- Chrysler 200 insurance costs $2,222 per year on average, or around $185 per month, for full coverage on the 2017 model.

- When compared to other midsize cars, the Chrysler 200 is one of the more expensive midsize cars to insure, costing $373 more per year on average.

- The cheapest model to insure is the LX Sedan trim level at an estimated $2,100 per year, while the C AWD Sedan is the most expensive to insure at $2,316 per year.

How much does Chrysler 200 insurance cost?

Chrysler 200 car insurance averages around $2,222 yearly, or $185 on a monthly basis. You can expect to pay approximately $373 more per year to insure a Chrysler 200 as compared to the average rate for midsize cars, and $54 less per year than the overall national average of $2,276.

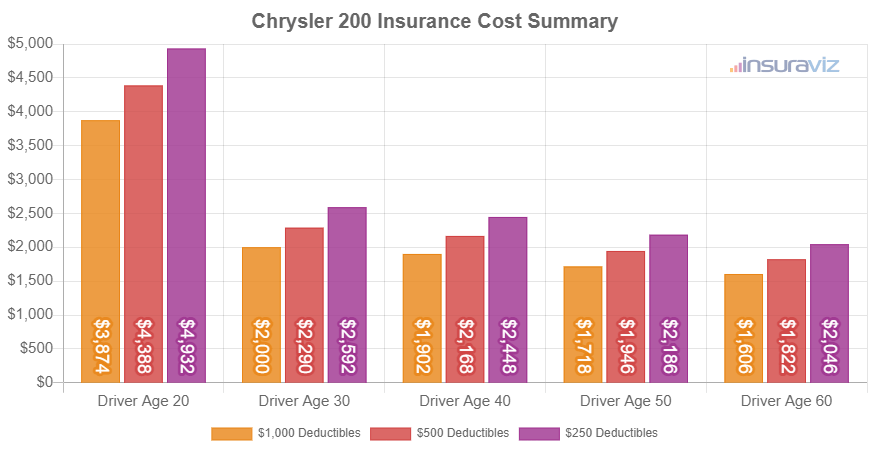

The following chart illustrates how average Chrysler 200 car insurance rates for the 2017 model year vary depending on the age of the driver and policy deductibles. Insurate rate estimates range from the lowest price of $1,644 per year for a driver age 60 with high physical damage deductibles to a high policy cost of $5,052 per year for a driver age 20 with $250 deductibles.

How does Chrysler 200 insurance cost compare?

When compared to the most popular models in the midsize car segment, insurance rates for a Chrysler 200 cost $388 more per year than the Toyota Camry, $364 more than the Honda Accord, $266 more than the Nissan Altima, and $414 more than the Tesla Model 3.

The Chrysler 200 ranks 16th out of 16 comparison vehicles in the midsize car category. The 200 costs an estimated $2,222 per year to insure for full coverage and the class average cost is $1,849 annually, a difference of $373 per year.

The chart below shows how average auto insurance cost for a 2017 Chrysler 200 compares to the top 10 selling midsize cars in America. An expanded table is also displayed after the chart that shows insurance affordability rankings for the entire midsize car class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Buick Cascada | $1,574 | -$648 |

| 2 | Mazda 6 | $1,616 | -$606 |

| 3 | Subaru Legacy | $1,722 | -$500 |

| 4 | Buick Verano | $1,740 | -$482 |

| 5 | Buick Regal | $1,748 | -$474 |

| 6 | Tesla Model 3 | $1,808 | -$414 |

| 7 | Toyota Camry | $1,834 | -$388 |

| 8 | Chevrolet Malibu | $1,846 | -$376 |

| 9 | Honda Accord | $1,858 | -$364 |

| 10 | Buick LaCrosse | $1,862 | -$360 |

| 11 | Volkswagen Passat | $1,878 | -$344 |

| 12 | Nissan Altima | $1,956 | -$266 |

| 13 | Hyundai Sonata | $1,966 | -$256 |

| 14 | Kia Optima | $1,968 | -$254 |

| 15 | Ford Fusion | $1,982 | -$240 |

| 16 | Chrysler 200 | $2,222 | -- |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2017 model year. Updated October 24, 2025

Which Chrysler 200 car insurance is cheapest?

With Chrysler 200 insurance rates ranging from $2,100 to $2,316 annually for an average driver, the cheapest model to insure is the base LX Sedan. The second cheapest trim level to insure is the Limited Sedan at $2,206 per year. Expect to pay a minimum of $175 per month to insure a 200 for full coverage.

The more expensive Chrysler 200 models to insure are the C AWD Sedan at $2,316 and the S AWD Sedan at $2,262 per year. Those two models will cost an extra $216 and $162 per year, respectively, over the least expensive LX Sedan model.

The table below displays average yearly and 6-month policy costs, including a monthly budget amount, for each Chrysler 200 trim level.

| 2017 Chrysler 200 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LX Sedan | $2,100 | $175 |

| Limited Sedan | $2,206 | $184 |

| S Sedan | $2,206 | $184 |

| C Sedan | $2,244 | $187 |

| S AWD Sedan | $2,262 | $189 |

| C AWD Sedan | $2,316 | $193 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Other insights about Chrysler 200 insurance rates include:

- Prepare for sticker shock for high-risk insurance. For a 30-year-old driver, having too many accidents or violations can increase the cost by $2,798 or more per year.

- Get better rates due to your choice of occupation. Some auto insurance providers offer discounts for being employed in occupations like engineers, scientists, accountants, emergency medical technicians, and other occupations. If you qualify for this occupational discount, you could potentially save between $67 and $188 on your annual premium, subject to the policy coverages selected.

- Car insurance for teenagers is expensive. Average rates for full coverage 200 insurance costs $8,312 per year for a 16-year-old driver, $7,937 per year for a 17-year-old driver, and $6,889 per year for an 18-year-old driver.

- Raising physical damage deductibles lowers cost. Increasing your deductibles from $500 to $1,000 could save around $274 per year for a 40-year-old driver and $528 per year for a 20-year-old driver.

- Low physical damage deductibles increase policy cost. Lowering your policy deductibles from $500 to $250 could cost an additional $284 per year for a 40-year-old driver and $558 per year for a 20-year-old driver.

- Driver gender influences rates. For a 2017 Chrysler 200, a 20-year-old male driver pays an average rate of $4,494 per year, while a 20-year-old female will pay an average of $3,244, a difference of $1,250 per year in the women’s favor by a large margin. But by age 50, the cost for a male driver is $1,996 and the cost for female drivers is $1,932, a difference of only $64.