- The average Land Rover LR4 insurance cost is $1,650 per year, or $138 per month for full coverage.

- Out of 13 other large luxury SUVs for the 2016 model year, the LR4 ranks sixth for insurance cost.

- The cheapest Land Rover LR4 insurance is usually found on the base 4WD trim, costing an average of $1,616 per year.

- The LR4 HSE Lux 4WD model has the most expensive insurance rates at $1,680 per year.

How much does Land Rover LR4 car insurance cost?

Expect to pay an average of $1,650 annually for full coverage to insure a Land Rover LR4, which is the equivalent of $138 a month. For individual coverages, liability/medical will cost an estimated $550 a year, comprehensive will cost approximately $334, and the remaining collision insurance will cost about $766.

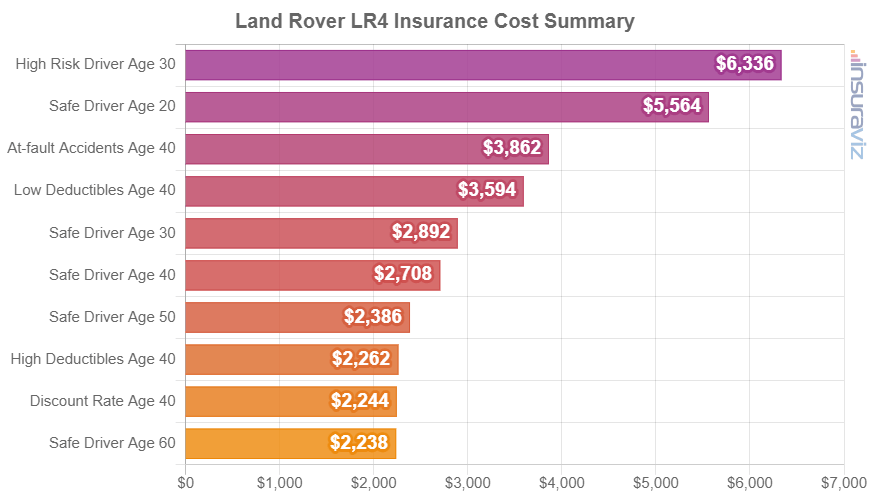

The rate summary chart below shows average yearly car insurance rates for a 2016 Land Rover LR4 using a range of policy scenarios.

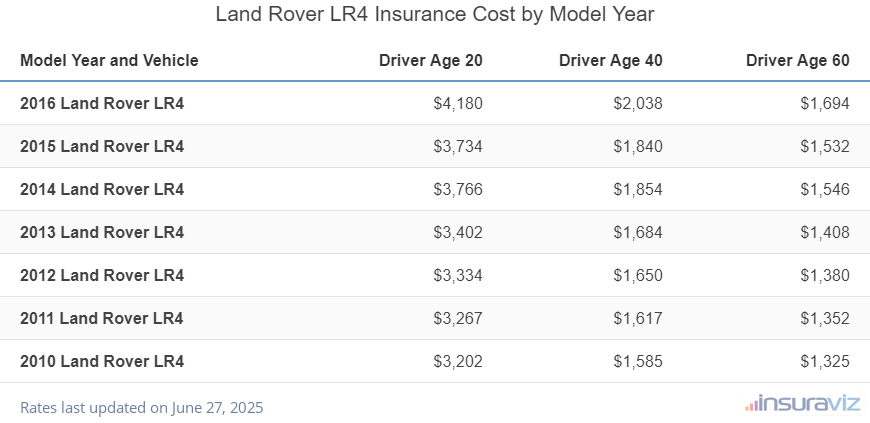

The following table illustrates average full coverage auto insurance policy costs for a Land Rover LR4 from the 2010 to the 2016 model years and for different driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2016 Land Rover LR4 | $3,390 | $1,650 | $1,374 |

| 2015 Land Rover LR4 | $3,004 | $1,482 | $1,232 |

| 2014 Land Rover LR4 | $3,050 | $1,502 | $1,254 |

| 2013 Land Rover LR4 | $2,758 | $1,364 | $1,140 |

| 2012 Land Rover LR4 | $2,703 | $1,337 | $1,117 |

| 2011 Land Rover LR4 | $2,649 | $1,310 | $1,095 |

| 2010 Land Rover LR4 | $2,596 | $1,284 | $1,073 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Land Rover LR4 trim levels for each model year. Updated February 23, 2024

The next table shows the estimated yearly and 6-month policy costs, including a monthly budget amount, for each Land Rover LR4 model trim level.

| 2016 Land Rover LR4 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 4WD | $1,616 | $135 |

| HSE 4WD | $1,654 | $138 |

| HSE Lux 4WD | $1,680 | $140 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 22, 2024

Other relevant data insights concerning LR4 insurance cost include:

- Clean up your credit for better rates. Insureds with excellent credit scores of 800+ could save an average of $259 per year over a good credit rating of 670-739. Conversely, a credit rating below 579 could cost up to $300 more per year.

- Driver gender influences rates. For a 2016 Land Rover LR4, a 20-year-old male driver pays an estimated $3,390 per year, while a 20-year-old female driver will pay $2,410, a difference of $980 per year in the women’s favor by a large margin. But by age 50, rates for male drivers are $1,466 and rates for female drivers are $1,426, a difference of only $40.

- High-risk drivers pay a lot more for insurance. For a 30-year-old driver, having a tendency to get into accidents or receive violations could trigger a rate increase of $2,096 or more per year.

- Being a cautious driver saves money. Having multiple accidents could cost you more, potentially by an additional $2,452 per year for a 20-year-old driver and even as much as $438 per year for a 60-year-old driver.

- Earn policy discounts to save money. Discounts may be available if the insured drivers are military or federal employees, work in certain occupations, insure multiple vehicles on the same policy, take a defensive driving course, drive a vehicle with safety or anti-theft features, or many other policy discounts which could save the average driver as much as $280 per year on their insurance cost.

- Your job could save you money. Some auto insurance companies offer policy discounts for being employed in occupations like police officers and law enforcement, scientists, firefighters, nurses, doctors, and others. By earning this discount on your policy you may save between $50 and $142 on your car insurance premium, depending on the policy coverages.

- Increasing deductibles makes car insurance cheaper. Raising deductibles from $500 to $1,000 could save around $248 per year for a 40-year-old driver and $500 per year for a 20-year-old driver.

- Low physical damage deductibles increase policy cost. Decreasing your deductibles from $500 to $250 could cost an additional $262 per year for a 40-year-old driver and $528 per year for a 20-year-old driver.

LR4 vs. other SUVs: How does insurance cost compare?

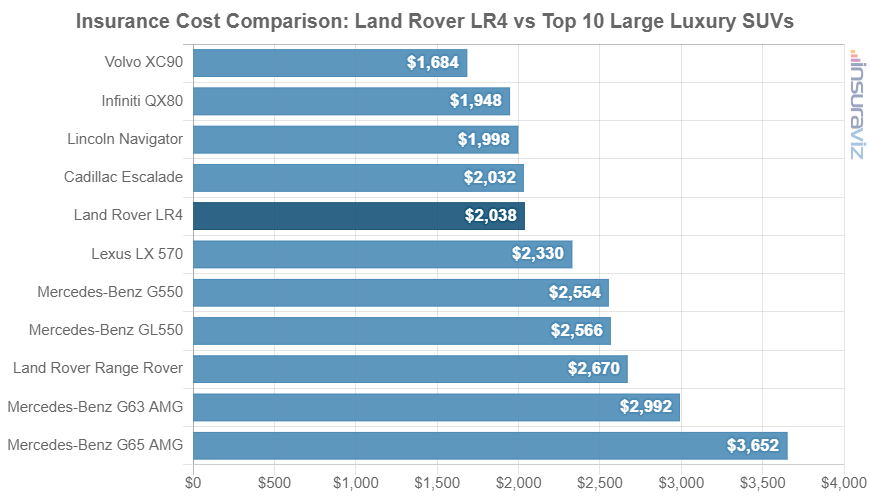

When compared to other vehicles in the 2016 large luxury SUV class, insurance rates for a Land Rover LR4 cost $286 more per year than the Volvo XC90, $2 more than the Cadillac Escalade, and $70 more than the Infiniti QX80.

The Land Rover LR4 ranks sixth out of 13 total comparison vehicles in the large luxury SUV segment for auto insurance affordability. The LR4 costs an average of $1,650 per year for an auto insurance policy with full coverage and the category average is $1,939 per year, a difference of $289 per year.

The following chart shows how average Land Rover LR4 car insurance rates fare against the top 10 best-selling large luxury SUVs in the United States like the Range Rover, Lincoln Navigator, and the Mercedes-Benz G550. A table is also added following the chart displaying average insurance cost for the entire large luxury SUV category.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Volvo XC90 | $1,364 | -$286 |

| 2 | Infiniti QX80 | $1,580 | -$70 |

| 3 | Lincoln Navigator | $1,618 | -$32 |

| 4 | Toyota Land Cruiser | $1,640 | -$10 |

| 5 | Cadillac Escalade | $1,648 | -$2 |

| 6 | Land Rover LR4 | $1,650 | -- |

| 7 | Lexus LX 570 | $1,888 | $238 |

| 8 | Mercedes-Benz G550 | $2,070 | $420 |

| 9 | Mercedes-Benz GL550 | $2,080 | $430 |

| 10 | Mercedes-Benz GL63 AMG | $2,120 | $470 |

| 11 | Land Rover Range Rover | $2,162 | $512 |

| 12 | Mercedes-Benz G63 AMG | $2,424 | $774 |

| 13 | Mercedes-Benz G65 AMG | $2,958 | $1,308 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2016 model year. Updated February 23, 2024