- Cadillac SRX car insurance costs $1,456 per year (about $121 per month) for a full coverage policy.

- The Cadillac SRX is one of the cheaper 2016 model year midsize luxury SUVs to insure, costing $169 less per year on average when compared to the rest of the vehicles in the segment.

- The SRX 2WD model is the cheapest to insure at around $1,388 per year. The most expensive trim is the Premium AWD at $1,506 per year.

How much does Cadillac SRX insurance cost?

The average policyholder can plan on paying approximately $1,456 annually to insure a Cadillac SRX. For individual policy coverages, collision coverage is about $546 a year, comprehensive coverage will cost approximately $360, and the remaining liability and medical coverage is an estimated $550.

The cost summary chart below breaks down average insurance cost on a 2016 Cadillac SRX using a variety of different risk scenarios.

The next table details the estimated annual and semi-annual policy costs, plus a monthly insurance rate, for each Cadillac SRX trim level.

| 2016 Cadillac SRX Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 2WD | $1,388 | $116 |

| Luxury 2WD | $1,428 | $119 |

| Luxury AWD | $1,468 | $122 |

| Performance 2WD | $1,468 | $122 |

| Performance AWD | $1,468 | $122 |

| Premium 2WD | $1,468 | $122 |

| Premium AWD | $1,506 | $126 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 22, 2024

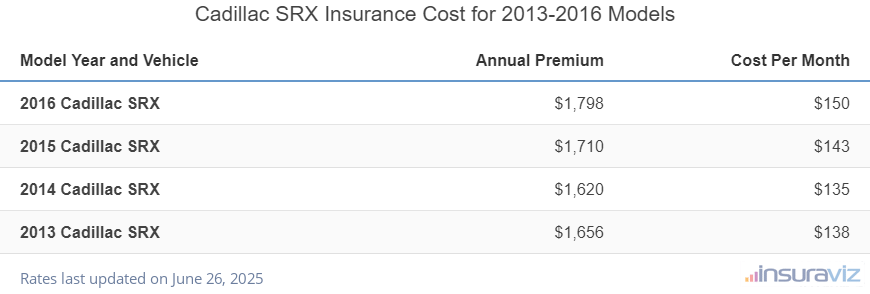

The table below shows average insurance policy premiums for a Cadillac SRX for the 2013-2016 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2016 Cadillac SRX | $1,456 | $121 |

| 2015 Cadillac SRX | $1,384 | $115 |

| 2014 Cadillac SRX | $1,312 | $109 |

| 2013 Cadillac SRX | $1,342 | $112 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Cadillac SRX trim levels for each model year. Updated February 23, 2024

More rates and insights

Some additional noteworthy data insights as they relate to Cadillac SRX insurance cost include:

- The higher deductible you choose, the lower the policy cost. Boosting your physical damage deductibles from $500 to $1,000 could save around $206 per year for a 40-year-old driver and $392 per year for a 20-year-old driver.

- Decreasing deductibles costs more money. Dropping your physical damage deductibles from $500 to $250 could cost an additional $212 per year for a 40-year-old driver and $412 per year for a 20-year-old driver.

- Raise your credit score for cheaper insurance rates. Having excellent credit of 800+ could save as much as $229 per year versus a lower credit rating of 670-739. Conversely, a credit score below 579 could cost up to $265 more per year.

- Rated driver gender affects the rate you pay. For a 2016 Cadillac SRX, a 20-year-old male will have an average rate of $2,904 per year, while a 20-year-old female driver will pay an average of $2,102, a difference of $802 per year in favor of the women by a long shot. But by age 50, the rate for males is $1,300 and the cost for female drivers is $1,262, a difference of only $38.

- Insuring teen drivers is expensive. Average rates for full coverage SRX insurance costs $5,228 per year for a 16-year-old driver, $5,025 per year for a 17-year-old driver, $4,428 per year for an 18-year-old driver, and $4,067 per year for a 19-year-old driver.

- Your employment could reduce your rates. Just about all car insurance companies offer policy discounts for specific professions like firefighters, dentists, lawyers, doctors, college professors, architects, and others. Getting this discount applied to your policy may save between $44 and $142 on your annual car insurance bill, depending on your age.

- SRX insurance is expensive for high-risk drivers. For a 30-year-old driver, the requirement to buy a high-risk policy could end up with a rate increase of $1,770 or more per year.

Is insurance on a Cadillac SRX affordable?

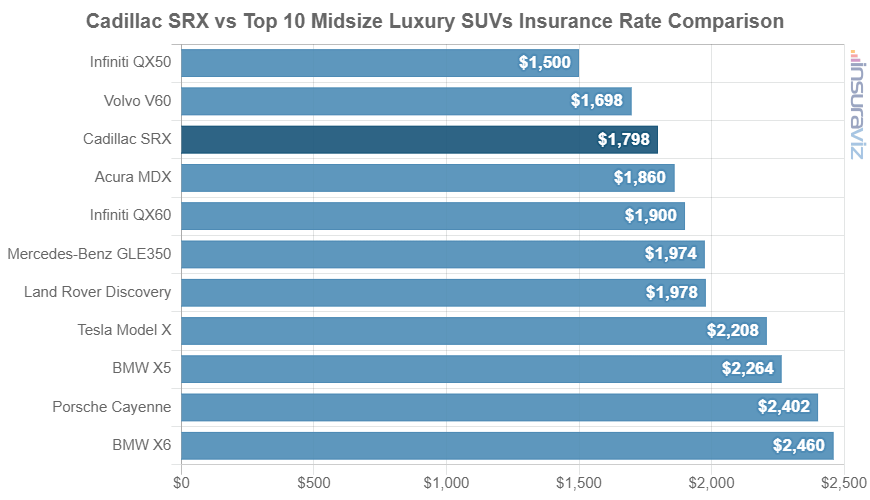

When compared directly to the other 2016 midsize luxury SUVs, insurance prices for a Cadillac SRX cost $66 more per year than the Lexus RX 350, $262 less than the Mercedes-Benz GLE400, and $378 less than the BMW X5.

The Cadillac SRX ranks sixth out of 24 total comparison vehicles in the 2016 midsize luxury SUV class for most affordable car insurance cost. The SRX costs an estimated $1,456 per year to insure, while the category average is $1,625 annually, a difference of $169 per year.

The next chart shows how the average car insurance rate for a Cadillac SRX compares to the best-selling midsize luxury SUVs like the Acura MDX, Lexus GX 460, and the Infiniti QX60. In addition to the chart, we also included a table after the chart showing typical insurance rates for all 24 vehicles in the 2016 midsize luxury SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Infiniti QX50 | $1,218 | -$238 |

| 2 | Lincoln MKX | $1,262 | -$194 |

| 3 | Volvo V60 | $1,378 | -$78 |

| 4 | Lexus RX 350 | $1,390 | -$66 |

| 5 | Volvo XC70 | $1,402 | -$54 |

| 6 | Cadillac SRX | $1,456 | -- |

| 7 | Acura MDX | $1,508 | $52 |

| 8 | Lincoln MKT | $1,528 | $72 |

| 9 | Infiniti QX60 | $1,540 | $84 |

| 10 | Lexus GX 460 | $1,564 | $108 |

| 11 | Lexus RX 450 | $1,576 | $120 |

| 12 | Mercedes-Benz GLE350 | $1,598 | $142 |

| 13 | Land Rover Discovery | $1,602 | $146 |

| 14 | Audi SQ5 | $1,650 | $194 |

| 15 | Mercedes-Benz GL350 | $1,666 | $210 |

| 16 | Mercedes-Benz GLE400 | $1,718 | $262 |

| 17 | Tesla Model X | $1,788 | $332 |

| 18 | Mercedes-Benz GLE300 | $1,800 | $344 |

| 19 | Mercedes-Benz GL450 | $1,824 | $368 |

| 20 | BMW X5 | $1,834 | $378 |

| 21 | Mercedes-Benz GLE450 | $1,848 | $392 |

| 22 | Mercedes-Benz AMG GLE63 | $1,910 | $454 |

| 23 | Porsche Cayenne | $1,944 | $488 |

| 24 | BMW X6 | $1,994 | $538 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2016 model year. Updated February 23, 2024