Despite the popularity of small and mid-size SUVs, minivans still fill a demand for larger passenger and cargo space and ease-of-entry. With 14 models like the Dodge Grand Caravan, Nissan Quest, and Chrysler Voyager being discontinued since 2005, that leaves only four minivan models still in production.

We ranked the full 2024 minivan segment for car insurance affordability to find out which model has the cheapest insurance rates. The Kia Carnival was a new model for 2022, having been named the Kia Sedona in prior model years.

In addition, we also ranked average insurance rates for all minivans for the 2015 through 2023 model years, because there are some discontinued models like the Dodge Grand Caravan, Chrysler Town & Country, and Nissan Quest that definitely need to be compared.

So without further ado, the table below shows the 2024 minivan car insurance cost rankings.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Honda Odyssey | $1,734 | $145 |

| 2 | Chrysler Pacifica | $1,876 | $156 |

| 3 | Toyota Sienna | $1,944 | $162 |

| 4 | Kia Carnival | $1,962 | $164 |

Data Methodology: Rates and models are for the 2024 model year. Driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 23, 2024

What is the cheapest minivan to insure?

The cheapest insurance rate for a 2024 minivan goes to the Honda Odyssey, costing an average of $1,734 per year. This is $867 for a 6-month policy or about $145 per month. With the segment average costing $1,879 per year, the Honda Odyssey can potentially save around $145 a year, or about 8%.

Second place goes to the Chrysler Pacifica, costing an average of $1,876 per year. Rounding out the list in third place is the Toyota Sienna at $1,944 per year.

Which minivan is most expensive to insure?

The most expensive minivan to insure for 2024 is the Kia Carnival, costing $1,962 per year. It will cost around $228 more to insure a Kia Carnival each year compared to the cheapest minivan to insure, the Honda Odyssey.

At $1,962 a year, that is a 4.3% premium over the $1,879 average for the minivan segment, but 4.1% less than the national average car insurance rate (all vehicles) of $1,883.

What is the average car insurance cost on a minivan?

The average car insurance cost per year for the 2024 minivan segment is $1,879, ranging from the cheapest rate on the Honda Odyssey at $1,734 per year to the most expensive rate on the Kia Carnival at $1,962. Overall, minivans cost 0.2% more to insure than the national average car insurance rate (all vehicles) of $1,883.

Minivan vs. SUV car insurance rates: Which are cheaper?

In general, minivans will be slightly more expensive to insure than the midsize class, but cheaper to insure than the large SUV class. The average insurance rate for the minivan segment is $1,879 per year. For midsize SUVs like the Toyota Highlander and Honda Pilot, the average rate is $1,874, and for large SUVs like the Chevy Suburban or GMC Yukon, the average cost is $2,096 per year.

See our full minivan vs SUV car insurance rates comparison for more information including in-depth comparisons of minivan insurance rates to compact, midsize, and full-size SUV models.

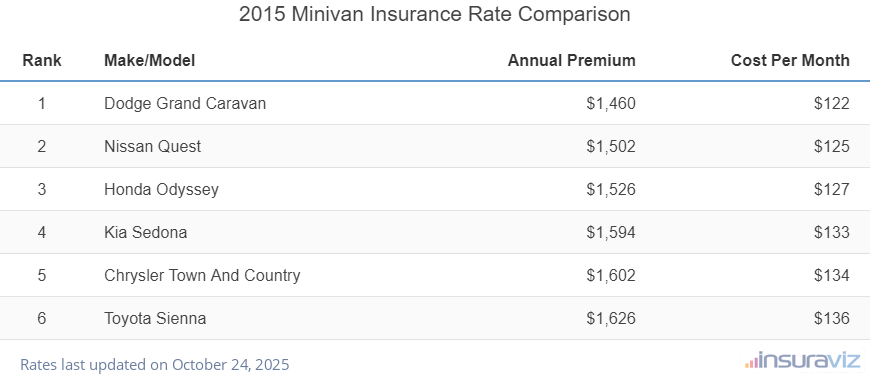

Minivan car insurance rates for 2015 to 2023 models

The tables below compare average full coverage insurance rates for the minivan segment for the 2015 through 2023 model years.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Honda Odyssey | $1,686 | $141 |

| 2 | Chrysler Pacifica | $1,808 | $151 |

| 3 | Kia Carnival | $1,848 | $154 |

| 4 | Toyota Sienna | $1,894 | $158 |

Data Methodology: Rates are based on the 2023 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 23, 2024

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Honda Odyssey | $1,614 | $135 |

| 2 | Chrysler Pacifica | $1,734 | $145 |

| 3 | Kia Carnival | $1,810 | $151 |

| 4 | Toyota Sienna | $1,816 | $151 |

Data Methodology: Rates are based on the 2022 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 22, 2024

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Kia Sedona | $1,422 | $119 |

| 2 | Chrysler Pacifica | $1,596 | $133 |

| 3 | Toyota Sienna | $1,708 | $142 |

| 4 | Honda Odyssey | $1,726 | $144 |

Data Methodology: Rates are based on the 2021 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 23, 2024

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Kia Sedona | $1,378 | $115 |

| 2 | Dodge Grand Caravan | $1,406 | $117 |

| 3 | Chrysler Pacifica | $1,548 | $129 |

| 4 | Toyota Sienna | $1,656 | $138 |

| 5 | Honda Odyssey | $1,676 | $140 |

Data Methodology: Rates are based on the 2020 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 22, 2024

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Dodge Grand Caravan | $1,460 | $122 |

| 2 | Chrysler Pacifica | $1,464 | $122 |

| 3 | Kia Sedona | $1,468 | $122 |

| 4 | Honda Odyssey | $1,488 | $124 |

| 5 | Toyota Sienna | $1,696 | $141 |

Data Methodology: Rates are based on the 2019 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 22, 2024

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Chrysler Pacifica | $1,318 | $110 |

| 2 | Dodge Grand Caravan | $1,392 | $116 |

| 3 | Honda Odyssey | $1,416 | $118 |

| 4 | Kia Sedona | $1,456 | $121 |

| 5 | Toyota Sienna | $1,642 | $137 |

Data Methodology: Rates are based on the 2018 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 23, 2024

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Dodge Grand Caravan | $1,282 | $107 |

| 2 | Chrysler Pacifica | $1,300 | $108 |

| 3 | Honda Odyssey | $1,352 | $113 |

| 4 | Kia Sedona | $1,400 | $117 |

| 5 | Nissan Quest | $1,434 | $120 |

| 6 | Toyota Sienna | $1,562 | $130 |

Data Methodology: Rates are based on the 2017 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 23, 2024

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Honda Odyssey | $1,158 | $97 |

| 2 | Dodge Grand Caravan | $1,210 | $101 |

| 3 | Nissan Quest | $1,304 | $109 |

| 4 | Kia Sedona | $1,332 | $111 |

| 5 | Chrysler Town And Country | $1,350 | $113 |

| 6 | Toyota Sienna | $1,386 | $116 |

Data Methodology: Rates are based on the 2016 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 23, 2024

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Dodge Grand Caravan | $1,158 | $97 |

| 2 | Nissan Quest | $1,190 | $99 |

| 3 | Honda Odyssey | $1,208 | $101 |

| 4 | Kia Sedona | $1,262 | $105 |

| 5 | Chrysler Town And Country | $1,270 | $106 |

| 6 | Toyota Sienna | $1,288 | $107 |

Data Methodology: Rates are based on the 2015 model year and the driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated February 23, 2024