- Buick LaCrosse car insurance costs an average of $2,026 per year, or around $169 per month.

- The LaCrosse Sedan base model has the cheapest insurance rate at an average of $1,846 per year.

- At the high end, the LaCrosse Avenir AWD is the most expensive to insure at $2,130 for an annual policy.

- The Buick LaCrosse is one of the more expensive midsize cars to insure, costing $6 more per year on average as compared to the rest of the vehicles in the segment.

How much does Buick LaCrosse car insurance cost?

Expect to pay an average of $2,026 annually to insure a Buick LaCrosse for full coverage, which is about $169 a month. Comprehensive insurance will cost around $486 a year, liability and medical (or PIP) coverage costs about $610, and the remaining collision insurance is around $930.

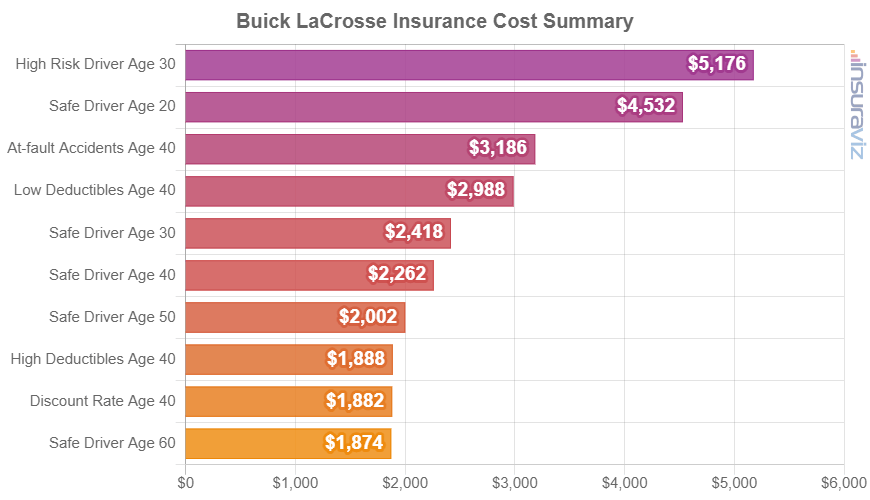

The chart below shows average car insurance rates on a 2019 LaCrosse using a range of different policy rating factors.

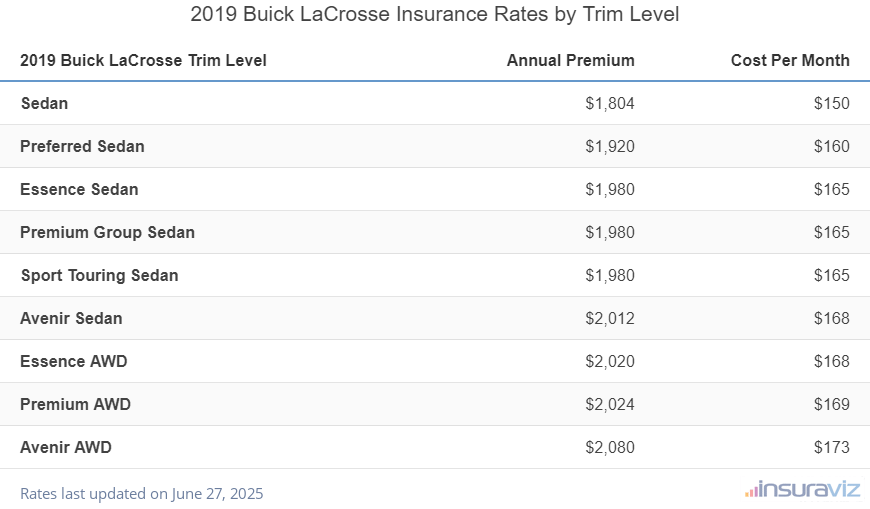

What model of LaCrosse is cheapest to insure?

With Buick LaCrosse car insurance rates ranging from $1,846 to $2,130 per year, the most affordable model to insure is the base Sedan model. The next cheapest model to insure is the Preferred Sedan at an average cost of $1,968 per year.

The priciest trim levels of Buick LaCrosse to insure are the Avenir AWD at $2,130 and the Premium AWD at $2,074 per year. Those two models will cost an extra $284 and $228 per year to insure, respectively, over the lowest-cost base Sedan model.

The table below displays average car insurance rates for the 2019 LaCrosse, plus a monthly budget figure, for each available model and trim level.

| 2019 Buick LaCrosse Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sedan | $1,846 | $154 |

| Preferred Sedan | $1,968 | $164 |

| Essence Sedan | $2,030 | $169 |

| Premium Group Sedan | $2,030 | $169 |

| Sport Touring Sedan | $2,030 | $169 |

| Avenir Sedan | $2,060 | $172 |

| Essence AWD | $2,068 | $172 |

| Premium AWD | $2,074 | $173 |

| Avenir AWD | $2,130 | $178 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

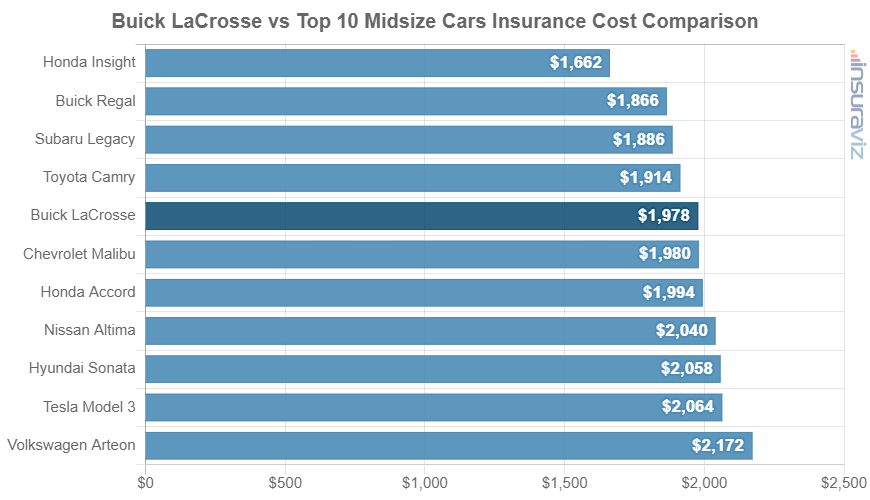

How does Buick LaCrosse insurance cost rank?

The Buick LaCrosse ranks eighth out of 16 total comparison vehicles in the midsize car category. The LaCrosse costs an average of $2,026 per year to insure for full coverage and the class average cost is $2,020 per year, a difference of $6 per year.

When compared directly to popular midsize cars, car insurance rates for a Buick LaCrosse cost $68 more per year than the Toyota Camry, $14 less than the Honda Accord, $62 less than the Nissan Altima, and $88 less than the Tesla Model 3.

The chart below shows how average LaCrosse car insurance rates compare to the most popular midsize cars in the U.S. The table following the chart shows insurance cost comparisons and rankings for all 16 models in the midsize car category.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Insight | $1,702 | -$324 |

| 2 | Buick Cascada | $1,778 | -$248 |

| 3 | Buick Regal | $1,912 | -$114 |

| 4 | Subaru Legacy | $1,932 | -$94 |

| 5 | Kia Optima | $1,954 | -$72 |

| 6 | Toyota Camry | $1,958 | -$68 |

| 7 | Volkswagen Passat | $1,970 | -$56 |

| 8 | Buick LaCrosse | $2,026 | -- |

| 9 | Chevrolet Malibu | $2,028 | $2 |

| 10 | Honda Accord | $2,040 | $14 |

| 11 | Nissan Altima | $2,088 | $62 |

| 12 | Hyundai Sonata | $2,108 | $82 |

| 13 | Tesla Model 3 | $2,114 | $88 |

| 14 | Ford Fusion | $2,150 | $124 |

| 15 | Volkswagen Arteon | $2,224 | $198 |

| 16 | Kia Stinger | $2,334 | $308 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2019 model year. Updated October 24, 2025

Additional rates and insights

Some additional details about Buick LaCrosse insurance rates include:

- Older drivers tend to pay cheaper insurance rates. The difference in Buick LaCrosse auto insurance rates between a 40-year-old driver ($2,026 per year) and a 20-year-old driver ($4,084 per year) is $2,058, or a savings of 67.4%.

- Your occupation could save you money. The vast majority of car insurance providers offer discounts for being employed in occupations like accountants, college professors, emergency medical technicians, lawyers, scientists, and other occupations. If you work in a qualifying profession, you could potentially save between $61 and $207 on your annual LaCrosse insurance premiuim, depending on the age of the rated driver.

- It’s expensive to buy high risk insurance. For a 20-year-old driver, having enough accidents and violations to require a high-risk insurance policy could trigger a rate increase of $3,198 or more per year.

- Higher physical damage deductibles lower policy cost. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $320 per year for a 40-year-old driver and $630 per year for a 20-year-old driver.

- Decreasing deductibles costs more money. Dropping your deductibles from $500 to $250 could cost an additional $336 per year for a 40-year-old driver and $666 per year for a 20-year-old driver.

- Excellent credit equals excellent rates. A credit score over 800 could save as much as $318 per year versus a credit rating of 670-739. Conversely, a mediocre credit rating could cost up to $369 more per year.