- Volkswagen Passat insurance rates cost an average of $1,712 per year, $856 for a 6-month policy, or $143 per month.

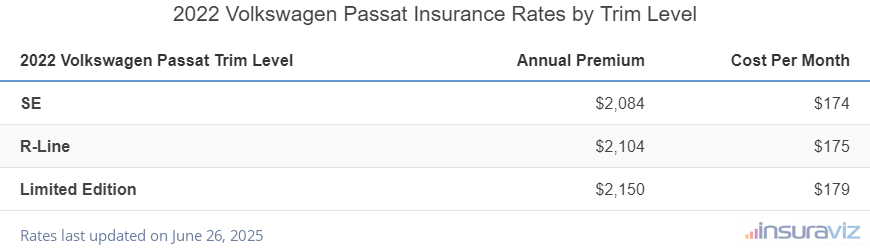

- The cheapest Passat insurance is on the SE trim level costing an average of $1,688 per year, or $141 per month. The model with the most expensive insurance is the Limited Edition at $1,742 per year, or around $145 per month.

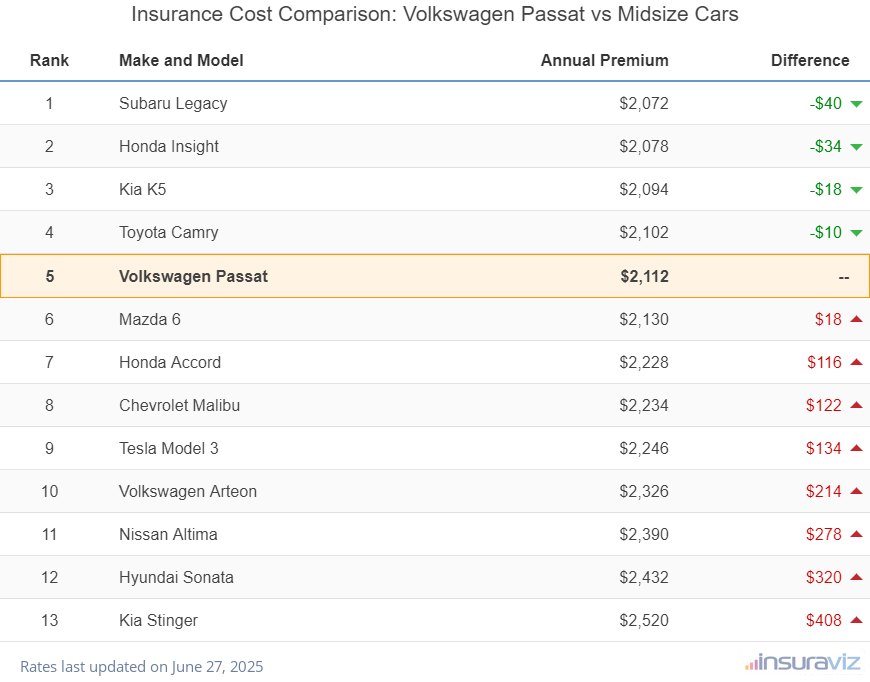

- When compared to the entire 2022 midsize car segment, the VW Passat ranks in the top half at fifth out of 13 total comparison vehicles.

- On a state level, car insurance rates range from a low of $1,094 per year in Maine to $2,246 in Michigan. Rates in a few larger cities include $2,918 in New York City, $1,762 in Dallas, TX, and $2,252 in Oakland, CA.

How much does VW Passat insurance cost?

Volkswagen Passat insurance rates average $1,712 a year, or $143 monthly, for a full coverage policy. Overall, expect to pay around $94 less per year for Volkswagen Passat insurance compared to similar vehicles, and $171 less per year than the all-vehicle national average of $1,883.

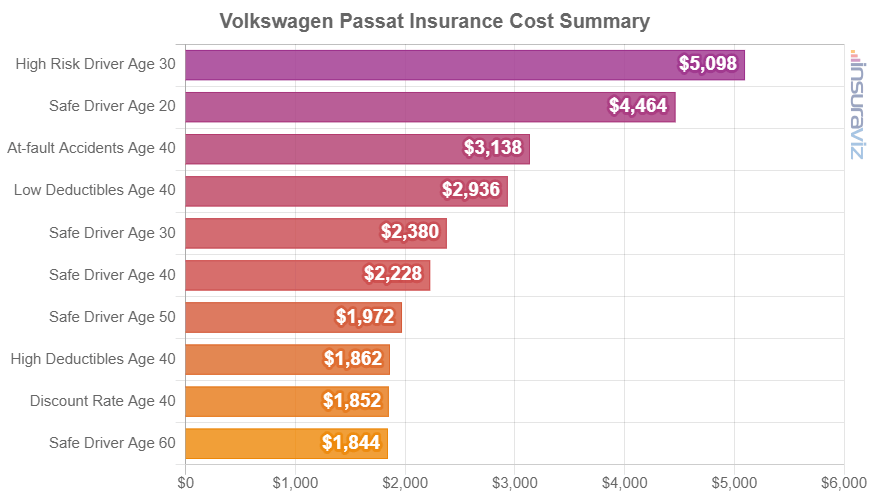

The following chart illustrates average car insurance cost for a 2022 Volkswagen Passat rated for different driver ages and risk profiles.

The insurance cost estimate chart above illustrates an intentionally limited set of data points from a very large data set. If we showed every rate for every risk scenario, including all three different trim levels of Passat and all 40,000+ zip codes in the U.S., the chart would contain 290,304,000,000 different rates.

Not shown in the chart are rates for teenage drivers, which are the highest-cost age group to insure. A 16-year-old male driver with a clean driving record would pay around $6,073 per year for full coverage on a new Passat, while a 16-year-old female would pay about $5,670. At age 17, males would pay around $5,891 and females $5,637.

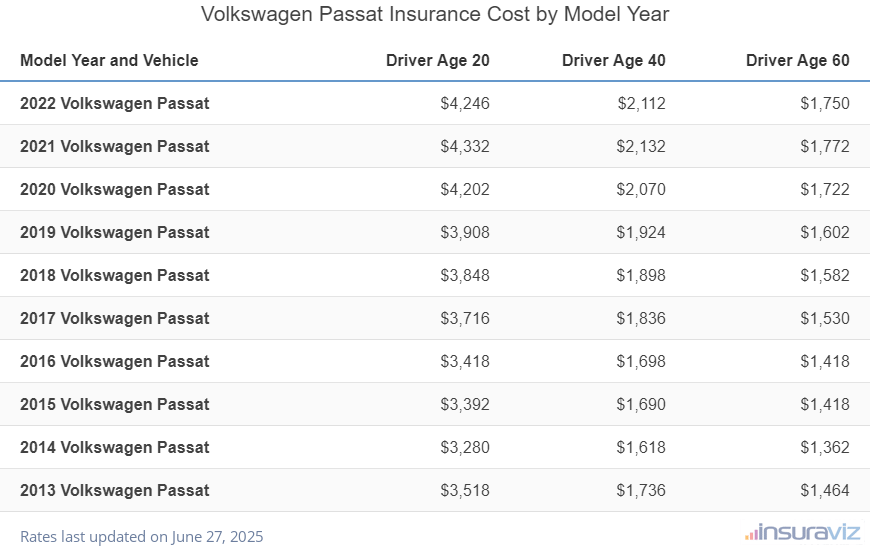

The following table shows average VW Passat car insurance premiums for the 2013-2022 model years and rates for drivers age 20 through 60.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2022 Volkswagen Passat | $3,442 | $1,712 | $1,420 |

| 2021 Volkswagen Passat | $3,508 | $1,726 | $1,438 |

| 2020 Volkswagen Passat | $3,408 | $1,676 | $1,396 |

| 2019 Volkswagen Passat | $3,168 | $1,558 | $1,298 |

| 2018 Volkswagen Passat | $3,118 | $1,538 | $1,282 |

| 2017 Volkswagen Passat | $3,014 | $1,486 | $1,240 |

| 2016 Volkswagen Passat | $2,770 | $1,374 | $1,150 |

| 2015 Volkswagen Passat | $2,748 | $1,368 | $1,148 |

| 2014 Volkswagen Passat | $2,658 | $1,314 | $1,102 |

| 2013 Volkswagen Passat | $2,848 | $1,410 | $1,186 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Volkswagen Passat trim levels for each model year. Updated February 22, 2024

What is the cheapest VW Passat insurance?

The cheapest Volkswagen Passat insurance rates are on the SE at around $1,688 per year, or about $141 per month. The second cheapest model is the R-Line at $1,702 per year.

The $30,295 Limited Edition trim is the most expensive to insure, costing an average of $54 more per year than the cheapest SE model.

The next table shows average VW Passat car insurance cost for each 2022 model year package and trim level.

| 2022 Volkswagen Passat Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE | $1,688 | $141 |

| R-Line | $1,702 | $142 |

| Limited Edition | $1,742 | $145 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

How does VW Passat insurance cost compare?

When compared to other midsize cars, car insurance for a Volkswagen Passat costs $8 more per year than the Toyota Camry, $94 less than the Honda Accord, $224 less than the Nissan Altima, and $110 less than the Tesla Model 3.

The Volkswagen Passat ranks fifth out of 13 total comparison vehicles in the midsize car class. The Passat costs an estimated $1,712 per year for full coverage insurance, while the segment median rate is $1,806 annually, a difference of $94 per year.

The table below shows how well average auto insurance cost for a Passat compares to all other midsize cars (excluding luxury midsize models).

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Legacy | $1,678 | -$34 |

| 2 | Honda Insight | $1,684 | -$28 |

| 3 | Toyota Camry | $1,704 | -$8 |

| 4 | Kia K5 | $1,704 | -$8 |

| 5 | Volkswagen Passat | $1,712 | -- |

| 6 | Mazda 6 | $1,726 | $14 |

| 7 | Honda Accord | $1,806 | $94 |

| 8 | Chevrolet Malibu | $1,812 | $100 |

| 9 | Tesla Model 3 | $1,822 | $110 |

| 10 | Volkswagen Arteon | $1,886 | $174 |

| 11 | Nissan Altima | $1,936 | $224 |

| 12 | Hyundai Sonata | $1,972 | $260 |

| 13 | Kia Stinger | $2,042 | $330 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2022 model year. Updated February 23, 2024

Cost of full coverage vs. liability only

At some point, drivers may have to make the decision to drop full coverage and just insure their Passat for liability only. The table below compares full coverage and liability-only insurance rates for the 2000 to 2012 Passat model years.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Volkswagen Passat | $1,352 | $692 |

| 2011 Volkswagen Passat | $1,300 | $684 |

| 2010 Volkswagen Passat | $1,246 | $678 |

| 2009 Volkswagen Passat | $1,196 | $672 |

| 2008 Volkswagen Passat | $1,150 | $666 |

| 2007 Volkswagen Passat | $1,136 | $660 |

| 2006 Volkswagen Passat | $1,114 | $654 |

| 2005 Volkswagen Passat | $1,076 | $646 |

| 2004 Volkswagen Passat | $1,050 | $640 |

| 2003 Volkswagen Passat | $1,029 | $627 |

| 2002 Volkswagen Passat | $1,008 | $615 |

| 2001 Volkswagen Passat | $988 | $602 |

| 2000 Volkswagen Passat | $968 | $590 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated February 23, 2024

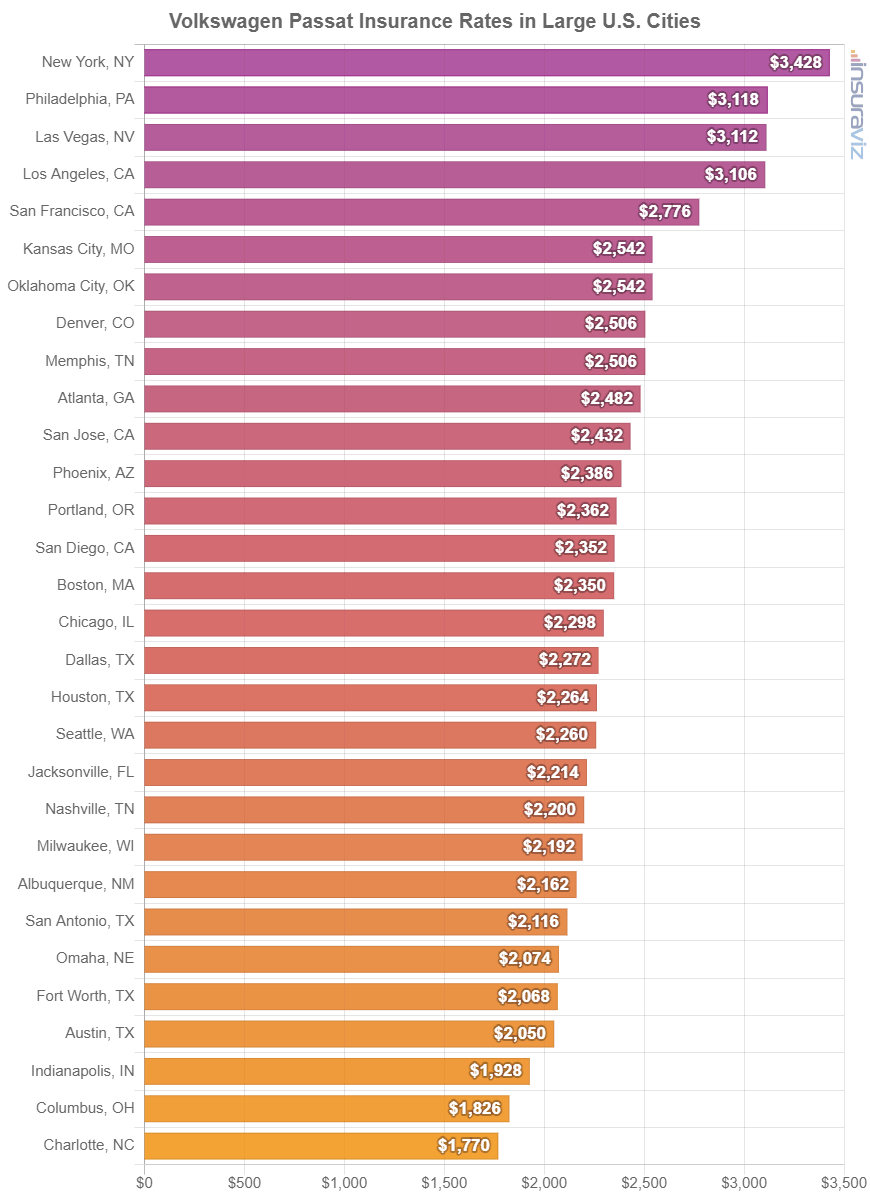

Rates in large U.S. cities

Insurance cost for a Volkswagen Passat varies significantly, from cheaper premiums like $1,200 a year in Virginia Beach, VA, or $1,314 in Columbus, OH, to more expensive rates like $2,848 a year in New Orleans, LA, and $2,918 in New York City, NY.

Volkswagen Passat insurance cost in some additional cities include Nashville, TN, costing $1,688 per year, Seattle, WA, at $1,748, San Francisco, CA, averaging $2,266, and Minneapolis, MN, at $1,738.

The following chart visualizes typical insurance cost data for a Volkswagen Passat for the 15 most populated cities in America. Following the chart, we also added a more comprehensive rate table that ranks Passat insurance rates in the top 50 largest cities in the U.S.

| Location | Annual Premium | Cost Per Month |

|---|---|---|

| New York, NY | $2,918 | $243 |

| Philadelphia, PA | $2,608 | $217 |

| Las Vegas, NV | $2,602 | $217 |

| Los Angeles, CA | $2,594 | $216 |

| San Francisco, CA | $2,266 | $189 |

| Kansas City, MO | $2,030 | $169 |

| Oklahoma City, OK | $2,030 | $169 |

| Denver, CO | $1,998 | $167 |

| Memphis, TN | $1,998 | $167 |

| Atlanta, GA | $1,972 | $164 |

| San Jose, CA | $1,922 | $160 |

| Phoenix, AZ | $1,876 | $156 |

| Portland, OR | $1,852 | $154 |

| San Diego, CA | $1,842 | $154 |

| Boston, MA | $1,838 | $153 |

| Jacksonville, FL | $1,802 | $150 |

| Chicago, IL | $1,790 | $149 |

| Dallas, TX | $1,762 | $147 |

| Houston, TX | $1,754 | $146 |

| Seattle, WA | $1,748 | $146 |

| Nashville, TN | $1,688 | $141 |

| Milwaukee, WI | $1,682 | $140 |

| Albuquerque, NM | $1,652 | $138 |

| San Antonio, TX | $1,604 | $134 |

| Omaha, NE | $1,564 | $130 |

| Fort Worth, TX | $1,556 | $130 |

| Austin, TX | $1,540 | $128 |

| Indianapolis, IN | $1,416 | $118 |

| Columbus, OH | $1,314 | $110 |

| Charlotte, NC | $1,264 | $105 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for a 2022 Volkswagen Passat and all Zip Codes in each city. Updated February 23, 2024

Additional Rates and Policy Information

It’s difficult to present the full range of insurance rates in a single article, since there are so many variables that affect the rate you ultimately pay. Below are a few more situations and things to watch out for when shopping around for insurance on your Passat.

- Get cheaper rates because of your profession. Some car insurance providers offer discounts for being employed in occupations like engineers, doctors, accountants, police officers and law enforcement, high school and elementary teachers, and others. Being employed in a qualifying profession could save between $51 and $184 on your annual auto insurance bill, depending on the coverage levels.

- Driver age and gender matter. For a 2022 Volkswagen Passat, a 20-year-old man will pay an estimated rate of $3,442 per year, while a 20-year-old female driver will get a rate of $2,466, a difference of $976 per year definitely in the women’s favor. But by age 50, male driver rates are $1,516 and the rate for females is $1,478, a difference of only $38.

- Volkswagen Passat insurance for teen drivers is expensive. Average rates for full coverage Passat insurance costs $6,073 per year for a 16-year-old driver, $5,891 per year for a 17-year-old driver, and $5,294 per year for an 18-year-old driver.

- As age goes up, auto insurance cost goes down. The difference in insurance rates for a Volkswagen Passat between a 60-year-old driver ($1,420 per year) and a 20-year-old driver ($3,442 per year) is $2,022, or a savings of 83.2%.

- High-risk drivers pay a lot more for insurance. For a 40-year-old driver, the requirement to buy a high-risk policy increases the cost by $2,068 or more per year.

- Avoid accidents to save on insurance. Having at-fault accidents will cost you more, potentially by an additional $2,436 per year for a 20-year-old driver and even as much as $412 per year for a 60-year-old driver.

- Get cheaper rates by researching discounts. Discounts may be available if the insured drivers are claim-free, drive low annual mileage, insure multiple vehicles on the same policy, are good students, or many other discounts which could save the average driver as much as $290 per year.