- Land Rover LR2 car insurance rates average $1,762 per year (about $147 per month) for full coverage, but can vary a lot based on the policy limits.

- Land Rover LR2 insurance cost ranges from $1,748 to $1,794 annually on average, depending on trim level.

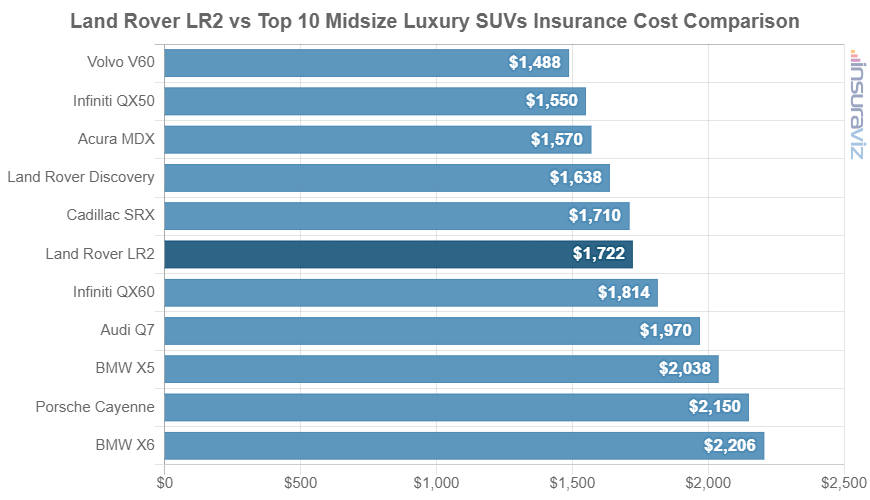

- Ranked 10th out of 23 vehicles in the 2015 midsize luxury SUV segment, average car insurance rates for the Land Rover LR2 cost $113 less per year than the segment average.

How much does Land Rover LR2 car insurance cost?

Ranked 10th out of 23 vehicles in the midsize luxury SUV class, Land Rover LR2 car insurance costs an average of $1,762 yearly, or $147 a month.

With the average midsize luxury SUV costing $1,875 a year to insure, the Land Rover LR2 could save around $113 or more every 12 months when compared to the average vehicle in the segment.

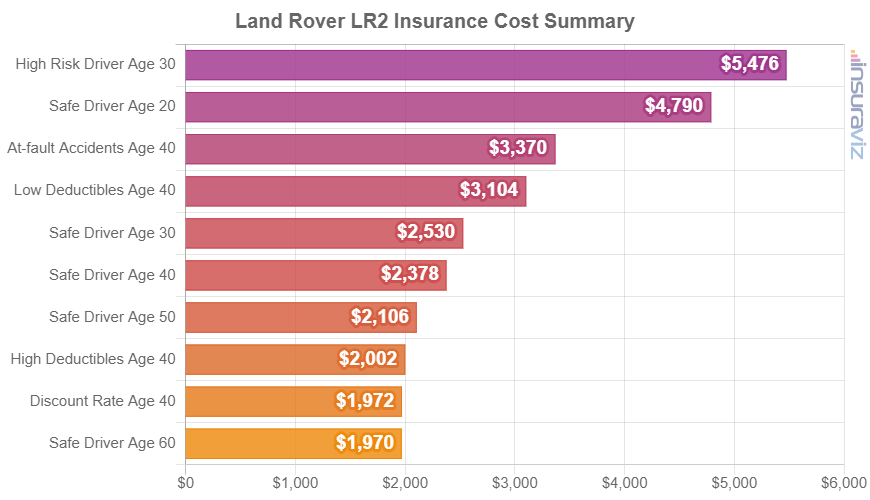

The following chart displays average 2015 Land Rover LR2 car insurance rates using variations of risk profiles and driver ages.

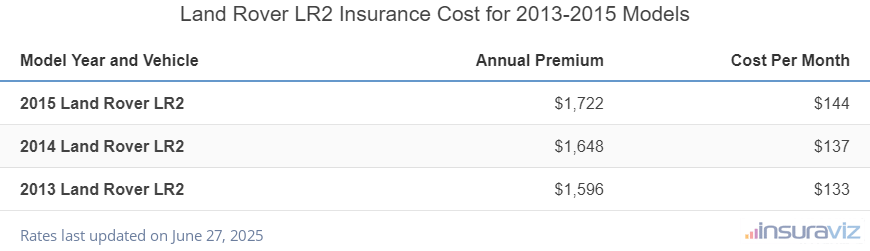

The table below breaks down average Land Rover LR2 insurance policy premiums for the 2013-2015 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2015 Land Rover LR2 | $1,762 | $147 |

| 2014 Land Rover LR2 | $1,686 | $141 |

| 2013 Land Rover LR2 | $1,634 | $136 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Land Rover LR2 trim levels for each model year. Updated October 24, 2025

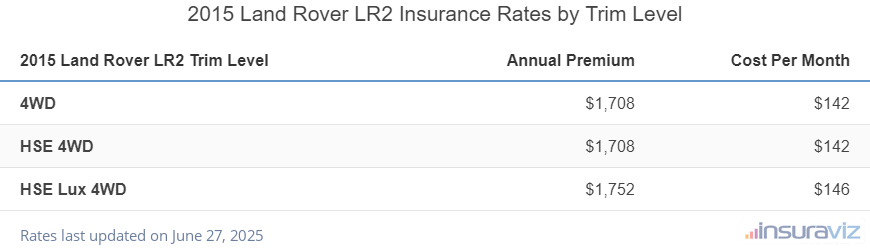

The table below details the average yearly and semi-annual policy costs, plus a monthly insurance rate, for each Land Rover LR2 model and trim level.

| 2015 Land Rover LR2 Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| 4WD | $1,748 | $146 |

| HSE 4WD | $1,748 | $146 |

| HSE Lux 4WD | $1,794 | $150 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How well do Land Rover LR2 insurance prices rank?

The Land Rover LR2 ranks 10th out of 23 total vehicles in the 2015 midsize luxury SUV segment for car insurance affordability. The LR2 costs an estimated $1,762 per year for an auto insurance policy with full coverage and the category average rate is $1,875 per year, a difference of $113 per year.

When compared directly to popular vehicles in the midsize luxury SUV segment, car insurance prices for a Land Rover LR2 cost $62 less per year than the Lexus RX 350, $326 less than the BMW X5, and $154 more than the Acura MDX.

The chart displayed below shows how well Land Rover LR2 car insurance rates compare to the top-selling midsize luxury SUVs like the Lexus GX 460, Infiniti QX60, and the Audi Q7. A rankings table is also included following the chart that displays insurance rankings for every vehicle in the midsize luxury SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Volvo V60 | $1,524 | -$238 |

| 2 | Infiniti QX50 | $1,588 | -$174 |

| 3 | Lincoln MKX | $1,594 | -$168 |

| 4 | Acura MDX | $1,608 | -$154 |

| 5 | Volvo XC70 | $1,636 | -$126 |

| 6 | Mercedes-Benz GLK350 | $1,662 | -$100 |

| 7 | Land Rover Discovery | $1,680 | -$82 |

| 8 | Lincoln MKT | $1,730 | -$32 |

| 9 | Cadillac SRX | $1,750 | -$12 |

| 10 | Land Rover LR2 | $1,762 | -- |

| 11 | Lexus RX 350 | $1,824 | $62 |

| 12 | Infiniti QX60 | $1,856 | $94 |

| 13 | Lexus GX 460 | $1,862 | $100 |

| 14 | Audi SQ5 | $1,914 | $152 |

| 15 | Audi Q7 | $2,018 | $256 |

| 16 | Lexus RX 450 | $2,064 | $302 |

| 17 | Mercedes-Benz ML350 | $2,078 | $316 |

| 18 | Mercedes-Benz GL350 | $2,080 | $318 |

| 19 | BMW X5 | $2,088 | $326 |

| 20 | Mercedes-Benz GL450 | $2,122 | $360 |

| 21 | Porsche Cayenne | $2,202 | $440 |

| 22 | Mercedes-Benz ML400 | $2,232 | $470 |

| 23 | BMW X6 | $2,256 | $494 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2015 model year. Updated October 24, 2025

Additional rates and observations

Additional key data observations concerning the cost of insurance for a LR2 include:

- LR2 insurance rates for teens are expensive. Average rates for full coverage LR2 insurance costs $6,463 per year for a 16-year-old driver, $6,208 per year for a 17-year-old driver, $5,462 per year for an 18-year-old driver, and $5,007 per year for a 19-year-old driver.

- Fewer violations means cheaper policy cost. If you want to pay the most budget-friendly LR2 insurance rates, it’s necessary to drive conservatively. Not surprisingly, just a couple of minor driving offenses have the ramification of increasing policy cost by as much as $480 per year. Serious citations like driving under the influence of drugs or alcohol could raise rates by an additional $1,652 or more.

- Auto insurance is cheaper with higher deductibles. Increasing your policy deductibles from $500 to $1,000 could save around $244 per year for a 40-year-old driver and $470 per year for a 20-year-old driver.

- Lowering deductibles results in a more expensive policy. Decreasing your deductibles from $500 to $250 could cost an additional $254 per year for a 40-year-old driver and $502 per year for a 20-year-old driver.

- Qualify for policy discounts to save money. Discounts may be available if the policyholders are accident-free, take a defensive driving course, sign their policy early, are loyal customers, or many other policy discounts which could save the average driver as much as $298 per year on their insurance cost.

- Young male drivers pay the highest rates. For a 2015 Land Rover LR2, a 20-year-old man pays an estimated $3,558 per year, while a 20-year-old woman will get a rate of $2,564, a difference of $994 per year in favor of the women by a long shot. But by age 50, the male rate is $1,574 and female rates are $1,528, a difference of only $46.

- High-risk insurance is expensive. For a 40-year-old driver, having too many driving record violations or accidents can potentially increase rates by $2,166 or more per year.

- Avoiding accidents keeps insurance rates low. Too frequent at-fault accidents can raise rates, potentially by an additional $2,552 per year for a 20-year-old driver and even $464 per year for a 60-year-old driver.