- Mazda 6 car insurance cost averages $1,726 per year, or around $144 per month, depending on the trim level.

- When compared to other midsize cars, the Mazda 6 is one of the cheaper midsize cars to insure, costing $80 less per year on average.

- The cheapest Mazda 6 to insure is the Sport model at an estimated $1,592 per year. The most expensive is the Signature at $1,806 annually.

How much does Mazda 6 insurance cost?

Mazda 6 insurance costs an average of $1,726 per year for a full-coverage car insurance policy. Depending on the trim level being insured, monthly car insurance rates for a 2022 Mazda 6 range from $133 to $151.

When a policy is broken down into individual coverages, collision insurance costs about $720 a year, comprehensive (or other-than-collision) coverage costs about $426, and the remaining liability and medical coverage is around $580.

The following chart demonstrates how car insurance rates fluctuate based on driver age and comprehensive and collision deductibles for the Mazda 6 midsize sedan.

The chart above provides just a small sampling of car insurance rates for different age groups and policy coverage levels. The list below gives example rates for some other policy situations, along with some potential savings discounts to be aware of.

- Negligent drivers pay higher insurance rates. Being the cause of frequent accidents will raise rates, possibly up to $830 per year for a 30-year-old driver and even $526 per year for a 50-year-old driver.

- Increasing deductibles makes car insurance cheaper. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $262 per year for a 40-year-old driver and $500 per year for a 20-year-old driver.

- Choosing a low deductible may not make good financial sense. Dropping your deductibles from $500 to $250 could cost an additional $270 per year for a 40-year-old driver and $532 per year for a 20-year-old driver.

- As you get older, rates tend to be cheaper. The difference in Mazda 6 car insurance rates between a 50-year-old driver ($1,534 per year) and a 20-year-old driver ($3,454 per year) is $1,920, or a savings of 77%.

- Age and gender affect car insurance rates. For a 2022 Mazda 6, a 20-year-old man will pay an average rate of $3,454 per year, while a 20-year-old female pays an average of $2,490, a difference of $964 per year. The females get much better rates. But by age 50, the rate for men is $1,534 and the cost for female drivers is $1,492, a difference of only $42.

- Obey driving laws to keep rates low. If you want the cheapest Mazda 6 insurance rates, it’s necessary to avoid traffic citations. A few minor driving infractions could increase the cost of a policy by as much as $456 per year.

- Mazda 6 insurance rates for teens are expensive. Average rates for full coverage Mazda 6 car insurance costs $6,167 per year for a 16-year-old driver, $5,952 per year for a 17-year-old driver, and $5,294 per year for a 18-year-old driver.

How does Mazda 6 insurance cost compare?

When rates are compared to the best-selling models in the midsize car category, insurance for a Mazda 6 costs $22 more per year than the Toyota Camry, $80 less than the Honda Accord, $210 less than the Nissan Altima, and $96 less than the Tesla Model 3.

The Mazda 6 ranks sixth out of 13 comparison vehicles in the 2022 midsize car class. It costs an average of $1,726 per year to insure and the category median rate is $1,806 per year, a savings of $80 per year.

The table below shows how well Mazda 6 insurance rates compare to the rest of the 2022 midsize car segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Legacy | $1,678 | -$48 |

| 2 | Honda Insight | $1,684 | -$42 |

| 3 | Toyota Camry | $1,704 | -$22 |

| 4 | Kia K5 | $1,704 | -$22 |

| 5 | Volkswagen Passat | $1,712 | -$14 |

| 6 | Mazda 6 | $1,726 | -- |

| 7 | Honda Accord | $1,806 | $80 |

| 8 | Chevrolet Malibu | $1,812 | $86 |

| 9 | Tesla Model 3 | $1,822 | $96 |

| 10 | Volkswagen Arteon | $1,886 | $160 |

| 11 | Nissan Altima | $1,936 | $210 |

| 12 | Hyundai Sonata | $1,972 | $246 |

| 13 | Kia Stinger | $2,042 | $316 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2022 model year. Updated February 23, 2024

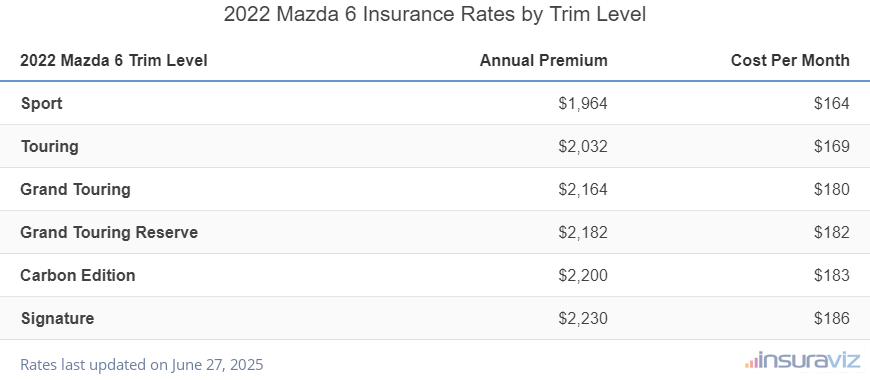

Which Mazda 6 model is cheapest to insure?

With Mazda 6 insurance rates ranging from $1,592 to $1,806 annually, the most budget-friendly model to insure is the Sport. The second cheapest trim level to insure is the Touring at $1,646 per year. Expect to budget at least $133 per month for a policy with full coverage.

The two most expensive models of Mazda 6 to insure are the Signature at $1,806 and the Carbon Edition at $1,782 per year. Those will cost an extra $214 and $190 per year, respectively, over the cheapest Sport model.

The next table shows average car insurance cost, including a monthly budget figure, for each Mazda 6 package and trim.

| 2022 Mazda 6 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sport | $1,592 | $133 |

| Touring | $1,646 | $137 |

| Grand Touring | $1,752 | $146 |

| Grand Touring Reserve | $1,768 | $147 |

| Carbon Edition | $1,782 | $149 |

| Signature | $1,806 | $151 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated February 23, 2024

How much is insurance on a used Mazda 6?

Driving a used Mazda 6 could reduce the cost of insurance by as much as $588 each year, at least when comparing the 2013 model to the 2022 model.

The following table illustrates average car insurance rates for a Mazda 6 for various driver age groups from 2013 to 2022. In general, the older the model, the lower the cost of insurance.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2022 Mazda 6 | $3,454 | $1,726 | $1,434 |

| 2021 Mazda 6 | $3,210 | $1,596 | $1,324 |

| 2020 Mazda 6 | $3,116 | $1,548 | $1,288 |

| 2018 Mazda 6 | $2,758 | $1,370 | $1,144 |

| 2017 Mazda 6 | $2,572 | $1,280 | $1,068 |

| 2016 Mazda 6 | $2,872 | $1,424 | $1,194 |

| 2015 Mazda 6 | $2,714 | $1,344 | $1,130 |

| 2014 Mazda 6 | $2,462 | $1,216 | $1,022 |

| 2013 Mazda 6 | $2,284 | $1,138 | $958 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mazda 6 trim levels for each model year. Updated February 23, 2024