- Chevrolet Spark insurance costs an average of $1,906 per year, or around $159 per month for full coverage.

- The Spark ranks second out of 20 compact cars for the 2022 model year for cheapest overall car insurance rates.

- The Spark 1LT trim level is the cheapest to insure at around $1,852 per year. The most expensive trim is the Activ at $1,968 per year.

How much does Chevy Spark insurance cost?

Chevy Spark car insurance costs on average $1,906 a year for full coverage, or $159 a month. With the average small car costing $2,252 a year to insure, the Spark costs $346 less than average per year to insure.

Depending on the Spark trim level being insured, monthly car insurance rates for a Chevrolet Spark range from $154 to $164, with the 1LT being cheapest and the Activ costing the most to insure.

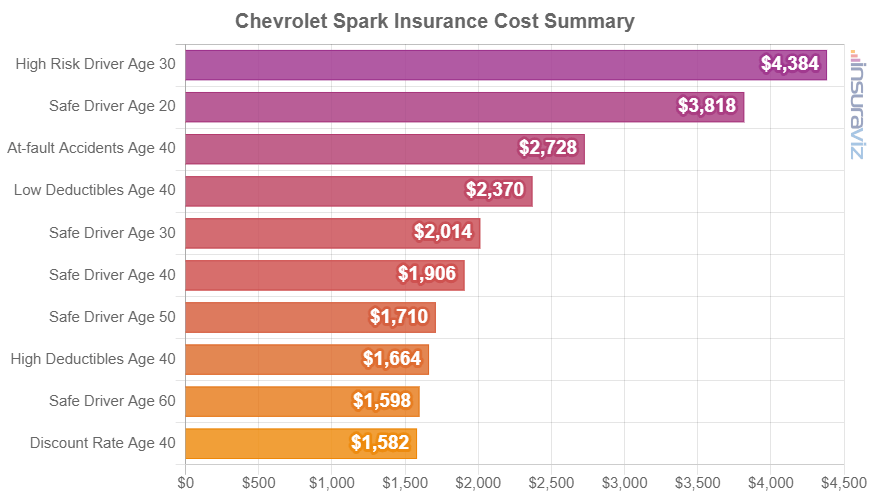

The chart below details average car insurance cost for a 2022 Chevy Spark using some common driver age and risk scenarios.

A liability-only auto insurance policy for a Spark in the cheaper areas of Iowa or North Carolina may cost as little as $239 a year. For the same 2022 Chevy Spark, a teen driver with a propensity for speed in the most expensive zip codes in America could total as much as $15,532 a year for full coverage.

That example illustrates how much car insurance rates can vary based on different drivers and locations. We also recommend getting a quote to ensure the most accurate rates for your situation and zip code.

Additional sample rates and possible policy discounts on Spark insurance include:

- Policy discounts equal cheaper Spark insurance rates. Discounts may be available if the insureds are claim-free, belong to certain professional organizations, insure their home and car with the same company, are good students, are senior citizens, or many other discounts which could save the average driver as much as $324 per year.

- Earn a discount from your employment. Some car insurance providers offer discounts for certain occupations like members of the military, emergency medical technicians, scientists, architects, police officers and law enforcement, and other occupations. Working in a qualifying occupation could potentially save between $57 and $232 on your car insurance premium, depending on your policy.

- Clean up your credit to lower your rates. In states that authorize a driver’s credit data to be used as an auto insurance rate factor, drivers who maintain a credit score over 800 could find savings as much as $299 per year when compared to a credit score ranging from 670-739. Conversely, a weak credit rating could cost as much as $347 more per year.

- Avoid accidents for cheaper rates. At-fault accidents raise insurance rates, to the tune of $934 per year for a 30-year-old driver and even $516 per year for a 60-year-old driver.

- The higher deductible you choose, the lower the policy cost. Raising deductibles from $500 to $1,000 could save around $242 per year for a 40-year-old driver and $462 per year for a 20-year-old driver.

- Choosing a low deductible may not make good financial sense. Decreasing your deductibles from $500 to $250 could cost an additional $252 per year for a 40-year-old driver and $482 per year for a 20-year-old driver.

- Rates tend to decrease as driver age increases. The difference in 2022 Spark insurance cost between a 60-year-old driver ($1,598 per year) and a 20-year-old driver ($3,818 per year) is $2,220, or a savings of 82%.

The Spark vs. other cars: How does insurance compare?

When compared to other popular small cars, car insurance for a Chevy Spark costs $254 less per year than the Honda Civic, $242 less than the Toyota Corolla, $226 less than the Nissan Sentra, and $560 less than the Hyundai Elantra.

The Chevrolet Spark ranks second out of 20 total vehicles in the small car segment. The Spark costs an average of $1,906 per year to insure, while the segment median average cost is $2,252 annually, a difference of $346 per year.

The table below shows how average Chevy Spark car insurance rates compare to all 20 vehicles in the compact car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Impreza | $1,900 | -$6 |

| 2 | Chevrolet Spark | $1,906 | -- |

| 3 | Volkswagen Golf | $2,104 | $198 |

| 4 | Volkswagen Jetta | $2,124 | $218 |

| 5 | Nissan Sentra | $2,132 | $226 |

| 6 | Toyota Corolla | $2,148 | $242 |

| 7 | Honda Civic | $2,160 | $254 |

| 8 | Mazda 3 | $2,164 | $258 |

| 9 | Kia Rio | $2,174 | $268 |

| 10 | Toyota Prius | $2,188 | $282 |

| 11 | Hyundai Accent | $2,212 | $306 |

| 12 | Kia Forte | $2,238 | $332 |

| 13 | Hyundai Veloster | $2,250 | $344 |

| 14 | Nissan Leaf | $2,338 | $432 |

| 15 | Hyundai Ioniq | $2,346 | $440 |

| 16 | Honda Clarity | $2,410 | $504 |

| 17 | Hyundai Elantra | $2,466 | $560 |

| 18 | Nissan Versa | $2,472 | $566 |

| 19 | Mitsubishi Mirage G4 | $2,482 | $576 |

| 20 | Toyota Mirai | $2,828 | $922 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2022 model year. Updated October 24, 2025

Which Spark trim level is cheapest to insure?

With Chevrolet Spark insurance cost ranging from $1,852 to $1,968 annually, the lowest-cost trim level to insure is the 1LT. The next cheapest trim level to insure is the LS at $1,862 per year. Expect to budget at a minimum $154 per month for full coverage Spark insurance.

The most expensive model of Spark to insure is the Activ at $1,968 per year. It costs about $140 more per year to insure this model over the cheapest 1LT model.

The next table displays average car insurance rates for annual and 6-month policies, plus a monthly budget estimate, for each Chevrolet Spark model trim level.

| 2022 Chevrolet Spark Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 1LT | $1,852 | $154 |

| LS | $1,862 | $155 |

| 2LT | $1,940 | $162 |

| Activ | $1,968 | $164 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Do older Spark models cost less to insure?

Buying a 2013 Chevy Spark instead of a more expensive 2022 Spark could save an average of $686 each year. Even driving an almost new 2019 model could save the average driver around $200 each year.

The following table shows average Chevrolet Spark insurance rates for various driver age groups. Insurance rates range from the cheapest rate of $1,032 for a 60-year-old driver rated on a 2013 Chevy Spark to a maximum value of $3,410 for a 20-year-old driving a 2019 Spark.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2022 Chevrolet Spark | $3,818 | $1,906 | $1,598 |

| 2021 Chevrolet Spark | $3,328 | $1,666 | $1,396 |

| 2020 Chevrolet Spark | $3,246 | $1,626 | $1,362 |

| 2019 Chevrolet Spark | $3,410 | $1,706 | $1,434 |

| 2018 Chevrolet Spark | $3,318 | $1,658 | $1,396 |

| 2017 Chevrolet Spark | $3,170 | $1,584 | $1,338 |

| 2016 Chevrolet Spark | $3,076 | $1,536 | $1,294 |

| 2015 Chevrolet Spark | $2,798 | $1,400 | $1,180 |

| 2014 Chevrolet Spark | $2,702 | $1,350 | $1,138 |

| 2013 Chevrolet Spark | $2,436 | $1,220 | $1,032 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chevrolet Spark trim levels for each model year. Updated October 24, 2025

At some point as the vehicle gets older, vehicle owners have to make the decision to delete physical damage coverage (comprehensive and collision) from a policy. As a vehicle loses value over time, the expense of maintaining comprehensive and collision coverage begins to outweigh the benefits provided by having it.

Buying a liability-only policy on an older Chevrolet Spark could possibly save around $544 a year, depending on what the comprehensive and collision deductibles were set to and the age of the driver rated on the vehicle.