- Chevrolet Sonic car insurance costs $2,220 per year on average, or around $185 per month for full coverage.

- Sonic insurance rates range from $2,156 to $2,284 per year for the average driver, depending on trim level.

- The Chevy Sonic is one of the more expensive small cars to insure, costing $198 more per year on average as compared to the rest of the vehicles in the segment.

How much does Chevrolet Sonic car insurance cost?

Chevy Sonic insurance costs an average of $2,220 per year, which is about $185 each month. When looking at the cost of individual coverage, collision insurance is approximately $614 a year, liability/medical will cost an estimated $1,152, and the remaining comprehensive is an estimated $454.

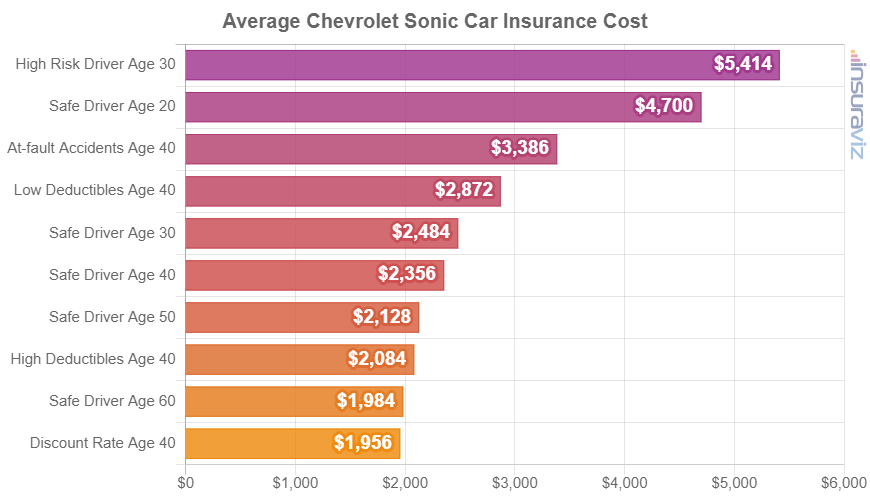

The chart below details average auto insurance cost for a 2020 Sonic using variations of driver age and risk profiles.

To give you a better understanding of how variable Sonic insurance rates can be, consider that a policy for liability only on a Chevy Sonic in the cheaper areas of Maine or Illinois can be as low as $246 a year.

For the same 2020 Chevrolet Sonic, a teenager with a tendency to speed in some New York City zip codes may have to pay as much as $18,503 a year for a full coverage policy.

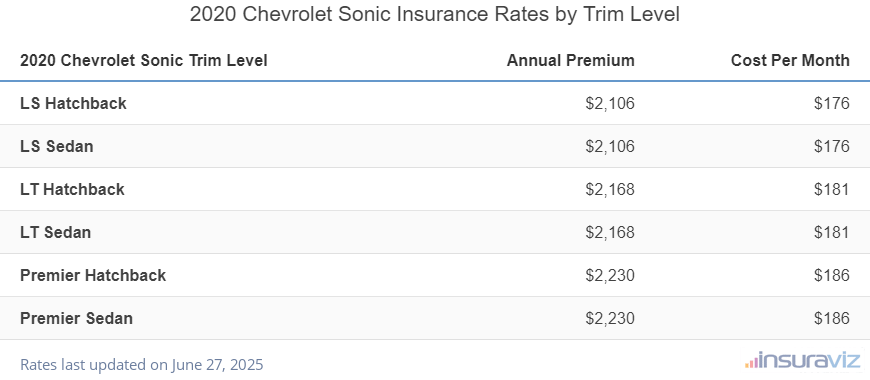

What are the cheapest Sonic trims to insure?

With Chevrolet Sonic insurance rates ranging from $2,156 to $2,284 per year, the cheapest models to insure are the LS Hatchback and the LS Sedan at an average cost of $2,156 per year.

The three highest cost models to insure are the LT Sedan, the Premier Hatchback, and the Premier Sedan trim levels at around $2,220, $2,284, and $2,284 per year, respectively.

The table below shows the average annual and semi-annual car insurance costs, plus a monthly insurance rate, for each Chevy Sonic package and trim.

| 2020 Chevrolet Sonic Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LS Hatchback | $2,156 | $180 |

| LS Sedan | $2,156 | $180 |

| LT Hatchback | $2,220 | $185 |

| LT Sedan | $2,220 | $185 |

| Premier Hatchback | $2,284 | $190 |

| Premier Sedan | $2,284 | $190 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

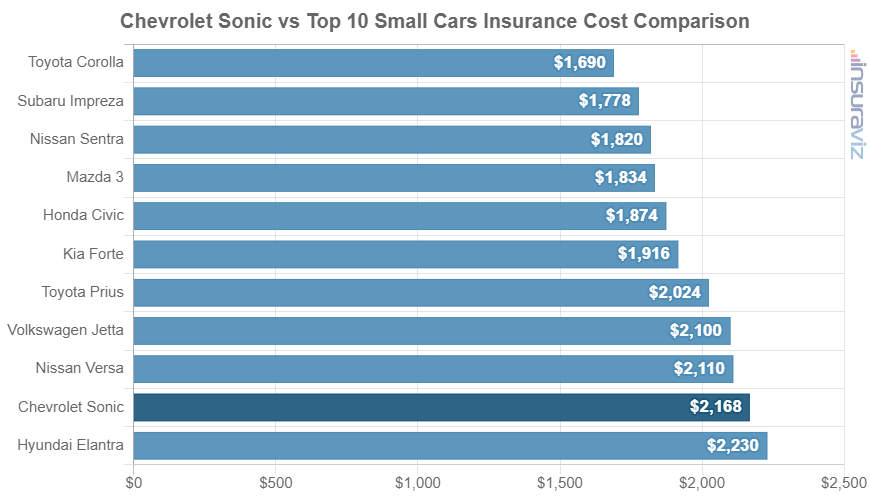

How does Sonic insurance cost compare?

When compared to other models in the 2020 compact car segment, Chevy Sonic car insurance costs $304 more per year than the Honda Civic, $490 more than the Toyota Corolla, $356 more than the Nissan Sentra, and $64 less than the Hyundai Elantra.

The Sonic ranks 22nd out of 27 comparison vehicles in the 2020 compact car category. The Sonic costs an estimated $2,220 per year for insurance and the segment average is $2,022 annually, a difference of $198.

The chart below shows how well Sonic insurance rates fare against the most popular small cars like the Honda Civic, Toyota Corolla, and the Hyundai Elantra. In addition, a rankings table is included after the chart that displays average insurance rates for all 27 models in the small car category, with the Sonic highlighted and the difference in cost noted for each model.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Chevrolet Spark | $1,626 | -$594 |

| 2 | Honda Fit | $1,686 | -$534 |

| 3 | Fiat 500L | $1,706 | -$514 |

| 4 | Toyota Corolla | $1,730 | -$490 |

| 5 | Volkswagen Golf | $1,774 | -$446 |

| 6 | Toyota Yaris | $1,798 | -$422 |

| 7 | Subaru Impreza | $1,820 | -$400 |

| 8 | Fiat 124 Spider | $1,850 | -$370 |

| 9 | Nissan Sentra | $1,864 | -$356 |

| 10 | Mazda 3 | $1,876 | -$344 |

| 11 | Honda Civic | $1,916 | -$304 |

| 12 | Kia Rio | $1,926 | -$294 |

| 13 | Hyundai Accent | $1,944 | -$276 |

| 14 | Kia Forte | $1,964 | -$256 |

| 15 | Toyota Prius | $2,074 | -$146 |

| 16 | Hyundai Veloster | $2,132 | -$88 |

| 17 | Volkswagen GTI | $2,140 | -$80 |

| 18 | Volkswagen Jetta | $2,152 | -$68 |

| 19 | Nissan Versa | $2,162 | -$58 |

| 20 | Nissan Leaf | $2,178 | -$42 |

| 21 | Mitsubishi Mirage G4 | $2,182 | -$38 |

| 22 | Chevrolet Sonic | $2,220 | -- |

| 23 | Honda Clarity | $2,260 | $40 |

| 24 | Hyundai Elantra | $2,284 | $64 |

| 25 | Hyundai Ioniq | $2,332 | $112 |

| 26 | Toyota 86 | $2,466 | $246 |

| 27 | Toyota Mirai | $2,520 | $300 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2020 model year. Updated October 24, 2025

Additional Rates and Information

Some additional insurance rates and ways to reduce policy cost are noted below.

- Higher physical damage deductibles lower policy cost. Raising policy deductibles from $500 to $1,000 could save around $244 per year for a 40-year-old driver and $458 per year for a 20-year-old driver.

- Low physical damage deductibles increases cost. Decreasing your deductibles from $500 to $250 could cost an additional $252 per year for a 40-year-old driver and $478 per year for a 20-year-old driver.

- Your profession could earn you discounts. The large majority of insurance companies offer discounts for occupations like doctors, engineers, college professors, members of the military, nurses, accountants, and others. Earning this discount could potentially save between $67 and $216 on your yearly insurance bill.

- Cautious drivers pay less for insurance. Causing too many accidents will raise rates, potentially by an extra $1,100 per year for a 30-year-old driver and as much as $634 per year for a 60-year-old driver.

- Find cheaper rates by qualifying for discounts. Discounts may be available if the policyholders work in certain occupations, belong to certain professional organizations, drive low annual mileage, insure their home and car with the same company, or many other discounts which could save the average driver as much as $378 per year on Chevrolet Sonic insurance.

- It’s expensive to buy high risk insurance. For a 20-year-old driver, the need to buy a high-risk policy increases the cost by $3,526 or more per year.

- As you age, Sonic car insurance rates tend to get cheaper. The difference in insurance cost for a 2020 Chevy Sonic between a 40-year-old driver ($2,220 per year) and a 20-year-old driver ($4,456 per year) is $2,236, or a savings of 67%.