- BMW 320i insurance costs an average of $2,040 per year or around $170 per month, but can vary a lot based on the policy limits.

- When compared to other small luxury cars, the BMW 320i is one of the cheaper small luxury cars to insure, costing $89 less per year on average.

- With the cheapest insurance rates, the base 320i Sedan model costs an average of $2,012 per year to insure, while the xDrive Sedan costs $2,068 per year to insure.

How much does BMW 320i car insurance cost?

BMW 320i car insurance rates average $2,040 a year for full coverage, or $170 a month. Drivers can expect to pay around $89 less per year to insure a BMW 320i compared to the average rate for small luxury cars, and $236 less per year than the overall national average of $2,276.

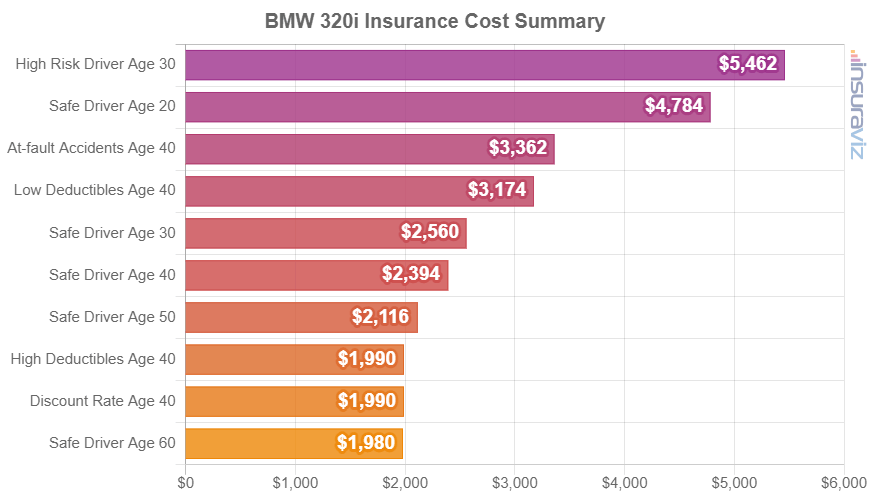

The chart below illustrates average insurance rates on a 2018 BMW 320i using a range of driver ages, deductible levels, and risk profiles.

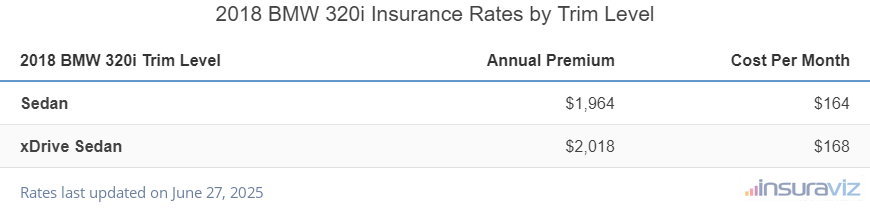

The table below displays the average yearly and semi-annual car insurance rates, in addition to a monthly budget estimate, for each BMW 320i model package and trim level.

| 2018 BMW 320i Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sedan | $2,012 | $168 |

| xDrive Sedan | $2,068 | $172 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

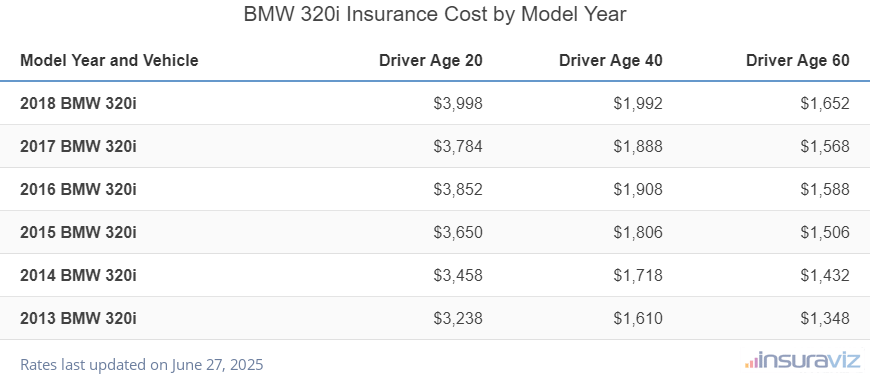

The following table illustrates average insurance rates for a BMW 320i from the 2013 to the 2018 model years and for various driver ages.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2018 BMW 320i | $4,096 | $2,040 | $1,694 |

| 2017 BMW 320i | $3,878 | $1,932 | $1,606 |

| 2016 BMW 320i | $3,946 | $1,952 | $1,626 |

| 2015 BMW 320i | $3,740 | $1,848 | $1,542 |

| 2014 BMW 320i | $3,544 | $1,758 | $1,468 |

| 2013 BMW 320i | $3,316 | $1,650 | $1,380 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all BMW 320i trim levels for each model year. Updated October 24, 2025

Other rates and insights

A few additional observations as they relate to BMW 320i insurance cost include:

- Avoiding accidents keeps insurance rates low. Having a few at-fault accidents can really raise rates, potentially up to $2,898 per year for a 20-year-old driver and even $604 per year for a 50-year-old driver.

- High-risk BMW 320i insurance is expensive. For a 30-year-old driver, the need to buy a high-risk policy could trigger a rate increase of $2,500 or more per year.

- Cheaper rates come with better credit scores. Having a credit score above 800 could save $320 per year when compared to a rating of 670-739. Conversely, a mediocre credit score could cost as much as $371 more per year.

- The higher deductible you choose, the lower the policy cost. Increasing your policy deductibles from $500 to $1,000 could save around $326 per year for a 40-year-old driver and $636 per year for a 20-year-old driver.

- Lowering deductibles results in a more expensive policy. Decreasing deductibles from $500 to $250 could cost an additional $338 per year for a 40-year-old driver and $672 per year for a 20-year-old driver.

- Driving violations increase insurance rates. In order to have the best 320i insurance rates, it’s necessary to follow the law. A few minor traffic violations have the ramification of raising rates by as much as $536 per year. Major misdemeanors such as DUI or reckless driving could raise rates by an additional $1,882 or more.

- As you get older, car insurance rates go down. The difference in insurance rates for a 2018 320i between a 50-year-old driver ($1,806 per year) and a 30-year-old driver ($2,174 per year) is $368, or a savings of 18.5%.

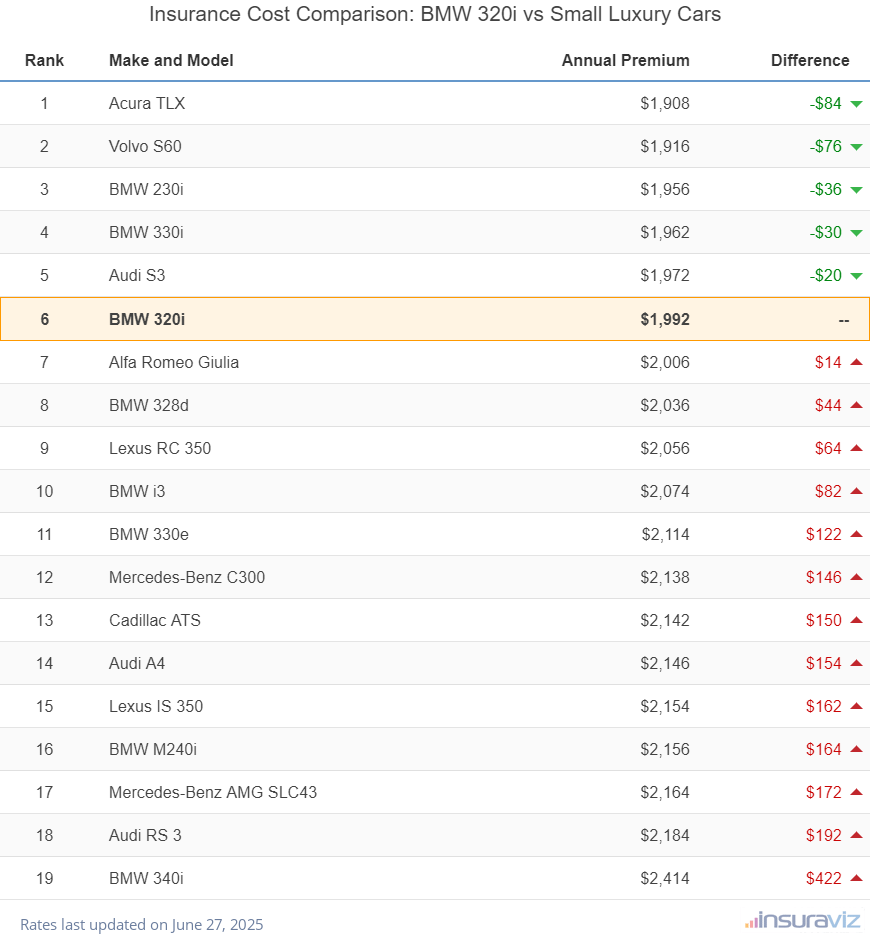

How does 320i insurance compare to similar vehicles?

When average rates are compared to other popular small luxury cars, insurance on a BMW 320i costs $28 more per year than the BMW 330i, $150 less than the Mercedes-Benz C300, and $80 more than the Volvo S60.

The BMW 320i ranks sixth out of 19 comparison vehicles in the small luxury car class for most affordable insurance cost. The 320i costs an average of $2,040 per year to insure for full coverage and the class average auto insurance cost is $2,129 annually, a difference of $89 per year.

The table displayed below shows how BMW 320i car insurance rates rank against the rest of the compact luxury car market like the Acura TLX, Audi A4, and the Lexus IS 350.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura TLX | $1,954 | -$86 |

| 2 | Volvo S60 | $1,960 | -$80 |

| 3 | BMW 230i | $2,006 | -$34 |

| 4 | BMW 330i | $2,012 | -$28 |

| 5 | Audi S3 | $2,022 | -$18 |

| 6 | BMW 320i | $2,040 | -- |

| 7 | Alfa Romeo Giulia | $2,058 | $18 |

| 8 | BMW 328d | $2,084 | $44 |

| 9 | Lexus RC 350 | $2,108 | $68 |

| 10 | BMW i3 | $2,124 | $84 |

| 11 | BMW 330e | $2,166 | $126 |

| 12 | Mercedes-Benz C300 | $2,190 | $150 |

| 13 | Cadillac ATS | $2,194 | $154 |

| 14 | Audi A4 | $2,198 | $158 |

| 15 | Lexus IS 350 | $2,206 | $166 |

| 16 | BMW M240i | $2,210 | $170 |

| 17 | Mercedes-Benz AMG SLC43 | $2,218 | $178 |

| 18 | Audi RS 3 | $2,236 | $196 |

| 19 | BMW 340i | $2,470 | $430 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2018 model year. Updated October 24, 2025