- Volkswagen Routan car insurance rates average $1,232 per year (about $103 per month) for full coverage, but can vary based on deductibles and limits.

- The cheapest model of VW Routan to insure is the S 2WD at an estimated $1,140 per year, or about $95 per month.

- Ranked sixth out of seven midsize minivans for the 2014 model year, insurance cost for the Routan costs $28 more per year than the average cost for the segment.

How much does Volkswagen Routan insurance cost?

Volkswagen Routan car insurance averages $1,232 annually for full coverage, or $103 monthly. Drivers can plan on paying around $28 more annually for Volkswagen Routan insurance when compared to the average rate for all midsize minivans, and $651 less per year than the $1,883 national average.

The next chart displays average car insurance rates on a 2014 Volkswagen Routan using variations of risk profiles and driver ages.

The next table shows average insurance policy premiums for a Volkswagen Routan for the 2009 to 2014 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2014 Volkswagen Routan | $1,232 | $103 |

| 2013 Volkswagen Routan | $1,214 | $101 |

| 2012 Volkswagen Routan | $1,190 | $99 |

| 2011 Volkswagen Routan | $1,166 | $97 |

| 2010 Volkswagen Routan | $1,143 | $95 |

| 2009 Volkswagen Routan | $1,120 | $93 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Volkswagen Routan trim levels for each model year. Updated February 23, 2024

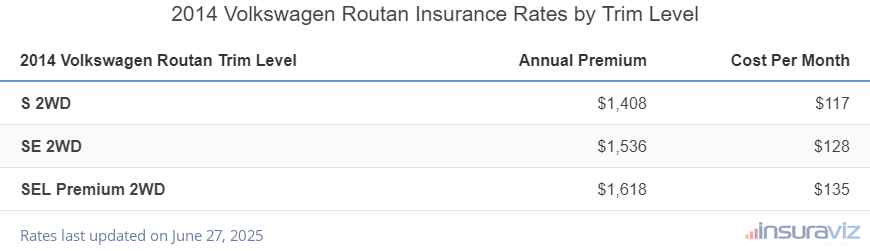

The next table details the average annual and 6-month policy costs, including a monthly budget estimate, for each 2014 VW Routan model and trim level.

| 2014 Volkswagen Routan Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S 2WD | $1,140 | $95 |

| SE 2WD | $1,244 | $104 |

| SEL Premium 2WD | $1,310 | $109 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 22, 2024

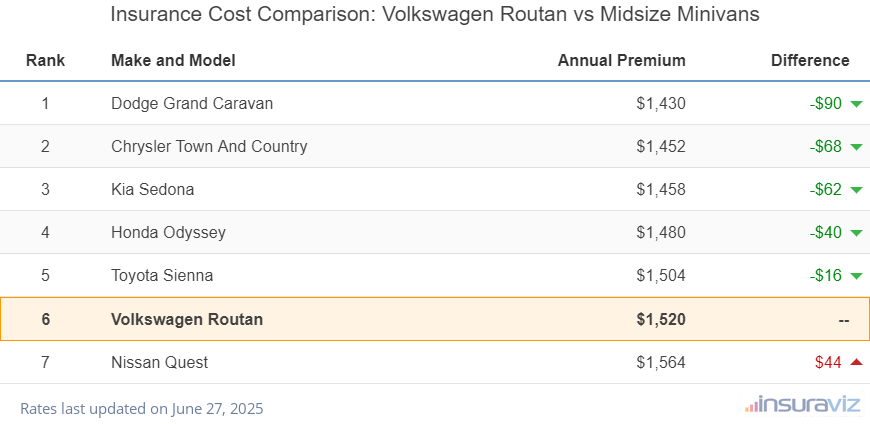

Volkswagen Routan insurance cost vs. other minivans

The Volkswagen Routan ranks sixth out of seven total vehicles in the midsize minivan category for most affordable auto insurance rates. The Routan costs an average of $1,232 per year to insure for full coverage and the category average insurance cost is $1,204 per year, a difference of $28 per year.

When compared side-by-side to other midsize minivans, car insurance prices for a 2014 Volkswagen Routan cost $74 more per year than the Dodge Grand Caravan, $32 more than the Honda Odyssey, and $14 more than the Toyota Sienna.

The table below shows how the average car insurance rate for a Routan compares to the best-selling midsize minivans like the Kia Sedona, Chrysler Town And Country, and the Nissan Quest.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Dodge Grand Caravan | $1,158 | -$74 |

| 2 | Chrysler Town And Country | $1,176 | -$56 |

| 3 | Kia Sedona | $1,180 | -$52 |

| 4 | Honda Odyssey | $1,200 | -$32 |

| 5 | Toyota Sienna | $1,218 | -$14 |

| 6 | Volkswagen Routan | $1,232 | -- |

| 7 | Nissan Quest | $1,266 | $34 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2014 model year. Updated February 23, 2024

Additional rates and insights

Other details regarding the cost to insure a Volkswagen Routan include:

- Plan on paying a lot to insure a teen driver. Average rates for full coverage VW Routan insurance costs $4,545 per year for a 16-year-old driver, $4,347 per year for a 17-year-old driver, $3,784 per year for an 18-year-old driver, and $3,486 per year for a 19-year-old driver.

- It’s expensive to buy high-risk insurance. For a 20-year-old driver, having to buy a high-risk insurance policy could end up with a rate increase of $1,946 or more per year.

- Qualify for policy discounts to save money. Discounts may be available if the policyholders belong to certain professional organizations, insure their home and car with the same company, are loyal customers, are military or federal employees, are senior citizens, or many other policy discounts which could save the average driver as much as $210 per year on Volkswagen Routan insurance.

- Age and gender affect car insurance rates. For a 2014 Volkswagen Routan, a 20-year-old man will have an average rate of $2,476 per year, while a 20-year-old woman pays an average of $1,792, a difference of $684 per year. The females get much better rates. But by age 50, the rate for males is $1,104 and the rate for females is $1,072, a difference of only $32.

- Fewer accidents means cheaper Routan insurance rates. At-fault accidents increase insurance cost, possibly as much as $1,778 per year for a 20-year-old driver and as much as $330 per year for a 60-year-old driver.

- As driver age increases, Routan car insurance rates tend to go down. The difference in Routan insurance rates between a 60-year-old driver ($1,034 per year) and a 20-year-old driver ($2,476 per year) is $1,442, or a savings of 82.2%.