- Buick Cascada insurance costs an average of $1,406 per year or around $117 per month, depending on the trim level.

- The 2019 Buick Cascada ranks second out of 16 vehicles in the midsize car class for insurance affordability.

- The cheapest Cascada to insure is the base convertible at an average cost of $1,278 per year. The most expensive is the Sport Touring Convertible at $1,618 annually.

How much does Buick Cascada car insurance cost?

Buick Cascada insurance costs on average $1,406 a year for full coverage, or $117 on a monthly basis. Expect to pay about $192 less per year to insure a Buick Cascada compared to the average rate for other midsize cars, and $477 less per year than the overall national average of $1,883.

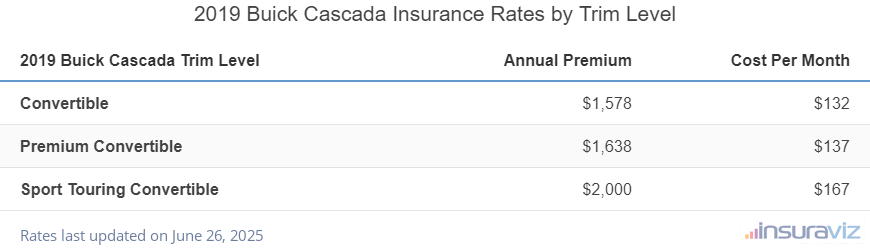

Depending on the trim level being insured, average monthly car insurance cost for a 2019 Buick Cascada ranges from $107 to $135, with the Convertible being cheapest and the Sport Touring Convertible costing the most to insure.

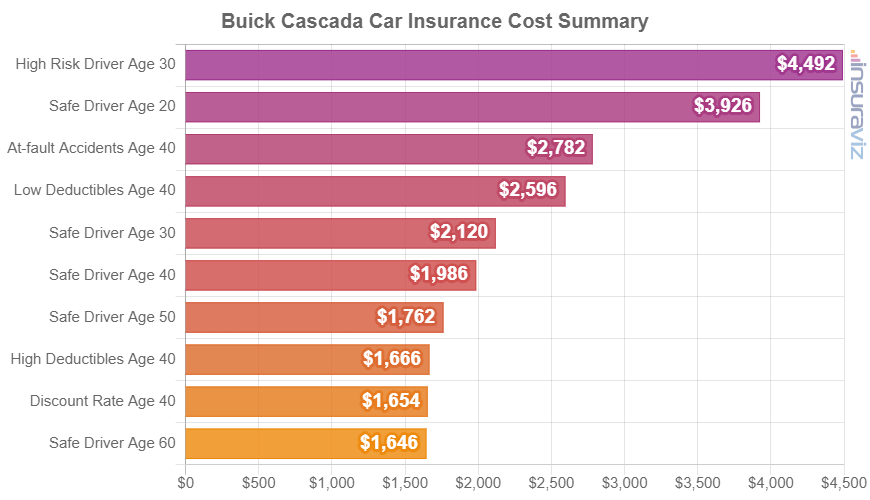

The chart below demonstrates average car insurance rates for a 2019 Buick Cascada with a variety of policy scenarios.

How do Cascada insurance rates rank?

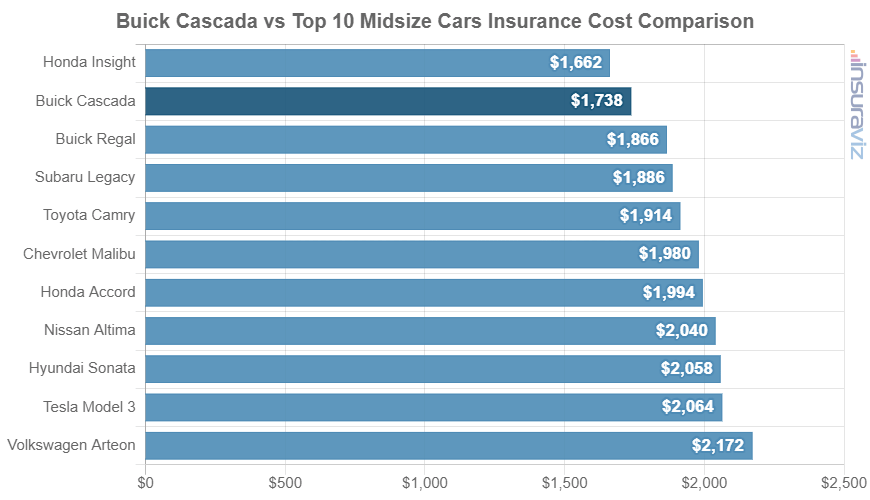

The Buick Cascada ranks second out of 16 total vehicles in the 2019 midsize car category. The Cascada costs an average of $1,406 per year to insure for full coverage, while the class median rate is $1,598 annually, a difference of $192 per year.

When compared to other midsize cars, Buick Cascada insurance costs $148 less per year than the Toyota Camry, $208 less than the Honda Accord, $248 less than the Nissan Altima, and $268 less than the Tesla Model 3.

The chart below shows how average Buick Cascada car insurance rates compare to the best-selling midsize cars in the U.S. Below the chart, an expanded table is included that ranks insurance affordability for the entire 2019 midsize car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Insight | $1,346 | -$60 |

| 2 | Buick Cascada | $1,406 | -- |

| 3 | Buick Regal | $1,510 | $104 |

| 4 | Subaru Legacy | $1,528 | $122 |

| 5 | Kia Optima | $1,546 | $140 |

| 6 | Toyota Camry | $1,554 | $148 |

| 7 | Volkswagen Passat | $1,558 | $152 |

| 8 | Buick LaCrosse | $1,602 | $196 |

| 9 | Chevrolet Malibu | $1,604 | $198 |

| 10 | Honda Accord | $1,614 | $208 |

| 11 | Nissan Altima | $1,654 | $248 |

| 12 | Hyundai Sonata | $1,666 | $260 |

| 13 | Tesla Model 3 | $1,674 | $268 |

| 14 | Ford Fusion | $1,702 | $296 |

| 15 | Volkswagen Arteon | $1,758 | $352 |

| 16 | Kia Stinger | $1,846 | $440 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2019 model year. Updated February 23, 2024

What is the cheapest Buick Cascada insurance?

With Buick Cascada car insurance cost ranging from $1,278 to $1,618 annually for an average driver, the cheapest model to insure is the base level convertible. The next cheapest model to insure is the Premium Convertible at $1,326 per year. The most expensive Cascada model to insure is the Sport Touring Convertible at around $1,618 per year.

The rate table below shows average annual, 6-month, and monthly car insurance costs for each Buick Cascada trim level.

| 2019 Buick Cascada Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Convertible | $1,278 | $107 |

| Premium Convertible | $1,326 | $111 |

| Sport Touring Convertible | $1,618 | $135 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

Below are some additional insights and possible discounts to watch for when shopping for Buick Cascada insurance.

- Get cheaper rates because of your employment. Just about all auto insurance companies offer discounts for having a job in professions like the military, police officers and law enforcement, nurses, high school and elementary teachers, architects, and other occupations. If your job can earn you this discount, you could potentially save between $42 and $164 on your car insurance bill, depending on the policy coverages.

- Younger drivers pay higher rates. The difference in insurance rates for a Cascada between a 40-year-old driver ($1,406 per year) and a 20-year-old driver ($2,804 per year) is $1,398, or a savings of 66.4%.

- High-risk Cascada insurance is expensive. For a 30-year-old driver, having a high frequency of accidents or violations increases the cost by $1,710 or more per year.

- Citations and violations increase rates. If you want the most budget-friendly Cascada insurance rates, it’s necessary to obey traffic laws. As a matter of fact, just one or two minor lapses of judgement on your driving record have the ramification of increasing policy rates as much as $368 per year. Major violations like hit-and-run could raise rates by an additional $1,284 or more.

- Careless drivers pay higher rates. Multiple at-fault accidents raise rates, possibly up to $1,974 per year for a 20-year-old driver and as much as $338 per year for a 60-year-old driver.

- Polish up your credit rating for lower rates. Having excellent credit of 800+ may save $221 per year when compared to a lower credit score of 670-739. Conversely, a subpar credit rating could cost up to $256 more per year.

- Find cheaper rates by qualifying for discounts. Discounts may be available if the insureds are good students, are claim-free, are accident-free, belong to certain professional organizations, or many other discounts which could save the average driver as much as $234 per year on Buick Cascada insurance.