- Mercedes GL350 insurance costs an average of $2,106 per year, $1,053 for a 6-month policy, or around $176 per month.

- The GL350 ranks 15th out of 24 vehicles in the 2016 midsize luxury SUV class for car insurance affordability.

- Insurance on a GL350 costs 2.5% more than the average rate for similar luxury SUV models.

How much does Mercedes GL350 insurance cost?

Average Mercedes GL350 car insurance rates cost $2,106 per year, or around $176 a month. Insurance costs around $53 more per year when compared to the average rate for all midsize luxury SUVs, and $170 less per year than the overall all-vehicle average of $2,276.

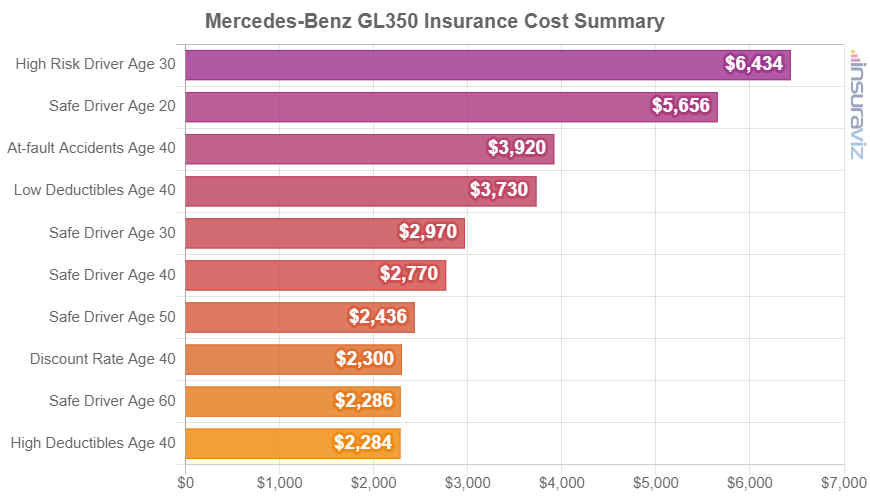

The chart below breaks down average auto insurance cost for a 2016 Mercedes GL350 with a variety of different driver ages and risk profiles. Rates are considered full coverage, which means comprehensive and collision insurance is include in each price.

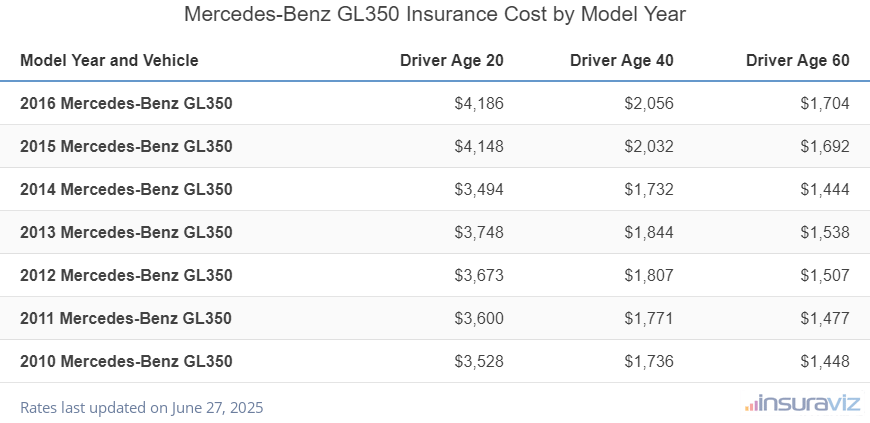

The table below illustrates the average cost to insure a Mercedes GL350 for drivers age 20 through 60 for each model year from 2010 to 2016.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2016 Mercedes-Benz GL350 | $4,286 | $2,106 | $1,746 |

| 2015 Mercedes-Benz GL350 | $4,250 | $2,080 | $1,732 |

| 2014 Mercedes-Benz GL350 | $3,578 | $1,774 | $1,478 |

| 2013 Mercedes-Benz GL350 | $3,840 | $1,886 | $1,574 |

| 2012 Mercedes-Benz GL350 | $3,763 | $1,848 | $1,543 |

| 2011 Mercedes-Benz GL350 | $3,688 | $1,811 | $1,512 |

| 2010 Mercedes-Benz GL350 | $3,614 | $1,775 | $1,481 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Mercedes-Benz GL350 trim levels for each model year. Updated October 24, 2025

Does GL350 insurance cost more than other SUVs?

When compared to other midsize luxury models, insurance rates for a Mercedes-Benz GL350 cost $350 more per year than the Lexus RX 350, $64 less than the Mercedes-Benz GLE400, and $212 less than the BMW X5.

The GL350 ranks 15th out of 24 comparison vehicles in the 2016 midsize luxury SUV class for car insurance affordability. The GL350 costs an estimated $2,106 per year for full coverage car insurance, while the segment average price is $2,053 per year, a difference of $53 per year.

The next chart shows how well GL350 insurance rates compare to the top 10 most popular midsize luxury SUVs in the U.S. like the Acura MDX, Lexus GX 460, and the Infiniti QX60.

An additional table is shown after the chart that compares average car insurance rates for the entire 2016 midsize luxury SUV category.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Infiniti QX50 | $1,538 | -$568 |

| 2 | Lincoln MKX | $1,596 | -$510 |

| 3 | Volvo V60 | $1,740 | -$366 |

| 4 | Lexus RX 350 | $1,756 | -$350 |

| 5 | Volvo XC70 | $1,772 | -$334 |

| 6 | Cadillac SRX | $1,840 | -$266 |

| 7 | Acura MDX | $1,904 | -$202 |

| 8 | Lincoln MKT | $1,930 | -$176 |

| 9 | Infiniti QX60 | $1,946 | -$160 |

| 10 | Lexus GX 460 | $1,976 | -$130 |

| 11 | Lexus RX 450 | $1,992 | -$114 |

| 12 | Mercedes-Benz GLE350 | $2,020 | -$86 |

| 13 | Land Rover Discovery | $2,024 | -$82 |

| 14 | Audi SQ5 | $2,088 | -$18 |

| 15 | Mercedes-Benz GL350 | $2,106 | -- |

| 16 | Mercedes-Benz GLE400 | $2,170 | $64 |

| 17 | Tesla Model X | $2,262 | $156 |

| 18 | Mercedes-Benz GLE300 | $2,268 | $162 |

| 19 | Mercedes-Benz GL450 | $2,306 | $200 |

| 20 | BMW X5 | $2,318 | $212 |

| 21 | Mercedes-Benz GLE450 | $2,336 | $230 |

| 22 | Mercedes-Benz AMG GLE63 | $2,414 | $308 |

| 23 | Porsche Cayenne | $2,460 | $354 |

| 24 | BMW X6 | $2,518 | $412 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2016 model year. Updated October 24, 2025

Additional insurance rates and insights

Some other relevant insights about insuring a GL350 include:

- Bring up your credit score to save money. Having excellent credit of 800+ could save $331 per year versus a slightly lower credit score between 670-739. Conversely, a credit score lower than 579 could cost up to $383 more per year.

- Save money due to your employer. The large majority of auto insurance providers offer policy discounts for specific occupations like doctors, scientists, firefighters, emergency medical technicians, nurses, and others. If you can earn this discount, you could potentially save between $63 and $179 on your Mercedes-Benz GL350 insurance premium.

- Earn policy discounts to save money. Discounts may be available if the insured drivers are military or federal employees, are good students, work in certain occupations, are accident-free, drive a vehicle with safety or anti-theft features, or many other policy discounts which could save the average driver as much as $358 per year on Mercedes-Benz GL350 insurance.

- Be a safe driver and save on insurance. Multiple at-fault accidents raise rates, as much as $3,066 per year for a 20-year-old driver and as much as $520 per year for a 60-year-old driver.

- Teen drivers cost a lot to insure. Average rates for full coverage GL350 insurance costs $7,582 per year for a 16-year-old driver, $7,363 per year for a 17-year-old driver, $6,626 per year for an 18-year-old driver, and $6,008 per year for a 19-year-old driver.

- Older drivers tend to pay cheaper insurance rates. The difference in Mercedes-Benz GL350 insurance cost between a 50-year-old driver ($1,862 per year) and a 20-year-old driver ($4,286 per year) is $2,424, or a savings of 78.9%.