- Alfa Romeo Guilia car insurance costs an average of $2,138 per year, $1,069 for a 6-month policy, or $178 per month.

- With an insurance cost range of $432, the cheapest Giulia model to insure is the base Sprint 2WD at around $1,998 per year, and the most expensive trim being the Quadrifoglio at $2,430 annually.

- The Alfa Romeo Giulia is one of the more expensive small luxury cars to insure for the 2024 model year, costing $50 more per year on average as compared to the rest of the vehicles in the segment.

How much does Alfa Romeo Giulia insurance cost?

Ranked 12th out of 18 vehicles in the compact luxury sedan class, Alfa Romeo Giulia insurance averages $2,138 per year, or about $178 each month.

Average monthly car insurance cost for a 2024 Alfa Romeo Giulia ranges from $167 to $203, with the base Sprint 2WD being cheapest and the Quadrifoglio costing the most to insure.

With the average small luxury car costing $2,088 a year to insure, the Alfa Romeo Giulia costs $50 more to insure on average every 12 months.

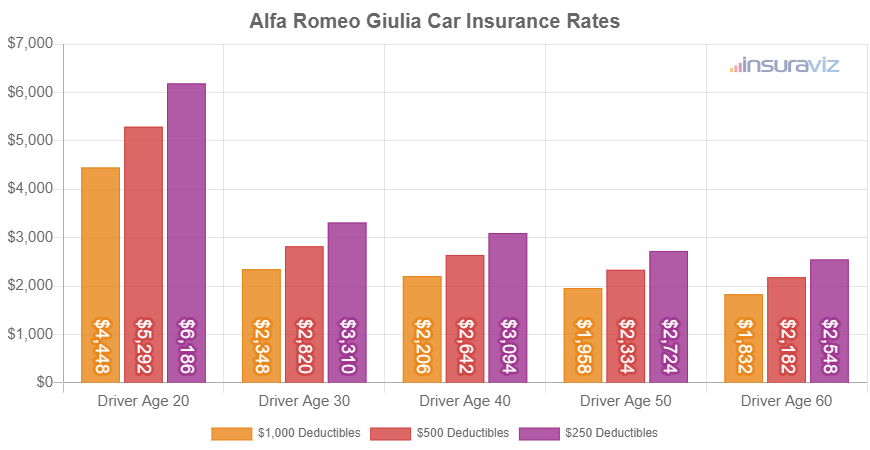

The chart below illustrates how average Alfa Romeo Giulia car insurance cost varies depending on the age of the driver and coverage deductibles.

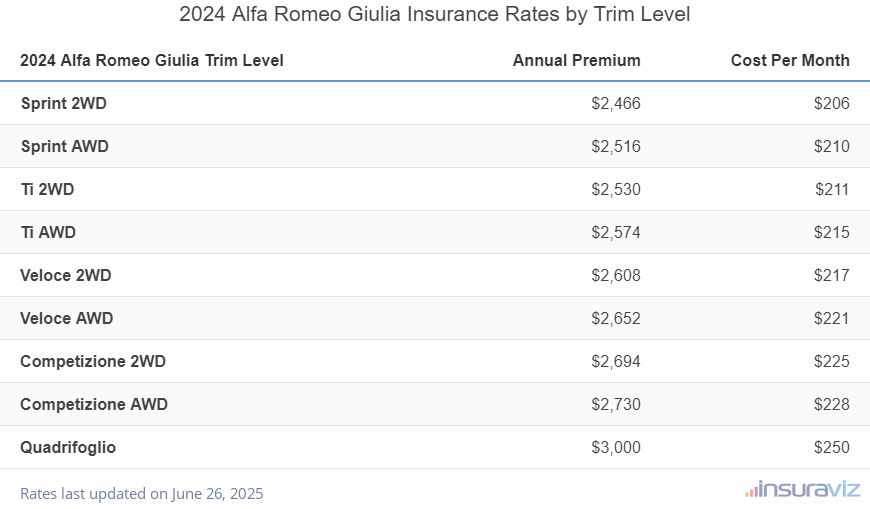

Which Giulia trim level has the cheapest insurance?

With Alfa Romeo Giulia insurance cost ranging from $1,998 to $2,430 annually, the cheapest trim level to insure is the base Sprint 2WD model. The next cheapest model to insure is the Giulia Sprint AWD at $2,036 per year. On average, expect to pay an average of $167 per month to insure a Giulia for full coverage.

The most expensive models of Giulia to insure are the Quadrifoglio at $2,430 and the Competizione AWD at $2,210 per year. Those two trim levels will cost an extra $432 and $212 per year, respectively, over the least expensive Sprint 2WD model.

Average annual and 6-month car insurance policy rates are shown in the table below, including a monthly budget figure, for each Alfa Romeo Giulia trim level.

| 2024 Alfa Romeo Giulia Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sprint 2WD | $1,998 | $167 |

| Sprint AWD | $2,036 | $170 |

| Ti 2WD | $2,048 | $171 |

| Ti AWD | $2,084 | $174 |

| Veloce 2WD | $2,112 | $176 |

| Veloce AWD | $2,148 | $179 |

| Competizione 2WD | $2,182 | $182 |

| Competizione AWD | $2,210 | $184 |

| Quadrifoglio | $2,430 | $203 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

How does Giulia insurance cost rank vs other luxury cars?

The Alfa Romeo Giulia ranks 12th out of 18 total vehicles in the 2024 compact luxury car segment. The Giulia costs an average of $2,138 per year for full coverage insurance, while the segment median rate is $2,088 annually, a difference of $50 per year.

When compared to other luxury models, car insurance for an Alfa Romeo Giulia costs:

- $10 more per year than the Audi S3

- $156 more per year than the Cadillac CT4

- $450 more per year than the Acura Integra

- $46 less per year than the Audi A4

- $176 more per year than the Acura TLX

The chart below shows how well 2024 Giulia car insurance rates compare to the rest of the top 10 most popular small luxury cars in America. Additionally, a larger table is included after the chart that ranks insurance affordability for the entire compact luxury car class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Acura Integra | $1,688 | -$450 |

| 2 | BMW 330i | $1,932 | -$206 |

| 3 | Acura TLX | $1,962 | -$176 |

| 4 | Cadillac CT4 | $1,982 | -$156 |

| 5 | Genesis G70 | $1,986 | -$152 |

| 6 | Lexus IS 350 | $1,996 | -$142 |

| 7 | Lexus RC 350 | $2,058 | -$80 |

| 8 | BMW 330e | $2,060 | -$78 |

| 9 | BMW 228i | $2,064 | -$74 |

| 10 | BMW 230i | $2,080 | -$58 |

| 11 | Audi S3 | $2,128 | -$10 |

| 12 | Alfa Romeo Giulia | $2,138 | -- |

| 13 | Audi A4 | $2,184 | $46 |

| 14 | BMW M235i | $2,196 | $58 |

| 15 | Volvo S60 | $2,226 | $88 |

| 16 | Audi RS 3 | $2,268 | $130 |

| 17 | BMW M240i | $2,312 | $174 |

| 18 | BMW M340i | $2,318 | $180 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated February 23, 2024

When insuring a luxury vehicle like the Giulia, it’s important to understand that rates can vary considerably based on a lot of factors. The bullet points below detail some additional rates and possible discounts that may be available when shopping around for car insurance.

- Policy discounts equal cheaper Giulia insurance rates. Discounts may be available if the insureds are accident-free, work in certain occupations, are loyal customers, are senior citizens, or many other policy discounts which could save the average driver as much as $360 per year.

- Good credit scores mean better rates. Drivers who have credit scores over 800 could save as much as $336 per year over a decent credit rating of 670-739. Conversely, a subpar credit score could cost up to $389 more per year. Not every state allows credit scores to be used when calculating rates, so your mileage may vary on this discount.

- Driver gender influences rates. For a 2024 Alfa Romeo Giulia, a 20-year-old man pays an estimated $4,292 per year, while a 20-year-old woman will pay an average of $3,082, a difference of $1,210 per year. Women get significantly cheaper rates. But by age 50, male driver rates are $1,892 and the rate for women is $1,846, a difference of only $46.

- Giulia insurance rates for teenagers are high. Average rates for full coverage Giulia insurance costs $7,537 per year for a 16-year-old driver, $7,317 per year for a 17-year-old driver, and $6,590 per year for an 18-year-old driver.

- Getting older means cheaper auto insurance rates. The difference in insurance cost on a 2024 Giulia between a 50-year-old driver ($1,892 per year) and a 20-year-old driver ($4,292 per year) is $2,400, or a savings of 77.6%.

- Increase physical damage deductibles to save money. Raising your policy deductibles from $500 to $1,000 could save around $350 per year for a 40-year-old driver and $686 per year for a 20-year-old driver.

- Low deductibles makes insurance more expensive. Dropping your physical damage deductibles from $500 to $250 could cost an additional $368 per year for a 40-year-old driver and $724 per year for a 20-year-old driver.

- Prepare for sticker shock for high-risk insurance. For a 50-year-old driver, being required to buy a high-risk insurance policy can increase the cost by $2,492 or more per year.