- Toyota Corolla insurance cost averages $2,336 per year, or around $195 per month for full coverage.

- The cheapest Corolla insurance is on the LE trim level costing an average of $2,128 per year. The most expensive to insure is the XSE Hatchback at $2,644 per year.

- When compared to other small cars, the Toyota Corolla is one of the cheaper small cars to insure, costing $35 less per year on average.

How much does Toyota Corolla insurance cost?

Toyota Corolla car insurance costs an average of $2,336 a year for a full coverage policy on a 2024 model, which is about $195 a month.

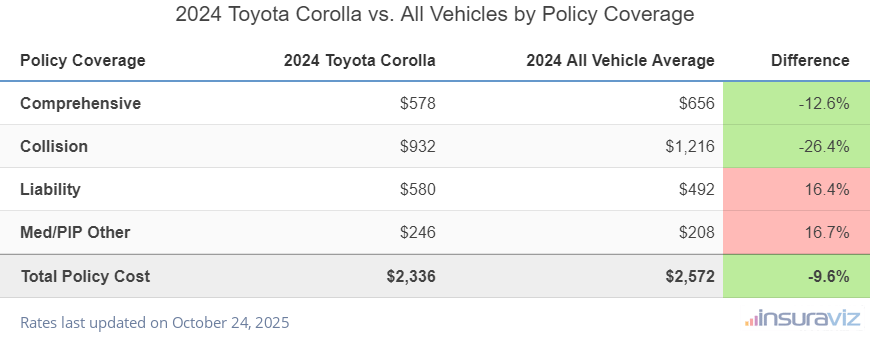

When compared to the average insurance rate for all 2024 model year vehicles, which is $2,572 per year, a 2024 Toyota Corolla is 9.6% cheaper to insure.

Depending on the Corolla trim level being insured, monthly payments for a 2024 Toyota Corolla range from $177 to $220, with the LE being cheapest and the XSE Hatchback costing the most to insure.

For individual policy coverages, collision insurance will cost about $932 a year, liability and medical coverage will cost about $826, and the remaining comprehensive (or other-than-collision) coverage is around $578.

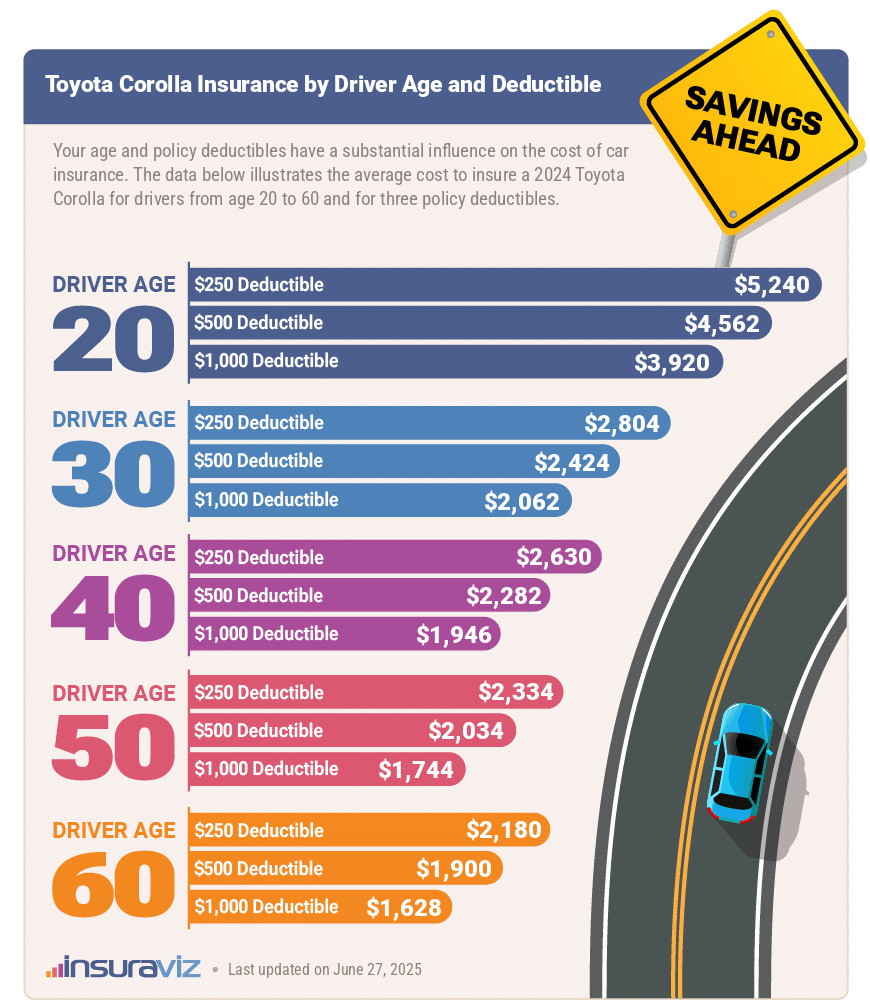

The following infographic illustrates how average Corolla car insurance rates change depending on the age of the driver and the policy deductibles.

Younger drivers pay higher car insurance rates. Their riskier driving behaviors and tendency to have accidents means more risk assumed by their car insurance company. This added risk translates into more expensive coverage.

Policy deductibles are a significant factor in rate determination. Higher deductibles mean you have to pay more out-of-pocket expenses when you have a claim, so your premiums are lower. Conversely, if you want the luxury of less out-of-pocket expense when you have a claim, you’ll need to pay more with each car insurance bill.

When comparing individual policy coverages, we can gain a little insight into exactly where the Corolla has the biggest savings, and also where you’ll pay a little more.

The next table compares each policy coverage for a 2024 Corolla to the average across all models in the 2024 model year.

| Policy Coverage | 2024 Toyota Corolla | 2024 All Vehicle Average | Difference |

|---|---|---|---|

| Comprehensive | $578 | $656 | -12.6% |

| Collision | $932 | $1,216 | -26.4% |

| Liability | $580 | $492 | 16.4% |

| Med/PIP Other | $246 | $208 | 16.7% |

| Total Policy Cost | $2,336 | $2,572 | -9.6% |

Lower than average cost Higher than average cost

Data Methodology: Rated driver is a 40-year-old male with no driving violations or at-fault accidents in the prior three years. Coverage premiums are averaged for all trim levels available for the 2024 Toyota Corolla. Updated October 24, 2025

As shown by the green-highlighted cells in the ‘Difference’ column, the Corolla tends to have cheaper rates for both comprehensive and collision coverage than the overall average.

But when it comes to the liability and medical coverage portion of a policy, the Corolla doesn’t fare quite as well as rates are slightly higher than average.

The farther ahead of your policy expiration date that you buy new coverage the better. Called an early signing discount, it could save you anywhere from $70 to $234 on your 2024 Toyota Corolla insurance.

That’s some serious variability to wrap your head around. Here are some additional data insights as they relate to Toyota Corolla insurance cost.

- Careless drivers spend more on insurance. At-fault accidents raise insurance rates, as much as $3,318 per year for a 20-year-old driver and even as much as $588 per year for a 60-year-old driver.

- Raising physical damage deductibles lowers costs. Jacking up your deductibles from $500 to $1,000 could save around $346 per year for a 40-year-old driver and $658 per year for a 20-year-old driver.

- Low physical damage deductibles may be wasting money. Decreasing your policy deductibles from $500 to $250 could cost an additional $356 per year for a 40-year-old driver and $694 per year for a 20-year-old driver.

- Obey driving laws to save money. To get the cheapest Corolla insurance rates, it pays to not be aggressive behind the wheel. Not surprisingly, just a couple of minor blemishes on your driving record have the potential to increase the cost of a policy by as much as $622 per year.

- High-risk insurance is expensive. For a 20-year-old driver, having too many accidents or violations can potentially increase rates by $3,658 or more per year. That’s some serious coin. In latte-speak, that’s the equivalent of just under 400 lattes that you’ll have to spend just because you’re careless behind the wheel.

- Good credit can save money. Having a high credit rating of over 800 could see savings of $367 per year over a credit rating of 670-739. Conversely, a lesser credit rating could cost around $425 more per year.

What is the cheapest Toyota Corolla insurance?

The cheapest trim level of Toyota Corolla to insure is the LE costing an average of $2,128 per year, or about $177 per month. The second cheapest Corolla to insure LE Hybrid at $2,188 per year.

For the pricier trim levels, the three most expensive Corolla trim levels to insure are the Toyota Corolla SE Hatchback, the Nightshade Hatchback, and the XSE Hatchback trim levels averaging from $2,524 to $2,644 per year.

The table below details average Corolla car insurance rates, in addition to a monthly budget figure, for each 2024 model year trim level.

| 2024 Toyota Corolla Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LE | $2,128 | $177 |

| LE Hybrid | $2,188 | $182 |

| SE | $2,226 | $186 |

| Nightshade | $2,262 | $189 |

| SE Hybrid | $2,276 | $190 |

| XSE Hybrid | $2,306 | $192 |

| Nightshade Hybrid | $2,308 | $192 |

| XSE | $2,314 | $193 |

| XLE Hybrid | $2,320 | $193 |

| SE Hatchback | $2,524 | $210 |

| Nightshade Hatchback | $2,562 | $214 |

| XSE Hatchback | $2,644 | $220 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

If you noticed a trend in the table above, the Corolla models that cost the most also cost the most to insure. As you add packages and options to any vehicle, it drives up the MSRP or purchase price. And it’s almost guaranteed that a more expensive model will cost more to insure than a lower-cost model.

How do Corolla car insurance prices rank?

The Toyota Corolla ranks seventh out of 15 comparison vehicles in the 2024 compact car segment. The Corolla costs an average of $2,336 per year for full coverage insurance, while the category median rate is $2,371 per year, a difference of $35 per year.

Insuring a Corolla costs $212 more per year than the Honda Civic, $136 more than the Nissan Sentra, $272 less than the Hyundai Elantra, and $90 less than the Volkswagen Jetta per year.

The table below shows how average Corolla car insurance rates compare to the rest of the 2024 compact car segment. The Corolla is highlighted in light orange while the segment average of $2,371 is highlighted in blue.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Toyota GR Corolla | $2,084 | -$252 |

| 2 | Nissan Leaf | $2,100 | -$236 |

| 3 | Honda Civic | $2,124 | -$212 |

| 4 | Nissan Sentra | $2,200 | -$136 |

| 5 | Subaru Impreza | $2,204 | -$132 |

| 6 | Toyota Prius | $2,242 | -$94 |

| 7 | Toyota Corolla | $2,336 | -- |

| 8 | Kia Forte | $2,342 | $6 |

| 9 | Nissan Versa | $2,364 | $28 |

| 2024 Small Car Average | $2,371 | $35 | |

| 10 | Mitsubishi Mirage G4 | $2,422 | $86 |

| 11 | Volkswagen Jetta | $2,426 | $90 |

| 12 | Mazda 3 | $2,480 | $144 |

| 13 | Hyundai Elantra | $2,608 | $272 |

| 14 | Volkswagen Golf | $2,650 | $314 |

| 15 | Toyota Mirai | $2,986 | $650 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each model. Updated October 24, 2025

One factor that is not included in the comparison above is the purchase price of each compact car. When shopping within a budget, it’s good to know how much insurance will cost between similarly-priced models.

A 2024 Corolla has an average MSRP of $25,198, ranging from the LE trim at $21,900 to the XSE Hatchback trim at $26,655.

The vehicles in the small car segment closest in price to the Toyota Corolla are the Subaru Impreza, Volkswagen Jetta, Hyundai Elantra, and Kia Forte.

Here’s how those four models compare to the Corolla for overall purchase price and average insurance cost.

- Toyota Corolla vs. Subaru Impreza – Having an average MSRP of $25,292 ($22,995 to $27,885), the 2024 Subaru Impreza costs $94 more than the average cost of the Corolla. Expect to pay an average of $132 less per year for full-coverage insurance on the Subaru Impreza compared to a Corolla.

- Toyota Corolla vs. Volkswagen Jetta – The Volkswagen Jetta retails for an average of $26,265 ($22,995 to $31,785), which is $1,067 more expensive than the average cost of the Corolla. Expect to pay an average of $90 more per year for insurance on the Volkswagen Jetta compared to a Corolla.

- Toyota Corolla vs. Hyundai Elantra – Having an average sticker price of $26,676 and ranging from $21,475 to $32,900, the Hyundai Elantra costs $1,478 more than the average cost for the Corolla. Drivers can expect to pay approximately $272 more each year for full-coverage insurance on the Hyundai Elantra compared to a Corolla.

- Toyota Corolla vs. Kia Forte – With an average sticker price of $22,410 and ranging from $19,790 to $25,190, the Kia Forte costs $2,788 less than the MSRP for the Corolla. Full-coverage insurance on the Kia Forte costs an average of $6 more every 12 months than the Toyota Corolla.

Links to many more insurance cost comparisons can be found on our comparisons index page.

Insurance rates for older Corolla models

The following table shows the average cost for full coverage car insurance starting with the 2013 model year up to the current 2024 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Toyota Corolla | $4,674 | $2,336 | $1,946 |

| 2023 Toyota Corolla | $4,372 | $2,186 | $1,818 |

| 2022 Toyota Corolla | $4,282 | $2,148 | $1,800 |

| 2021 Toyota Corolla | $3,536 | $1,776 | $1,480 |

| 2020 Toyota Corolla | $3,446 | $1,730 | $1,444 |

| 2019 Toyota Corolla | $3,140 | $1,590 | $1,326 |

| 2018 Toyota Corolla | $3,840 | $1,922 | $1,616 |

| 2017 Toyota Corolla | $3,734 | $1,868 | $1,570 |

| 2016 Toyota Corolla | $3,312 | $1,670 | $1,404 |

| 2015 Toyota Corolla | $2,926 | $1,472 | $1,238 |

| 2014 Toyota Corolla | $2,824 | $1,422 | $1,196 |

| 2013 Toyota Corolla | $2,776 | $1,398 | $1,182 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Toyota Corolla trim levels for each model year. Updated October 24, 2025

Best car insurance policy discounts

One of the best ways to save money on Corolla insurance is to qualify for a few discounts. Every major insurance company offers a wide variety of discounts, but each puts its own spin on the types available.

The table below shows the top ten discounts that can save you the most money. Each major insurer that offers each discount is listed, along with the average savings when insuring a 2024 Toyota Corolla.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $327 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $257 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $217 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $185 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $175 |

| Military Savings of 5% to 15% | Alfa, American Family, Direct General, Farmers, GEICO, Liberty Mutual, Shelter, USAA | $164 |

| Pay in Full Savings of 5% to 10% | Allstate, Nationwide, Progressive, State Farm, Travelers | $147 |

| Multiple Vehicles Savings of 4% to 15% | Allstate, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Progressive, Travelers, USAA | $140 |

| Student Away at School Savings of 4% to 25% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $135 |

| Good Student Savings of 3% to 20% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $121 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated October 24, 2025

It just makes sense that being a good driver will save you the most money. Not getting into accidents and keeping your driving record clean is going to save you a lot of money on car insurance.

But even if you have an accident or a couple of speeding tickets, don’t sweat it. There are plenty of other ways to cut your premiums.

If you own a home, or even have a renter or condo insurance policy, you should be able to qualify for a bundling discount.

Just about every car insurance company has an e-pay or autopay feature that saves time when paying your bill. Plus, it saves the cost of a postage stamp!

Usage-based discounts are earned by allowing the insurance company to track your driving habits through an electronic monitoring device that plugs into your car. It tracks things like how hard you stop, miles driven, sudden lane changes, and things of that nature.

Safe drivers should be able to save money on most usage-based programs. However, there is a chance that your rates could actually increase, so keep that in mind when considering one of these programs.

To see if your current company has discounts that you may not be taking advantage of, simply talk to your agent or a customer service representative and have them run through all possible discounts. It only takes a few minutes and it could end up reducing your premium by a pretty good amount.

During his career as an independent insurance agent,

During his career as an independent insurance agent,