 annually.

- The Ram 1500 pickup is one of the more expensive large trucks to insure for 2024, costing $116 more per year on average as compared to other large trucks. It ranks sixth in the large truck class for insurance affordability.

- Ram TRX insurance costs around $100 to $120 more per year than the average Ram 1500 model.

The Ram 1500 Truck, a symbol of rugged versatility and American craftsmanship, is a dependable companion for those who appreciate power and performance on the road.

But as with any vehicle, insuring your Ram Truck is a critical aspect of ownership. The cost of insurance can vary significantly based on a lot of different factors.

In this article, we will provide you with insights, tips, and guidance to help you understand and manage the costs of insuring your Ram. Whether you’re a proud Ram 1500 owner already, or are considering becoming one, this comprehensive guide will equip you with the knowledge needed to make informed insurance decisions and protect your investment.

Age and risk: A deep dive into Ram 1500 insurance rates

Age is more than just a number when it comes to auto insurance rates, especially when you’re insuring a powerful and capable vehicle like the Ram 1500.

In this section, we’ll take a deep dive into the relationship between your age and the insurance rates for your Ram 1500, along with some additional factors like your driving record and policy deductibles.

Ram 1500 insurance cost averages $2,776 per year, or $1,388 for a 6-month policy, for full coverage. With the average full-size truck costing $2,660 a year to insure, Ram Truck owners could be paying around $116 more each year on average.

Depending on the trim level of the truck being insured, monthly car insurance cost for the Ram 1500 ranges from $204 to $253, with the Tradesman Crew Cab 4WD being cheapest and the TRX Final Edition 4WD costing the most to insure.

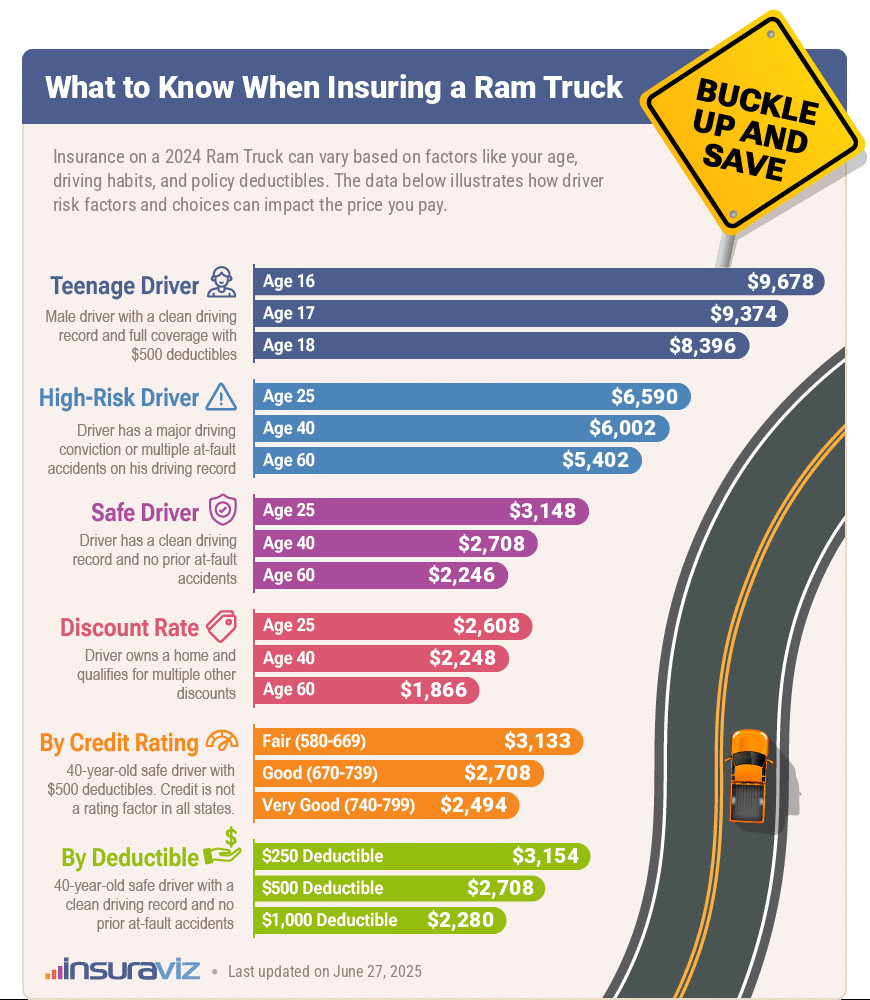

The infographic below shows average car insurance rates for a 2024 Ram 1500 using different driver ages and risk profiles.

What can you glean from the chart above? Well, for starters, high-risk insurance is expensive. If you’re unfortunate enough to have multiple serious driving offenses like reckless driving or a DUI (or two), you’re going to be paying more. A lot more, actually. For a 30-year-old driver, having to buy a high-risk insurance policy more than doubles the cost of Ram pickup insurance.

If you’re looking to save money on car insurance, increasing deductibles from $500 to $1,000 could save around $438 per year when insuring a Ram 1500.

One of the quickest ways to lower your insurance rates is to increase your deductibles, providing you maintain adequate savings to pay the higher deductible in the event of a claim.

It should also be pretty apparent that as driver age increases, insurance rates decrease. It’s just human nature to become more conservative (less aggressive) as we age, and that translates into fewer accidents and claims. The reward is cheaper insurance for your favorite Ram truck!

The discount rate data point in the chart is a scenario where you are essentially the perfect risk for a car insurance company. You’re middle-aged, married, own your home, have multiple vehicles on the same policy, insure your home and auto with the same company, have a clean driving record and no claims and have great credit.

The more discounts you can check off, the lower your insurance rate will be.

The cost of coverage: Ram 1500 insurance by trim level

The Ram 1500 is a truck known for its versatility, with various trim levels to suit a wide range of preferences and needs. However, when it comes to insuring your Ram 1500, the trim level you choose can significantly impact the cost of coverage.

In this section, we’ll provide you with insights into what drives these costs. Whether you’ve opted for a well-appointed trim with all the bells and whistles like a Limited or a more utilitarian version like the Tradesman, understanding how the trim level affects your insurance expenses is essential.

The cheapest Ram 1500 insurance is on the Tradesman Crew Cab 4WD trim level costing $2,452 per year. The next cheapest trim is the Big Horn Crew Cab 4WD at $2,560, and the third cheapest trim level is the Tradesman Crew Cab 2WD at $2,584 per year.

On the opposite end of the cost spectrum, the three most expensive Ram pickup trim levels to insure are the Ram 1500 TRX Crew Cab 4WD, the Limited Crew Cab 2WD, and the TRX Final Edition 4WD trim levels at an estimated $2,986, $3,008, and $3,036 per year, respectively.

As a general rule, the lower the MSRP of a vehicle, the cheaper it will be to insure. This is primarily due to the higher cost that would be incurred by your car insurance company if the vehicle is totaled out from an accident or weather-related event. In the case of the Ram truck lineup, it stands to reason that a lower-cost work truck model like the Tradesman would have cheaper insurance rates than the high-end Laramie, Longhorn, Limited, and TRX models.

The table below details the average Ram car insurance cost for the 2024 model year, plus a monthly budget figure, for each available package and trim.

| 2024 Ram Truck Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Tradesman Crew Cab 4WD | $2,452 | $204 |

| Big Horn Crew Cab 4WD | $2,560 | $213 |

| Tradesman Crew Cab 2WD | $2,584 | $215 |

| Tradesman HFE Crew Cab 2WD | $2,626 | $219 |

| Laramie Crew Cab 4WD | $2,704 | $225 |

| Big Horn Crew Cab 2WD | $2,712 | $226 |

| Rebel Crew Cab 4WD | $2,718 | $227 |

| Limited Longhorn Crew Cab 4WD | $2,784 | $232 |

| Limited Crew Cab 4WD | $2,820 | $235 |

| Laramie Crew Cab 2WD | $2,878 | $240 |

| Limited Longhorn Crew Cab 2WD | $2,972 | $248 |

| TRX Crew Cab 4WD | $2,986 | $249 |

| Limited Crew Cab 2WD | $3,008 | $251 |

| TRX Final Edition 4WD | $3,036 | $253 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Choosing the right insurance: Ram 1500 vs. its competitors

Knowing how your Ram 1500’s insurance rates stack up against the competition is crucial when it comes to buying insurance.

We’ll compare Ram 1500 insurance rates with rival trucks in this section, so you can get a comprehensive picture of how the costs compare.

When compared to other half-ton trucks, the Ram 1500 tends to cost a little more than average, ranking sixth at $2,776 per year. Ram insurance costs $116 more per year when compared to the average insurance rate for the full-size truck segment.

The table below compares Dodge Ram 1500 insurance cost to competition like the Ford F150, Chevy Silverado, and Toyota Tundra.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Nissan Titan | $2,246 | -$530 |

| 2 | GMC Sierra | $2,650 | -$126 |

| 3 | Chevrolet Silverado | $2,654 | -$122 |

| 4 | Ford F150 | $2,684 | -$92 |

| 5 | GMC Hummer EV Pickup | $2,756 | -$20 |

| 6 | Ram Truck | $2,776 | -- |

| 7 | Toyota Tundra | $2,856 | $80 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Even though the average insurance cost on a Ram 1500 isn’t the cheapest or most expensive in its class, keep in mind that the actual trim level of your truck is what will really determine the rate you pay.

If you’re insuring a model like the Tradesman Crew Cab 2WD, the average rate is around $2,584 a year. Compare that to the cost to insure a GMC Sierra EV Denali Edition 1 at around $3,032 a year and the cost of your Ram insurance isn’t so bad after all.

There are over 290 million tires discarded in the U.S. every year, with around 80% of these being recycled for other uses such as a fuel source, asphalt, or as garden mulch.

How much does Ram TRX insurance cost?

The TRX models cost anywhere from around $100 to $120 more to insure per year than the average Ram 1500 insurance cost of $2,776.

With 702 horsepower pumped out of the supercharged 6.2L Hemi, it’s going to cost a little more to cover the extra MSRP of the TRX models. Throw in the TRX Carbon-Fiber Package, the Technology Group, Advanced Safety Group, and Bed Utility Group, and you just tacked on another $4,200 to the MSRP.

When putting this much value into a truck, it’s best just to nail down the exact insurance rate for your location by getting some free quotes.

Ram 1500 insurance rates: The impact of new or used

The choice between a brand-new, off-the-lot Ram 1500 and a pre-owned one can have a substantial impact on your insurance rates.

The newer the model, generally the higher the premium. Additionally, a used Ram 1500 may be cheaper to insure, as the value of the vehicle is already depreciated. It’s important to weigh the pros and cons of both options before making a decision.

The following table shows average full-coverage Ram 1500 pickup truck insurance rates for the 2013-2024 model years and for various driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Ram Truck | $5,594 | $2,776 | $2,300 |

| 2023 Ram Truck | $5,146 | $2,560 | $2,124 |

| 2022 Ram Truck | $5,040 | $2,500 | $2,076 |

| 2021 Ram Truck | $4,676 | $2,314 | $1,930 |

| 2020 Ram Truck | $4,510 | $2,232 | $1,862 |

| 2019 Ram Truck | $4,390 | $2,164 | $1,812 |

| 2018 Ram Truck | $4,200 | $2,074 | $1,738 |

| 2017 Ram Truck | $4,082 | $2,022 | $1,692 |

| 2016 Ram Truck | $3,886 | $1,926 | $1,612 |

| 2015 Ram Truck | $3,618 | $1,792 | $1,502 |

| 2014 Ram Truck | $3,324 | $1,654 | $1,384 |

| 2013 Ram Truck | $3,348 | $1,668 | $1,406 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ram Truck trim levels for each model year. Updated October 24, 2025

How much is liability insurance on a Ram pickup?

Older Ram trucks may not require full coverage, and buying a liability-only insurance policy will cut the cost considerably. The table below compares the cost of full-coverage insurance to liability-only insurance on older model Ram trucks.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Ram Truck | $1,600 | $822 |

| 2011 Ram Truck | $1,544 | $816 |

| 2010 Ram Truck | $1,480 | $808 |

| 2009 Ram Truck | $1,418 | $800 |

| 2008 Ram Truck | $1,368 | $792 |

| 2007 Ram Truck | $1,350 | $786 |

| 2006 Ram Truck | $1,322 | $778 |

| 2005 Ram Truck | $1,280 | $770 |

| 2004 Ram Truck | $1,250 | $762 |

| 2003 Ram Truck | $1,225 | $747 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025

Deciding when to remove full coverage from your car insurance policy is a personal decision that depends on various factors. Full coverage typically includes both comprehensive and collision coverage, in addition to liability coverage.

Here are some situations in which you might consider removing full coverage from an older model Ram:

- Age and Value of Your Vehicle: As your vehicle ages, its value decreases. If your car is older and has a lower market value, it may no longer be cost-effective to maintain full coverage. You might consider dropping full coverage when the cost of the coverage exceeds a certain percentage of your car’s value.

- Financial Situation: If you have the financial means to repair or replace your vehicle in case of an accident, you might choose to drop full coverage. On the other hand, if losing your car would pose a significant financial burden, keeping full coverage is advisable.

- Loan or Lease Requirements: If you’re financing or leasing your vehicle, the lender or leasing company may require you to maintain full coverage until the loan is paid off. Once you own the vehicle outright, you have more flexibility in choosing your coverage.

- Driving Habits: If you’re a safe and experienced driver with a clean record, you may be less likely to get into accidents. This can make it more feasible to reduce coverage. However, if you frequently drive in high-traffic areas or have a history of accidents, it’s usually wise to maintain full coverage.

- Location: If you live in an area prone to natural disasters, theft, or vandalism, comprehensive coverage may be valuable. Consider your location and the associated risks when deciding on coverage.

- Alternative Savings: Calculate how much you can save by reducing coverage and whether those savings can be put to better use elsewhere, such as paying off debts or building an emergency fund.

- Personal Preferences: Some individuals simply prefer the peace of mind that comes with full coverage. If you’re uncomfortable with the idea of potentially paying for expensive repairs or a new vehicle out of pocket, you may want to keep full coverage.

Before making any changes to your car insurance coverage, it’s advisable to consult with your insurance provider and carefully evaluate your specific circumstances. Keep in mind that the minimum coverage requirements vary by state, and you should always ensure you meet the legal requirements.

Consistency is the key to finding and maintaining affordable car insurance. Make a habit of comparing rates once a year to ensure you’re getting the best deal.

During his career as an independent insurance agent,

During his career as an independent insurance agent,