- Volkswagen CC insurance costs an average of $1,970 per year, $985 for a 6-month policy, or $164 per month, for the 2017 model.

- When compared to other large cars, the Volkswagen CC is one of the cheaper large cars to insure, costing $16 less per year on average.

- The cheapest VW CC insurance can be found on the Sport Coupe trim level at an average of $1,944 per year.

- The R-Line Executive Coupe is the most expensive to insure at $1,998 per year.

How much does Volkswagen CC insurance cost?

Car insurance rates for the Volkswagen CC cost an average of $1,970 per year, or around $164 a month.

When broken down by coverage, comprehensive coverage is around $472 a year, liability/medical (or PIP) coverage costs approximately $700, and the remaining collision insurance is around $798.

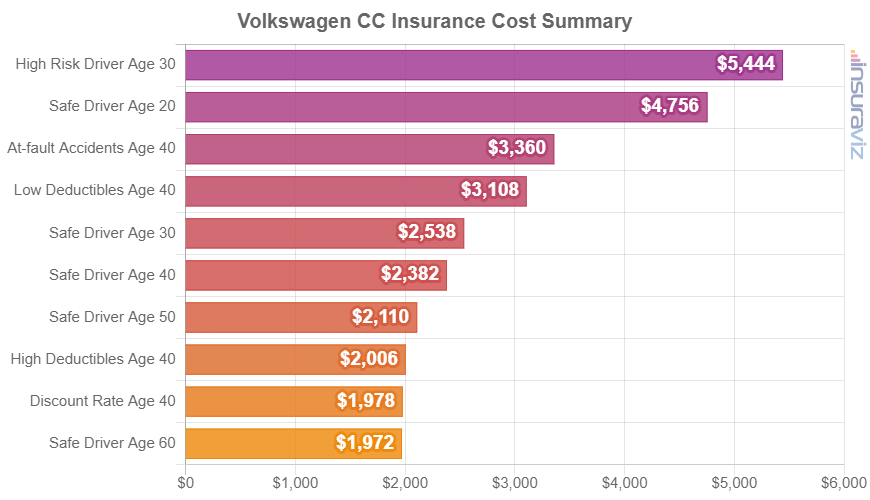

The following chart demonstrates average car insurance cost on a 2017 Volkswagen CC using a variety of different risk scenarios.

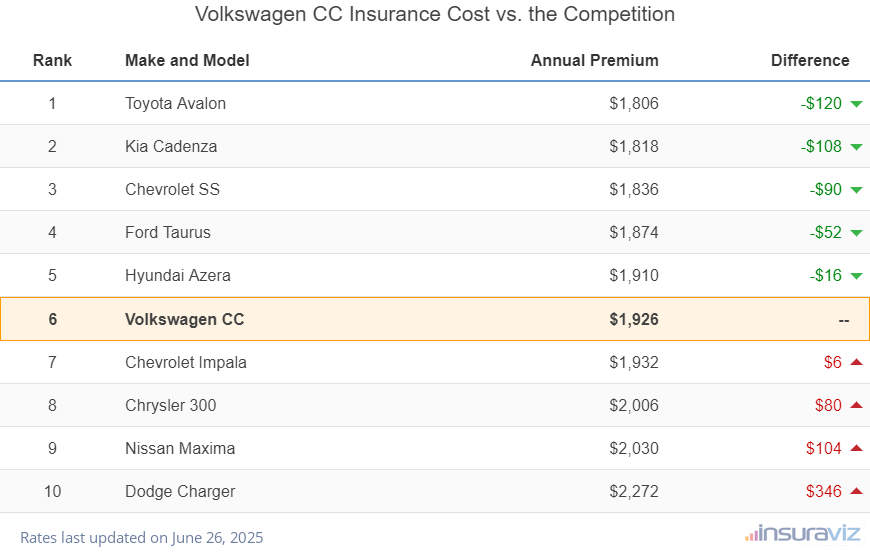

How does VW CC insurance cost rank?

The Volkswagen CC ranks sixth out of 10 total vehicles in the large car category. The CC costs an average of $1,970 per year for insurance and the segment average rate is $1,986 per year, a difference of $16 per year.

When rates are compared to popular vehicles in the large car segment, insurance for a Volkswagen CC costs $356 less per year than the Dodge Charger, $8 less than the Chevrolet Impala, $108 less than the Nissan Maxima, and $82 less than the Chrysler 300.

The table below shows how well Volkswagen CC car insurance rates compare to the best-selling large cars like the Dodge Charger, Chevrolet Impala, and the Chrysler 300.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Toyota Avalon | $1,848 | -$122 |

| 2 | Kia Cadenza | $1,860 | -$110 |

| 3 | Chevrolet SS | $1,880 | -$90 |

| 4 | Ford Taurus | $1,916 | -$54 |

| 5 | Hyundai Azera | $1,952 | -$18 |

| 6 | Volkswagen CC | $1,970 | -- |

| 7 | Chevrolet Impala | $1,978 | $8 |

| 8 | Chrysler 300 | $2,052 | $82 |

| 9 | Nissan Maxima | $2,078 | $108 |

| 10 | Dodge Charger | $2,326 | $356 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2017 model year. Updated October 24, 2025

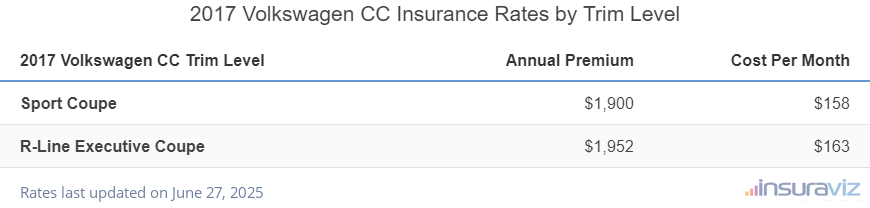

What is the cheapest Volkswagen CC insurance?

The cheapest trim level of Volkswagen CC to insure is the Sport Coupe at $1,944 per year, or about $162 per month. The second cheapest model is the R-Line Executive Coupe at an average cost of $1,998 per year, or about $167 per month.

The rate table below shows average annual and semi-annual car insurance costs for each Volkswagen CC package and trim level.

| 2017 Volkswagen CC Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sport Coupe | $1,944 | $162 |

| R-Line Executive Coupe | $1,998 | $167 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Some other observations concerning the cost of insurance for a CC include:

- High-risk drivers pay much more for CC insurance. For a 20-year-old driver, having too many driving record violations or accidents can potentially increase rates by $3,094 or more per year.

- Driving violations increase insurance rates. If you want the most budget-friendly VW CC insurance rates, it pays to be a good, safe driver. Not surprisingly, just one or two minor traffic citations have the consequences of raising insurance policy cost by up to $528 per year. Serious convictions like DWI and leaving the scene of an accident could raise rates by an additional $1,828 or more.

- Increase physical damage deductibles to save money. Increasing your deductibles from $500 to $1,000 could save around $290 per year for a 40-year-old driver and $556 per year for a 20-year-old driver.

- The lower the deductibles, the higher the cost. Cutting your deductibles from $500 to $250 could cost an additional $300 per year for a 40-year-old driver and $590 per year for a 20-year-old driver.

- Policyholder gender affects insurance cost. For 2017 Volkswagen CC insurance, a 20-year-old male will have an average rate of $3,956 per year, while a 20-year-old woman pays around $2,852, a difference of $1,104 per year. The females get the cheaper rate by far. But by age 50, male driver rates are $1,756 and the cost for women is $1,706, a difference of only $50.

- Great credit can mean great car insurance rates. An excellent credit score of 800+ could save $309 per year compared to a lower credit score of 670-739. Conversely, a weaker credit score below 579 could cost around $359 more per year.

- Qualify for policy discounts to lower insurance cost. Discounts may be available if the policyholders insure their home and car with the same company, are accident-free, insure multiple vehicles on the same policy, are loyal customers, or many other policy discounts which could save the average driver as much as $334 per year on their insurance cost.

- The cost to insure teenage drivers is high. Average rates for full coverage CC insurance costs $7,106 per year for a 16-year-old driver, $6,847 per year for a 17-year-old driver, and $6,065 per year for an 18-year-old driver.